UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

STRATOS RENEWABLES CORPORATION

(Name of Issuer)

Common Shares

(Title of Class of Securities)

863101101

(CUSIP Number)

Andrei

Lisyanski

I2BF Biodiesel Limited

c/o I2BF Venture Capital

Suite 401, One Heddon Street

Mayfair, London, W1B 4BD

United Kingdom

Telephone: +44

2074324516

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications)

with copies to:

Michael Lousteau, Esq.

Wilson Sonsini Goodrich & Rosati

Professional Corporation

650 Page

Mill Road

Palo Alto, CA 94034

Telephone: (650) 493-9300

March 4, 2010

(Date of Event which Requires Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note:

Schedules filed in paper format shall include a signed original and five

copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

|

*

|

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

CUSIP No. 863101101

|

|

1.

|

|

Names of Reporting

Persons.

I2BF Biodiesel Limited

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

WC

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings is Required Pursuant to Items 2(d) or

2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

101,164,273

|

|

|

8.

|

|

Shared Voting Power

0

|

|

|

9.

|

|

Sole Dispositive Power

101,164,273

|

|

|

10.

|

|

Shared Dispositive Power

0

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

101,164,273

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See

Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

40.5% (1)

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

CO

|

|

(1)

|

Based on the number of shares of Issuer’s common stock outstanding as of March 4, 2010 (as represented by Issuer in the Agreement (as described in this Statement),

I2BF may be deemed to have beneficial ownership of approximately 40.5% of the outstanding shares of Issuer common stock.

|

-2-

|

ITEM 1.

|

SECURITY AND ISSUER.

|

This Statement on Schedule 13D relates to the common stock (the “Common Stock”) of Stratos Renewables Corporation (the “Company”), a Nevada corporation. The principal executive offices of the Company are located at

9440 Santa Monica Blvd., Suite 401, Beverly Hills, CA 90210. The telephone number at that location is (310) 402-5901.

|

ITEM 2.

|

IDENTITY AND BACKGROUND.

|

This Statement is filed by I2BF Biodiesel Limited, a company incorporated in the British Virgin Islands (“I2BF”). I2BF Biodiesel Limited’s controlling shareholder is I2BF Management Ltd., a company incorporated in the British

Virgin Islands. I2BF Management Limited is controlled by sole stockholder and director Ilya Golubovich and director Andrei Lisyanski. Each of Ilya A. Golubovich and Andrei Lisyanski disclaim beneficial ownership in the securities of the Company

which are the subject of this filing, except as relates to their personal, indirect pecuniary interests therein.

I2BF,

together with its affiliates, is an international fund management group engaged in venture capital and public equity activities in the United States, Europe and Asia Pacific and focused on diversified clean energy investment. The principal executive

offices of I2BF are located at Suite 401, One Heddon Street, Mayfair, London, W1B 4BD, United Kingdom.

During the last five

years, neither I2BF nor, to I2BF’s knowledge, any executive officer or director of I2BF or it’s controlling shareholder I2BF Management Ltd. has been (i) convicted in any criminal proceeding (excluding traffic violations and other

similar misdemeanors) or (ii) has been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such person was or is subject to any judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

ITEM 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

|

Pursuant to a Note Facility Purchase Agreement (a copy of which is attached hereto as

Exhibit 3

), dated as of March 4, 2010 (the “Agreement”), by and between the Company, I2BF and

Blue Day Limited, a business company existing under the laws of the British Virgin Islands (“Blue Day”) (each, an “Investor” and collectively, the “Investors”), the Investors purchased Notes (as defined in Item 4

below) in the aggregate principal amount of $885,077 and an aggregate of 111,429,453 shares of the Common Stock of the Company.

The total amount of funds required by I2BF to purchase the Notes and the Common Stock pursuant to the Agreement was $585,077 in cash investment which was furnished from the working capital of I2BF. No additional funds were required to

acquire beneficial ownership of the Common Stock reported on this Schedule 13D.

|

ITEM 4.

|

PURPOSE OF TRANSACTION.

|

The information set forth and/or incorporated by reference in Items 2 and 3 is hereby incorporated by reference into this Item 4.

The acquisition by I2BF of beneficial ownership of Common Stock of the Company, as described herein, was effected (a) because of I2BF’s belief that the Company represents an attractive

investment based on the Company’s business prospects and strategy, (b) to help finance the Company’s general corporate operations.

Pursuant to the Agreement, the Company offered to the Investors: (a) a minimum of $885,077 in aggregate principal of Secured Promissory Notes (“Notes”) issued for new cash investment in the

Company as of the date of the Agreement (the “Initial Investment”), (b) up to an additional $664,923 principal amount of Notes to be issued to I2BF in five subsequent closings, each in the allocations and amounts set forth on the

Schedule of Anticipated Closings to the Agreement and (c) as consideration for such new investment, Common Stock representing an aggregate of seventy five percent (75%) of the fully diluted equity of the Company and certain adjustment

rights relating to such Common Stock as are set forth in the Agreement.

-3-

The first Closing on March 4, 2010 (the “Initial Closing”) was for the sale

of Notes in the aggregate principal amount of $885,077 and an aggregate of 111,429,453 shares of the Common Stock of the Company, of which Notes in the principal amount of $585,077 and 63,240,120 shares were issued to I2BF and Notes in the principal

amount of $300,000 and 48,189,333 shares were issued to Blue Day, evidencing not less than seventy one percent (71%) of the outstanding Common Stock determined on a fully diluted basis, and shall be consummated simultaneously with the execution

of the Agreement (the “Closing Date”).

I2BF will make additional investments in Notes with an aggregate principal

amount of $664,923 and shall be issued 23,877,445 additional shares of Common Stock, and additional Closings shall be held with respect to such investment (each, an “Anticipated Closing” and collectively, the “Anticipated

Closings”) as set forth on the Schedule of Anticipated Closings to the Agreement, subject to the approval by the Investors of the Company’s Proposed Budget for the month following such Anticipated Closing Date and the fulfillment by the

Company, to the satisfaction of the Investors, of the applicable Funding Milestones set forth in Exhibit C to the Agreement. An additional Note shall be issued to I2BF and certificate(s) evidencing the additional shares of Common Stock issuable to

I2BF and Blue Day shall be issued with respect to the Securities purchased and issued each Anticipated Closing. The ownership of I2BF and Blue Day following the completion of the Anticipated Closings shall be seventy five percent (75%) of the

outstanding Common Stock determined on a fully diluted basis.

The Notes bear an interest rate of 15% per annum and are

payable in full on the earliest to occur of (a) December 31, 2012; (b) a change of control of the Company; or (c) when, upon or after the occurrence of an event of default such amounts are declared payable by the Investors.

The Agreement will terminate on the earliest to occur of (i) the maturity date of any Note, (ii) 20 days following

the proposed date of an Anticipated Closing if the operating budget for the Company and its subsidiaries for the succeeding month has not been approved by a newly created Special Finance Committee (as discussed below), (iii) the closing of the

PAC Financing (as defined in the Agreement) or (iv) the date on which the balance of the Investors’ commitments have been disbursed in accordance with the terms of the Agreement.

The Agreement contains certain operational covenants, including that the Company continue in good faith negotiations with Banco

Internacional del Perú S.A.A. (“Interbank”) to obtain a credit facility of not less than $24,000,000 (the “Interbank Financing”). The Company is also not allowed, without the consent of the Investors: to incur indebtedness

for borrowed money or financed equipment in excess of $10,000 in the aggregate; to pledge, encumber or grant any security interest in any assets of the Company or any of its subsidiaries to any third party; to increase the compensation or benefits

to any employee or contractor; or to undertake any future equity or debt financing other than the closing of the Interbank Financing or the PAC Financing.

The Agreement contains certain other covenants and agreements, including that the Company initiate the deregistration of its Common Stock.

In connection with the transactions contemplated by the Agreement, the Company will also establish an equity incentive plan in order to

retain the services of, and provide incentives for, its employees, consultants, officers and directors. An equity incentive plan has not yet been formally adopted, and no option grants have yet been made, but the Company has agreed to reserve

approximately 19% (on a fully-diluted basis) of its Common Stock for option grants to be made under such equity incentive plan to members of management and the board of directors. Any options granted under such plan will vest (i) 50% upon the

closing and initial funding of a the Interbank Financing and (ii) 50% upon the Company’s first commercial shipment of ethanol yielding gross revenue to the Company of at least $100,000.

Furthermore, the Company has agreed to modify its compensation structure with respect to employees, consultants, officers and directors of

the Company and its subsidiaries, such that current compensation levels of such persons will be decreased and such persons will instead be eligible to receive payments in the future upon the occurrence of certain events (including the closing and

initial funding of the Interbank Financing, if any).

-4-

The Company simultaneously amended a Security Agreement, dated July 15, 2009, among the

Company, I2BF and Blue Day SC Ventures, in order to extend the existing first priority security interests under the Security Agreement to the Notes issued to the Investors.

Additionally, in connection with the transactions contemplated by the Agreement, certain changes were made to the composition of the

Company’s board of directors (the “Board”), and a Special Finance Committee of the Board was established to review and approve operating and financial budgets, indebtedness and compensation arrangements of the Company and its

subsidiaries.

The Agreement and the Notes and related documents and agreements are filed as exhibits to this report and

should be referred to in their entirety for a complete description thereof.

|

ITEM 5.

|

INTEREST IN SECURITIES OF THE ISSUER.

|

The information set forth and/or incorporated by reference in Items 2, 3 and 4 is hereby incorporated by reference into this Item 5.

(a) – (b) As a result of the Agreement, I2BF beneficially owns 101,164,273 shares of the Issuer’s Common Stock. This number

of shares represents approximately 40.5% of the issued and outstanding shares of the Issuer based on the number of shares outstanding as of March 4, 2010 (as represented by the Company in the Agreement). I2BF has sole power to vote, dispose or

direct the disposition of the 101,164,273 shares of the Issuer’s Common Stock acquired by it pursuant to the Agreement.

(c) Except as described in this Schedule 13D, there have been no transactions in the shares of common stock effected by I2BF during the last 60 days.

(d) – (e) Not applicable.

|

ITEM 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

|

The information set forth, or incorporated by reference, in Items 3 through 5 of this statement is hereby incorporated by reference to this

Item 6. To I2BF’s knowledge, except as otherwise described in this Schedule 13D, there are no contracts, arrangements, understandings or relationships among I2BF and between any such persons and any other person, with respect to any

securities of the Company, including but not limited to, transfer or voting of any of the securities of the Issuer, joint ventures, loan or option arrangements, puts or calls, guarantees or profits, division of profits or loss, or the giving or

withholding of proxies, or a pledge or contingency the occurrence of which would give another person voting power over the securities of the Issuer.

|

ITEM 7.

|

MATERIALS TO BE FILED AS EXHIBITS.

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

1

|

|

Blue Day Note (incorporated by reference to Exhibit 10.1 to the Form 8-K filed by Stratos Renewables Corporation on March 15, 2010).

|

|

|

|

|

2

|

|

I2BF Note (incorporated by reference to Exhibit 10.2 to the Form 8-K filed by Stratos Renewables Corporation on March 15, 2010)

|

|

|

|

|

3

|

|

Note Facility Purchase Agreement (incorporated by reference to Exhibit 10.3 to the Form 8-K filed by Stratos Renewables Corporation on March 15, 2010)

|

|

|

|

|

4

|

|

Consent and Waiver and Amendment No. 2 to Security Agreement (incorporated by reference to Exhibit 10.4 to the Form 8-K filed by Stratos Renewables Corporation on

March 15, 2010)

|

-5-

SIGNATURES

After reasonable inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this

Statement is true, complete and correct.

Dated: March 16, 2010

|

|

|

|

|

I2BF Biodiesel Limited

|

|

|

|

|

By:

|

|

/s/ I

LYA

A.

G

OLUBOVICH

|

|

|

|

Ilya A. Golubovich

Director

|

-6-

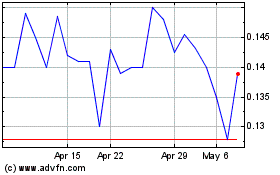

Stratos Renewables (PK) (USOTC:SRNW)

Historical Stock Chart

From Apr 2024 to May 2024

Stratos Renewables (PK) (USOTC:SRNW)

Historical Stock Chart

From May 2023 to May 2024