UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

SEC File Number

333-82580

|

|

|

|

CUSIP Number

361-544109

|

FORM 12b-25

NOTIFICATION OF LATE FILING

|

(Check One):

|

☒ Form 10-K ☐ Form 20-F ☐ Form 11-K ☐Form 10-Q ☐ Form 10-D ☐ Form N-SAR

|

☐ Form N-CSR

For period ended: March 31, 2020

☐ Transition Report on Form 10-K

☐ Transition Report on Form 20-F

☐ Transition Report on Form 11-K

☐ Transition Report on Form 10-Q

☐ Transition Report on Form N-SAR

For the transition period ended:

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates:

PART I—REGISTRANT INFORMATION

GB Sciences, Inc.

Full Name of Registrant

3550 W. Teco Avenue

Address of Principal Executive Office (Street and Number)

Las Vegas, Nevada 89118

City, State and Zip Code

PART II—RULE 12b-25(b) and (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

☒

|

(a)

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

☒

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

☐

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III—NARRATIVE

State below in reasonable detail the reason why Forms 10-K, 20-F, 11-K, 10-Q, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

(Attach extra sheets if needed)

The registrant is unable to file its Annual Report on Form 10-K for the fiscal year ended March 31, 2020 (the “Report”) by the prescribed date of August 13, 2020, without unreasonable effort or expense, because the registrant needs additional time to complete certain disclosures and analyses to be included in the Report. In accordance with Rule 12b-25 promulgated under the Securities Exchange Act of 1934, as amended, the registrant intends to file the Report on or prior to the fifteenth calendar day following the prescribed due date.

GB Sciences, Inc. (“the Company”) has relied on the March 4, 2020 order issued by the Commission under Section 36 (Release No. 3488318), as modified on March 25, 2020 (Release No. 3488465) of the Securities Exchange Act of 1934 (“Exchange Act”) granting exemptions from specified provisions of the Exchange Act and certain rules thereunder (the “Order”), as a result of the novel coronavirus (“COVID19”) pandemic, to delay the filing of its Annual Report on Form 10-K for the year ended March 31, 2020 (the “Report”), as discussed in greater detail in the Company's 8-K filed on June 29, 2020. The Company's reliance on the SEC order extended the due date of the Company's 10-K for the year ended March 31, 2020 to August 13, 2020.

PART IV—OTHER INFORMATION

(1) Name and telephone number of person to contact with regard to this notification.

Gary R. Henrie, Esq (307) 200-9415

(Name) (Area Code) (Telephone Number)

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) or the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

|

☒ Yes ☐No

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

☐ Yes ☒ No

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reason why a reasonable estimate of the results cannot be made.

On March 24, 2020, the Company entered into the Membership Interest Purchase Agreement ("Teco MIPA"). Pursuant to the Teco MIPA, the Company will sell 100% of its membership interests in GBSN and GBLV for $4.0 million cash upon close and will receive a $4.0 million 8% promissory note to be paid in monthly installments over 36 months. In connection with the sale of Teco, we entered into a Management Agreement with the purchaser whereby the facilities will be managed by an affiliate of the purchaser until the close of the sale.

The sale is expected to close upon the successful transfer of the Nevada cultivation and production licenses. The transfer of cannabis licenses in the State of Nevada has been subject to an indefinite moratorium since October 2019. In a meeting held on July 21, 2020, the Nevada Cannabis Compliance Board lifted the moratorium, however, the board has indicated that there are over 90 requests pending and it will take up to several months to process the entire backlog of pending license transfers. Based on this information, there is significant uncertainty as to the timing of the close of the sale. The lifting of the moratorium and processing of cannabis license transfers have been delayed by the COVID-19 pandemic and could be further delayed if the pandemic continues.

As a result of entering into the Teco MIPA, the Company determined that the long-lived assets of the Teco Facility might be impaired due to the current expectation that the asset group will more likely than not be disposed of by sale significantly before the end of its previously estimated useful life. The Company estimated future undiscounted future cash flows related to the Teco Facility to be $8.0 million, an amount reflecting the proceeds of the sale including a $4.0 million cash payment on closing and a $4.0 million note receivable. This amount was less than the carrying amount of the Teco Facility asset group of $11.9 million and the carrying value of the assets was deemed to be unrecoverable based on the carrying value exceeding estimated future undiscounted cash flows. Using a discounted cash flow approach, the Company estimated the fair value of the asset group to be approximately $7.3 million, and we anticipate reporting an impairment loss of $4.6 million related to the Teco Facility asset group in the Company’s 10-K for the year ended March 31, 2020.

Forward-Looking Statements

This Form 12b-25 contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, believes”, “estimates”, “predicts” or “continue”, which list is not meant to be all-inclusive and other such negative terms and comparable technology. These forward-looking statements include, without limitation, statements about market opportunity, strategies, competition, expected activities and expenditures as we pursue business our plan, and the adequacy of available cash reserves. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include among other things: (i) product demand, market and customer acceptance of any or all of the Company’s products, equipment and other goods, (ii) ability to obtain financing to expand its operations, (iii) ability to attract qualified personnel, (iv) competition pricing and development difficulties, (v) ability to increase cultivation production, (vi) the timing and extent of changes in prices for medical and adult-use cannabis, (vii) agricultural risks of growing and harvesting medical and adult-use cannabis, (viii) the availability of equipment, such as extraction equipment, (ix) the adequacy of capital reserves and liquidity including, but not limited to, access to additional borrowing capacity, (x) our ability to close the sale of the Company's Nevada cannabis cultivation and production facilities, (xi) and general industry and market conditions and growth rates, unexpected natural disasters, and other factors, which we have little or no control: and any other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”). Any forward-looking statements are based on information available to us today and we undertake no obligation to publicly update any forward-looking statements, whether as a result of future events, new information or otherwise.

GB Sciences, Inc.

(Name of Registrant as Specified in Charter)

Has caused this notification to be signed on its behalf by the undersigned heretofore duly authorized.

|

Date: August 13, 2020

|

By: /s/ Zach Swarts

|

|

|

Name: Zach Swarts

|

|

|

Title: CFO

|

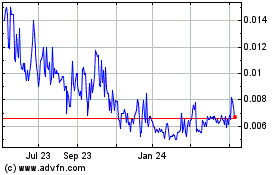

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Jun 2024 to Jul 2024

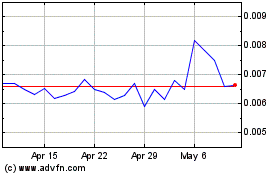

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Jul 2023 to Jul 2024