Hungarian Development Bank MFB In Talks On Takarekbank Takeover -Report

May 03 2012 - 4:57AM

Dow Jones News

Hungary's state-owned development bank MFB Zrt. is in talks with

German shareholder DZ Bank AG regarding the takeover of

Takarekbank, MFB Chief Executive Laszlo Baranyay told Hungarian

weekly Heti Valasz in an interview published Thursday.

The Hungarian government is looking for ways to enhance lending

in order to kick-start growth in the ailing economy. Hungarian

banks, mostly foreign-owned, have been under deleveraging pressure

amid severe losses imposed by a government scheme to reduce the

stock of household foreign currency mortgages and a hefty tax on

the financial sector.

"It is not the MFB group's job to move instead of commercial

banks. But there are times when--for a transitionary period--we

need to take their place," Baranyay said.

Baranyay said negotiations with Takarekbank's owners would yield

an outcome soon and no further acquisitions were planned for the

time being.

Takarekbank is a savings cooperative, with DZ Bank owning 37% of

its shares. The remaining ownership is divided among member

institutions.

The development bank's plans are in line with the government aim

to raise ownership in strategic companies. The cabinet has closed

transactions on raising its stake in Hungarian oil company MOL

Nyrt.(MOL.BU) and the takeover of automotive manufacturer Raba

Nyrt. (RABA.BU).

Newspaper website: www.hetivalasz.hu

-Budapest Bureau, Dow Jones Newswires; +361-267-0622

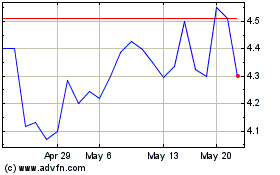

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jun 2024 to Jul 2024

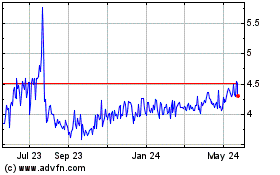

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jul 2023 to Jul 2024