Current Report Filing (8-k)

January 06 2022 - 12:04PM

Edgar (US Regulatory)

0001307624

false

0001307624

2021-12-30

2021-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): December

30, 2021

______________

HEALTHTECH SOLUTIONS,

INC./UT

(Exact name of registrant

as specified in its charter)

______________

|

Utah

|

0-51012

|

84-2528660

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

181 Dante Avenue,

Tuckahoe, New York 10707

(Address of Principal

Executive Office) (Zip Code)

844-926-3399

(Registrant’s telephone

number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

|

|

|

|

|

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

On December 30, 2021, Healthtech Solutions,

Inc. ("Healthtech") entered into a binding Term Sheet (the "Term Sheet") with Predictive Technology Group, Inc. (“PTG”)

and its subsidiary, Predictive Biotech, Inc. (“Biotech”). The Term Sheet calls for Healthtech to organize a subsidiary (“Newco”)

that will acquire the assets of Biotech related to wound care. Healthtech will also receive from PTG three year options to purchase Biotech

and/or Cellsure, LLC, another subsidiary of PTG, each for a purchase price of $10. Prior to any purchase of Biotech or Cellsure by Healthtech,

PTG will be entitled to remove from the subsidiary any assets not related to wound care. During the three year term of the options, Healthtech

will be entitled to exercise exclusive managerial control over the operations of Biotech and Cellsure related to wound care.

In consideration of the transfer of the wound

care assets to Newco, PTG will receive shares representing 30% of the equity in Newco. Until Newco achieves positive cash flow or $3.5

million in capital has been contributed to Newco, the shares held by PTG will continue to represent 30% of Newco’s equity. The Term

Sheet commits Healthtech to provide working capital to Newco and Biotech until Newco achieves positive cash flow or Healthtech contributes

$3.5 million or Healthtech determines that market conditions make it unlikely that Newco will be financially successful.

The Term Sheet provides that a royalty will

be paid to PTG. The royalty will initially be equal to 20% of gross income from sales by Newco to certain Specified Accounts. The percentage

will decline 2% per year from year four through year ten and thereafter equal industry standards.

Upon the execution of the Term Sheet, Healthtech

loaned $100,000 to PTG and Biotech, and Healthtech paid Biotech’s last bi-weekly payroll of 2021. Upon execution of a formal purchase

agreement, Healthtech will loan an additional $150,000 to PTG. Upon satisfaction of certain regulatory conditions, Healthtech

will loan an additional $250,000 to PTG. The loans will be repaid by allocating to that purpose 25% of the royalties payable by Newco

to PTG.

The terms and conditions included in the

Term Sheet are binding on the parties, except to the extent they are modified in the formal purchase agreement. The Term Sheet will terminate

if a closing of the asset transfer has not occurred by January 31, 2022.

|

|

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

|

Exhibits

|

10-a

|

Term Sheet: Acquisition of Assets of Predictive Biotech by HLTT and Related

Transactions, dated December 30, 2021.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

|

|

Healthtech Solutions, Inc.

|

|

|

|

|

|

Date: January 6, 2022

|

By:

|

/s/ Manuel E. Iglesias

Manuel E. Iglesias, President

|

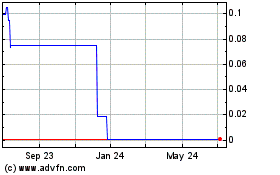

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

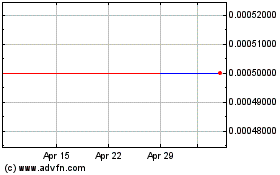

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Nov 2023 to Nov 2024