UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

|

|

T

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

|

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2009

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

|

SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-8157

THE RESERVE PETROLEUM COMPANY

(Exact Name of Registrant As Specified In Its Charter)

|

DELAWARE

|

73-0237060

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

6801 N. BROADWAY, SUITE 300

OKLAHOMA CITY, OKLAHOMA

73116-9092

(405) 848-7551

(Address and telephone number, including area code, of registrant’s principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes

T

No

£

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes

o

No

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

(Check one):

Large accelerated filer

£

Accelerated filer Yes

£

Non accelerated

filer

£

Smaller reporting company

T

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

£

No

T

As of August 10, 2009, 162,064.64 shares of the Registrant’s $.50 par value common stock were outstanding.

PART 1

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

THE RESERVE PETROLEUM COMPANY

CONDENSED BALANCE SHEETS

ASSETS

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

(Unaudited)

|

|

|

(Derived from audited financial statements)

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

$

|

948,548

|

|

|

$

|

1,430,832

|

|

|

Available for Sale Securities

|

|

|

15,803,533

|

|

|

|

15,120,573

|

|

|

Trading Securities

|

|

|

270,915

|

|

|

|

218,228

|

|

|

Refundable Income Taxes

|

|

|

594,626

|

|

|

|

999,573

|

|

|

Receivables

|

|

|

1,326,089

|

|

|

|

1,738,856

|

|

|

Prepaid Expenses

|

|

|

46,300

|

|

|

|

----

|

|

|

|

|

|

18,990,011

|

|

|

|

19,508,062

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Equity Investments

|

|

|

581,323

|

|

|

|

562,584

|

|

|

Other

|

|

|

15,298

|

|

|

|

15,298

|

|

|

|

|

|

596,621

|

|

|

|

577,882

|

|

|

Property, Plant & Equipment:

|

|

|

|

|

|

|

|

|

|

Oil & Gas Properties, at Cost Based on the Successful Efforts Method of Accounting

|

|

|

|

|

|

|

|

|

|

Unproved Properties

|

|

|

1,175,312

|

|

|

|

1,029,500

|

|

|

Proved Properties

|

|

|

21,509,572

|

|

|

|

20,543,660

|

|

|

|

|

|

22,684,884

|

|

|

|

21,573,160

|

|

|

Less - Valuation Allowance and Accumulated Depreciation, Depletion & Amortization

|

|

|

13,612,015

|

|

|

|

12,932,782

|

|

|

|

|

|

9,072,869

|

|

|

|

8,640,378

|

|

|

Other Property & Equipment, at Cost

|

|

|

376,734

|

|

|

|

375,544

|

|

|

Less - Accumulated Depreciation & Amortization

|

|

|

286,914

|

|

|

|

272,779

|

|

|

|

|

|

89,820

|

|

|

|

102,765

|

|

|

Total Property, Plant & Equipment

|

|

|

9,162,689

|

|

|

|

8,743,143

|

|

|

Other Assets

|

|

|

327,247

|

|

|

|

325,744

|

|

|

Total Assets

|

|

$

|

29,076,568

|

|

|

$

|

29,154,831

|

|

See Accompanying Notes

THE RESERVE PETROLEUM COMPANY

CONDENSED BALANCE SHEETS

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

(Unaudited)

|

|

|

(Derived from audited financial statements)

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$

|

237,524

|

|

|

$

|

208,487

|

|

|

Other Current Liabilities -

|

|

|

|

|

|

|

|

|

|

Deferred Income Taxes and Other

|

|

|

268,848

|

|

|

|

221,266

|

|

|

|

|

|

506,372

|

|

|

|

429,753

|

|

|

Long-Term Liabilities:

|

|

|

|

|

|

|

|

|

|

Asset Retirement Obligation

|

|

|

640,173

|

|

|

|

516,054

|

|

|

Dividends Payable

|

|

|

1,084,181

|

|

|

|

959,319

|

|

|

Deferred Tax Liability

|

|

|

1,575,349

|

|

|

|

1,613,163

|

|

|

|

|

|

3,299,703

|

|

|

|

3,088,536

|

|

|

Total Liabilities

|

|

|

3,806,075

|

|

|

|

3,518,289

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

92,368

|

|

|

|

92,368

|

|

|

Additional Paid-in Capital

|

|

|

65,000

|

|

|

|

65,000

|

|

|

Retained Earnings

|

|

|

25,767,967

|

|

|

|

26,114,016

|

|

|

|

|

|

25,925,335

|

|

|

|

26,271,384

|

|

|

Less - Treasury Stock, at Cost

|

|

|

654,842

|

|

|

|

634,842

|

|

|

Total Stockholders’ Equity

|

|

|

25,270,493

|

|

|

|

25,636,542

|

|

|

Total Liabilities and Stockholders’ Equity

|

|

$

|

29,076,568

|

|

|

$

|

29,154,831

|

|

See Accompanying Notes

THE RESERVE PETROLEUM COMPANY

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

Operating Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil & Gas Sales

|

|

$

|

2,069,447

|

|

|

$

|

6,280,735

|

|

|

$

|

4,126,369

|

|

|

$

|

10,617,804

|

|

|

Other

|

|

|

47,430

|

|

|

|

544,560

|

|

|

|

105,140

|

|

|

|

770,013

|

|

|

|

|

|

2,116,877

|

|

|

|

6,825,295

|

|

|

|

4,231,509

|

|

|

|

11,387,817

|

|

|

Operating Costs & Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production

|

|

|

397,622

|

|

|

|

721,384

|

|

|

|

814,480

|

|

|

|

1,141,800

|

|

|

Exploration

|

|

|

1,268

|

|

|

|

2,611

|

|

|

|

483,122

|

|

|

|

63,412

|

|

|

Depreciation, Depletion, Amortization and Valuation Provisions

|

|

|

286,274

|

|

|

|

294,843

|

|

|

|

701,179

|

|

|

|

708,524

|

|

|

General, Administrative and Other

|

|

|

386,280

|

|

|

|

375,644

|

|

|

|

757,651

|

|

|

|

686,610

|

|

|

|

|

|

1,071,444

|

|

|

|

1,394,482

|

|

|

|

2,756,432

|

|

|

|

2,600,346

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income From Operations

|

|

|

1,045,433

|

|

|

|

5,430,813

|

|

|

|

1,475,077

|

|

|

|

8,787,471

|

|

|

Other Income, Net

|

|

|

126,337

|

|

|

|

572,800

|

|

|

|

156,137

|

|

|

|

668,047

|

|

|

Income Before Income Taxes

|

|

|

1,171,770

|

|

|

|

6,003,613

|

|

|

|

1,631,214

|

|

|

|

9,455,518

|

|

|

Provision (benefit) for Income Taxes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

180,875

|

|

|

|

1,371,519

|

|

|

|

426,168

|

|

|

|

2,228,689

|

|

|

Deferred

|

|

|

120,897

|

|

|

|

382,963

|

|

|

|

(70,232

|

)

|

|

|

494,828

|

|

|

Total Provision for Income Taxes

|

|

|

301,772

|

|

|

|

1,754,482

|

|

|

|

355,936

|

|

|

|

2,723,517

|

|

|

Net Income

|

|

$

|

869,998

|

|

|

$

|

4,249,131

|

|

|

$

|

1,275,278

|

|

|

$

|

6,732,001

|

|

|

Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income, Basic and Diluted

|

|

$

|

5.37

|

|

|

|

26.17

|

|

|

$

|

7.87

|

|

|

$

|

41.45

|

|

|

Cash Dividends

|

|

$

|

10.00

|

|

|

|

10.00

|

|

|

$

|

10.00

|

|

|

$

|

10.00

|

|

|

Weighted Average Shares Outstanding, Basic and Diluted

|

|

|

162,124

|

|

|

|

162,349

|

|

|

|

162,145

|

|

|

|

162,393

|

|

See Accompanying Notes

THE RESERVE PETROLEUM COMPANY

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Operating Activities

|

|

$

|

2,725,281

|

|

|

$

|

6,379,753

|

|

|

Cash Flows from Investing Activities:

|

|

|

|

|

|

|

|

|

|

Maturity of Available for Sale Securities

|

|

|

15,120,572

|

|

|

|

12,445,531

|

|

|

Purchase of Available for Sale Securities

|

|

|

(15,803,533

|

)

|

|

|

(14,187,308

|

)

|

|

Property Dispositions

|

|

|

2,957

|

|

|

|

648,333

|

|

|

Property Additions

|

|

|

(1,025,848

|

)

|

|

|

(2,330,855

|

)

|

|

Cash Distributions from Equity Investments

|

|

|

14,750

|

|

|

|

2,975

|

|

|

Purchase of Equity Investment in Gathering System

|

|

|

----

|

|

|

|

(51,541

|

)

|

|

Net Cash Applied to Investing Activities

|

|

|

(1,691,102

|

)

|

|

|

(3,472,865

|

)

|

|

Cash Flows from Financing Activities:

|

|

|

|

|

|

|

|

|

|

Payments of Dividends

|

|

|

(1,496,463

|

)

|

|

|

(1,485,544

|

)

|

|

Purchase of Treasury Stock

|

|

|

(20,000

|

)

|

|

|

(31,320

|

)

|

|

Cash Applied to Financing Activities

|

|

|

(1,516,463

|

)

|

|

|

(1,516,864

|

)

|

|

Net Change in Cash and Cash Equivalents

|

|

|

(482,284

|

)

|

|

|

1,390,024

|

|

|

Cash and Cash Equivalents, Beginning of Period

|

|

|

1,430,832

|

|

|

|

1,232,376

|

|

|

Cash and Cash Equivalents, End of Period

|

|

$

|

948,548

|

|

|

$

|

2,622,400

|

|

|

Supplemental Disclosures of Cash Flows

|

|

|

|

|

|

|

|

|

|

Information:

|

|

|

|

|

|

|

|

|

|

Cash Paid During the Periods For:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

3,857

|

|

|

$

|

3,853

|

|

|

Income Taxes

|

|

$

|

21,221

|

|

|

$

|

1,915,200

|

|

See Accompanying Notes

THE RESERVE PETROLEUM COMPANY

NOTES TO CONDENSED FINANCIAL STATEMENTS

June 30, 2009

(Unaudited)

Note 1 – BASIS OF PRESENTATION

The accompanying condensed balance sheet as of December 31, 2008, which has been derived from audited financial statements, the unaudited interim condensed financial statements and these notes have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, certain disclosures

normally included in financial statements prepared in accordance with the accounting principles generally accepted in the United States of America (“GAAP”) have been omitted. The accompanying condensed financial statements and notes thereto should be read in conjunction with the financial statements and notes thereto included in the Company’s 2008 Annual Report on Form 10-K.

In the opinion of Management, the accompanying financial statements reflect all adjustments (consisting only of normal recurring accruals) which are necessary for a fair statement of the results of the interim periods presented. The results of operations for the current interim periods are not necessarily indicative of the operating

results for the full year.

In addition Management has evaluated all subsequent events occurring since June 30, 2009 through August 14, 2009, the date the financial statements were filed with the Securities and Exchange Commission. There have been no subsequent events that would require changes to the accompanying financial statements or disclosure therein.

Note 2 - OTHER INCOME, NET

The following is an analysis of the components of Other Income, Net for the three months and six months ended June 30, 2009 and 2008:

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30

|

|

|

June 30

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

Realized and Unrealized Gain (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on Trading Securities

|

|

$

|

72,804

|

|

|

$

|

36,091

|

|

|

$

|

51,932

|

|

|

$

|

(12,490

|

)

|

|

Gain on Asset Sales

|

|

|

1,045

|

|

|

|

448,056

|

|

|

|

3,046

|

|

|

|

449,016

|

|

|

Interest Income

|

|

|

17,834

|

|

|

|

73,480

|

|

|

|

51,147

|

|

|

|

199,338

|

|

|

Equity Earnings in Investees

|

|

|

9,063

|

|

|

|

15,150

|

|

|

|

33,490

|

|

|

|

34,399

|

|

|

Other Income

|

|

|

30,841

|

|

|

|

107

|

|

|

|

31,233

|

|

|

|

1,802

|

|

|

Interest and Other Expenses

|

|

|

(5,250

|

)

|

|

|

(84

|

)

|

|

|

(14,711

|

)

|

|

|

(4,018

|

)

|

|

Other Income, Net

|

|

$

|

126,337

|

|

|

$

|

572,800

|

|

|

$

|

156,137

|

|

|

$

|

668,047

|

|

Note 3 -

INVESTMENTS AND RELATED COMMITMENTS AND CONTINGENT LIABILITIES, INCLUDING GUARANTEES

The carrying value of Equity Investments consists of the following:

|

|

|

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

Ownership %

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadway Sixty-Eight, Ltd.

|

|

33%

|

|

|

$

|

472,626

|

|

|

$

|

451,654

|

|

|

JAR Investment, LLC

|

|

25%

|

|

|

|

(4,073

|

)

|

|

|

(5,001

|

)

|

|

Bailey Hilltop Pipeline, LLC

|

|

10%

|

|

|

|

59,572

|

|

|

|

61,233

|

|

|

OKC Industrial Properties, LLC

|

|

10%

|

|

|

|

53,198

|

|

|

|

54,698

|

|

|

|

|

|

|

|

$

|

581,323

|

|

|

$

|

562,584

|

|

Broadway Sixty-Eight, Ltd., an Oklahoma limited partnership (the Partnership), owns and operates an office building in Oklahoma City, Oklahoma. Although the Company invested as a limited partner, along with the other limited partners, it agreed jointly and severally with all other limited partners to reimburse

the general partner for any losses suffered from operating the Partnership. The indemnity agreement provides no limitation to the maximum potential future payments.

The Company leases its corporate office from the Partnership. The operating lease under which the space was rented expired December 31, 1994, and the space is currently rented on a year-to-year basis under the terms of the expired lease.

Included with Receivables is a Note Receivable in the amount of $125,000 from the Partnership bearing 3.5% interest and due December 31, 2009. This related party transaction is connected to the construction of a new office building.

JAR Investment, LLC, (JAR) an Oklahoma limited liability company, invested in Oklahoma City metropolitan area real estate, most of which was sold in June 2005. JAR also owns a 70% management interest in Main-Eastern, LLC (M-E), also an Oklahoma limited liability company. JAR and M-E established a joint venture

in 2002 and developed a retail/commercial center on the portion of JAR’s real estate not sold in 2005.

The Company has a guarantee agreement limited to 25% of JAR’s 70% interest in M-E’s outstanding loan plus all costs and expenses related to enforcement and collection, or $137,944 at June 30, 2009. This loan matures December 27, 2013. The Company has evaluated its guarantee related to this obligation and believes

it is unlikely to have to make any payments under the provisions of the guarantee agreement.

In March 2008, the Company purchased a 10% interest in the Bailey Hilltop Pipeline, LLC (Bailey) an Oklahoma limited liability company. Bailey was formed to construct and operate a gathering system for gas produced from wells drilled on the Bailey Hilltop prospect in Grady County, Oklahoma.

Note 4 – PROVISION FOR INCOME TAXES

In 2009 and 2008, the effective tax rate was less than the statutory rate as the combined result of allowable depletion for tax purposes in excess of depletion for financial statements and the corporate graduated tax rate structure.

An audit of the Company’s 2007 Federal income tax return was commenced in the second quarter of 2009 by the Internal Revenue Service. The Company does not anticipate any changes to the income tax return as originally filed.

Note 5 -

ASSET RETIREMENT OBLIGATION

In 2008, the Company began recording an estimated liability for future costs associated with the plugging and abandonment of its oil and gas properties. A liability for the fair value of an asset retirement obligation and a corresponding increase to the carrying value of the related long-lived asset are recorded at the time a well is completed

or acquired. The increase in carrying value is included in proved oil and gas properties in the balance sheets. The Company amortizes the amount added to proved oil and gas property costs and recognizes accretion expense in connection with the discounted liability over the remaining estimated economic lives of the respective oil and gas properties.

The Company’s estimated asset retirement obligation liability is based on estimated economic lives and estimates of the cost to abandon the wells in the future. The liability is discounted using a credit-adjusted risk-free rate estimated at the time the liability is incurred or revised. The credit-adjusted risk-free rates used to

discount the Company’s abandonment liabilities range from 3.25% to 4.00%. Revisions to the liability are due to increases in estimated abandonment costs and changes in well economic lives.

A reconciliation of the Company’s asset retirement obligation liability is as follows:

|

Asset retirement obligation at December 31, 2008

|

|

$

|

516,054

|

|

|

Liabilities incurred for new wells

|

|

|

60,398

|

|

|

Revisions to estimates

|

|

|

53,400

|

|

|

Accretion expense

|

|

|

10,321

|

|

|

Asset retirement obligation at June 30, 2009

|

|

$

|

640,173

|

|

Note 6 – Fair Value Measurements

Certain of the Company’s assets and liabilities are reported at fair value in the accompanying balance sheets. Such assets and liabilities include amounts for both financial and nonfinancial instruments. The Company’s financial instruments consist primarily of cash and cash equivalents, trade receivables, marketable

securities, trade payables, and dividends payable. As of June, 30, 2009 and December 31, 2008, the historical cost of cash and cash equivalents, trade receivables, trade payables and dividends payable are considered to be representative of their respective fair values due to the short-term maturities of these items. At June 30, 2009 and December 31, 2008, the fair value of the Company’s marketable securities was based upon quoted market prices for the securities owned by the Company, which is a Level 1

input. The fair value of the Asset Retirement Obligation a non-financial liability was based upon the assumptions described in the Level 3 inputs below.

The carrying amounts and estimated fair values of select Company assets and liabilities are as follows as of June 30, 2009:

|

|

|

Level 1 Inputs

|

|

|

Level 2 Inputs

|

|

|

Level 3 Inputs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Assets:

|

|

|

|

|

|

|

|

|

|

|

Available for sale securities

|

|

$

|

15,803,533

|

|

|

$

|

----

|

|

|

$

|

----

|

|

|

Trading securities

|

|

$

|

270,915

|

|

|

$

|

----

|

|

|

$

|

----

|

|

|

Nonfinancial Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Retirement Obligation

|

|

$

|

----

|

|

|

$

|

----

|

|

|

$

|

640,173

|

|

The carrying amounts and estimated fair values of select Company assets and liabilities are as follows as of December 31, 2008:

|

|

|

Level 1 Inputs

|

|

|

Level 2 Inputs

|

|

|

Level 3 Inputs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Assets:

|

|

|

|

|

|

|

|

|

|

|

Available for sale securities

|

|

$

|

15,120,573

|

|

|

$

|

----

|

|

|

$

|

----

|

|

|

Trading securities

|

|

$

|

218,228

|

|

|

$

|

----

|

|

|

$

|

----

|

|

|

Nonfinancial Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Retirement Obligation

|

|

$

|

----

|

|

|

$

|

----

|

|

|

$

|

516,054

|

|

Level 1 inputs consist of quoted prices in active markets for identical assets. Level 2 inputs have not been utilized by the Company but are inputs other than quoted prices for similar assets that are observable. Level 3 inputs are unobservable inputs for the liabilities and reflect the Company’s assumptions about the credit markets

and discount rates. These are utilized for the Asset Retirement Obligation. See Note 5 above for a description of the assumptions utilized by the Company to support the fair value as recorded for these liabilities.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This discussion and analysis should be read with reference to a similar discussion in the Company’s December 31, 2008, Form 10-K filed with the Securities and Exchange Commission, as well as the condensed financial statements included in this Form 10-Q.

Forward Looking Statements.

This discussion and analysis includes forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements give the Company’s current expectations of future events. They include statements regarding the drilling

of oil and gas wells, the results of drilling and production which may be obtained from oil and gas wells, cash flow and anticipated liquidity and expected future expenses.

Although management believes the expectations in these and other forward looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Factors that would cause actual results to differ

materially from expected results are described under “Forward Looking Statements” on page 9 of the Company’s Form 10-K for the year ended December 31, 2008.

We caution you not to place undue reliance on these forward looking statements, which speak only as of the date of this report, and we undertake no obligation to update this information. You are urged to carefully review and consider the disclosures made in this and our other reports filed with the Securities and Exchange Commission

that attempt to advise interested parties of the risks and factors that may affect our business.

Financial Conditions and Results of Operations

Item 1.

Liquidity and Capital Resources

.

Please refer to the Condensed Balance Sheets on pages 2 and 3 and the Condensed Statements of Cash Flows on page 5 of this Form 10-Q to supplement the following discussion. In the first half of 2009, the Company continued to fund its business activity through the use of internal sources of cash. In addition to

net cash provided by operations of $2,725,281, the Company also had cash provided by maturity of available for sale securities of $15,120,572, by property dispositions of $2,957, and by distributions from equity investments of $14,750, for total cash provided by internal sources of $17,863,560. The Company utilized cash for the purchase of available for sale securities of $15,803,533, for oil and gas property additions of $1,025,848 and for financing activities of $1,516,463 for total cash applied

of $18,345,844. The excess cash applied over cash provided decreased cash and cash equivalents by $482,284.

Discussion of Significant Changes in Working Capital.

In addition to the changes in cash and cash equivalents discussed above, there were other significant changes in balance sheets working capital line items from December 31, 2008. A discussion of these

items follows.

Available for Sale Securities increased $682,960 (5%) to $15,803,533 as part of the excess cash from operations was used to purchase additional securities.

Receivables decreased $412,767 (24%) in 2009 to $1,326,089 from $1,738,856. This decrease was due to a $149,875 decline in purchaser receivables and a $128,911 decline in the regular oil and natural gas revenue accruals. These declines were both due to lower average monthly revenues for the second quarter of 2009 compared to the fourth

quarter of 2008. In addition, other receivables (including interest receivable and coal royalties) declined $133,981 due to lower interest rates in the first half of 2009 versus 2008 and lower coal royalties in the second quarter of 2009 versus the fourth quarter of 2008. See the discussion of revenues under “Operating Revenues” in Item 2. below for more information about the decline of sales of oil and natural gas.

Refundable income taxes decreased $404,947 (41%) to $594,626 in 2009 from $999,573. The decrease is due primarily to applying 2009 estimated tax payments to the December 31, 2008 refundable income taxes balance. See additional comments under “Provision for Income Taxes” in Item 2. below.

Prepaid expenses increased from $-0- as of December 31, 2008 to $46,300 as of June 30, 2009. This prepayment was for costs associated with the seismic data acquired in July, 2009 on a Grady County, Oklahoma prospect. See “Exploration Costs” in the “Results of Operations” section below for more discussion

of this activity.

Accounts payable increased $29,037 (14%) to $237,524 from $208,487. This increase is due to approximately $131,000 of unpaid charges from an operator for the Company’s share of costs on an exploratory well. The operator has filed for bankruptcy and has had several liens filed by service company vendors who worked on the well. We are

waiting for some clarification before payment of the amount owed is made. This increase is offset by an approximate $100,000 decrease in vendor payables to other operators due to decreased drilling activity at June 30, 2009 versus December 31, 2008. See “Exploration Costs” in the “Results of Operations” section below for more discussion of the current drilling activity.

Deferred income taxes and other liabilities increased $47,582 (22%) to $268,848 from $221,266. The increase is due to a decrease in current deferred taxes payable of $32,418 and an increase of $80,000 in property tax accruals. The deferred tax liability decrease was due to a decline in the current book/tax timing differences from December

31, 2008. Property taxes are mostly for Texas properties and are accrued for the first three quarters each year and usually paid in the fourth quarter.

Discussion of Significant Changes in the Condensed Statements of Cash Flow.

As noted in the above paragraph, net cash provided by operating activities was $2,725,281 in 2009, a decrease of $3,654,472 (57%) from the comparable period in 2008. The decrease was

primarily the result of a decrease in revenue from oil and gas sales and lease bonuses offset by decreased income tax payments. For more information, see “Operating Revenues” below.

Available for sale securities at June 30, 2009 and December 31, 2008 are comprised entirely of US treasury bills with six month maturities. During the six months ended June 30, 2009, $15,120,572 of these securities matured and the cash was used to purchase new securities. As discussed above in the working capital changes, $682,961 of excess

cash provided by operating activities was used to purchase additional securities.

Cash applied to the purchase of property additions in 2009 was $1,025,848, a decrease of $1,356,548 (57%) from property additions in 2008 of $2,382,396. In both 2008 and 2009, all of the cash applied to property additions was related to oil and gas exploration activity. See the subheading “Exploration Costs” below

for additional information regarding this activity and the related capital expenditures.

The cash provided by property dispositions in 2009 was $2,957, a decrease of $645,376 from cash provided in 2008 of $648,333. The decrease was due entirely to $647,373 of proceeds from the sale of the Company’s working interest in a group of 10 producing properties in June 2008. No similar sales occurred in 2009.

Conclusion.

Management is unaware of any additional material trends, demands, commitments, events or uncertainties which would impact liquidity and capital resources to the extent that the discussion presented in Form 10-K for December 31,

2008, would not be representative of the Company’s current position.

Item 2.

Material Changes in Results of Operations Six Months Ended June 30, 2009, Compared with Six Months Ended June 30, 2008

.

The Company had net income of $1,275,278 in 2009, as compared to net income of $6,732,001 in 2008, a decrease of $5,456,723. The decrease in net income was the combined result of a $7,156,308 (63%) decrease in operating revenues; a $156,086 (6%) increase in operating costs and expenses and a $511,910 (77%) decrease in other income,

net. The net effect of these changes was a decrease in income before income taxes of $7,824,304 (83%). This decrease was partially offset by a $2,367,581 (87%) decrease in the provision for income taxes.

A discussion of revenue from oil and gas sales and other significant line items in the condensed statements of operations follows.

Operating Revenues

. Revenues from oil and gas sales decreased $6,491,435 (61%) to $4,126,369 in 2009 from $10,617,804 in 2008. Of the $6,491,435 decrease, crude oil sales declined $2,619,117, natural gas sales declined $3,818,453 and miscellaneous oil and

gas product sales declined $53,865.

The $2,619,117 (60%) decrease in oil sales to $1,735,991 in 2009 from $4,355,108 in 2008 was the result of a decrease in the volume of oil sold and the average price per barrel (Bbl). The volume sold declined 1,059 Bbls to 41,307 Bbls in 2009 resulting in a negative volume variance of $108,862. The average price per Bbl declined $60.77

to $42.03 per Bbl resulting in a negative price variance of $2,510,255.

The decrease in oil volumes sold was mostly due to normal production declines from existing working interest wells exceeding the production from new working interest wells that first produced after June 30, 2008.

The $3,818,453 (62%) decrease in gas sales to $2,311,671 in 2009 from $6,130,124 in 2008 was the result of a decrease in the volume of gas sold and the average price per thousand cubic feet (MCF). The volume sold declined 62,012 MCF to 649,746 MCF resulting in a negative volume variance of $534,290. The average price per MCF

declined $5.06 to $3.56 per MCF, resulting in a negative price variance of $3,284,163.

Gas sales from the Robertson County, Texas royalty interest properties continue to account for a significant portion of the Company’s gas revenues. These properties provided approximately 65% of the Company’s first six months of 2009 gas sales volumes and revenues versus 59% for the first six months of 2008. See sub-heading

“Operating Revenues” on page 15 of the Company’s 2008 Form 10-K for more information about these properties.

For both oil and gas sales, the price change was mostly the result of a change in the spot market prices upon which most of the Company’s oil and gas sales are based. Spot market prices have had significant fluctuations in the past and these fluctuations are expected to continue.

Other operating revenues include lease bonuses of $14,407 in 2009 and $636,429 in 2008. The 2008 lease bonuses were mostly for leases in Leon and Robertson Counties in East Texas. Other operating revenues also include $90,733 of coal royalties for the first half of 2009, compared to $133,584 for 2008.

Operating Costs and Expenses

. Operating costs and expenses increased $156,086 (6%) to $2,756,432 in 2009 from $2,600,346 in 2008. The increase was mostly the result of an increase in exploration costs charged to expense of $419,710 and an increase

in general administrative and other expense (G&A) of $71,041 offset by a decrease in production costs of $327,320. The significant changes in these line items will be discussed below.

Production Costs.

Production costs decreased $327,320 (29%) in 2009 to $814,480 from $1,141,800 in 2008 due to decreases in gross production tax, transportation and compression expense and lease operating expense. Gross production tax decreased

$219,530 (54%) to $188,248 in 2009 from $407,778 in 2008 as a result of the decline in oil and gas sales. Transportation and compression expense decreased $51,452 (22%) to $181,422 in 2009 from $232,874 in 2008 due mostly to the decline in gas production and sales. Lease operating expense decreased $56,337 (11%) to $444,811 in 2009 from $501,148 in 2008 due mostly to the June, 2008 sale of the Company’s working interest in a group of ten producing properties.

Exploration Costs.

Total exploration expense increased $419,710 to $483,122 in 2009 from $63,412 in 2008. The increase was due to increases in geological expenses of $173,395 to $223,323 and dry hole expenses of $246,315 to $259,799 in 2009 versus

2008.

The following is a summary as of July 31, 2009, updating both exploration and development activity from December 31, 2008.

The Company participated with its 18% working interest in the drilling of two step-out wells on a Barber County, Kansas prospect. Both wells were started in November 2008. One was completed in July 2009 as a commercial oil and gas well. The other was also completed in July 2009 and is currently being tested. Total

capitalized costs were $201,303 at June 30, 2009, including $53,006 in prepaid drilling costs.

The Company participated in the drilling of three exploratory wells on a Grady County, Oklahoma prospect in which it has a 10% interest. The first well was started in July 2008 and completed in March 2009 as a commercial gas and condensate producer. The second well was started in August 2008 and completed in April

2009, flowing gas and condensate at a commercial rate. Sales commenced in June 2009. The third well, a re-entry and sidetrack of a 2007 exploratory dry hole, was started in December 2008 and completed in January 2009 as a dry hole. In July 2009 the Company participated in the acquisition of additional 3-D seismic data over a portion of the prospect and that data is currently awaiting processing. The Company will participate in the drilling of a step-out well which is

planned for the third quarter of 2009. Total capitalized costs for the period ended June 30, 2009 were $84,979. Dry hole costs of $125,635 were expensed as of June 30, 2009. In addition the Company had prepaid costs of $46,300 at June 30, 2009 for its share of the seismic survey discussed above.

The Company participated with its 16.2% working interest in the drilling of an exploratory well on a Comanche County, Kansas prospect. The well was started in November 2008 and completed in March 2009 as a marginal oil and gas producer. A re-completion attempt in another zone is currently in progress. Total

capitalized costs as of June 30, 2009 were $120,103, including $12,658 in prepaid drilling costs.

The Company participated with its 18% working interest in the drilling of an exploratory well on a Kiowa County, Kansas prospect. The well was started in November 2008 and completed in February 2009 as a commercial oil and gas producer. Total capitalized costs were $134,442 at June 30, 2009, including $12,310 in prepaid

drilling costs.

The Company participated with its 18% working interest in the drilling of two exploratory wells on a Comanche County, Kansas prospect. The first was started in April 2009 and completed in June 2009 as a commercial oil and gas well. The second was drilled in April 2009 and completed as a dry hole. As of

June 30, 2009, capitalized costs were $71,236, prepaid drilling costs were $24,057, and dry hole costs were $31,103.

The Company participated with its 18% working interest in the drilling of an exploratory well on a Comanche County, Kansas prospect. The well was started in May 2009 and a completion attempt is currently in progress. Capitalized costs at June 30, 2009 were $94,500 including $44,750 in prepaid drilling costs.

The Company participated with its 18% working interest in the drilling of two exploratory wells on a Comanche County, Kansas prospect. One was drilled in May 2009 and the other in June 2009. Both are currently awaiting completion attempts. Capitalized costs at June 30, 2009 were $180,000, including $95,963

in prepaid drilling costs.

The Company participated with its 16% working interest in the drilling of two step-out wells on a Harper County, Kansas prospect. Both wells were drilled starting in June 2009 and both are currently awaiting completion attempts. Total capitalized costs at June 30, 2009 were $105,832 including, $74,554 in prepaid drilling costs.

The Company participated with an 18% interest in the development of a McClain County, Oklahoma prospect. Acreage has been acquired and it is likely that an exploratory well will be drilled in 2009. Leasehold costs at June 30, 2009 were $10,606.

The Company participated with a 50% interest in the development of another McClain County, Oklahoma prospect. Acreage has been acquired and agreements negotiated to sell part of the Company’s interest and to obtain access to a 3-D seismic survey which covered the prospect area. The Company will retain a 16%

interest in the prospect acreage. It is likely that an exploratory well will be drilled in 2009. Leasehold costs at June 30, 2009 were $43,644.

The Company is participating with a 21% interest in the development of a Lincoln County, Oklahoma prospect. Acreage is being acquired and it is possible that an exploratory horizontal well will be drilled in 2009, but 2010 is more likely. Leasehold costs were $44,124 as of June 30, 2009.

The Company participated with a 12% working interest in the drilling of two step-out wells on a Woods County, Oklahoma prospect. Both wells were started in June 2009. The first was completed in July 2009 as a commercial oil and gas well. A completion attempt is currently in progress on the second. Capitalized

costs as of June 30, 2009 were $57,600, including $21,011 in prepaid drilling costs.

The Company participated with its 10.5% working interest in the drilling of two exploratory wells on a Woods County, Oklahoma prospect. Both wells were started in November 2008. The first was completed in March 2009 as a commercial oil well. The second was completed in April 2009 as a commercial oil and

gas well, although it also produces large quantities of water. Total capitalized costs were $286,286 at June 30, 2009.

The Company participated with its 8% working interest in the drilling of a step-out well on a Woods County, Oklahoma prospect. The well was started in December 2008 and completed in March 2009 as a commercial oil and gas producer. Total capitalized costs were $56,780 at June 30, 2009, including $3,010 in prepaid drilling

costs.

In January 2009, the Company purchased a 16% interest in 18,343 net acres of leasehold on a Ford County, Kansas prospect for $176,094 and paid $219,429 in seismic costs. A 3-D seismic survey has been completed and an exploratory well will be drilled starting in August 2009.

In March 2009, the Company purchased a 7% interest in 3,262 net acres of leasehold on a Williams and Defiance Counties, Ohio prospect for $15,702, including $3,889 expensed for seismic. Two exploratory wells were drilled starting in April 2009. Completion attempts on both wells were unsuccessful and the operator has

recommended that both be plugged. Capitalized costs were $59,208 for the period ended June 30, 2009, including $58,713 in prepaid drilling costs.

In April 2009, the Company agreed to participate with a fee mineral interest in the drilling of a step-out horizontal well in Van Buren County, Arkansas. The Company will have a 9.3% interest in the well which will be drilled before the end of 2009.

In July 2009, the Company purchased a 6% interest in 10,142 net acres of leasehold on a Ford and Kiowa Counties, Kansas prospect for $18,255. An exploratory horizontal well was started in July 2009 and is currently drilling.

General, Administrative and Other Expenses (G&A).

G&A increased $71,041 (10%) to $757,651 in 2009 from $686,610 in 2008. The increase was due to increased accounting and legal fees of about $40,000 and increased salaries and benefits of

about $32,000.

Other Income, Net.

This line item decreased $511,910 (77%) to income of $156,137 in 2009 from $668,047 in 2008. See Note 2 to the accompanying condensed financial statements for an analysis of the components of this item.

Trading securities gains in 2009 were $51,932 as compared to losses of $(12,490) in 2008, an increase of $64,422. In 2009, the Company had unrealized gains from adjusting securities held at June 30, 2009 to fair market value of $33,563 and net realized gains of $18,369. In 2008 the Company had unrealized

losses of $(25,475) and net realized gains of $12,985.

Gain on asset sales decreased $445,970 to $3,046 in 2009 from $449,016 in 2008. The decrease was due entirely to a $448,056 gain from the sale of the Company’s working interest in a group of ten producing properties in June, 2008. No similar sales occurred in 2009.

Interest income decreased $148,191 to $51,147 in 2009 from $199,338 in 2008. The decrease was mostly the result of a decrease in the effective yield of US treasury bills which comprise the Company’s available for sale securities investments. The effect of the interest rate decline was offset slightly by an increase

in the average balance of these investments for the first six months of 2009 versus 2008.

Equity earnings in investees decreased $909 to of $33,490 in 2009 from $34,399 in 2008. The following is the Company’s share of earnings for the six months ended June 30, 2009 and 2008:

|

|

|

Earnings

|

|

|

|

|

2009

|

|

|

2008

|

|

|

Broadway Sixty-Eight, Ltd.

|

|

$

|

20,972

|

|

|

$

|

29,579

|

|

|

JAR Investments, LLC

|

|

|

4,179

|

|

|

|

4,820

|

|

|

Bailey Hilltop Pipeline, LLC

|

|

|

8,339

|

|

|

|

----

|

|

|

|

|

$

|

33,490

|

|

|

$

|

34,399

|

|

See Note 3, to the accompanying condensed financial statements, for additional information, including guarantees, pertaining to Broadway Sixty-Eight, Ltd., and JAR Investments, LLC.

Provision for Income Taxes.

The provision for income taxes decreased $2,367,581 to $355,936 in 2009 from $2,723,517 in 2008. The decrease was due primarily to the decreased pretax income in 2009 from 2008. Of the 2009 income tax provision,

the estimated current tax expense was $426,168 and the estimated deferred tax benefit was $(70,232). Of the 2008 income tax provision, the current and deferred expenses were $2,228,689 and $494,828 respectively. See Note 4, to the condensed statements for additional information on income taxes.

Item 3.

Material Changes in Results of Operations Three Months Ended June 30, 2009, Compared with Three Months Ended June 30, 2008

.

Net income decreased $3,379,133 to $869,998 in 2009 from $4,249,131 in 2008. The material changes in the results of operations which caused the decrease in net income will be discussed below.

Operating Revenues.

Revenues from oil and gas sales decreased $4,211,288 (67%) to $2,069,447 in 2009 from $6,280,735 in 2008. The decrease was the result of a decrease in gas sales of $2,576,551 (73%) to $968,650, a decrease in oil sales of $1,609,761

(60%) to $1,055,903 and a decrease in sales of miscellaneous products of $24,978 to $44,892.

The decrease in gas sales was the result of a decrease in the average price of $6.44 per MCF to $3.27 for a negative price variance of $1,911,029 and a decrease in the volume of gas sold of 68,521 for a negative volume variance of $665,522.

The decrease in oil sales was the result of a decrease in the average price received of $63.25 per Bbl to $50.42 for a negative price variance of $1,324,553 and a decrease in the volume of oil sold of 2,509 Bbls to 20,941 Bbls for a negative volume variance of $285,208.

Other operating revenues decreased $497,130 to $47,430 in 2009 from $544,560 in 2008. This decrease was primarily due to a decrease in Texas lease bonuses from $451,278 in 2008 to $-0- in 2009.

Production Costs.

Production costs decreased $323,762 to $397,622 in 2009 from $721,384 in 2008. Of this decrease, lease operating expense accounted for $83,524, gross production tax accounted for $204,165 and transportation and compression expense

accounted for the remaining $36,073. The reasons for the decreased costs are discussed above in “Item 2.” under “Production Costs”.

Exploration Expense.

Exploration expense decreased $1,343 to $1,268 in 2009 from $2,611 in 2008. See the 2009 exploration and development activity discussion above in “Item 2.” under “Exploration Costs” for more information.

Other Income, Net.

See Note 2 to the accompanying condensed financial statements for an analysis of the components of other income, net. In 2009 this line item decreased $446,463 to $126,337 from $572,800 in 2008. Most of the decrease was due

to a $448,056 gain on asset sale in 2008 versus a gain of only $1,045 in 2009. Other line items that decreased in 2009 from 2008 were a decline in interest income of $55,646 and a decline in equity earnings of $6,087. These decreases were offset by a $36,713 increase in gains on trading securities and a $25,135 increase in other income. The reasons for these variances were covered in the discussion above in “Item 2.”

Provision for Income Taxes.

Provision for income taxes decreased $1,452,710 (83%) to $301,772 in 2009 from $1,754,482 in 2008. See discussion above in “Item 2.” and Note 4 to the accompanying condensed financials for a discussion of the changes

in the provision for income taxes.

There were no additional material changes between the quarters which were not covered in the discussion in “Item 2.” above, for the six months ended June 30, 2009.

Item 4.

Off-Balance Sheet Arrangements

The Company’s off-balance sheet arrangements consists of JAR Investments, LLC, an Oklahoma limited liability company and Broadway Sixty-Eight, Ltd., an Oklahoma limited partnership. The Company does not have actual or effective control of either of these entities. Management of these entities could at any time

make decisions in their own best interest which could materially affect the Company’s net income or the value of the Company’s investments.

For more information about these entities, see Note 3, to the accompanying financial statements and this management’s discussion and analysis above in “Item 2.” under “Other Income, Net”, for the six months ended June 30, 2009.

ITEM

3.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not Applicable.

ITEM 4T

.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As defined in Rule 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934 (the "Exchange Act"), the term “disclosure controls and procedures” means controls and other procedures of an issuer that are designed to ensure that information required to be disclosed

by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer's management, including its principal executive

and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

The Company’s Principal Executive Officer and Principal Financial Officer evaluated the effectiveness of the Company’s disclosure controls and procedures. Based on this evaluation, they concluded that the Company’s disclosure controls and procedures were effective as of June 30, 2009.

Internal Control Over Financial Reporting

As defined in Rule 13a-15(f) and 15d-15(f) of the Exchange Act, the term "internal control over financial reporting" means a process designed by, or under the supervision of, the issuer's principal executive and principal financial officers, or persons performing similar functions, and effected by the issuer's board of directors, management

and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

|

|

(1)

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the issuer;

|

|

|

(2)

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of management and directors of the issuer; and

|

|

|

(3)

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the issuer's assets that could have a material adverse effect on the financial statements.

|

The Company's management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. There were no changes in the Company’s internal control over financial reporting during the quarter ended June 20, 2009 that have materially affected, or are reasonably likely to materially

affect, the Company's internal control over financial reporting.

PART II

OTHER INFORMATION

ITEM

1.

LEGAL PROCEEDINGS

During the current year second quarter ended June 30, 2009, the Company did not have any material legal proceedings brought against

it or its

properties

.

ITEM

1A.

RISK FACTORS

Not Applicable.

ITEM

2.

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

ISSUER PURCHASES OF EQUITY SECURITIES

|

Period

|

|

Total Number of Shares Purchased

|

|

|

Average Price Paid Per Share

|

|

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1)

|

|

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (1)

|

|

|

April 1 to April 30, 2009

|

|

|

16

|

|

|

$

|

200.00

|

|

|

|

-

|

|

|

|

-

|

|

|

May 1 to May 31, 2009

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

June 1 to June 30, 2009

|

|

|

54

|

|

|

$

|

200.00

|

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

|

70

|

|

|

$

|

200.00

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1)

|

The Company has no formal equity security purchase program or plan. The Company acts as its own transfer agent and most purchases result from requests made by shareholders receiving small odd lot share quantities as the result of probate transfers.

|

ITEM

3.

DEFAULTS UPON SENIOR SECURITIES

None.

ITEM

4.

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

(a)

|

The annual meeting of stockholders’ was held on Tuesday, May 19, 2009. A brief description of each matter voted on at the meeting is given in the paragraphs below.

|

|

(b)

|

The registrant’s board of directors was re-elected in its entirety. A summary of voting results follows:

|

|

|

|

RESULTS OF VOTE

|

|

|

|

BY PROXY

|

|

|

IN PERSON

|

|

|

|

FOR

|

|

|

WITHHOLD

AUTHORITY

|

|

|

FOR

|

|

WITHHOLD

AUTHORITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MASON McLAIN

|

|

61,307

|

|

|

579

|

|

|

50,674

|

|

|

|

R.T. McLAIN

|

|

61,398

|

|

|

488

|

|

|

50,674

|

|

|

|

ROBERT SAVAGE

|

|

61,436

|

|

|

450

|

|

|

50,674

|

|

|

|

MARVIN E. HARRIS

|

|

61,436

|

|

|

450

|

|

|

50,674

|

|

|

|

JERRY L. CROW

|

|

61,436

|

|

|

450

|

|

|

50,674

|

|

|

|

WILLIAM (BILL) SMITH

|

|

61,436

|

|

|

450

|

|

|

50,674

|

|

|

|

DOUG FULLER

|

|

61,436

|

|

|

450

|

|

|

50,674

|

|

|

|

CAMERON R. McLAIN

|

|

61,391

|

|

|

495

|

|

|

50,674

|

|

|

|

KYLE McLAIN

|

|

61,398

|

|

|

488

|

|

|

50,674

|

|

|

|

(c)

|

The stockholders approved all actions of the directors since the stockholders’ annual meeting on Tuesday, May 19, 2009. The stockholders cast 112,560 votes for the proposal. There were no abstentions, broker non-votes or votes cast against the proposal.

|

ITEM

5. OTHER INFORMATION

None

.

ITEM

6. EXHIBITS

The following documents are exhibits to this Form 10-Q. Each document marked by an asterisk is filed electronically herewith.

|

Exhibit

|

|

|

Number

|

Description

|

|

|

|

|

|

Certification of Principal Executive Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

|

Certification of Principal Financial Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

|

Certification Pursuant to 18 U.S.C. Section 1350.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereto duly authorized.

|

|

THE RESERVE PETROLEUM COMPANY

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

August 14, 2009

|

/s/ Cameron R. McLain

|

|

|

|

Cameron R. McLain,

|

|

|

|

Principal Executive Officer

|

|

|

|

|

|

|

|

|

|

|

Date:

August 14, 2009

|

/s/ James L. Tyler

|

|

|

|

James L. Tyler

|

|

|

|

Principal Financial and Accounting Officer

|

|

19

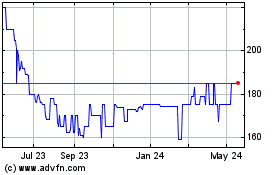

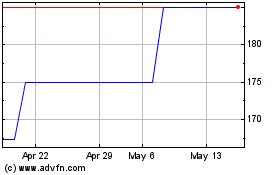

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From May 2024 to Jun 2024

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Jun 2023 to Jun 2024