Current Report Filing (8-k)

September 07 2022 - 5:30PM

Edgar (US Regulatory)

0000034285

false

0000034285

2022-08-31

2022-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report: August 31, 2022

(Date

of earliest event reported)

RELIABILITY

INCORPORATED

(Exact

name of registrant as specified in its charter)

| Texas |

|

000-07092 |

|

75-0868913 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

22505

Gateway Center Drive

P.O. Box 71

Clarksburg,

MD 20871

(Address

of principal executive offices, including zip code)

(202)

965-1100

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, no par value |

|

RLBY |

|

OTC

Pink Sheets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events.

As

previously disclosed, Reliability Incorporated (the “Company”) and Maslow Media Group, Inc. (“MMG”) were in arbitration

with Vivos Holdings, LLC (“Vivos”), Vivos Real Estate Holdings, LLC (“VREH”), Naveen Doki (“Naveen”)

Silvija Valleru (“Valleru”), Suresh Doki (“Suresh”), Shirisha Janumpally (“Janumpally”), individually

and as Trustee of Judos Trust, Kalyan Pathuri (“Pathuri”), individually and as Trustee of Igly Trust, and Federal Systems,

LLC (“Federal Systems” and, together with Vivos, VREH, Naveen, Valleru, Suresh, Janumpally and Pathuri, collectively the

“Vivos Group”) before a retired judge (the “Arbitrator”) relating to amounts due and owing under various promissory

notes and to a claim for fraud regarding that certain Merger Agreement between the Company, MMG and certain other persons

and entities, dated September 18, 2019 (the “Merger Agreement”). The arbitration hearings were held over the course of

six days in March 2022 with closing arguments in June 2022.

On

August 31, 2022, the Arbitrator issued an award (the “Award”) with the Company and MMG prevailing on their claims. The Company

and MMG were awarded the following:

| |

● |

an

award in favor of MMG against Vivos under Note I (as defined in the Award) in the amount of $3,458,377, with interest thereon from

June 30, 2022, at the rate of 4.5% per year; |

| |

● |

no

award as to Note II (as defined in the Award) until and at such time as the automatic stay imposed by the United States Bankruptcy

Court as a result of the filing of a petition in bankruptcy by VREH is lifted or the bankruptcy proceeding is terminated; |

| |

● |

an

award in favor of MMG against Vivos under Note III (as defined in the Award) in the amount of $800,448, with interest thereon from

June 30, 2022, at the rate of 2.5% per year, plus collection costs, including reasonable attorneys’ fees, incurred in the effort

to collect Note III; |

| |

● |

an

award in favor of MMG against Naveen under the Personal Guaranty (as defined in the Award) in the amount of $2,309,449, plus interest

thereon at the rate of 6% per year from the date of the Award; |

| |

● |

an

award in favor of the Company against Naveen, Valleru, Janumpally, individually and as Trustee of Judos Trust, and Pathuri, as Trustee

of Igly Trust, jointly and severally, for contract damages of $1,000,000, to be satisfied by the transfer of their shares of the

Company common stock to the Company equal in value to $1,000,000, valued as of the date of the Award, in accordance with the provisions

of Section 9.06(d) of the Merger Agreement; |

| |

● |

an

award in favor of the Company against Naveen, Valleru, Janumpally, individually and as Trustee of Judos Trust, and Pathuri, as Trustee

of Igly Trust, jointly and severally, for fraud damages in the amount of $4,327,127, plus interest thereon at the rate of 6% per

year from the date of the Award, together with any out-of-pocket fees and expenses, including attorneys’ and accountants’

fees; |

| |

● |

an

award appointing a rehabilitative receiver for the Company under the deadlock situation provisions of Section 11.404(a)(1)(B) of

the Texas Business Organizations Code, the primary function of which is to collect the contract and fraud damages, including costs,

expenses and fees provided in the Award, due to the Company, with matters regarding such receivership to be set forth in a supplemental

award; and |

| |

● |

declaratory

relief in favor of the Company and its officers and directors. |

Section

11.404(a)(1)(B) of the Texas Business Organizations Code provides for the appointment of a rehabilitative receiver when “the governing

persons of the entity are deadlocked in the management of the entity’s affairs, the owners or members of the entity are unable

to break the deadlock, and irreparable injury to the entity is being suffered or is threatened because of the deadlock.” With respect

to the receivership, the owners or holders of all of the shares of common stock of the Company received as a result of the conversion

of 1,600 shares of common stock of MMG owed by Naveen and Valleru under the Merger Agreement shall not be entitled to vote any of those

shares at any annual or special meeting of the shareholders of the Company during the period of the receivership. Upon the completion

of the receiver’s primary function of collecting damages due to the Company, the receivership shall terminate and the restrictions

on the rights of the shareholders of the Company imposed by the Award shall be lifted. The parties have until September 19, 2022 to submit

to the Arbitrator written proposals for the rehabilitative receivership.

The

foregoing summary of the Award is qualified in its entirety by reference to the full text of the Award, which is filed as Exhibit 99.1

hereto and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

RELIABILITY

INCORPORATED |

| |

|

|

| |

By: |

/s/ Nick

Tsahalis |

| |

|

Nick

Tsahalis |

| |

|

President

and Chief Executive Officer |

Date:

September 7, 2022

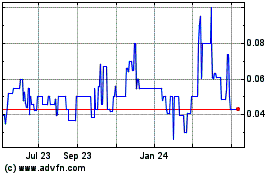

Reliability (PK) (USOTC:RLBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

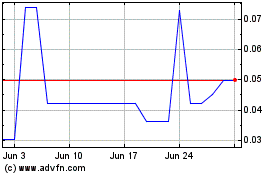

Reliability (PK) (USOTC:RLBY)

Historical Stock Chart

From Jan 2024 to Jan 2025