Current Report Filing (8-k)

April 06 2023 - 12:04PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report: March 31, 2023

(Date

of earliest event reported)

GOLDRICH

MINING COMPANY

(Exact

name of registrant as specified in its charter)

Commission

File Number: 001-06412

Alaska

(State or other jurisdiction of incorporation) |

91-0742812

(IRS Employer Identification No.) |

2525

E. 29th Ave. Ste. 10B-160

Spokane,

Washington 99223

(Address

of principal executive offices, including zip code)

(509)

535-7367

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| o | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item

1.01 | Entry

into a Material Definitive Agreement. |

On

March 31, 2023, Goldrich Mining Company (“Goldrich” or the “Company”) signed a settlement agreement between the Company,

NyacAU, LLC (“NyacAU”), Goldrich Placer, LLC (“GP”), Goldrich NyacAU Placer, LLC (“GNP”), Dr. J. Michael

James, individually (“Dr. James”), and Bear Leasing, LLC (“Bear Leasing”) (each a “Party” and, collectively,

the “Parties”).

Subject

to Goldrich making a payment of $105,000 to NyacAU by April 30, 2023, the settlement agreement, among other things, resolves all outstanding

arbitration issues, awards, and orders and all outstanding issues before the Alaska superior court, including all court-entered judgments.

The agreement also terminates and supersedes all prior agreements between all Parties except a security agreement between NyacAU and

GNP to secure repayment of fifty percent (50%) of a funding mechanism known as Line of Credit 1 (LOC1), which was advanced by NyacAU

to GNP. GNP was formally dissolved in 2019 but remains in a state of “winding up.”

Concurrent

with signing the settlement agreement, Goldrich also signed an option agreement with the Parties. The option agreement, among other things,

grants Goldrich, or its designee, the right, but not the obligation, to receive and assume the mining permits to mine the placer claims

at the Chandalar mine. If the option is exercised, Goldrich or its designee would also obtain ownership of all camp facilities and mining

equipment remaining at the Chandalar placer mine site owned by NyacAU and its affiliates. Currently Goldrich owns the claims but NyacAU

is the named operator on the mining permits and is responsible for reclamation and the related costs.

To

exercise the option, Goldrich, or its designee, must give written and electronic notice of its intent to do so by April 30, 2024 and

pay $1,000,000 into escrow within five business days of giving notice. Upon exercise of the option, Goldrich or its designee would assume

all reclamation responsibilities and liability and NyacAU would be released from any reclamation liability. Also, NyacAU would be entitled

to limited payments out of the production of placer gold at the Chandalar placer mine up to the greater of eight million five hundred

thousand dollars ($8,500,000) or 4,860 ounces of fine gold (the Maximum Amount). No production payment shall be due to NyacAU on the

first 5,000 ounces of fine gold production. Thereafter, NyacAU would receive at least five percent (5%) of all production from the Chandalar

placer mine until the Maximum Amount is paid. Additionally, after the first 5,000 ounces of fine gold production, NyacAU would be entitled

to a minimum annual payment equal to the value of $120,000 or 68 fine gold ounces, whichever is greater, and such payment would apply

towards the satisfaction of the Maximum Amount.

| Item

9.01 | Financial

Statements and Exhibits. |

| * | Furnished

to, not filed with, the SEC pursuant to Item 1.01 above. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

GOLDRICH

MINING COMPANY

(Registrant) |

| |

|

| Dated:

April 5, 2023 |

By: |

/s/

Ted R. Sharp |

| |

|

Ted

R. Sharp, Chief Financial Officer |

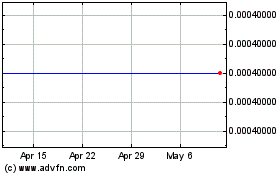

Goldrich Mining (CE) (USOTC:GRMC)

Historical Stock Chart

From Apr 2024 to May 2024

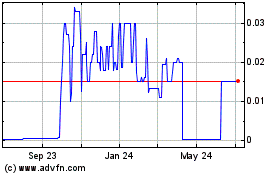

Goldrich Mining (CE) (USOTC:GRMC)

Historical Stock Chart

From May 2023 to May 2024