Merge Acquires Ophthalmic Imaging - Analyst Blog

August 10 2011 - 1:43PM

Zacks

Recently, Merge Healthcare (MRGE) completed the

acquisition of Ophthalmic Imaging Systems for approximately $30.3

million (excluding the debt). Ophthalmic Imaging provides digital

imaging and informatics solutions for ophthalmology and other

medical specialties.

Merge believes that the acquisition will be accretive as the

company expects to integrate Ophthalmic Imaging Systems’ ophthalmic

imaging and informatics solutions, including a highly regarded

single platform electronic health record (EHR) and practice

management system, digital imaging management solution and a

modular imaging to its portfolio.

Moreover, huge client base of Ophthalmic Imaging Systems (more

than 2,000 sites representing 60% of the top ophthalmic

institutions in the US) is expected to further enhance Merge’s

existing client base of 1,500 hospitals and 4,000 clinics and

practices to a large extent.

Ophthalmic Imaging Systems’ current portfolio primarily focuses

on radiology, cardiology and orthopedics; products for clinical

trials; software for financial and pre-surgical management. Merge

believes ophthalmic imaging solutions possesses huge potential

given an aging population, better treatment results owing to early

detection of disease, increased incidence of visual impairment and

the growing need for portable diagnostic equipment.

However, we do not expect any significant benefit from the deal

in the near term as the company reported dismal results in the

first quarter of 2011.. Ophthalmic Imaging reported revenue of $3.5

million (lower than $4.1 million in the year-ago period) with a net

loss of $1.5 million.

Merge has grown through several acquisitions, the most

significant being AMICAS, an image and information management

solutions provider, in April 2010. The company exited the second

quarter with $45.2 million in cash (including restricted cash)

compared with $41.0 million at the end of December 2010. Cash from

core business operations was $6.6 million versus $9.4 million in

the year-ago quarter.

There is immense potential in the diagnostic imaging market,

especially with the government’s emphasis on HIT and an ageing

population. However, Merge’s growth prospect is highly dependent on

capital investments by hospitals for advanced imaging solutions,

which are in turn tied to general economic conditions.

Merge’s growth prospect is highly dependent on capital

investments by hospitals for advanced imaging solutions, which are

in turn tied to the general economic conditions. Major players like

General Electric Co (GE) and McKesson

Corporation (MCK) have made the diagnostic imaging market

highly competitive. However, there is immense potential in the

diagnostic imaging market, especially with government’s emphasis on

HIT and an ageing population.

GENL ELECTRIC (GE): Free Stock Analysis Report

MCKESSON CORP (MCK): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

Zacks Investment Research

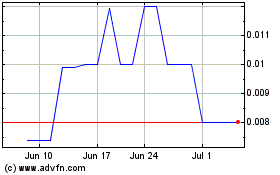

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024