Post-effective Amendments. (pos Ami)

September 24 2013 - 3:52PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on September 24, 2013

File Nos. 811-05028

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-1A

|

|

|

|

|

REGISTRATION STATEMENT UNDER THE INVESTMENT

COMPANY ACT OF 1940

|

|

x

|

|

|

|

|

Amendment No. 332

|

|

x

|

PIMCO Funds

(Exact name of Registrant as Specified in Charter)

840 Newport Center Drive

Newport Beach, California 92660

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including area code:

(866) 746-2606

|

|

|

|

|

Robert W. Helm, Esq.

Brendan C. Fox, Esq.

Dechert

LLP

1900 K Street, N.W.

Washington, D.C. 20006

|

|

Brent R. Harris

Pacific Investment Management Company LLC

840 Newport Center Drive

Newport

Beach, California 92660

|

|

(Name and Address of Agent for Service)

|

It is intended that this filing will become effective immediately upon filing in accordance with

Section 8 of the Investment Company Act of 1940 and the rules thereunder.

EXPLANATORY NOTE

This Amendment No. 332 to the Registration Statement of PIMCO Funds (the “Trust” or the “Registrant”) on Form N-1A

(File No. 811-05028) (the “Registration Statement”) is being filed to update each Offering Memorandum of the Trust’s Private Account Portfolio Series (the “Portfolios”), dated July 31, 2013.

The shares of beneficial interest in the Private Account Portfolio Series are not registered under the Securities Act of 1933, as amended (the

“1933 Act”), because such shares will be issued by the Registrant solely in private placement transactions that do not involve any “public offering” within the meaning of the 1933 Act. Shares of the Private Account Portfolio

Series may be purchased only by clients of Pacific Investment Management Company LLC (“PIMCO”), including separately managed private accounts and investment companies registered under the Investment Company Act of 1940 (the “1940

Act”) and other funds, who are “accredited investors,” as defined in Regulation D under the 1933 Act, and either (i) “qualified purchasers,” as defined for purposes of Section 3(c)(7) of the 1940 Act, or

(ii) “qualified institutional buyers,” as defined in Rule 144A(a)(1) under the 1933 Act. Shares of the Private Account Portfolio Series may also be purchased by certain investors outside of the United States consistent with applicable

regulatory requirements. This Amendment is not an offer to sell, or a solicitation of any offer to buy, any security to the public within the meaning of the 1933 Act.

PIMCO Funds

Private Account Portfolio Series

Amendment Dated September 24,

2013

to the Private Account Portfolio Series Offering Memorandum and the PIMCO Short-

Term Floating NAV Portfolio and PIMCO Short-Term Floating NAV Portfolio III

Offering Memorandum, each dated July 31, 2013, each as amended from time to time

(each an “Offering Memorandum”)

Disclosure Related to the Portfolios

Effective as of

September 23, 2013, the following disclosure is added to the “Management of the Portfolios” section of each Offering Memorandum of the Portfolios:

Certain Regulatory and Litigation Matters

In September 2004, Allianz

Global Investors Fund Management LLC (“AGIFM”), PEA Capital LLC (“PEA”) and Allianz Global Investors Distributors LLC (“AGID”) settled a regulatory action with the Securities and Exchange Commission (the

“SEC”) that alleged violations of various antifraud provisions of the federal securities laws in connection with an alleged market timing arrangement involving trading of shares of the PEA Growth Fund, the PEA Opportunity Fund, the PEA

Innovation Fund and the PEA Target Fund. PEA, AGID and Allianz Global Investors of America L.P. (“AGI”) reached a settlement (the “NJ Settlement”) relating to the same subject matter with the Attorney General of the State of New

Jersey (“NJAG”) in June 2004. AGI, AGIFM, PEA and AGID paid a total of $68 million to the SEC and New Jersey to settle the claims related to market timing. Also in September 2004, AGIFM, PEA and AGID settled separate regulatory actions

with the SEC and the Attorney General of the State of California related to revenue sharing and the use of brokerage commissions in connection with the sale of mutual fund shares, pursuant to which they paid a total of $20.6 million to settle the

claims. In addition to monetary payments, the settling parties agreed to undertake certain corporate governance, compliance and disclosure reforms related to market timing, brokerage commissions, revenue sharing and shelf space arrangements, and

consented to cease and desist orders and censures. The settling parties did not admit or deny the findings in these settlements.

The foregoing speaks only as of the date of this Offering Memorandum. In addition, although certain of the entities above may be considered “affiliated persons” (as defined in the 1940 Act) of

PIMCO, the disclosure above is not an admission that any of the above named entities are “affiliated issuers” (as defined in Regulation D) of any of the Portfolios.

Investors Should Retain This Amendment For Future Reference

PART C. OTHER INFORMATION

Item 28. Exhibits

|

|

|

|

|

|

|

(a)

|

|

(1)

|

|

Amended and Restated Declaration of Trust dated December 15, 2010

(13)

|

|

|

|

(2)

|

|

Amended and Restated Establishment and Designation of Series of Shares of Beneficial Interest dated November 9, 2010

(13)

|

|

|

|

(3)

|

|

Establishment and Designation of Series of Beneficial Interest relating to the PIMCO Total Return Fund IV dated February 7, 2011

(16)

|

|

|

|

(4)

|

|

Establishment and Designation of Series of Beneficial Interest relating to the PIMCO Emerging Markets Corporate Bond Fund, PIMCO Funds: Private Account Portfolio Series – Senior Floating Rate Portfolio, PIMCO International

Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO RealRetirement

®

2015 Fund, PIMCO RealRetirement

®

2025 Fund, PIMCO RealRetirement

®

2035 Fund and PIMCO Small Company Fundamental

IndexPLUS

®

AR Strategy Fund dated February 28, 2011

(14)

|

|

|

|

(5)

|

|

Establishment and Designation of Series of Beneficial Interest relating to the PIMCO Senior Floating Rate Fund dated December 29, 2010

(16)

|

|

|

|

(6)

|

|

Establishment and Designation of Series of Beneficial Interest relating to the PIMCO Credit Absolute Return Fund and PIMCO Inflation Response Multi-Asset Fund dated May 23,

2011

(18)

|

|

|

|

(7)

|

|

Establishment and Designation of Series of Beneficial Interest relating to the PIMCO Funds: Private Account Portfolio Series – Low Duration Portfolio and the PIMCO Funds: Private Account Portfolio Series – Moderate

Duration Portfolio dated August 16, 2011

(19)

|

|

|

|

(8)

|

|

Establishment and Designation of Series of Beneficial Interest relating to the PIMCO RealRetirement

®

2045 Fund dated November 8, 2011

(20)

|

|

|

|

(9)

|

|

Establishment and Designation of Additional Series of Shares of Beneficial Interest relating to the PIMCO California Municipal Bond Fund, PIMCO National Intermediate Municipal Bond Fund, PIMCO Short Asset Investment Fund and PIMCO

Funds: Private Account Portfolio Series – Short Term Floating NAV Portfolio III dated February 28, 2012

(21)

|

|

|

|

(10)

|

|

Establishment and Designation of Additional Series of Beneficial Interest relating to the PIMCO Mortgage Opportunities Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated August 14, 2012

(27)

|

|

|

|

(11)

|

|

Establishment and Designation of Additional Series of Beneficial Interest relating to the PIMCO Emerging Markets Full Spectrum Bond Fund dated November 13, 2012

(28)

|

|

|

|

(12)

|

|

Amended Designation for PIMCO StocksPLUS

®

AR Short Strategy Fund, PIMCO Fundamental IndexPLUS

®

AR Fund, PIMCO

StocksPLUS

®

Absolute Return Fund, PIMCO Small Cap StocksPLUS

®

AR Strategy Fund, PIMCO International StocksPLUS

®

AR Strategy Fund (Unhedged), PIMCO International StocksPLUS

®

AR Strategy Fund (U.S. Dollar Hedged), PIMCO Fundamental Advantage Absolute

Return Strategy Fund, PIMCO EM Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO Small Company Fundamental IndexPLUS

®

AR Strategy Fund,

PIMCO International Fundamental IndexPLUS

®

AR Strategy Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated February 26,

2013

(29)

|

|

|

|

(13)

|

|

Establishment and Designation of Additional Series of Beneficial Interest relating to the PIMCO TRENDS Managed Futures Strategy Fund dated [ ], 2013

(33)

|

|

(b)

|

|

|

|

Amended and Restated By-Laws of Registrant dated December 15, 2010

(13)

|

|

(c)

|

|

|

|

Not applicable

|

|

(d)

|

|

(1)

|

|

Amended and Restated Investment Advisory Contract dated February 23, 2009

(3)

|

|

|

|

(2)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Emerging Markets and Infrastructure Bond Fund and the PIMCO MuniGO Fund dated May 19, 2009

(5)

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Real Income 2019 Fund, PIMCO Real Income 2029 Fund, and PIMCO Tax Managed Real Return Fund dated August 11, 2009

(7)

|

|

|

|

(4)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to fee changes dated October 1, 2009

(8)

|

|

|

|

(5)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO CommoditiesPLUS

®

Strategy Fund and PIMCO CommoditiesPLUS

®

Short Strategy Fund dated February 23, 2010

(9)

|

|

|

|

(6)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO High Yield Spectrum Fund and PIMCO Funds: Private Account Portfolio Series FX Strategies Portfolio dated August 17, 2010

(11)

|

|

|

|

(7)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to certain fee reductions dated October 1, 2010

(12)

|

|

|

|

(8)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Funds: Private Account Portfolio Series – Senior Floating Rate Portfolio, PIMCO Senior Floating Rate Fund, PIMCO Total

Return Fund IV, PIMCO International Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO RealRetirement

®

2015 Fund, PIMCO RealRetirement

®

2025 Fund, PIMCO RealRetirement

®

2035 Fund and PIMCO Small Company Fundamental

IndexPLUS

®

AR Strategy Fund dated February 28, 2011

(15)

|

|

|

|

(9)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Credit Absolute Return Fund and PIMCO Inflation Response Multi-Asset Fund dated May 23, 2011

(18)

|

|

|

|

(10)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Funds: Private Account Portfolio Series – Low Duration Portfolio and PIMCO Funds: Private Account Portfolio Series

– Moderate Duration Portfolio dated August 16, 2011

(19)

|

|

|

|

(11)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO California Municipal Bond Fund, PIMCO National Intermediate Municipal Bond Fund, PIMCO Short Asset Investment Fund and PIMCO

Funds: Private Account Portfolio Series – Short Term Floating NAV Portfolio III dated February 28, 2012

(21)

|

|

|

|

(12)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to PIMCO RealRetirement

®

2045 Fund dated November 8, 2011

(20)

|

|

|

|

(13)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Mortgage Opportunities Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated August 15, 2012

(27)

|

|

|

|

(14)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO Emerging Markets Full Spectrum Bond Fund dated November 13,

2012

(28)

|

|

|

|

(15)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO EM Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO Fundamental

Advantage Absolute Return Strategy Fund, PIMCO Fundamental IndexPLUS

®

AR Fund, PIMCO International Fundamental IndexPLUS

®

AR

Strategy Fund, PIMCO International StocksPLUS

®

AR Strategy Fund (Unhedged), PIMCO International StocksPLUS

®

AR Strategy Fund (U.S.

Dollar Hedged), PIMCO Small Cap StocksPLUS

®

AR Strategy Fund, PIMCO Small Company Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO

StocksPLUS

®

Absolute Return Fund, PIMCO StocksPLUS

®

AR Short Strategy Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund

dated March 22, 2013

(30)

|

|

|

|

|

|

|

|

|

|

(16)

|

|

Supplement and Amended Exhibit A to Amended and Restated Investment Advisory Contract relating to the PIMCO TRENDS Managed Futures Strategy Fund dated [ ], 2013

(33)

|

|

|

|

(17)

|

|

Amended and Restated Asset Allocation Sub-Advisory Agreement relating to PIMCO All Asset Fund and PIMCO All Asset All Authority Fund dated December 1, 2010

(17)

|

|

|

|

(18)

|

|

Supplement to Amended and Restated Asset Allocation Sub-Advisory Agreement relating to PIMCO All Asset Fund and PIMCO All Asset All Authority Fund and Sub-Advisory Agreement relating to PIMCO Fundamental IndexPLUS

®

AR Fund, PIMCO International Fundamental IndexPLUS

®

AR Strategy Fund and PIMCO Small Company Fundamental IndexPLUS

®

AR Strategy Fund dated December 1, 2012

(28)

|

|

|

|

(19)

|

|

Sub-Advisory Agreement relating to the PIMCO Fundamental IndexPLUS

®

Fund and PIMCO Fundamental IndexPLUS

®

AR Fund

dated October 13, 2006

(23)

|

|

|

|

(20)

|

|

Supplement to Sub-Advisory Agreement relating to the PIMCO Fundamental Advantage Tax Efficient Strategy Fund and PIMCO Fundamental Advantage Absolute Return Strategy Fund dated February 28, 2008

(4)

|

|

|

|

(21)

|

|

Supplement to Sub-Advisory Agreement relating to the PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated August 15, 2012

(27)

|

|

|

|

(22)

|

|

Sub-Advisory Agreement relating to the PIMCO EM Fundamental IndexPLUS

®

AR Strategy Fund dated November 10,

2008

(6)

|

|

|

|

(23)

|

|

Supplement to Sub-Advisory Agreement relating to the PIMCO International Fundamental IndexPLUS

®

AR Strategy and PIMCO Small Company Fundamental IndexPLUS

®

AR Strategy Fund dated August 16, 2011

(20)

|

|

(e)

|

|

(1)

|

|

Amended and Restated Distribution Contract dated April 1, 2012

(22)

|

|

|

|

(2)

|

|

Supplement to Amended and Restated Distribution Contract relating to the PIMCO Mortgage Opportunities Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated August 15,

2012

(27)

|

|

|

|

(3)

|

|

Supplement to Amended and Restated Distribution Contract relating to the PIMCO Emerging Markets Full Spectrum Bond Fund dated November 13, 2012

(28)

|

|

|

|

(4)

|

|

Supplement to Amended and Restated Distribution Contract relating to the PIMCO EM Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO Fundamental Advantage Absolute Return

Strategy Fund, PIMCO Fundamental IndexPLUS

®

AR Fund, PIMCO International Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO

International StocksPLUS

®

AR Strategy Fund (Unhedged), PIMCO International StocksPLUS

®

AR Strategy Fund (U.S. Dollar Hedged),

PIMCO Small Cap StocksPLUS

®

AR Strategy Fund, PIMCO Small Company Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO StocksPLUS

®

Absolute Return Fund, PIMCO StocksPLUS

®

AR Short Strategy Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated March 22,

2013

(30)

|

|

|

|

(5)

|

|

Supplement to Amended and Restated Distribution Contract relating to the PIMCO TRENDS Managed Futures Strategy Fund dated [ ], 2013

(33)

|

|

|

|

(6)

|

|

Form of Sales Agreement

(28)

|

|

|

|

(7)

|

|

Form of Sales Agreement

(28)

|

|

(f)

|

|

|

|

Not Applicable

|

|

(g)

|

|

(1)

|

|

Custody and Investment Accounting Agreement dated January 1, 2000

(6)

|

|

|

|

(2)

|

|

Amendment to Custody and Investment Accounting Agreement dated June 8, 2001

(6)

|

|

|

|

(3)

|

|

Amendment to Custody and Investment Accounting Agreement dated March 30, 2010

(9)

|

|

(h)

|

|

(1)

|

|

Second Amended and Restated Supervision and Administration Agreement dated April 1, 2012

(23)

|

|

|

|

(2)

|

|

Supplement to the Second Amended and Restated Supervision and Administration Agreement relating to the PIMCO Mortgage Opportunities Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund dated August 15, 2012

(27)

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Supplement to the Second Amended and Restated Supervision and Administration Agreement relating to the PIMCO Emerging Markets Full Spectrum Bond Fund dated November 13,

2012

(28)

|

|

|

|

(4)

|

|

Supplement to the Second Amended and Restated Supervision and Administration Agreement relating to the PIMCO EM Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO Fundamental

Advantage Absolute Return Strategy Fund, PIMCO Fundamental IndexPLUS

®

AR Fund, PIMCO International Fundamental IndexPLUS

®

AR

Strategy Fund, PIMCO International StocksPLUS

®

AR Strategy Fund (Unhedged), PIMCO International StocksPLUS

®

AR Strategy Fund (U.S.

Dollar Hedged), PIMCO Small Cap StocksPLUS

®

AR Strategy Fund, PIMCO Small Company Fundamental IndexPLUS

®

AR Strategy Fund, PIMCO

StocksPLUS

®

Absolute Return Fund, PIMCO StocksPLUS

®

AR Short Strategy Fund and PIMCO Worldwide Fundamental Advantage AR Strategy Fund

dated March 22, 2013

(30)

|

|

|

|

(5)

|

|

Supplement to the Second Amended and Restated Supervision and Administration Agreement relating to the PIMCO TRENDS Managed Futures Strategy Fund dated [ ], 2013

(33)

|

|

|

|

(6)

|

|

Fourth Amended and Restated Fee Waiver Agreement relating to the PIMCO Global Multi-Asset Fund dated July 25, 2011

(17)

|

|

|

|

(7)

|

|

Amended and Restated Fee Waiver Agreement relating to the PIMCO Inflation Response Multi-Asset Fund dated July 25, 2011

(17)

|

|

|

|

(8)

|

|

Sixth Amended and Restated Fee Waiver Agreement relating to PIMCO RealRetirement 2010

®

Fund, PIMCO RealRetirement

2015

®

Fund, PIMCO RealRetirement 2020

®

Fund, PIMCO RealRetirement 2025

®

Fund,

PIMCO RealRetirement 2030

®

Fund, PIMCO RealRetirement 2035

®

Fund, PIMCO RealRetirement

2040

®

Fund, PIMCO RealRetirement 2045

®

Fund and PIMCO RealRetirement 2050

®

Fund dated November 8, 2011

(20)

|

|

|

|

(9)

|

|

Amended and Restated Fee Waiver Agreement relating to the PIMCO Short Asset Investment Fund dated May 25, 2012

(29)

|

|

|

|

(10)

|

|

Fee and Expense Limitation Agreement relating to PIMCO Government Money Market Fund, PIMCO Money Market Fund and PIMCO Treasury Money Market Fund dated February 14,

2011

(17)

|

|

|

|

(11)

|

|

Amended and Restated Expense Limitation Agreement dated February 23, 2009

(17)

|

|

|

|

(12)

|

|

Amendment to Amended and Restated Expense Limitation Agreement dated February 23, 2010

(17)

|

|

|

|

(13)

|

|

Revised Schedules A and B to Amended and Restated Expense Limitation Agreement dated [ ], 2013

(33)

|

|

|

|

(14)

|

|

Second Amended and Restated Expense Limitation Agreement relating to the PIMCO All Asset Fund dated September 26, 2012

(29)

|

|

|

|

(15)

|

|

Second Amended and Restated Expense Limitation Agreement relating to the PIMCO All Asset All Authority Fund dated September 26, 2012

(29)

|

|

|

|

(16)

|

|

Fee Waiver Agreement relating to the PIMCO Funds: Private Account Portfolio Series – PIMCO International Portfolio (PIMCO Cayman Japan Fund II, Ltd.) dated June 12,

2011

(25)

|

|

|

|

(17)

|

|

Fee Waiver Agreement relating to the PIMCO Emerging Markets Full Spectrum Bond Fund dated November 13, 2012

(28)

|

|

|

|

(18)

|

|

Fee Waiver Agreement relating to the PIMCO TRENDS Managed Futures Strategy Fund dated [ ], 2013

(33)

|

|

|

|

(19)

|

|

Amended and Restated Fee Waiver Agreement relating to the PIMCO CommodityRealReturn Strategy Fund (PIMCO Cayman Commodity Fund I Ltd.) dated February 23, 2009

(29)

|

|

|

|

(20)

|

|

Amended and Restated Fee Waiver Agreement relating to the PIMCO Global Multi-Asset Fund (PIMCO Cayman Commodity Fund II, Ltd.) dated February 23,

2009

(29)

|

|

|

|

|

|

|

|

|

|

(21)

|

|

Fee Waiver Agreement relating to the PIMCO CommoditiesPLUS Strategy Fund and PIMCO CommoditiesPLUS Short Strategy Fund (PIMCO Cayman Commodity Fund III, Ltd. and PIMCO Cayman Commodity Fund IV, Ltd.) dated May 7, 2010

(29)

|

|

|

|

(22)

|

|

Fee Waiver Agreement relating to the PIMCO Inflation Response Multi-Asset Fund (PIMCO Cayman Commodity Fund VII, Ltd.) dated May 23, 2011

(29)

|

|

|

|

(23)

|

|

Fee Waiver Agreement relating to the PIMCO TRENDS Managed Futures Strategy Fund (PIMCO Cayman Commodity Fund VIII, Ltd.) dated [ ], 2013

(33)

|

|

|

|

(24)

|

|

PIMCO Cayman Commodity Fund I Ltd. Appointment of Agent for Service of Process

(1)

|

|

|

|

(25)

|

|

PIMCO Cayman Commodity Fund II Ltd. Appointment of Agent for Service of Process

(2)

|

|

|

|

(26)

|

|

PIMCO Cayman Commodity Fund III Ltd. Appointment of Agent for Service of Process

(9)

|

|

|

|

(27)

|

|

PIMCO Cayman Commodity Fund IV Ltd. Appointment of Agent for Service of Process

(9)

|

|

|

|

(28)

|

|

PIMCO Cayman Commodity Fund VII, Ltd. Appointment of Agent for Service of Process

(18)

|

|

|

|

(29)

|

|

PIMCO Cayman Commodity Fund VIII, Ltd. Appointment of Agent for Service of Process

(33)

|

|

|

|

(28)

|

|

PIMCO Cayman Japan Fund I Ltd. Appointment of Agent for Service of Process

(25)

|

|

|

|

(29)

|

|

PIMCO Cayman Japan Fund II Ltd. Appointment of Agent for Service of Process

(25)

|

|

|

|

(30)

|

|

Transfer Agency and Service Agreement dated October 3, 2008

(9)

|

|

|

|

(31)

|

|

Amendment to the Transfer Agency and Service Agreement dated June 1, 2010

(15)

|

|

|

|

(32)

|

|

Amendment to the Transfer Agency and Service Agreement dated May 1, 2011

(17)

|

|

(i)

|

|

|

|

Opinion and Consent of Counsel

(33)

|

|

(j)

|

|

|

|

Consent of Independent Registered Public Accounting Firm

(33)

|

|

(k)

|

|

|

|

Not Applicable

|

|

(l)

|

|

|

|

Not Applicable

|

|

(m)

|

|

(1)

|

|

Distribution and Servicing Plan for Class A Shares

(6)

|

|

|

|

(2)

|

|

Distribution and Servicing Plan for Class B Shares

(6)

|

|

|

|

(3)

|

|

Distribution and Servicing Plan for Class C Shares

(6)

|

|

|

|

(4)

|

|

Distribution and Servicing Plan for Class D Shares

(22)

|

|

|

|

(5)

|

|

Distribution and Servicing Plan for Administrative Class Shares

(22)

|

|

|

|

(6)

|

|

Distribution and Services Plan for Class R Shares

(6)

|

|

|

|

(7)

|

|

Form of Bank Fund Services Agreement

(28)

|

|

|

|

(8)

|

|

Form of Fund Services Agreement

(28)

|

|

(n)

|

|

|

|

Eleventh Amended and Restated Multi-Class Plan Adopted Pursuant to Rule 18f-3 dated April 1, 2012

(22)

|

|

(p)

|

|

(1)

|

|

Revised Code of Ethics for the Registrant

(15)

|

|

|

|

(2)

|

|

Revised Code of Ethics for PIMCO

(29)

|

|

|

|

(3)

|

|

Form of Code of Ethics for Research Affiliates LLC

(9)

|

|

|

|

(4)

|

|

Revised Code of Ethics for PIMCO Investments LLC

(15)

|

|

|

|

|

|

*

|

|

Power of Attorney

(10)

|

|

|

|

|

|

(1)

|

|

Filed with Post-Effective Amendment No. 133 on April 29, 2008, and incorporated by reference herein.

|

|

(2)

|

|

Filed with Post-Effective Amendment No. 147 on December 22, 2008, and incorporated by reference herein.

|

|

(3)

|

|

Filed with Post-Effective Amendment No. 151 on March 18, 2009, and incorporated by reference herein.

|

|

(4)

|

|

Filed with Post-Effective Amendment No. 153 on April 13, 2009, and incorporated by reference herein.

|

|

(5)

|

|

Filed with Post-Effective Amendment No. 157 on June 8, 2009, and incorporated by reference herein.

|

|

(6)

|

|

Filed with Post-Effective Amendment No. 160 on July 29, 2009, and incorporated by reference herein.

|

|

|

|

|

|

(7)

|

|

Filed with Post-Effective Amendment No. 165 on August 28, 2009, and incorporated by reference herein.

|

|

(8)

|

|

Filed with Post-Effective Amendment No. 167 on October 28, 2009, and incorporated by reference herein.

|

|

(9)

|

|

Filed with Post-Effective Amendment No. 173 on May 12, 2010, and incorporated by reference herein.

|

|

(10)

|

|

Filed with Post-Effective Amendment No. 177 on July 27, 2010, and incorporated by reference herein.

|

|

(11)

|

|

Filed with Post-Effective Amendment No. 178 on August 30, 2010, and incorporated by reference herein.

|

|

(12)

|

|

Filed with Post-Effective Amendment No. 181 on November 3, 2010, and incorporated by reference herein.

|

|

(13)

|

|

Filed with Post-Effective Amendment No. 183 on February 11, 2011, and incorporated by reference herein.

|

|

(14)

|

|

Filed with Amendment No. 243 on March 8, 2011, and incorporated by reference herein.

|

|

(15)

|

|

Filed with Post-Effective Amendment No. 187 on March 18, 2011, and incorporated by reference herein.

|

|

(16)

|

|

Filed with Post-Effective Amendment No. 191 on April 19, 2011, and incorporated by reference herein.

|

|

(17)

|

|

Filed with Post-Effective Amendment No. 210 on July 28, 2011, and incorporated by reference herein.

|

|

(18)

|

|

Filed with Post-Effective Amendment No. 213 on August 17, 2011, and incorporated by reference herein.

|

|

(19)

|

|

Filed with Amendment No. 279 on August 30, 2011, and incorporated by reference herein.

|

|

(20)

|

|

Filed with Post-Effective Amendment No. 222 on January 30, 2012, and incorporated by reference herein.

|

|

(21)

|

|

Filed with Post-Effective Amendment No. 226 on March 7, 2012, and incorporated by reference herein.

|

|

(22)

|

|

Filed with Post-Effective Amendment No. 228 on April 30, 2012, and incorporated by reference herein.

|

|

(23)

|

|

Filed with Post-Effective Amendment No. 229 on May 21, 2012, and incorporated by reference herein.

|

|

(24)

|

|

Filed with Post-Effective Amendment No. 230 on May 21, 2012, and incorporated by reference herein.

|

|

(25)

|

|

Filed with Amendment No. 304 on June 15, 2012, and incorporated by reference herein.

|

|

(26)

|

|

Filed with Post-Effective Amendment No. 236 on July 30, 2012, and incorporated by reference herein.

|

|

(27)

|

|

Filed with Post-Effective Amendment No. 238 on September 5, 2012, and incorporated by reference herein.

|

|

(28)

|

|

Filed with Post-Effective Amendment No. 243 on January 29, 2013, and incorporated by reference herein.

|

|

(29)

|

|

Filed with Post-Effective Amendment No. 245 on March 15, 2013, and incorporated by reference herein.

|

|

(30)

|

|

Filed with Post-Effective Amendment No. 246 on May 14, 2013, and incorporated by reference herein.

|

|

(31)

|

|

Filed with Post-Effective Amendment No. 248 on May 30, 2013, and incorporated by reference herein.

|

|

(32)

|

|

Filed with Post-Effective Amendment No. 249 on July 26, 2013, and incorporated by reference herein.

|

|

(33)

|

|

To be filed by amendment.

|

Item 29.

Persons Controlled by or Under Common Control with Registrant

.

The Trust through the PIMCO CommodityRealReturn Strategy Fund, a separate series of the Trust, wholly owns and controls the PIMCO Cayman

Commodity Fund I Ltd. (“CRRS Subsidiary”), a company organized under the laws of the Cayman Islands. The CRRS Subsidiary’s financial statements will be included, on a consolidated basis, in the PIMCO CommodityRealReturn Strategy

Fund’s annual and semi-annual reports to shareholders.

The Trust through the PIMCO Global Multi-Asset Fund, a separate series of the

Trust, wholly owns and controls the PIMCO Cayman Commodity Fund II Ltd. (“GMA Subsidiary”), a company organized under the laws of the Cayman Islands. The GMA Subsidiary’s financial statements will be included, on a consolidated basis,

in the PIMCO Global Multi-Asset Fund’s annual and semi-annual reports to shareholders.

The Trust through the PIMCO CommoditiesPLUS

Strategy Fund, a separate series of the Trust, wholly owns and controls the PIMCO Cayman Commodity Fund III Ltd. (“CPS Subsidiary”), a company organized under the laws of the Cayman Islands. The CPS Subsidiary’s financial statements

will be included, on a consolidated basis, in the PIMCO CommoditiesPLUS Strategy Fund’s annual and semi-annual reports to shareholders.

The Trust through the PIMCO CommoditiesPLUS Short Strategy Fund, a separate series of the Trust, wholly owns and controls the PIMCO Cayman

Commodity Fund IV Ltd. (“CPSS Subsidiary”), a company organized under the laws of the Cayman Islands. The CPSS Subsidiary’s financial statements will be included, on a consolidated basis, in the PIMCO CommoditiesPLUS Short Strategy

Fund’s annual and semi-annual reports to shareholders.

The Trust through the PIMCO Inflation Response Multi-Asset Fund, a separate

series of the Trust, wholly owns and controls the PIMCO Cayman Commodity Fund VII, Ltd. (“IRMA Subsidiary”), a company organized under the laws of the Cayman Islands. The IRMA Subsidiary’s financial statements will be included, on a

consolidated basis, in the PIMCO Inflation Response Multi-Asset Fund’s annual and semi-annual reports to shareholders.

The Trust

through the PIMCO TRENDS Managed Futures Strategy Fund, a separate series of the Trust, wholly owns and controls the PIMCO Cayman Commodity Fund VIII, Ltd. (“MF Subsidiary”), a company organized under the laws of the Cayman Islands. The MF

Subsidiary’s financial statements will be included, on a consolidated basis, in the PIMCO TRENDS Managed Futures Strategy Fund’s annual and semi-annual reports to shareholders.

The Trust through the PIMCO Short-Term Floating NAV Portfolio III, a separate series of the Trust, wholly owns and controls the PIMCO Cayman

Japan Fund I Ltd. (“Short-Term Floating NAV Subsidiary”), a company organized under the laws of the Cayman Islands. The Short-Term Floating NAV Subsidiary’s financial statements will be included, on a consolidated basis, in the PIMCO

Short-Term Floating NAV Portfolio III’s annual and semi-annual reports to shareholders.

The Trust through the PIMCO International

Portfolio, a separate series of the Trust, wholly owns and controls the PIMCO Cayman Japan Fund II Ltd. (“International Subsidiary”), a company organized under the laws of the Cayman Islands. The International Subsidiary’s financial

statements will be included, on a consolidated basis, in the PIMCO International Portfolio’s annual and semi-annual reports to shareholders.

Item 30.

Indemnification

Reference is made to Article IV of the Registrant’s Amended and Restated Declaration of Trust, which was filed with the Registrant’s

Post-Effective Amendment No. 183 on February 11, 2011.

Insofar as indemnification for liabilities arising under the Securities

Act of 1933 may be permitted to trustees, officers and controlling persons of the Registrant by the Registrant pursuant to the Declaration of Trust or otherwise, the Registrant is aware that in the opinion of the Securities and Exchange Commission,

such indemnification is against public policy as expressed in the Act and, therefore, is unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by

trustees, officers or controlling persons of the Registrant in connection with the successful defense of any act, suit or proceeding) is asserted by such trustees, officers or controlling persons in connection with the shares being registered, the

Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the

Act and will be governed by the final adjudication of such issues.

Item 31.

Business and Other Connections of the Investment Adviser

The directors and executive officers of PIMCO and their business and other connections are as follows:

|

|

|

|

|

Name

|

|

Business and Other Connections

|

|

Amey, Mike

|

|

Managing Director, PIMCO

|

|

Anderson, Joshua

|

|

Managing Director, PIMCO

|

|

Baker, Brian P.

|

|

Managing Director, PIMCO; Director, PIMCO Asia Pte Ltd. and PIMCO Asia Limited (Hong Kong)

|

|

Balls, Andrew T.

|

|

Managing Director, PIMCO

|

|

Benz II, William R.

|

|

Managing Director, PIMCO

|

|

Bhansali, Vineer

|

|

Managing Director, PIMCO

|

|

Bodereau, Philippe

|

|

Managing Director, PIMCO

|

|

Bosomworth, Andrew

|

|

Managing Director, PIMCO

|

|

Bridwell, Jennifer S

|

|

Managing Director, PIMCO

|

|

Callin, Sabrina C.

|

|

Managing Director, PIMCO; Acting Head of PIMCO Advisory; and Vice President, StocksPLUS Management, Inc.

|

|

Cupps, Wendy W.

|

|

Managing Director, PIMCO

|

|

Dada, Suhail H.

|

|

Managing Director, PIMCO

|

|

Dawson, Craig A.

|

|

Managing Director, PIMCO; Director, PIMCO Europe Ltd.

|

|

De Leon, William G.

|

|

Managing Director, PIMCO

|

|

Dialynas, Chris P.

|

|

Managing Director, PIMCO

|

|

Durham, Jennifer E.

|

|

Managing Director and Chief Compliance Officer, PIMCO. Chief Compliance Officer, the Trust, PIMCO Variable Insurance Trust, PIMCO ETF

Trust, PIMCO Equity Series and PIMCO Equity Series VIT

|

|

El-Erian, Mohamed A.

|

|

Managing Director, Chief Executive Officer and Co- Chief Investment Officer, PIMCO. Senior Vice President, the Trust, PIMCO Variable

Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. Formerly President and CEO of Harvard Management Co.

|

|

|

|

|

|

Flattum, David C.

|

|

Managing Director, General Counsel, PIMCO. Chief Legal Officer, the Trust, PIMCO Variable Insurance Trust,

PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT

|

|

Gomez, Michael A.

|

|

Managing Director, PIMCO

|

|

Gross, William H.

|

|

Managing Director, Chief Investment Officer and Executive Committee Member, PIMCO. Director and Vice President, StocksPLUS Management,

Inc. Senior Vice President of the Trust, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT

|

|

Harris, Brent Richard

|

|

Managing Director and Executive Committee Member, PIMCO. Director and President, StocksPLUS Management, Inc. Trustee, Chairman and

President of the Trust, PIMCO Variable Insurance Trust and PIMCO ETF Trust. Trustee, Chairman and Senior Vice President, PIMCO Equity Series and PIMCO Equity Series VIT. Director, PIMCO Luxembourg S.A. and PIMCO Luxembourg II

|

|

Hodge, Douglas M.

|

|

Managing Director and Chief Operating Officer, PIMCO; Trustee and Senior Vice President, the Trust, PIMCO Variable Insurance Trust and

PIMCO ETF Trust. President, PIMCO Equity Series and PIMCO Equity Series VIT. Director and Vice President, StocksPLUS Management Inc.; Director, PIMCO Europe Ltd., PIMCO Asia Pte Ltd., PIMCO Australia Pty Ltd, PIMCO Japan Ltd. and PIMCO Asia Limited

(Hong Kong)

|

|

Holden, Brent L.

|

|

Managing Director, PIMCO

|

|

Ivascyn, Daniel J.

|

|

Managing Director, PIMCO

|

|

Jacobs IV, Lew W.

|

|

Managing Director, PIMCO

|

|

Kiesel, Mark R.

|

|

Managing Director, PIMCO

|

|

Lahr, Chuck

|

|

Managing Director, PIMCO

|

|

Lown, David C.

|

|

Managing Director, PIMCO

|

|

Masanao, Tomoya

|

|

Managing Director, PIMCO

|

|

Mather, Scott A.

|

|

Managing Director, PIMCO

|

|

Mattu, Ravi K.

|

|

Managing Director, PIMCO. Formerly, Head of Research and Strategy, Citadel Securities.

|

|

McDevitt, Joseph V.

|

|

Managing Director, PIMCO. Director and Chief Executive Officer, PIMCO Europe Limited

|

|

Mead, Robert

|

|

Managing Director, PIMCO

|

|

Mewbourne, Curtis A.

|

|

Managing Director, PIMCO

|

|

Miller, John M.

|

|

Managing Director, PIMCO

|

|

Mogelof, Eric

|

|

Managing Director, PIMCO

|

|

Moore, James F.

|

|

Managing Director, PIMCO

|

|

Murata, Alfred

|

|

Managing Director, PIMCO

|

|

Ongaro, Douglas J.

|

|

Managing Director, PIMCO

|

|

Otterbein, Thomas J.

|

|

Managing Director, PIMCO

|

|

Pagani, Lorenzo

|

|

Managing Director, PIMCO

|

|

Parikh, Saumil H.

|

|

Managing Director, PIMCO

|

|

Ravano, Emanuele

|

|

Managing Director, PIMCO

|

|

Rodosky, Stephen A.

|

|

Managing Director, PIMCO

|

|

Schneider, Jerome

|

|

Managing Director, PIMCO

|

|

Seidner, Marc Peter

|

|

Managing Director, PIMCO

|

|

Short, Jonathan D.

|

|

Managing Director, PIMCO

|

|

|

|

|

|

Stracke, Christian

|

|

Managing Director, PIMCO.

|

|

Strelow, Peter G.

|

|

Managing Director, PIMCO

|

|

Sutherland, Eric

|

|

Managing Director, PIMCO; Head of Sales, PIMCO Investments. Formerly, Managing Director, Nuveen Investments.

|

|

Takano, Makoto

|

|

Managing Director, PIMCO; Director and President, PIMCO Japan Ltd.

|

|

Thimons, Josh

|

|

Managing Director, PIMCO

|

|

Vaden, Andrew Taylor

|

|

Managing Director, PIMCO

|

|

Wang, Qi

|

|

Managing Director, PIMCO

|

|

Wilson, Susan L.

|

|

Managing Director, PIMCO

|

|

Worah, Mihir P.

|

|

Managing Director, PIMCO

|

|

Young, Robert

|

|

Managing Director, PIMCO

|

The directors and officers of Research Affiliates LLC (“Research Affiliates”) and their business and

other connections are as follows:

|

|

|

|

|

Name

|

|

Business and Other Connections

|

|

Arnott, Robert D.

|

|

Founder, Chairman, Chief Executive Officer

|

|

Hsu, Jason

|

|

Chief Investment Officer

|

|

Sherrerd, Katrina F.

|

|

Chief Operating Officer

|

|

Brightman, Christopher

|

|

Managing Director, Head of Investment Management

|

|

Hattesohl, Joseph

|

|

Chief Financial Officer

|

|

Harkins, Daniel M.

|

|

Chief Legal & Compliance Officer

|

|

Larsen, Michael

|

|

Director, Global Head of Affiliate Relations

|

|

Li, Feifei

|

|

Director, Head of Research

|

|

West, John

|

|

Managing Director, GTAA Product Management

|

|

Wilson, Jeff

|

|

Director, Head of U.S. Institutional Group

|

The address of Research Affiliates LLC is 620 Newport Center Drive, Newport Beach, California, 92660.

Item 32.

Principal Underwriter

|

(a)

|

PIMCO Investments LLC (the “Distributor”) serves as Distributor of Shares of the Trust.

|

|

(b)

|

The officers of the Distributor are:

|

|

|

|

|

|

|

|

Name and Principal Business Address*

|

|

Positions and Offices With Underwriter

|

|

Positions and Offices

with Registrant

|

|

Short, Jonathan D.

|

|

Chairman

|

|

None

|

|

Sutherland, Eric M.

|

|

President

|

|

None

|

|

Bishop, Gregory A.

|

|

Head of Business Management

|

|

None

|

|

Martin, Colleen M.

|

|

Chief Financial Officer and Financial and Operations Principal

|

|

None

|

|

Froio, Richard F.

|

|

Chief Compliance Officer

|

|

None

|

|

Zucker, Meg

|

|

Anti-Money Laundering Compliance Officer

|

|

None

|

|

Ratner, Joshua D.

|

|

Chief Legal Officer

|

|

None

|

|

Ongaro, Douglas J.

|

|

Senior Vice President

|

|

None

|

|

Wolf, Greggory S.

|

|

Vice President

|

|

Vice President

|

|

Plump, Steven B.

|

|

Vice President

|

|

None

|

|

Johnson, Eric D.

|

|

Vice President

|

|

Vice President

|

|

Harry, Seon L.

|

|

Vice President

|

|

None

|

|

*

|

The business address of all officers of the Distributor is 1633 Broadway, New York, NY 10019.

|

Item 33.

Location of Accounts and Records

The account books and other documents required to be maintained by Registrant pursuant to

Section 22(a) of the Investment Company Act of 1940 and the Rules thereunder will be maintained at the offices of Pacific Investment Management Company LLC, 840 Newport Center Drive, Newport Beach, California 92660, State Street Bank &

Trust Co., 801 Pennsylvania Ave., Kansas City, Missouri 64105, State Street Investment Manager Solutions, 46 Discovery, Suite 150, Irvine, California 92618, State Street Bank & Trust Co. c/o Iron Mountain Information Management, Inc., 1000

Campus Boulevard, Collegeville, PA 19426, Boston Financial Data Services—Midwest, 330 W. 9th Street, Kansas City, Missouri 64105, Boston Financial Data Services, Inc., P.O. Box 55060, Boston, Massachusetts 02205-8050, Boston Financial Data

Services, c/o Recall North America, 5 Beeman Road, Northborough, MA 01532, Boston Financial Data Services, c/o Iron Mountain, 175 Bearfoot Road, Northborough, MA 01532, Boston Financial Data Services, c/o Iron Mountain, 6119 Dermus, Kansas City,

Missouri 64120, and Schick Databank, 2721 Michelle Drive, Tustin, California 92680.

Item 34.

Management Services

Not applicable

SIGNATURES

Pursuant to the requirements of the Investment Company Act of 1940, as amended, the Registrant has duly caused this Registration Statement to

be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Washington in the District of Columbia on the 24th day of September, 2013.

|

|

|

|

|

PIMCO FUNDS

|

|

(Registrant)

|

|

|

|

|

By:

|

|

|

|

|

|

Brent R. Harris*, President

|

|

|

|

|

*By:

|

|

/s/ BRENDAN C. FOX

|

|

|

|

Brendan C. Fox

|

|

|

|

as attorney-in fact

|

|

*

|

Pursuant to power of attorney filed with Post-Effective Amendment No. 177 to Registration Statement No. 33-12113 on July 27, 2010.

|

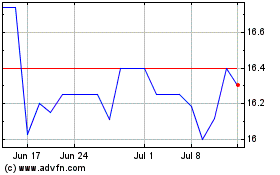

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Jul 2023 to Jul 2024