Current Report Filing (8-k)

August 25 2016 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act 1934

Date of Report (Date of earliest event

reported):

July 18, 2016

General

Steel Holdings, Inc.

(Exact name of registrant as specified in charter)

|

Nevada

|

|

001-33717

|

|

41-2079252

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

Level 2,

Building G,

No. 2A Chen Jia Lin, Ba Li Zhuang,

Chaoyang District, Beijing, China 100025

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code: + 86 (10) 85723073

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12(b) under

the Exchange Act (17 CFR 240.14a-12(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On August 19, 2016, General Steel Holdings,

Inc. (the “Company”), together with certain of its subsidiaries entered into debt cancellation agreements with each

of Oriental Ace Limited (“Oriental Ace”), an unrelated party, and General Steel (China) Co., Ltd, a related party

(“ GS China ”) (collectively, the “Debt Cancellation Agreements”). The Debt Cancellation Agreements allow

for a debt-for-equity swap with each of Oriental Ace and GS China.

Pursuant to the Debt

Cancellation Agreement with GS China, the Company has agreed to exchange RMB144,287,664 (equivalent to USD$21,632,333.44) of

outstanding debt owed by its subsidiary, Tongyong Shengyuan (Tianjin) Technology Development Co., Ltd. and payable to GS

China, for 100,000 shares of Common Stock of the Company and 19,565,757 shares of a new series of convertible preferred

stock. The convertible preferred stock shall be designated as Series B Preferred Stock, following the effectiveness of

stockholder approval regarding the designation of such series under the Nevada Revised Statutes and the filing of a

Certificate of Designation relating thereto with the Secretary of State of Nevada.

Pursuant to the Debt Cancellation

Agreement with Oriental Ace, the Company has agreed to exchange USD$3,600,000 of outstanding debt owed by its

subsidiary, General Steel Investment Co., Ltd., and payable to Oriental Ace, for 3,272,727 shares of Common Stock of the

Company.

The foregoing

summary of the Debt Cancellation Agreements does not purport to be complete and is qualified in its entirety by reference to the

actual Debt Cancellation Agreements with GS China and Oriental Ace, which are filed hereto as Exhibits 10.1 and 10.2, respectively,

which are incorporated by reference in this report.

|

Item 3.01

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On July 18,

2016, the Company received a letter (the “Letter”) from the New York Stock Exchange (the “NYSE”)

stating that the staff of the NYSE (the “Staff”) has determined to commence proceedings to delist the

Company’s common stock. The Company’s common stock was suspended immediately from trading on the NYSE at the

close on July 18, 2016. The Company had previously been deemed below compliance with the NYSE’s continued listing

standard requiring listed companies to maintain either (i) at least fifty million dollars ($50,000,00.00) in

stockholders’ equity, or (ii) at least fifty million dollars ($50,000,00.00) in total market capitalization on a 30

trading-day average basis. In addition, the Staff stared in the Letter that Company is delayed in its filing with the

Securities and Exchange Commission of its Annual Report on Form 10-K for the year ended December 31, 2015 and its Quarterly

Report on Form 10-Q for the period ended March 31, 2016. The NYSE also made a public announcement of this decision on July

18, 2016.

The Letter further

stated that the Company has the right to a review of this determination by the NYSE Regulations, Inc., Board of Directors’

Committee for Review (the “CFR”), provided a written request for such a review is filed with the Assistant Corporate

Secretary of the NYSE within ten business days after the receipt of the Letter (August 1, 2016).

On July 28, 2016, the Company issued a press

release announcing that it intends to avail itself of its right of review and appeal the NYSE’s decision to commence proceedings

to delist its common stock. A copy of that press release is attached as Exhibit 99.1 hereto and incorporated into this Item 3.01

by reference.

On August 1, 2016, the

Company submitted its written request (the “Request”) in support of the delisting determination review to CFR requesting

an opportunity to make an oral presentation at the review hearing.

On August 2, 2016, the

Company received a letter from the NYSE Office of General Counsel acting as counsel to the CFR stating that the Company’s

Request for the CFR to review the determination by the Staff to delist the Company’s common stock had been received and in

accordance with Section 804.00 of the NYSE Listed Company Manual, such review will take place at the NYSE’s offices in New

York City on October 13, 2016.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

|

10.1

|

Debt Cancellation Agreement, by and among the Registrant, Tongyong Shengyuan (Tianjin) Technology Development Co., Ltd. and General Steel (China) Co., Ltd., dated August 19, 2016.

|

|

|

|

|

10.2

|

Debt Cancellation Agreement, by and among the Registrant, General Steel Investment Co., Ltd. and Oriental Ace Limited, dated August 19, 2016.

|

|

|

|

|

99.1

|

Press Release issued on July 28, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GENERAL STEEL HOLDINGS, INC.

|

|

|

|

|

|

By:

|

/s/ John Chen

|

|

|

Name:

|

John Chen

|

|

|

Title:

|

Chief Financial Officer

|

Dated: August 25, 2016

Exhibit Index

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Debt Cancellation Agreement, by and among the Registrant, Tongyong Shengyuan (Tianjin) Technology Development Co., Ltd. and General Steel (China) Co., Ltd., dated August 19, 2016.

|

|

|

|

|

|

10.2

|

|

Debt Cancellation Agreement, by and among the Registrant, General Steel Investment Co., Ltd. and Oriental Ace Limited, dated August 19, 2016.

|

|

|

|

|

|

99.1

|

|

Press Release issued on July 28, 2016.

|

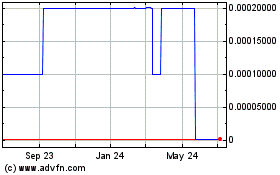

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Oct 2024 to Nov 2024

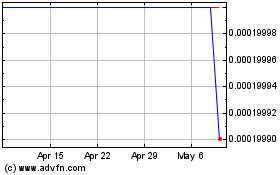

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Nov 2023 to Nov 2024