Imperial Brands Sets Strategy to Spur Profit, Grow Dividend Through to 2025

January 27 2021 - 8:59AM

Dow Jones News

By Jaime Llinares Taboada

Imperial Brands PLC on Wednesday unveiled a new strategy to

improve profits and progressively increase the dividend until 2025

by cutting costs and focusing on its core businesses.

The FTSE 100 tobacco company is proposing to reorganize and

simplify the business by focusing its top markets and brands. The

group is aiming to generate annualized savings of 100 million-150

million pounds ($137.3 million-$206.0 million) by the end of fiscal

2023, which would be partly used to increase investments in core

capabilities such as sales and marketing by GBP50 million-GBP60

million.

As a result, Imperial Brands expects to grow its revenues by

1%-2% between fiscal 2020 and fiscal 2025, and to increase the

adjusted operating profit at a mid-single-digit organic annual rate

from fiscal 2023 until fiscal 2025.

In addition, the company promised to annually increase the

dividend from the current rebased level--taking into account

underlying business performance--and said it will consider surplus

capital returns to shareholders once the leverage target of 2.0-2.5

times net-debt-to-Ebitda ratio is achieved.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

January 27, 2021 08:44 ET (13:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

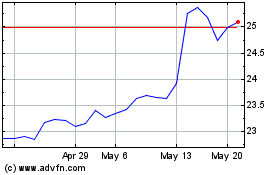

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Apr 2024 to May 2024

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From May 2023 to May 2024