Amended Current Report Filing (8-k/a)

February 11 2022 - 3:55PM

Edgar (US Regulatory)

0001454742

true

0001454742

2022-02-11

2022-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 11, 2022

GOOD

GAMING, INC.

(Exact

name of registrant as specified in charter)

|

Nevada

|

|

000-53949

|

|

26-3988293

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

415

McFarlan Road, Suite 108

Kennett

Square, PA 19348

(Address

of Principal Executive Offices) (Zip Code)

(888)

295-7279

(Registrant’s

Telephone Number, Including Area Code)

2130

N. Lincoln Park West, Suite 8N

Chicago,

IL 60614

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

None

|

|

None

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

This

Amendment No. 1 to the Current Report on Form 8-K amends Item 1.01 of the Current Report on Form 8-K filed on January 7, 2022 (the

“Original Form 8-K”) solely to correct an error in calculation of the outstanding balance to be paid to ViaOne Services,

LLC, a Texas limited liability company (“ViaOne”) under the original Employee Services Agreement, which was effective on

March 1, 2017. ViaOne was owed 24,540 shares of the Company’s Series E Preferred Stock under the Original Agreement, not 25,680

shares of Series E Preferred Stock. The parties have agreed to cancel the additional 1,140 shares of Series E Preferred Stock.

Except

as described above, no other changes have been made to the 8-K and this Form 8-K/A does not amend or update any other information in

the 8-K. Information not affected by the changes described above is unchanged and reflects the disclosures made at the time of the 8-K

filing. Accordingly, this Form 8-K/A should be read in conjunction with the Company’s filings made with the SEC subsequent to the

date of the filing of the 8-K.

Item

1.01 Entry into a Material Agreement.

Amendments

to Employee Services Agreements

On

December 31, 2021, Good Gaming, Inc. (the “Company”) and ViaOne Services, LLC, a Texas Limited Liability

Company (the “ViaOne”) entered into an amendment to the Employee Services Agreement (the “Employee Services Agreement”),

which became effective on September 1, 2021, and superseded the prior services agreement, which was effective March 1, 2017, amended

on January 1, 2018, and expired on August 31, 2021 (the “Original Agreement”). Pursuant to the Employee Services Agreement,

the Management Fee due ViaOne shall be convertible into 1,557 shares of the Company’s Series E Preferred Stock for services rendered

through December 31, 2021. Previously, the Management Fee was convertible into shares of the Company’s common stock.

Additionally,

on December 31, 2021, the Company amended the Original Agreement to allow for the conversion of the outstanding balance remaining to

be paid under the Original Agreement to be converted into 24,540 shares of the Company’s Series E Preferred Stock, which fulfills

all remaining obligations under the Original Agreement.

The

foregoing description of the Amendment to the Employee Services Agreement and the Amendment to the Original Agreement is not complete

and is subject to, and qualified in its entirety by the full text of the Amendment to the Original Agreement and the New Agreement, which

are attached to this Current Report on Form 8-K as Exhibits 10.1 and 10.2, the terms of which are incorporated herein by reference.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

February 11, 2022

|

|

Good

Gaming, Inc.

|

|

|

|

|

|

By:

|

/s/

David B. Dorwart

|

|

|

Name:

|

David

B. Dorwart

|

|

|

Title:

|

Chief

Executive Officer

|

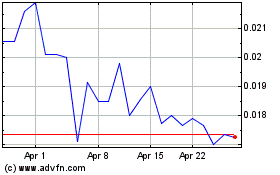

Good Gaming (QB) (USOTC:GMER)

Historical Stock Chart

From Jun 2024 to Jul 2024

Good Gaming (QB) (USOTC:GMER)

Historical Stock Chart

From Jul 2023 to Jul 2024