Oil Prices Rebound -- Ivanhoe Energy and Independence Energy Shares Jump

June 21 2012 - 8:20AM

Marketwired

Oil prices Tuesday rebounded on hopes of stimulus measures from the

Federal Reserve and on a rising Euro. Oil investors have been

worried about how a potential recession in Europe would affect

global oil demand, Europe currently accounts for approximately 20

percent of the world's oil consumption. Any action by the Federal

Reserve will provide a boost for oil prices, which on February 24

was at a yearly high of $109.77. The Paragon Report examines

investing opportunities in the Independent Oil & Gas Industry

and provides equity research on Ivanhoe Energy Inc. (NASDAQ: IVAN)

(TSX: IE) and Independence Energy Corp. (OTCQB: IDNG) (PINKSHEETS:

IDNG).

Access to the full company reports can be found at:

www.ParagonReport.com/IVAN

www.ParagonReport.com/IDNG

Investors are watching closely for any signs of stimulus from

the Federal Reserve as the U.S. central bank began a two-day

meeting Tuesday. "A few market participants are still waiting and

hoping for the U.S. Fed to trigger a new round of something that

can boost global markets," said Olivier Jakob, a Petromatrix energy

analyst.

Growing concerns of an embargo or attack on Iran, which

significantly cut oil supply, have also pushed oil prices higher.

The possibility of a European oil embargo in July has increased as

recent talks regarding Iran's nuclear program have done little to

ease tensions between Iran and the six world powers.

Paragon Report releases regular market updates on the

Independent Oil & Gas Industry so investors can stay ahead of

the crowd and make the best investment decisions to maximize their

returns. Take a few minutes to register with us free at

www.ParagonReport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Ivanhoe Energy is an independent international heavy oil

exploration and development company focused on pursuing long-term

growth in its reserves and production using advanced technologies,

including its proprietary heavy oil upgrading process. For the

first quarter of 2012 the company posted a net loss of $10.7

million, compared to $11.1 million net loss in the year ago

quarter.

Independence Energy Corp. is an oil and gas exploration and

development company focused on projects in the United States.

Independence Energy is seeking to further advance its existing

projects through development or offset drilling and to expand its

portfolio to include additional property interests in the United

States.

Paragon Report provides Market Research focused on equities that

offer growth opportunities, value, and strong potential return. We

strive to provide the most up-to-date market activities. We

constantly create research reports and newsletters for our members.

The Paragon Report has not been compensated by any of the

above-mentioned companies. We act as independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.ParagonReport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

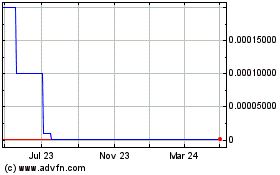

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Jun 2024 to Jul 2024

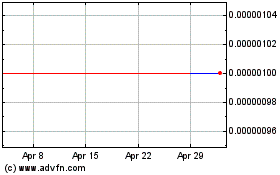

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Jul 2023 to Jul 2024