Merge Extends Customer Base - Analyst Blog

February 13 2013 - 9:30AM

Zacks

Imaging and interoperability

solutions provider Merge Healthcare Incorporated

(MRGE) has extended its customer base as it seeks to provide its

complete cardiology solutions suite to Arnot Ogden Medical Center,

a member of Arnot Health.

The Merge cardiology suite consists of Merge Cardio and Merge Hemo.

While Merge Cardio is an enterprise level image and information

system which delivers a patient’s complete cardio record across all

cardiac modalities, Merge Hemo automates the cath lab process into

an electronic record to enable automated reporting. In Dec 2012,

Merge Hemo was selected as Category Leader in the Best in KLAS

Awards for 2012 in the realm of Software and Services for

Cardiology Hemodynamics. This marked the second year that Merge’s

offering has won this award.

The deployment of Merge’s solutions at Arnot Ogden will enable the

latter to improve standards of care as it will capture, manage and

display multi-modality cardiac images and hemodynamics and ECG data

across the enterprise. The implementation of the complete

cardiology suite will increase image access and exchange while

decreasing healthcare costs at Arnot Ogden.

Management at Arnot Ogden assert that the deployment of Merge

Cardio will enhance workflow efficacy and improve time management

for physicians. Further, the implementation of Merge Hemo is

expected to augment quality control, helped by upgraded

organizational environment.

Our Take

It is commendable that Merge has effectively expanded its client

base amid a tough reimbursement environment for advanced medical

imaging. We are also encouraged by the impressive growth in recent

quarters on the back of client wins despite the general slowdown in

hospital spending and low demand for imaging equipment and related

technology.

Going forward, we are bullish on Merge as it has immense potential

in the diagnostic imaging market. As a result, the stock carries a

Zacks Rank #2 (Buy). Besides Merge, medical stocks like

ResMed (RMD), Medical Action

(MDCI) and MedAssets Inc (MDAS), carrying a Zacks

Rank #1 (Strong Buy) are expected to do well in the near term.

MEDASSETS INC (MDAS): Free Stock Analysis Report

MEDICAL ACTION (MDCI): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

RESMED INC (RMD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

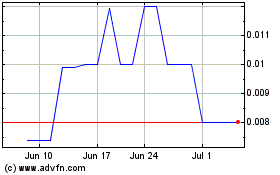

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024