false

0000015847

PRE 14A

00000158472023-05-012024-04-30

iso4217:USD

00000158472021-05-012022-04-30

0000015847buks:FormerPEOMember2021-05-012022-04-30

00000158472022-05-012023-04-30

0000015847buks:FormerPEOMember2022-05-012023-04-30

0000015847buks:FormerPEOMember2023-05-012024-04-30

thunderdome:item

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☒

|

Preliminary Proxy Statement

|

| |

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

|

☐

|

Definitive Proxy Statement

|

| |

|

|

☐

|

Definitive Additional Materials

|

| |

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

BUTLER NATIONAL CORPORATION

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

|

☒

|

No fee required.

|

| |

|

|

☐

|

Fee paid previously with preliminary materials

|

| |

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

BUTLER NATIONAL CORPORATION

One Aero Plaza

New Century, Kansas 66031

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

October 30, 2024

To the Stockholders of Butler National Corporation:

Notice is hereby given that the 2024 Annual Meeting of Stockholders of Butler National Corporation (the “Company” or “Butler National”) will be held at Hallbrook Country Club, 11200 Overbrook Rd., Leawood, Kansas 66211, on Wednesday, October 30, 2024, at 10:00 a.m., local time. The purpose of the meeting is to:

| |

1.

|

Elect two (2) directors to serve for the term of three (3) years or until a successor is elected and qualified;

|

| |

|

|

| |

2.

|

Ratify the selection of RBSM, LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2025;

|

| |

|

|

| |

3.

|

Vote on an advisory basis to approve the compensation of the Company Named Executive Officers;

|

| |

|

|

| |

4.

|

Vote to amend the bylaws to declassify the Company’s Board of Directors;

|

| |

|

|

| |

5.

|

Vote to amend the Articles of Incorporation to allow a reverse split and reduce authorized Common Stock; and

|

| |

|

|

| |

6.

|

Transact such other business as may properly come before the meeting or any postponements or adjournments thereof.

|

The Board of Directors has fixed the close of business on September 3, 2024, as the record date for the determination of stockholders entitled to notice of and to vote at the meeting.

| |

By Order of the Board of Directors,

TAD MCMAHON,

Secretary

|

New Century, Kansas

September 16, 2024

YOU MAY VOTE YOUR SHARES VIA A TOLL-FREE TELEPHONE NUMBER OR OVER THE INTERNET. IF YOU RECEIVED A PAPER COPY OF A PROXY CARD BY MAIL, YOU MAY SUBMIT YOUR PROXY CARD BY SIGNING, DATING AND RETURNING YOUR PROXY CARD IN THE ENCLOSED ENVELOPE. STOCKHOLDERS WHO ATTEND THE MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON.

BUTLER NATIONAL CORPORATION

One Aero Plaza

New Century, Kansas 66031

PROXY STATEMENT

Important notice regarding the availability of proxy materials. The proxy statement and proxy card are available to view or download at www.proxyvote.com for the stockholder meeting on October 30, 2024.

This proxy statement is furnished to our stockholders in connection with the solicitation of proxies by Butler National Corporation’s Board of Directors to be voted at the Annual Meeting of Stockholders to be held on Wednesday, October 30, 2024, at 10:00 a.m. local time, or any postponements or adjournments thereof.

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to each stockholder of record, we have decided to provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. On September 16, 2024, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to stockholders of record as of September 3, 2024, and we posted our proxy materials on the website referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, stockholders may choose to access our proxy materials at www.proxyvote.com or may request a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. For those who previously requested printed proxy materials or electronic materials on an ongoing basis, you will receive those materials as you requested.

|

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY SUBMIT YOUR PROXY EITHER IN THE ENCLOSED ENVELOPE, VIA THE INTERNET OR BY TELEPHONE.

|

Our proxy tabulator, Broadridge Financial Solutions, must receive any proxy that will not be delivered in person at the annual meeting by 11:59 p.m., Eastern Time on Tuesday, October 29, 2024.

INFORMATION ABOUT THE ANNUAL MEETING

Who is entitled to vote?

You may vote if you owned shares of our common stock at the close of business on September 3, 2024, the record date for the annual meeting, provided such shares are held directly in your name as the stockholder of record or are held for you as the beneficial owner through a bank, broker or other nominee. Each outstanding share of common stock is entitled to one vote for all matters that properly come before the annual meeting for a vote. At the close of business on the record date, there were 68,270,856 shares of Butler National common stock outstanding and entitled to vote.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholders of Record. If your shares are registered directly with our transfer agent, EQ by Equiniti, you are considered the stockholder of record with respect to those shares, and the Notice and/or proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us through the enclosed proxy card or to vote in person at the annual meeting.

Beneficial Owners. Many of our stockholders hold their shares through a bank, broker or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials (including a voting instruction card) are being forwarded to you by your bank, broker or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your bank, broker or nominee on how to vote your shares. As the beneficial owner of shares, you are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you obtain a legal proxy from your bank, broker or nominee and present it at the 2024 annual meeting. Your bank, broker or nominee has enclosed a voting instruction card for you to use in directing the bank, broker or nominee regarding how to vote your shares.

How do I vote by proxy?

Stockholders of Record.

1. You May Vote by Mail. You can vote by mail by requesting a full packet of proxy materials be sent to your home address. Upon receipt of the materials, you may fill out the enclosed proxy card and return it per the instructions on the card.

2. You May Vote by Telephone or the Internet. You may vote by telephone or on the internet by following the instructions included on the proxy card. If you vote by telephone or on the internet, you do not have to mail in your proxy card. Internet and telephone voting are available 24 hours a day. Votes submitted through the internet (proxyvote.com) or by telephone (1-800-690-6903) must be received by 11:59 p.m. Eastern Time on October 29, 2024.

3. You May Vote in Person at the Meeting. You may deliver your completed proxy card in person. Additionally, we will pass out written ballots to registered stockholders who wish to vote in person at the meeting.

Beneficial Owners.

If you hold your shares in street name, follow the voting instruction card you receive from your bank, broker or other nominee. If you want to vote in person at the annual meeting, you must obtain a legal proxy from your bank, broker or nominee and present it at the annual meeting.

Can I change my vote?

Stockholders of Record. You may change your vote at any time before the proxy is exercised by voting in person at the annual meeting, giving written notice to Butler National’s Secretary revoking your proxy, submitting a properly signed proxy bearing a later date or voting again by telephone or on the internet (your latest telephone or internet vote is counted).

Beneficial Owners. If you hold your shares through a bank, broker or other nominee, you may change your vote by submitting new voting instructions following the instructions provided by your bank, broker or nominee.

What if I do not vote for some of the items listed on the proxy card or voting instruction card?

Stockholders of Record. If you indicate a choice with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions. Proxy cards that are signed and returned, but do not contain voting instructions with respect to a proposal, will be voted in accordance with the recommendations of the Board with respect to that proposal.

Beneficial Owners. If you indicate a choice with respect to any matter to be acted upon on your voting instruction card, the shares will be voted in accordance with your instructions. If you do not indicate a choice with respect to a proposal or do not return your voting instruction card, the bank, broker or other nominee will determine if it has the discretionary authority to vote your shares. Regulations prohibit banks, brokers and other nominees from voting shares in elections of directors, compensation of Named Executive Officers, with respect to whether to approve the declassification of the Board of Directors, and the vote on the effectuation of a reverse stock split and reduction in authorized common stock, unless the beneficial owners indicate how the shares are to be voted. Therefore, unless you instruct your bank, broker or nominee on how to vote your shares with respect to the election of directors, the compensation of Butler National’s Named Executive Officers, declassification of the Board of Directors and vote on the effectuation of a reverse stock split and reduction in authorized common stock, your bank, broker or nominee will be prohibited from voting on your behalf on any such matter for which your instructions are not provided. As such, it is critical that you cast your vote if you want it to count for the proposals regarding the aforementioned matters. Your bank, broker or nominee will, however, continue to have discretionary authority to vote uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm.

Can I vote in person at the annual meeting instead of voting by proxy?

Yes. However, we encourage you to vote your proxy by Internet, telephone, or mail prior to the meeting.

How many shares must be present to hold the meeting?

A quorum must be present at the annual meeting for any business to be conducted. The presence at the annual meeting, in person or by proxy, of 35% of the shares of Butler National common stock outstanding on the record date will constitute a quorum. Abstentions and broker non-votes (which occur when a bank, broker or other nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to a proposal and has not received instructions with respect to that proposal from the beneficial owner) will be treated as shares present for purposes of determining whether a quorum is present.

How many votes are required to elect the director nominees?

Because this is an uncontested election, a nominee for director is elected to the Board of Directors if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Abstentions will not affect the election of directors. In tabulating the voting results for the election of directors, only “FOR” and “AGAINST” votes are counted. If an incumbent director fails to receive a majority of the vote for re-election, the Board will act on an expedited basis to determine whether to accept the director’s previously tendered irrevocable resignation. In considering whether to accept or reject the tendered resignation, the Board will consider any factors they deem relevant. Any director who fails to receive a majority of the vote for re-election will not participate in the Board consideration regarding whether or not to accept the tendered resignation.

What happens if a nominee is unable to stand for election?

If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee unless you have withheld authority.

How many votes are required to approve the proposals other than the director nomination proposal?

The advisory approval of the compensation of Butler National’s Named Executive Officers and the ratification of the appointment of RBSM, LLP as the Company’s independent registered public accounting firm each require the affirmative vote of a majority of the shares present at the meeting in person or by proxy and entitled to vote. With respect to the proposal concerning the adoption of the amended bylaws to declassify the Board of Directors and the proposal seeking approval to adopt amended articles of incorporation to effectuate a reverse stock split, both require the affirmative vote of a majority of all outstanding shares entitled to vote.

What effect will abstentions and broker non-votes have on the proposals?

Shares voting “ABSTAIN” with respect to any nominee for director will be excluded entirely from the vote and will have no effect on the proposal. Shares voting “ABSTAIN” on the advisory vote on executive compensation, the ratification of the appointment of the Company’s independent registered public accounting firm, whether to approve the amended bylaws to declassify the Board of Directors, and whether to approve the amended articles of incorporation to effectuate a reverse stock split and reduce the number of authorized common stock, will be treated as shares present for quorum purposes and entitled to vote, so they will have the same practical effect as votes against the proposals. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

CORPORATE GOVERNANCE

THE BOARD, BOARD MEETINGS AND COMMITTEES

The system of governance practices followed by the Company is memorialized in the Company’s bylaws and in the written charters of the three standing committees of the Board of Directors (the Audit Committee the Compensation Committee, and the Nominating and Governance Committee). The charters are intended to provide the Board of Directors with the necessary authority and practices to review and evaluate the Company’s business and to make decisions independent of the influence of the Company’s management.

The committee charters are reviewed annually and updated as necessary to reflect evolving governance practices and changes in regulatory requirements. Each of the Board’s committee charters are available free of charge on the Company’s website under the investor relations section.

The Company has adopted a Standard of Business Conduct and Ethics applicable to all directors, officers and employees, including its principal executive officer, principal financial officer and principal accounting officer. The latest version of the Standard of Business Conduct and Ethics was filed as Exhibit 14.1 of the Company’s Form 8-K filed September 29, 2022.

Meetings

The Board of Directors held eight (8) meetings in fiscal 2024. Each director attended at least 75% of the meetings convened by the Board and the applicable committees during such director’s service on the Board during fiscal 2024. The Board has adopted a policy that absent unusual circumstances, directors are expected to attend all annual meetings of stockholders. Each of the directors then-serving on the Board attended the Company’s 2023 annual meeting of stockholders.

Board Committees

The Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. Current Committee memberships are as follows:

|

Audit Committee

|

|

Compensation Committee

|

|

Nominating and Governance Committee

|

|

Mr. David B. Hayden, Chair

|

|

Mr. Jeffrey D. Yowell, Chair

|

|

Mr. Joseph P. Daly, Chair

|

|

Mr. Jeffrey D. Yowell

|

|

Mr. John M. Edgar

|

|

Mr. Jeffrey D. Yowell

|

| |

|

Mr. Joseph P. Daly

|

|

Mr. Michael A. Loh

|

Mr. Bradley K. Hoffman served as an independent director on the Audit Committee and Compensation Committee prior to his resignation from the Board on February 10, 2024.

Audit Committee

Mr. Yowell is an independent member of the Audit Committee under applicable Nasdaq listing standards; however, the Board has determined Mr. Hayden is not independent due to his existing consulting relationship with the Company. The Audit Committee met four (4) times during fiscal year 2024, excluding actions by unanimous written consent. Mr. Wagoner attended each Audit Committee meeting before he resigned from the Audit Committee in August 2024. In light of Mr. Wagoner’s resignation from the Audit Committee, as of August 16, 2024, only two directors serve on the Audit Committee. Each member of the Audit Committee has experience or education in business or financial matters sufficient to provide him with a working familiarity with basic finance and accounting matters of the Company.

The Audit Committee is primarily concerned with the effectiveness of the Company accounting policies and practices, financial reporting and internal controls. The Audit Committee is authorized (i) to make recommendations to the Board of Directors regarding the engagement of the Company’s independent auditors, (ii) to review the plan, scope and results of the annual audit, the independent auditors’ letter of comments and management response thereto, (iii) to approve all audit and non-audit services, (iv) to review the Company policies and procedures with respect to internal accounting and financial controls and (v) to review any changes in accounting policy.

Audit Committee Financial Expert

The Company’s Board of Directors does not have an “audit committee financial expert,” within the meaning of such phrase under applicable regulations of the Securities and Exchange Commission, serving on its audit committee. Prior to Mr. Wagoner’s resignation from the Audit Committee on August 16, 2024, he qualified as an “audit committee financial expert.” The Board of Directors believes that all members of its audit committee are financially literate and experienced in business matters, and that one or more members of the audit committee are capable of (i) understanding generally accepted accounting principles (“GAAP”) and financial statements, (ii) assessing the general application of GAAP principles in connection with our accounting for estimates, accruals and reserves, (iii) analyzing and evaluating our financial statements, (iv) understanding our internal controls and procedures for financial reporting; and (v) understanding audit committee functions, all of which are attributes of an audit committee financial expert. However, the Board of Directors believes that there is not any audit committee member who has obtained these attributes through the experience specified in the SEC’s definition of “audit committee financial expert.”

Compensation Committee

The Compensation Committee held four (4) meetings in fiscal year 2024. The functions of the Compensation Committee are described in the Compensation Committee charter and include, among others, the following:

| |

●

|

recommend to the Board the salaries, bonuses and other remuneration and terms and conditions of employment of the Named Executive Officers of Butler National;

|

| |

|

|

| |

●

|

supervise the administration of Butler National’s incentive compensation and equity-based compensation plans; and

|

| |

|

|

| |

●

|

make recommendations to the Board of Directors with respect to Butler National’s executive officer compensation policies and the compensation of non-employee directors.

|

Mr. Yowell and Mr. Daly qualify as (i) an independent director under applicable Nasdaq rules and Rule 10C-1 of the Securities Exchange Act of 1934; and (ii) a “non-employee director” for purposes of Rule 16b-3 of the Securities Exchange Act of 1934. The Board has determined that Mr. Edgar is not independent due to his firm providing professional services to the Company. Mr. Edgar does qualify as a “non-employee director”.

Nominating and Governance Committee

The Nominating and Governance Committee was established in March 2024 but did not meet in fiscal year 2024. The functions of the Nominating and Governance Committee are described in the Nominating and Governance Committee Charter and include, among others, the following:

| |

●

|

review the size and composition of the Board and make recommendations to the Board as appropriate;

|

| |

●

|

advise and make recommendations to the Board on corporate governance matters;

|

| |

●

|

review criteria for election to the Board and recommend candidates for Board membership;

|

| |

●

|

review the structure and composition of the Board committees and make recommendations to the Board as appropriate;

|

| |

●

|

develop and oversee an annual self-evaluation process for the Board and its committees;

|

| |

●

|

evaluate, at least annually, the overall effectiveness of the Board and its committees and provide recommendations to the Board as appropriate;

|

| |

●

|

provide recommendations to the Board on other matters relating to the practices, policies, and performance of the Board as appropriate;

|

| |

●

|

provide oversight of corporate ethics issues and, at least annually, review and assess the adequacy of the Company’s Standard of Business Ethics and Conduct; and

|

| |

●

|

provide oversight of the Company’s major non-financial reporting enterprise risk assessment and management processes not retained by the Board or otherwise allocated to another Board committee.

|

Qualifications, Skills and Nominations of Directors

The Company believes that its Board as a whole should encompass a range of talent, skill, diversity, and expertise enabling it to provide sound guidance with respect to the Company’s operations and interests. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of the businesses.

The Nominating and Governance Committee identifies candidates for election to the Board of Directors; reviews their skills, characteristics and experience. The Nominating and Governance Committee seeks directors with strong reputations and experience in areas relevant to the strategy and operations of the Company’s businesses, particularly industries and growth segments that the Company serves, such as avionics, aircraft modifications and gaming. Each of the Company’s current directors has experience in core management skills, such as strategic and financial planning, public company financial reporting, corporate governance, risk management, and leadership development.

The Nominating and Governance Committee believes that each of the current directors has other key attributes that are important to an effective Board: integrity and demonstrated high ethical standards, the ability to engage management and each other in a constructive and collaborative fashion, diversity of origin, background, experience, and thought, and the commitment to devote significant time and energy to service on the Board and its Committees.

Neither the Board nor the Nominating and Governance Committee has a formal policy with respect to the diversity of directors. However, the Nominating and Governance Committee believes that it is essential that the Board members represent diverse viewpoints, with a broad array of experiences, professions, skills and backgrounds that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities to the long-term interests of the Company’s stockholders.

The Nominating and Governance Committee will consider nominee candidates proposed by stockholders but has not adopted a formal policy regarding the consideration of such nominees. The Nominating and Governance Committee has not adopted a formal policy regarding the consideration of nominees. If a stockholder suggests a director nominee, the Company reserves the right to request such stockholder furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as an independent director or that could be material to a reasonable stockholder’s understanding of the independence of such nominee. The additional information would likely include a request to provide:

| |

●

|

All information relating to such nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14 of the Securities Exchange Act of 1934 and the rules promulgated thereunder (including such nominee’s written consent to being named in the proxy statement and to serving as a director if elected);

|

| |

|

|

| |

●

|

A statement whether such person, if elected, intends to tender, promptly following such person’s election or re-election, an irrevocable resignation effective upon such person’s failure to receive the required vote for re-election at the next meeting at which such person would face re-election and upon acceptance of such resignation by the Board of Directors;

|

| |

|

|

| |

●

|

A description of all direct and indirect compensation and other material monetary arrangements and understandings during the past three years, and any other material relationships, between the nominating stockholder and beneficial owner, if any (and any of their respective affiliates and associates) and each proposed nominee, including any information that would be required to be disclosed under Rule 404 of Regulation S-K if the stockholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, were the “registrant” for purposes of such rule and the nominee were the director of such registrant;

|

| |

|

|

| |

●

|

A completed and signed questionnaire with respect to the background and qualifications of the nominee and the background of any other person or entity on whose behalf the nomination is being made and a completed and signed representation and agreement that (a) such nominee is not and will not become a party to any agreement with, and has not given any commitment or assurance to, any person as to how such nominee, if elected as a director, will act or vote on any issue or question that has not been disclosed to the Company or that could limit or interfere with the nominee’s ability to comply with the nominee’s fiduciary duties as a director, (b) such nominee is not and will not become a party to any agreement with any person other than the Company with respect to any action or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed, and (c) in such nominee’s individual capacity and on behalf of any person on whose behalf the nomination is being made, the nominee would be in compliance, if elected as a director, and will comply, with all applicable policies and guidelines of the Company; and

|

| |

|

|

| |

●

|

A completed background investigation as would be required by the Kansas Racing and Gaming Commission. All members of the board of directors must meet the requirements of the Kansas regulations for involvement in management services for gaming or be a member of the board of directors of the Company.

|

Board’s Role in Risk Oversight and Board Leadership Structure

The Board has determined that the positions of Chairman of the Board and Chief Executive Officer may be held by the same persons. The Chairman of the Board is responsible for coordinating the Board’s activities, including scheduling of meetings of the full Board, scheduling executive sessions of the non-employee directors and setting relevant items on the agenda (in consultation with the Chief Executive Officer as necessary or appropriate). The Board believes having one leader with deep industry experience and Company knowledge in a combined Chairman and CEO role provides clear accountability and decisive and effective leadership. Because the Chairman is not “independent,” the Board uses a Lead Independent Director, who is selected by the independent directors of the Board. The independent directors elected Jeffrey D. Yowell as Lead Independent Director for the board term ending October 30, 2024. The Lead Independent Director:

| |

●

|

provides the Chairman input into agendas for Board meetings;

|

| |

●

|

advises the Chairman and CEO as to quality, quantity, and timeliness of the flow of information from management that is necessary to ensure non-employee directors perform their duties appropriately;

|

| |

●

|

chairs all meetings of the Board of Directors at which the Chairman is not present;

|

| |

●

|

coordinates, and develops the agenda for, chairs and moderates meetings of independent directors;

|

| |

●

|

acts as a liaison between the independent directors and the Chairman or the CEO on sensitive issues and when necessary, ensures the full discussion of those issues at Board meetings;

|

| |

●

|

provides input to the Board regarding the CEO’s performance and meets with the CEO to discuss the Board’s evaluation; and

|

| |

●

|

guides the Board’s planning for CEO succession.

|

The Board as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant Board committees.

The Audit Committee focuses on key business and financial risks and related controls and processes.

The Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy and objectives and helps ensure that the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. The Compensation Committee structures the Company’s executive compensation program to reduce the possibility that the executive officers, either individually or as a group, make excessively risky business decisions that could maximize short-term results at the expense of long-term value. The Compensation Committee regularly reviews the Company’s compensation policies and practices, including the risks created by the Company’s compensation plans. Based on this review and analysis, the Compensation Committee concluded that any risks arising from its employee compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

The Nominating and Governance Committee is responsible for recommending director candidates to the Board of Directors and for providing oversight of corporate ethic issues. Further, the Nominating and Governance Committee is responsible for non-financial risk assessment and management processes not retained by the Board or otherwise allocated to another Board Committee; provided, however, that the full Board takes responsibility for cybersecurity related risk oversight.

The Audit, Compensation, and Nominating and Governance Committees provide reports to the full Board. The oversight responsibility of the Board and its committees are enabled by management reporting processes that are designed to provide visibility to the Board about the identification, assessment, and management of critical risks.

At this time the Company does not have practices or policies in place regarding the ability of employees (including officers) or directors, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities granted as part of the compensation of the employee or director or held, directly or indirectly by the employee or director. As a result, these transactions are generally permitted.

Legal Proceedings Involving a Director or Executive Officer

The Company is pleased to confirm that during the past ten years:

| |

●

|

No director or officer has been convicted in a criminal proceeding or is a named subject of a pending criminal proceeding, exclusive of traffic violations.

|

| |

|

|

| |

●

|

No petitions under the Federal bankruptcy laws have been filed by or against any business or property of any director or officer of the Company nor has any bankruptcy petition been filed against a partnership or business association where these persons were general partners or executive officers.

|

| |

|

|

| |

●

|

No director or officer has been permanently or temporarily enjoined, barred, suspended or otherwise limited from involvement in any type of business, securities or banking activities.

|

| |

|

|

| |

●

|

No director or officer has been convicted of violating a federal or state securities or commodities law.

|

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS:

The executive officers of the Company are elected each year at the annual meeting of the Board of Directors held in conjunction with the annual meeting of stockholders. The executive officers of the Company are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Christopher J. Reedy

|

|

58

|

|

President and Chief Executive Officer

|

|

Tad M. McMahon

|

|

57

|

|

Chief Financial Officer and Secretary

|

|

Joe Aric Peters

|

|

49

|

|

Vice President – Sales and Marketing

|

|

Clark D. Stewart

|

|

84

|

|

Former President and Chief Executive Officer

|

Christopher J. Reedy worked for Colantuono & Associates, LLC from 1997 to 2000 in the area of aviation, general business and employment counseling, and from 1995 to 1997 with the Polsinelli, White firm. He was involved in aviation product development and sales with Bendix/King, a division of Allied Signal, Inc. from 1988 through 1993. Mr. Reedy joined the Company in November 2000. Previously, Mr. Reedy was Vice President and Secretary of the Company since 2005. Mr. Reedy became President and Chief Executive Officer in May 2023. Mr. Reedy was appointed to the Butler National Corporation Board of Directors in February 2024. In August 2024, Mr. Reedy was appointed as Chairman of the Board.

Tad M. McMahon worked in public accounting as an auditor with KPMG, LLP and Grant Thornton, LLP from 1993 to 2000 focusing on manufacturing clients. Mr. McMahon worked in private industry from April 2000 to August 2008 when he joined the Company. Mr. McMahon became Chief Financial Officer in March 2017. Mr. McMahon became Secretary in May 2023.

Joe Aric Peters joined Butler National Corporation in 1999 focused on sales for the Special Mission Electronics – Tempe and marketing for Aircraft Modifications. In 2013, Mr. Peters was promoted to Director of Sales for Aircraft Modifications. In June of 2022, Mr. Peters was appointed to the Board of Directors. In October of 2023, Mr. Peters was appointed as an executive officer, Vice President – Sales and Marketing. In July of 2024, Mr. Peters resigned from the Board.

Clark D. Stewart terminated his employment effective May 9, 2023 and previously was the Company’s President and Chief Executive Officer. Clark D. Stewart was President of Tradewind Industries, Inc., a manufacturing company, from 1979 to 1985. From 1986 to 1989, Mr. Stewart was Executive Vice President of RO Corporation. In 1980, Mr. Stewart became President of Tradewind Systems, Inc. He became President of the Company in 1989.

The executive officers named above are the Named Executive Officers who appear in the compensation tables of this Proxy Statement.

Our compensation programs are designed to support our business goals and promote both short-term and long-term growth. This section of the proxy statement explains how our compensation programs are designed and operate in practice with respect to our listed officers. This “Executive Compensation” section presents compensation earned by the Named Executive Officers for fiscal years ending April 30, 2024 and 2023.

Our Compensation Philosophy

Butler National Corporation's executive compensation program is designed and administered by the Compensation Committee of the Board of Directors. The Compensation Committee annually reviews the Company's compensation philosophy, the overall design of the compensation program and the elements of each component of compensation, including reviewing and revising the executive officer compensation plans, programs, and guidelines as appropriate. The Compensation Committee also consults with management regarding non-executive employee compensation programs.

The core element of our overall compensation philosophy is the alignment of pay and performance. Total compensation varies with individual performance and Butler National’s performance in achieving financial and non-financial objectives. Our equity plans are designed to ensure that executive compensation is aligned with the long-term interests of our stockholders. The Compensation Committee and our management believe that compensation should help to recruit, retain, and motivate the employees that the Company will depend on for current and future success. The Compensation Committee and our management also believe that the proportion of “at risk” compensation (variable cash compensation and equity) should rise as an employee’s level of responsibility increases. This philosophy is reflected in the following key design priorities that govern compensation decisions:

| |

●

|

pay for performance;

|

| |

|

|

| |

●

|

employee recruitment, retention, and motivation;

|

| |

●

|

cost management;

|

| |

|

|

| |

●

|

egalitarian treatment of employees;

|

| |

|

|

| |

●

|

alignment with stockholders’ interests; and

|

| |

|

|

| |

●

|

continued focus on corporate governance.

|

Each element of compensation reflects one or more of these design priorities. In most cases, our employees, except for our executive officers and a few key employees, are employed at will, without employment agreements, severance payment arrangements (except as required by local law), or payment arrangements that would be triggered by a “change in control” of Butler National. Retirement plan programs are broad-based; Butler National does not provide special retirement plans or benefits solely for executive officers.

Total compensation for the majority of our employees including the Named Executive Officers, includes two or more of the following components:

|

PAY COMPONENT

|

|

BRIEF DESCRIPTION

|

|

Base salary

|

|

Paid to provide a fixed form of executive compensation for performing daily responsibilities. Described below under “Base Salary.”

|

|

Annual and semiannual incentive cash payments

|

|

Paid as discretionary cash bonuses to motivate individual employees as a reward for outstanding performance of a task. Described below under “Cash Bonus.”

|

|

Equity Awards

|

|

Equity Awards are granted by the Compensation Committee to align management objective toward improved earnings and retention of the management team. In 2016 the Company’s stockholders approved the 2016 Equity Incentive Plan, which empowers the Compensation Committee to issue awards as stock options, restricted stock or restricted stock units. Equity Awards are paid to motivate and reward executives over an appropriate time period and is also used for executive retention. Further described below under “Equity Awards.”

|

|

Employee stock purchase plan

|

|

Any employee may purchase the Company stock at the fair market value on the date of purchase without broker or issue fees. The Company first implemented the Employee Stock Purchase Plan in 1981 but no shares have been purchased under this plan since 1988.

|

|

Retirement benefits

|

|

We pay the required federal and state retirement contributions, the required unemployment contributions and match the employee’s contribution to their account in the Butler National Corporation 401(k) plan according to the parameters set forth in the plan. Retirement benefits are paid for executive retention.

|

|

Health and welfare benefits

|

|

Employees electing to participate in the various insurance plans offered by the Company receive a payment for a share of the health, dental, vision and life insurance costs for the employee. Health and welfare benefits are paid for executive retention.

|

The Compensation Committee and management continue to believe that a similar method of compensating all employees with cash, equity and retirement benefits supports a culture of fairness, collaboration, and egalitarianism.

The Company provides its stockholders with the opportunity to cast an advisory vote on executive compensation in connection with the Annual Meeting of Stockholders. The Company believes that it is appropriate to seek the views of the stockholders on the design and effectiveness of the Company’s executive compensation program. As an advisory vote the proposal is not binding upon the Company. However, the Compensation Committee values the opinions expressed by stockholders and considers the outcome of the vote when making compensation decisions for named executive officers.

Determining Executive Compensation

The Compensation Committee process for determining compensation includes a review of Butler National executive compensation and practices, and an analysis, for each Butler National executive officer, of all elements of compensation. In conducting an annual performance review and determining appropriate compensation levels, the Compensation Committee meets and deliberates outside the presence of the executive officers. In determining base salary, the Compensation Committee reviews Company and individual performance information and the Company employment agreement obligations discussed below. The Compensation Committee also reviews the executive officer compensation mix of peer companies to help identify the compensation mix that is needed to attract and retain talent. The Compensation Committee has used third-party compensation consultants in the past to help design compensation and incentive plans. The Compensation Committee is authorized to engage consultants as deemed necessary.

Base Salary

The Compensation Committee establishes executive officers’ base salaries at levels that it believes are reasonable for comparable positions. When the Compensation Committee determines the executive officers’ base salaries during the first quarter of the year, the Compensation Committee takes into account each officer’s role and level of responsibility at the company. In general, executive officers with the highest level and amount of responsibility have received the highest base salaries. The Compensation Committee met four (4) times in fiscal 2024. They considered the current economic conditions and determined any compensation changes to be made in fiscal 2024.

Cash Bonus

The Compensation Committee establishes executive officers’ bonuses based on performance and completion of specific strategic initiatives of the Company. Bonuses paid in fiscal 2024 and 2023 are listed in the Summary Compensation Table. Under the Employment Agreements, executive officers participate in the Company cash bonus plan for employees that have been employed for fifteen years, subject to the company being profitable.

Equity Awards

There were no awards to Named Executive Officers in fiscal 2024 and 2023.

Performance Measures and Decision-Making Process of Executive Compensation

Fiscal Year 2024:

The performance measures used by the Compensation Committee in determining executive compensation for fiscal year 2024 were:

| |

●

|

the absolute one-year and multi-year company performance as measured by levels of revenue, profit from operations, operating margins and operating cash flows;

|

| |

|

|

| |

●

|

one-year and multi-year performance on the same measures as compared with competitors; and

|

| |

|

|

| |

●

|

Company progress toward its strategic goals.

|

To make its decisions on executive compensation, the Compensation Committee reviewed in detail each of the performance measures above and reviewed compensation market data. The Compensation Committee also reviewed the total compensation and benefits of the executive officers and considered the impact that their retirement, or termination under various other scenarios, would have on their compensation and benefits.

The CEO provided the entire Board of Directors with an assessment of his own performance with respect to the performance measures listed above, which the Board considered in its assessment of his performance for fiscal year 2023. The CEO reviewed the performance of the other executive officers with the Compensation Committee and made recommendations regarding the components of their compensation.

When making its compensation decisions, the Compensation Committee discussed levels of compensation for the CEO and the other executive officers with the full Board of Directors.

In fiscal year 2023, Butler National Corporation did reach projected levels of revenue, profit from operations, operating margin and operating cash flow.

With regard to progress toward strategic goals, Butler National improved its products and technology positions, and strengthened its relationships with customers.

Taking into account Company performance, both absolute and relative to competition and the executive officers’ contribution to that performance, the Compensation Committee set its targeted compensation levels so as to be commensurate with that relative performance. The Compensation Committee made the following determinations for fiscal year 2024 with respect to each component of compensation for the former CEO and his existing contract and the other executive officers:

Base Salary - In keeping with its strategy, the Compensation Committee base salary decisions for fiscal year 2024 were generally intended to provide salaries at the median level of salaries for similarly situated executives of the comparator companies. Base salary amounts for the executive officers subject to an employment contract are proscribed by such contract and the Committee did not elect to pay more than the contractually agreed base salary amount.

Cash Bonus - The Compensation Committee establishes executive officers’ bonuses based on performance and completion of specific strategic initiatives of the Company. Bonuses paid in fiscal 2024 are listed in the Summary Compensation Table.

Long-Term Compensation - The Compensation Committee granted no equity compensation.

Fiscal Year 2025:

The Compensation Committee has made no decision to change base salary, cash bonus or long-term compensation through the end of the current employment contracts with the executive officers. The Compensation Committee is considering measures to bring management to industry standards and be competitive with its peers. Specifically, the Compensation Committee is evaluating additional awards to employees/management/executive officers of incentive equity with multiple year vesting requirements.

Employment Contracts, Termination of Employment and Change-in-Control Agreements

On February 4, 2020, the Company, entered into employment agreements (each an “Employment Agreement” and collectively, the “Employment Agreements”) with the following executive officers: (i) Christopher J. Reedy, President and Chief Executive Officer (“Reedy”), (ii) Tad M. McMahon, Chief Financial Officer and Secretary (“McMahon”), (iii) Joe Aric Peters, Vice President (“Peters”), and (iv) Clark D. Stewart, former President and CEO (“Stewart”), (collectively, the “Executives” and each, an “Executive”).

The Employment Agreements each contain substantially the same terms and conditions, except as provided below. Each Employment Agreement has a five (5) year term commencing on January 1, 2020. The Employment Agreements may be terminated earlier: (i) by the Executive with or without Good Reason (as defined in the Employment Agreements), (ii) by the Company with or without Cause (as defined in the Employment Agreements), (iii) as a result of the Executive’s death, permanent disability or incapacity or (iv) by mutual agreement of the Executive and the Company.

On October 4, 2023, the Company amended its employment agreements with Reedy, McMahon and Peters, to adjust base compensation for each Executive in light of evolving duties and responsibilities. The Company has notified Reedy, McMahon and Peters that the Employment Agreements will not be renewed or extended past January 1, 2025. Mr. Stewart’s contract was terminated in connection with his departure from the Company in May 2024.

Under the Employment Agreements, the Executives are entitled to receive the following compensation and benefits in connection with their services as executive officers:

| |

●

|

an annual base salary of $595,000, $375,000, $610,000, and $189,000 for Christopher J. Reedy, Tad M. McMahon, Joe Aric Peters, Clark D. Stewart, respectively (each, a “Base Salary”). The Base Salary will increase by five percent (5%) on January 1 of each year for the initial term and any extension term;

|

| |

|

|

| |

●

|

eligibility to receive a discretionary annual bonus for certain long-term employees, provided that the Company is profitable;

|

| |

|

|

| |

●

|

eligibility to participate in the Company’s Management Incentive Bonus Plan;

|

| |

|

|

| |

●

|

participation in all employee benefit programs; and

|

| |

|

|

| |

●

|

included in accrued liabilities are $0 and $244,000 as of April 30, 2024, and 2023 respectively for amounts owed to our former CEO for accrued compensation.

|

The Employment Agreements entitle the Executives to their respective Base Salary through the date of termination for (i) a termination for Cause, (ii) termination by Executive for a reason other than for Good Reason or (iii) at the expiration of the term in which notice of termination of employment was properly given by either the Executive or the Company.

The Employment Agreements also provide for severance benefits in the event that the Executive’s employment is terminated: (i) by the Company without Cause (other than by reason of death or disability) or by the Executive for Good Reason prior to a Change in Control (as defined in the Employment Agreements) (each a “Pre-Change in Control Termination”); or (ii) by the Company without Cause (other than by reason of death or disability) or by the Executive for Good Reason within eighteen (18) months following a Change in Control, in each case (each a “Post-Change in Control Termination”), subject to the Executive’s execution of the Release Conditions (as defined in the Employment Agreements).

In the event of a Pre-Change in Control Termination, the Executives will be entitled to receive the following compensation and benefits:

| |

●

|

All previously earned and accrued but unpaid Base Salary up to the date of the termination;

|

| |

|

|

| |

●

|

A severance payment in an amount equal to the Base Salary paid for the balance of the initial term or extension term, whichever is later;

|

| |

|

|

| |

●

|

A lump sum payment equal to three (3) times the mean of payments under any short-term incentive, commission or annual bonus plan maintained by the Company during each of the three (3) calendar years prior to the year in which such termination occurs;

|

| |

|

|

| |

●

|

For the twelve (12) month period following the Executive’s termination or such shorter period of time that the Executive or any of the Executive’s dependents is eligible for and elects COBRA continuation coverage; and

|

| |

|

|

| |

●

|

The annual bonus that is paid to certain long-term employees, provided the Company is profitable.

|

In the event of a Post-Change in Control Termination, the Executives will be entitled to receive the same compensation and benefits set forth above, except instead of a severance payment in an amount equal to the Base Salary paid for the balance of the initial term or extension term (whichever is later), the severance payment will be in an amount equal to thirty-six (36) months of Base Salary.

In the event of a termination due to the death or disability, the Executive will be entitled to receive all previously earned and accrued but unpaid Base Salary up to such date. In the event the Executive is unable to perform his duties for a period exceeding thirty (30) days on account of sickness or injury, the Executive will continue to receive his Base Salary and benefits for a period of twelve (12) months less any amounts received pursuant to any disability insurance. Thereafter, the Executive will receive no further salary or other payments until he resumes his duties.

The Employment Agreements also include customary intellectual property, non-solicitation, non-compete and confidentiality provisions.

Each of the Named Executive Officers is subject to one or more restricted stock award agreements. In the event of the death, disability or retirement of the executive after the grant date and prior to the vesting date, the award vests. In the event of an employment termination for any other reason, all unvested shares under the award agreement are forfeited. Upon a change in control of Butler National Corporation, all unvested shares under the award agreement are vested.

Stock Ownership Guidelines

In August of 2024, the Board of Directors unanimously approved and adopted stock ownership guidelines for executive officers and directors. The Board of Directors adopted stock ownership guidelines in order to align executive officer’s interests and director’s interests with those of the Company and its stockholders. Under the guidelines, executive officers and directors have three years from the date they become subject to the guidelines to acquire shares of the Company’s common stock valued at two times the executive officer’s base salary or the director’s cash compensation, as applicable.

2024 Summary Compensation

The following table below sets forth certain compensation information concerning the Chief Executive Officer and our three additional most highly compensated executive officers for the fiscal years ended April 30, 2024 and 2023. Our listed officers are the CEO, CFO, Vice President and former CEO. The “Executive Compensation” section presents compensation earned by the listed officers for fiscal years ending April 30, 2024 and 2023:

Summary Compensation Table

(dollars in thousands)

|

Name

and Principal

Position

|

Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)(1)

|

|

|

Option

Awards and

Stock

Appreciation

Rights

($)

|

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

|

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings($)

|

|

|

All Other

Compensation

($)(2)

|

|

|

Total

($)(3)

|

|

|

Christopher J. Reedy

|

2024

|

|

|

590 |

|

|

|

211 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

70 |

|

|

|

871 |

|

|

President and Chief Executive Officer

|

2023

|

|

|

347 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

63 |

|

|

|

410 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tad M. McMahon

|

2024

|

|

|

373 |

|

|

|

87 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

73 |

|

|

|

533 |

|

|

Chief Financial Officer and Secretary

|

2023

|

|

|

273 |

|

|

|

30 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

71 |

|

|

|

374 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Aric Peters *

|

2024

|

|

|

705 |

|

|

|

112 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

84 |

|

|

|

901 |

|

|

Vice President

|

2023

|

|

|

683 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

80 |

|

|

|

763 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clark D. Stewart **

|

2024

|

|

|

189 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

2 |

|

|

|

191 |

|

|

Former President and Chief Executive Officer

|

2023

|

|

|

989 |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

71 |

|

|

|

1,060 |

|

| * Joe Aric Peters salary amount includes $101 of commissions earned prior to the execution of his amended employment contract. |

|

** Clark D. Stewart terminated his employment with the Company on May 9, 2023, and the salary amount includes deferred compensation accrued prior to April 30, 2023.

|

All Other Compensation (dollars in thousands):

|

Name

|

Year

|

|

Automobile

Usage

($)

|

|

|

Health

Benefits

($)

|

|

|

Memberships

($)

|

|

|

Matching

Contributions

to 401(k)

($)

|

|

|

Christopher J. Reedy

|

2024

|

|

|

--- |

|

|

|

17 |

|

|

|

9 |

|

|

|

44 |

|

| |

2023

|

|

|

--- |

|

|

|

17 |

|

|

|

5 |

|

|

|

41 |

|

|

Tad M. McMahon

|

2024

|

|

|

--- |

|

|

|

26 |

|

|

|

3 |

|

|

|

44 |

|

| |

2023

|

|

|

--- |

|

|

|

27 |

|

|

|

3 |

|

|

|

41 |

|

|

Joe Aric Peters

|

2024

|

|

|

--- |

|

|

|

26 |

|

|

|

14 |

|

|

|

44 |

|

| |

2023

|

|

|

--- |

|

|

|

27 |

|

|

|

12 |

|

|

|

41 |

|

|

Clark D. Stewart

|

2024

|

|

|

--- |

|

|

|

2 |

|

|

|

--- |

|

|

|

--- |

|

| |

2023

|

|

|

7 |

|

|

|

17 |

|

|

|

6 |

|

|

|

41 |

|

| |

(1)

|

Stock awards are comprised of restricted stock. Valuation is based on aggregate grant date fair value computed in accordance with FASB ASC Topic 718. See Note 11 to the Consolidated Financial Statements in the Annual Report on Form 10-K for the year ended April 30, 2024 for valuation assumptions used.

|

| |

|

|

| |

(2)

|

Includes the amounts in the “All Other Compensation” table.

|

| |

|

|

| |

(3)

|

All benefits are provided for in the tables, summaries, and footnotes above. We did not participate in the following transaction and such item is therefore not reported in table format: Nonqualified Deferred Compensation Table.

|

The following table sets forth information regarding the number of shares of unvested restricted stock held by the Named Executive Officers at April 30, 2024.

Outstanding Equity Awards at April 30, 2024

(dollars in thousands)

| |

|

Option Awards

|

|

|

Stock Awards

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised

Options

(#) Not

Exercisable

|

|

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration

Date

|

|

|

Number

of

Shares

or Units

of Stock

that

Have

Not

Vested

(#)

|

|

|

Market

Value of

Shares

or Units

of Stock

that

Have

Not

Vested

($)(4)

|

|

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units, or

Other

Rights

that Have

Not

Vested

(#)

|

|

|

Equity

Incentive

Plan

Awards:

Market

or Payout

Value of

Unearned

Shares,

Units, or

Other

Rights

that Have

Not

Vested

($)

|

|

|

Christopher J. Reedy

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

400,000 |

(1) |

|

$ |

336 |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tad M. McMahon

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

400,000 |

(2) |

|

$ |

336 |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Aric Peters

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

|

|

400,000 |

(3) |

|

$ |

336 |

|

|

|

--- |

|

|

|

--- |

|

All unvested shares of restricted stock were issued under the Butler National Corporation 2016 Equity Incentive Plan. See also “Employment Contracts, Termination of Employment and Change-in-Control Agreements” for additional information that could affect the vesting of these awards.

| |

(1)

|

Mr. Reedy’s restricted stock award will vest as follows: 400,000 shares on March 16, 2025.

|

| |

|

|

| |

(2)

|

Mr. McMahon’s restricted stock award will vest as follows: 400,000 shares on March 16, 2025.

|

| |

|

|

| |

(3)

|

Mr. Peter's restricted stock award will vest as follows: 400,000 shares on March 16, 2025.

|

| |

|

|

| |

(4)

|

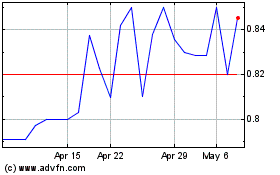

Value is based on the closing price of the Company’s stock of $0.84 on April 30, 2024, as reported on OTCQX.

|

Pay versus Performance Table

As required by Item 402(v) of Regulation S-K, we are providing the following information regarding the relationship between executive compensation and our financial performance for each of the fiscal years ended April 30, 2024 and 2023. In determining the “compensation actually paid” to our Named Executive Officers, SEC rules require us to make various adjustments to amounts reported in the Summary Compensation Table because the SEC’s valuation methods for this section differ from those required in the Summary Compensation Table. The table below summarizes compensation values reported in our Summary Compensation Table, as well as the adjusted values required in this section by SEC rules.

|

Year(1)

|

|

Summary

Compensation

Table Total

for Current

PEO

($)

|

|

|

Summary

Compensation

Table Total

for Former

PEO

($)

|

|

|

Compensation

Actually Paid

to Current

PEO

($)(1)

|

|

|

Compensation

Actually Paid

to Former

PEO

($)(1)

|

|

|

Average

Summary

Compensation

Table Total

for Non-PEO

NEOs ($)

|

|

|

Average

Compensation

Actually Paid

to Non-PEO

NEOs ($)(1)

|

|

|

Value of

Initial Fixed

$100

Investment

Based on:

Total

Shareholder

Return

($)(2)

|

|

|

Net Income

($)

|

|

|

2024

|

|

$ |

871,000 |

|

|

$ |

191,000 |

|

|

$ |

961,000 |

|

|

$ |

(568,000 |

) |

|

$ |

717,000 |

|

|

$ |

807,000 |

|

|

$ |

140.00 |

|

|

$ |

12,512,000 |

|

|

2023

|

|

$ |

410,000 |

|

|

$ |

1,060,000 |

|

|

$ |

266,000 |

|

|

$ |

796,000 |

|

|

$ |

352,000 |

|

|

$ |

(92,000 |

) |

|

$ |

115.00 |

|

|

$ |

4,516,000 |

|

|

2022

|

|

$ |

863,000 |

|

|

$ |

- |

|

|

$ |

1,226,000 |

|

|

$ |

- |

|

|

$ |

462,000 |

|

|

$ |

682,000 |

|

|

$ |

155.00 |

|

|

$ |

12,240,000 |

|

| |

(1)

|

Amounts represent compensation “actually paid” to our Principal Executive Officer (“PEO”) and the average compensation actually paid to our remaining Named Executive Officers for the relevant fiscal year, as determined under SEC rules (and described below), which includes the individuals indicated in the table below for each fiscal year:

|

| |

(2)

|

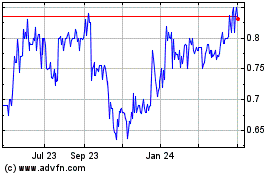

Calculated as 100 dollars invested in the Company’s common stock on April 30, 2021 at $0.60 per share, with a share price of $0.93 per share on April 29, 2022, $0.69 per share on April 28, 2023 and $0.84 per share on April 30, 2024.

|

|

Year

|

Current PEO

|

Former PEO

|

Non-PEO NEOs

|

|

2024

|

Christopher J. Reedy

|

Clark D. Stewart

|

Tad M. McMahon, Joe Aric Peters

|

|

2023

|

Christopher J. Reedy

|

Clark D. Stewart

|

Tad M. McMahon, Craig D. Stewart

|

|

2022

|

Clark D. Stewart

|

|

Christopher J. Reedy, Tad M. McMahon, Craig D. Stewart

|

Compensation actually paid to our Named Executive Officers represents the “Total” compensation reported in the Summary Compensation Table for the applicable fiscal year, as adjusted as follows:

| |

|

2022

|

|

|

2023

|

|

|

2024

|

|

|

Adjustments

|

|

Current

PEO

|

|

|

Average

non-

PEO

NEOs

|

|

|

Current

PEO

|

|

|

Former

PEO

|

|

|

Average

non-

PEO

NEOs

|

|

|

Current

PEO

|

|

|

Former

PEO

|

|

|

Average

non-

PEO

NEOs

|

|

|

Increase/deduction for Awards Granted during Prior FYs that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End

|

|

$ |

363,000 |

|

|

$ |

220,000 |

|

|

$ |

(144,000 |

) |

|

$ |

(264,000 |

) |

|

$ |

(72,000 |

) |

|

$ |

60,000 |

|

|

$ |

- |

|

|

$ |

60,000 |

|

|

Increase/deduction for Awards Granted during Prior FYs that were Outstanding and Vested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

30,000 |

|

|

|

- |

|

|

|

30,000 |

|

|

Deduction of ASC 718 Fair Value of Awards Granted during Prior FYs that were Forfeited during Applicable FY, determined as of Prior FY End (3)(4)

|

|

|

- |

|

|

|

- |