Current Report Filing (8-k)

January 17 2023 - 5:01PM

Edgar (US Regulatory)

0001688126

false

0001688126

2023-01-10

2023-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 10, 2023

The

Crypto Company

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-55726 |

|

46-4212105 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 23823

Malibu Road, #50477, Malibu, CA |

|

90265 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(424)

228-9955

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Effective

January 10, 2023, The Crypto Company (the “Company”) borrowed funds pursuant to a Securities Purchase Agreement (the “SPA”)

entered into with 1800 Diagonal Lending, LLC (“Diagonal”), and Diagonal purchased a convertible promissory note (the “Note”)

from the Company in the aggregate principal amount of $79,250. Pursuant to the SPA, the Company agreed to reimburse Diagonal for certain

fees in connection with entry into the SPA and the issuance of the Note. The SPA contains customary representations and warranties by

the Company and Diagonal typically contained in such documents.

The

maturity date of the Note is January 3, 2024 (the “Maturity Date”). The Note bears interest at a rate of 10% per annum, and

a default interest of 22% per annum. Diagonal has the option to convert all of the outstanding amounts due under the Note into shares

of the Company’s common stock beginning on the date which is 180 days following the date of the Note and ending on the later of:

(i) the Maturity Date and (ii) the date of payment of the default amount, as such term is defined under the Note. The conversion price

under the Note for each share of common stock is equal to 65% of the lowest trading price of the Company’s common stock for the

10 trading days prior to the conversion date. The conversion of the Note is subject to a beneficial ownership limitation of 4.99% of

the number of shares of common stock outstanding immediately after giving effect to such conversion. Failure of the Company to convert

the Note and deliver the common stock when due will result in the Company paying Diagonal a monetary penalty for each day beyond such

deadline.

The

Company may prepay the Note in whole, however, if it does so between the issuance date and the date which is 60 days from the issuance

date, the repayment percentage is 115%. If the Company prepays the Note on or between the 61st day after issuance and the 90th day after

issuance, the prepayment percentage is 120%. If the Company prepays the Note on or between the 91st day after issuance and 180 days after

issuance, the prepayment percentage is 125%. After such time, the Company can submit an optional prepayment notice to Diagonal, however

the prepayment shall be subject to the agreement between the Company and Diagonal on the applicable prepayment percentage.

Pursuant

to the Note, as long as the Company has any obligations under the Note, the Company cannot without Diagonal’s written consent,

sell, lease or otherwise dispose of any significant portion of its assets which would render the Company a “shell company”

as such term is defined in SEC Rule 144. Additionally, under the Note, any consent to the disposition of any assets may be conditioned

on a specified use of the proceeds of disposition.

The

Note contains standard and customary events of default such as failing to timely make payments under the Note when due, the failure of

the Company to timely comply with the Securities Exchange Act of 1934, as amended, reporting requirements and the failure to maintain

a listing on the OTC Markets. The occurrence of any of the events of default, entitle Diagonal, among other things, to accelerate the

due date of the unpaid principal amount of, and all accrued and unpaid interest on, the Note. Upon an “Event of Default”,

interest shall accrue at a default interest rate of 22%, and the Company may be obligated pay to the Diagonal an amount equal to 150%

of all amounts due and owing under the Note.

The

foregoing descriptions of SPA and Note, do not purport to be complete and are qualified in their entirety by the full text of the forms

of the of SPA and Note which will be filed as exhibits to a subsequent current, quarterly, or annual report to be filed by the Company.

The

offer and sale of the Note to Diagonal was made in a private transaction exempt from the registration requirements of the Securities

Act in reliance on exemptions afforded by Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

The

information set forth under Item 1.01 is incorporated herein by reference.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

THE

CRYPTO COMPANY |

| Date:

January 17, 2023 |

|

|

| |

By: |

/s/

Ron Levy |

| |

Name: |

Ron

Levy |

| |

Title: |

Chief

Executive Officer, Chief Operating Officer and Secretary |

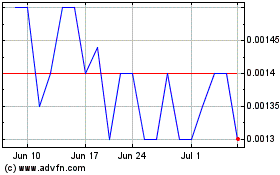

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Nov 2024 to Dec 2024

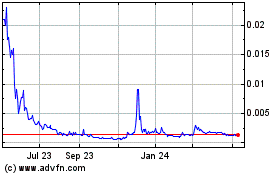

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Dec 2023 to Dec 2024