Wendy's, Walt Disney, Nintendo: Stocks That Defined the Week -- WSJ

May 09 2020 - 3:02AM

Dow Jones News

By Francesca Fontana

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 9, 2020).

Wendy's Co.

Where's the beef? Wendy's is limiting its signature fresh-beef

hamburgers due to coronavirus-related meat shortages caused by

temporary closures of meatpacking plants across the country.

Wendy's serves only fresh beef at its 5,850 U.S. locations. That

makes it more vulnerable to supply disruptions because it can't

rely on frozen stocks like rivals Restaurant Brands International

Inc.'s Burger King and McDonald's Corp. do. Wendy's shares fell

2.4% Tuesday.

Norwegian Cruise Line Holdings Ltd.

Norwegian Cruise Line is struggling to stay afloat. The cruise

line said Tuesday that it won't be able to remain in business

without a significant influx of money needed to offset the

suspension of travel during the coronavirus pandemic. Norwegian has

canceled all its sailings through the end of June, and has said it

plans to restart some cruise operations as soon as July 1 if the

Centers for Disease Control and Prevention has lifted its no-sail

order by then. The company is seeking to raise about $2 billion in

debt and equity. Norwegian shares plummeted 23% Tuesday.

Mattel Inc.

Families in need of entertainment during a pandemic are reaching

for board games, not Barbie dolls. Mattel toy maker posted a 14%

drop in first-quarter sales late Tuesday. Its Barbie sales fell 10%

and its Fisher-Price and Thomas & Friends toys were down 25%.

Those results follow a report last month from rival Hasbro Inc. of

surging sales during the first quarter of board games Monopoly,

Jenga, Connect 4 and Operation. Mattel did have some brands that

stood out: Hot Wheels sales rose 5%, while games like Uno and

Pictionary also posted gains. Mattel shares fell 1.3%

Wednesday.

Walt Disney Co.

The Magic Kingdom ran out of tricks in the first three months of

2020. Walt Disney said late Tuesday that it lost $1.4 billion as

the pandemic shut down its film and TV productions and closed theme

parks world-wide. The global economic shutdown has exposed a

central vulnerability to Disney's franchise-based business model

that uses characters from Marvel Studios or the Star Wars universe

to sell movie tickets, action figures, streaming-service

subscriptions and theme-park tickets. Disney+ has been a rare

bright spot as people stay at home to avoid spreading the virus,

and the company said last month it had surpassed 50 million

subscribers. Disney shares fell 0.2% Wednesday.

Nintendo Co.

Millions of homebound consumers are escaping lockdowns on their

own virtual tropical islands, giving Nintendo's business a big

boost. The Japanese game giant's "Animal Crossing: New Horizon"

sold 13.4 million copies in the first six weeks in major markets

since it went on sale March 20, and Nintendo sold more than three

million Switch videogame consoles during the most recent quarter.

Demand for the "Animal Crossing" game and supply-chain issues

during the pandemic have led to some shortages of the Switch

hardware, but Nintendo said the shortages had only a limited impact

on its results for the fiscal year ended in March. American

depositary shares of Nintendo added 2.3% Thursday.

Marathon Petroleum Corp.

After weeks of staying inside, Americans are starting to get

back behind the wheel. That's welcome news for fuel makers like

Marathon Petroleum, Valero Energy and Phillips 66. The companies

have said they expect gasoline demand to continue to rebound after

plunging to roughly half of normal levels in early April, as states

reopen from lockdowns imposed to limit the spread of the new

coronavirus. Marathon reported a first-quarter loss of $9.2

billion, the company's largest quarterly loss on record. Still, the

companies are generally optimistic about an eventual recovery in

demand. Marathon shares fell 1.2% Tuesday.

Uber Technologies Inc.

Uber is mapping out a revised path to profitability. After

losing riders during the pandemic, Chief Executive Dara

Khosrowshahi said Thursday that Uber plans $1 billion in fixed-cost

cuts. That includes lower marketing expenses, deferral of capital

expenditures and a 14% reduction of staff. Those measures could put

Uber in a position to be profitable in 2021, the milestone that the

company had targeted to reach on an adjusted basis in 2020. Smaller

rival Lyft Inc. has also shelved its profitability target and

embarked on a cost-cutting effort that it says will make it easier

to turn profitable once ridership recovers. Uber shares rose 6%

Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

May 09, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

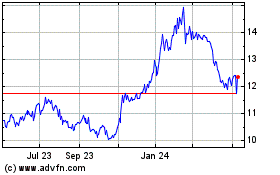

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Oct 2024 to Nov 2024

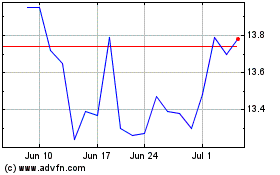

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Nov 2023 to Nov 2024