false

0000844887

DE

0000844887

2024-06-13

2024-06-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 13, 2024

DIAMONDHEAD

CASINO CORPORATION

DELAWARE

COMMISSION

FILE NUMBER: 0-17529

IRS

EMPLOYER IDENTIFICATION NO. 59-2935476

1013

Princess Street

Alexandria,

Virginia 22314

(703)

683-6800

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act. |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a- 12 under the Securities Act. |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14e-4(c) under the Exchange Act. |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

(i)

On June 13, 2024, Diamondhead Casino Corporation (the “Company”) issued a press release. A copy of the press release is attached

to this Current Report on Form 8-K as Exhibit 99.1 and the information contained therein is incorporated by reference.

(ii)

On June 12, 2024, eight creditors of the Company filed an Involuntary Petition Against a Non-Individual in the United States Bankruptcy

Court for the District of Delaware (Case No. 24-1154) against the Company, requesting an Order for relief under Chapter 7 of the Bankruptcy

Code (title 11 of the United States Code.) On June 14, 2024, the Company learned of the filing. The total of Petitioners’ claims

filed is for $2,422,500.00. The Company was served by mail on June 17, 2024 and a response is due within 21 days of service.

Item

9.01

(d)

Exhibits

The

information contained in this Current Report on Form 8-K, including Exhibit 99.1, attached hereto, is being furnished to the Securities

and Exchange Commission and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). In addition, none of such information shall be incorporated by reference in any filing made

by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as to the extent specifically referenced in any

such filings.

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

DIAMONDHEAD

CASINO CORPORATION |

| |

|

|

| |

By: |

/s/

Deborah A. Vitale |

| |

|

Deborah

A. Vitale |

| |

|

President |

Dated:

June 20, 2024

Exhibit

99.1

DIAMONDHEAD

CASINO CORPORATION RETAINS COLLIERS TO ASSIST WITH MARKETING AND FINANCING

ALEXANDRIA,

Va., June 13, 2024 /PRNewswire/ — Diamondhead Casino Corporation (OTCBB: DHCC) (the “Company”) is pleased to announce

that it has retained Colliers to assist the Company in marketing and financing the development of its Diamondhead, Mississippi Property

and/or to sell all or part of the Diamondhead Property. Colliers has prepared marketing materials to market and promote the Property

and is now in the process of soliciting interested parties.

The

Company owns, through its wholly-owned subsidiary, Mississippi Gaming Corporation, an approximate 400-acre tract of land on Interstate

10 in Diamondhead, Mississippi. The property fronts Interstate 10 for approximately two miles and fronts the Bay of St. Louis for approximately

two miles. Over eighteen million vehicles pass the site yearly. The property is already zoned as a Special Use District-Waterfront Gaming

District, which permits the development of a casino resort. In addition, the Mississippi Gaming Commission has granted Mississippi Gaming

Corporation Gaming Site Approval on a fifty acre site located on the east side of the property.

In

commenting on the opportunity, Patrick Slagle, Vice President of Colliers in Washington, D.C. stated: “We believe the Diamondhead

site is one of the best remaining gaming sites in the entire country. Its location on Interstate 10, between Biloxi and New Orleans,

coupled with the accessibility to the site provided by nearby airports makes it one of the most easily accessible gaming sites in the

country. It is a 400-acre blank slate with over two miles of waterfront and ready to be developed as a mixed-use resort with a casino

as an anchor and a two mile boardwalk. We know of nothing comparable and no other opportunity of this nature in the industry. With over

eighteen million vehicles passing the site annually on Interstate 10, it is an ideal gaming location. The Gulf Coast region of the United

States where this casino would be located, is one of the fastest growing gambling markets in the United States. We look forward to finding

the perfect match for this outstanding location.”

Under

its agreement with Colliers, the Company is free to continue discussions with other interested parties. Unless extended by the parties,

the Agreement will terminate at the end of this year.

The

Company also announced that its subsidiary, Mississippi Gaming Corporation (“MGC”), had entered into a Settlement Agreement

with Cooperative Energy, a Mississippi Electric Cooperative, which had filed an eminent domain action against MGC, for $1,000,000 million

in return for easements along the northern portion of the property. In October of 2023, Mississippi Gaming Corporation received $845,378

as part of the settlement amount. The parties are working on the wording of the easements. Once the easements are finalized and signed,

Cooperative Energy will pay MGC the remaining amount due of $154,622.

The

Company’s Officers and Directors may purchase the Company’s stock in the open market from time to time at prevailing prices.

About

Colliers

Colliers

(NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 68 countries,

our 19,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than

29 years, our experienced leadership with significant inside ownership, has delivered compound annual investment returns of approximately

20% for shareholders. With annual revenues of $4.3 billion and $96 billion of assets under management, Colliers maximizes the potential

or property and real assets to accelerate the success of our clients, our investors and our people. Learn more at colliers.com,

X@Colliers or Lindkedin.

About

Diamondhead Casino Corporation

Diamondhead

Casino Corporation (OTCBB: DHCC) f/k/a Europa Cruises Corporation, has been in business for over thirty-three years. The Company previously

operated gambling ships out of ports located in Miami Beach, Florida, Ft. Myers Beach, Florida and Madeira Beach, Florida. The Company

sold its four ocean-going vessels, divested itself of all ship-based gambling operations in Florida and devoted its resources to the

development of the Diamondhead, Mississippi property.

Cautionary

Statement Regarding Forward-Looking Statements

The

Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements so long as those

statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that

could cause actual results to differ materially from those projected in such statements.

All

statements, trend analysis and other information contained in this release relative to performance, trends in operations or financial

results, plans, expectations, estimates and beliefs, as well as other statements including words such as “anticipate,” “believe,”

“plan,” “estimate,” “expect,” “intend,” “will,” “could,” “may,”

and other similar expressions, constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. In connection

with certain forward-looking statements contained in this release and those that may be made in the future, there are various factors

that could cause actual results to differ materially from those set forth in any such forward-looking statements. The forward-looking

statements contained in this release were prepared by management and are qualified by, and subject to, permitting, significant business,

economic, financial, competitive, environmental, regulatory and other uncertainties and contingencies, all of which are difficult or

impossible to predict and many of which are beyond the control of the Company. Accordingly, there can be no assurance that the forward-looking

statements contained in this release will be realized. The forward-looking statements in this release reflect the opinion of the management

as of the date of this release. Readers are hereby advised that developments subsequent to this release are likely to cause these statements

to become outdated with the passage of time or other factors beyond the control of the Company. The Company does not intend, however,

to update the guidance provided herein prior to its next release or unless otherwise required to do so. Readers of this release should

consider these facts in evaluating the information contained herein. In addition, the business and operations of the Company are subject

to substantial risks, including but not limited to risks relating to liquidity and cash flows, which increase the uncertainty inherent

in the forward-looking statements contained in this release. The inclusion of the forward-looking statements contained in this release

should not be regarded as a representation that the forward-looking statements contained in the release will be achieved. In light of

the foregoing, readers of this release are cautioned not to place reliance on the forward-looking statements contained herein.

Additional

information concerning potential risk factors that could affect the Company’s financial condition and future performance are described

from time to time in the Company’s periodic reports filed with the SEC, including, but not limited to, its Annual Report on Form

10-K and Quarterly Reports on Form 10-Q and amendments thereto.

For

further information, contact:

Deborah

A. Vitale, President

Diamondhead

Casino Corporation

Cell:

(727) 510-1412

or

Gregory

Harrison, Chairman of the Board

Diamondhead

Casino Corporation

Cell:

(301) 775-3602

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

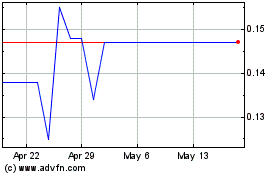

Diamondhead Casino (PK) (USOTC:DHCC)

Historical Stock Chart

From May 2024 to Jun 2024

Diamondhead Casino (PK) (USOTC:DHCC)

Historical Stock Chart

From Jun 2023 to Jun 2024