Sanwire Announces Debt Retirement and Enhanced Distribution Network Which Includes iTunes, Spotify, and Apple Music

August 19 2020 - 10:30AM

InvestorsHub NewsWire

Sanwire Announces Debt Retirement and

Enhanced Distribution Network Which Includes iTunes, Spotify, and

Apple Music

Los Angeles, CA -- August 19, 2020

-- InvestorsHub NewsWire -- Sanwire Corporation, (“Sanwire” or

“the Company”) (OTC:

SNWR), a diversified company

with a focus on technologies for the entertainment

industry, is pleased to announce the retirement of

$415,000 in long-term debt in the form of a convertible note (the

“Note”) issued in March 2018.

The

Company reached an agreement with the Note holder to retire

$415,000, which includes a principal amount of $310,000 and unpaid

accrued interest of $105,000 at 12% annual interest rate. The Note

holder has agreed to exchange the debt amount into Series C

Preferred Stock (the “Preferred Stock”). This action is a

follow up to the Company’s press release

dated June 29, 2020 where the Company

announced the creation of Series A, B, and C preferred stock

to minimize dilution to its shareholders and enhance the Company’s

balance sheet. The details of the debt retirement transaction

will be reflected in the Company’s third quarter

filings.

“Following the removal of this

debt obligation, the balance sheet will be in a better position for

future investments and potential merger and acquisition

transactions,” stated Mr. Chris Whitcomb, CEO of Sanwire.

“This will lead the way to enhanced service offerings and a

broader distribution network which already includes iTunes,

Spotify, Apple Music, Amazon Music, and many

more.”

Intercept Music, Inc.

("Intercept"), wholly owned subsidiary of Sanwire, has progressed

rapidly from development stage to product commercialization to

revenue generation in a short timeframe. Intercept is embarking on

a rapid growth plan that includes revenue expansion from existing

markets, accelerated customer acquisition, new industry

partnerships, and penetration of new markets. To support

Intercept's business plan, Sanwire is working on a

multi-dimensional plan to attract seasoned investors and enhance

Sanwire's balance sheet while minimizing shareholder

dilution.

"We are very pleased to further

unencumber the Company via this beneficial debt

restructuring which represented over 34% of our overall

long-term debt,” said Whitcomb, “this shows confidence in our

efforts and the long-term commitment our investors have made to

Sanwire. We will continue delivering on our promise to find ways to

strengthen our balance sheet and grow our business and market

share.”

About Intercept Music,

Inc.

Intercept

Music, Inc. is an entertainment technology company dedicated to

helping independent artists effectively distribute, market, and

monetize their music. Sold through a Software as a Service (Saas)

model, Intercept’s online platform delivers an unsurpassed

combination of marketing, promotion, and distribution to hundreds

of stores worldwide and every major streaming service, including

Apple Music, Google Music, Pandora and Spotify. Intercept’s options

include full-service, concierge-style support and even one-on-one

coaching from award-winning music industry

professionals. Intercept focuses exclusively on the

independent music market, which is estimated at 12 million artists,

and is the fastest-growing sector of the music

industry. For more information,

visit interceptmusic.com.

About Sanwire

Corporation

Sanwire Corporation (OTC:

SNWR), a diversified company with a focus on the

entertainment industry, has been involved in aggregating

technologies for a number of years. We look for opportunities in

fragmented markets, where technology can be applied to consolidate

services into a single platform of delivery. Our current focus is

advanced entertainment technologies. For more information,

visit sanwirecorporation.com.

For further inquiries,

contact ir@sanwirecorporation.com, casper.casparian@interceptmusic.com,

or (424) 835-0833.

Safe Harbor Statement:

Forward-Looking Statements are included within the meaning of

Section 27A of the Securities Act of 1933, and Section 21E of the

Securities Act of 1934, as amended. All statements regarding our

expected future financial positions, results of operations, cash

flows, financing plans, business strategy, products and services,

competitive positions, growth opportunities, plans and objectives

of management for future operations, listing on the OTC Markets,

including words such as "anticipate," "if," "believe," "plan,"

"estimate," "expect," "intend," "may," "could," "should," "will,"

and other similar expressions are forward-looking statements and

involve risks, uncertainties, and contingencies, many of which are

beyond our control, which may cause actual results, performance, or

achievements to differ materially from anticipated results,

performance, or achievements. We are under no obligation to (and

expressly disclaim any such obligation to) update or alter our

forward-looking statements, whether as a result of new information,

future events or otherwise.

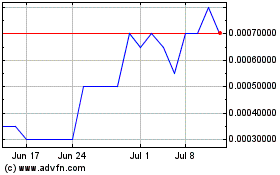

Sanwire (PK) (USOTC:SNWR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sanwire (PK) (USOTC:SNWR)

Historical Stock Chart

From Jan 2024 to Jan 2025