M&S Shares Dip on Weak Clothing Sales But Primark Owner ABF Soars

July 07 2016 - 8:40AM

Dow Jones News

LONDON—British retailer Marks & Spencer Group PLC on

Thursday reported weak first-quarter sales as the company continued

to be dragged down by poor performance in its clothing and home

business.

Shares fell 1% in morning trading in London as M&S's 4.3%

decline in U.K. like-for-like sales for the first quarter of fiscal

2017 missed analyst estimates, even though the company said its

full-year guidance on group sales would be similar to fiscal

2016.

Like-for-like food sales in the quarter ended July 2 fell 0.9%.

Sales in the clothing and home arm—which has turned in a weak

performance for several consecutive quarters—tumbled 8.9%, after

M&S scaled back on price promotions in a bid to move products

toward lower, more consistent pricing.

"We knew our actions would reduce total sales but we are seeing

some encouraging early signs," said Chief Executive Steve Rowe on a

call with analysts.

One of the best-known names on the U.K. high street, M&S

said consumer confidence had "weakened in the run up to the EU

referendum" but added that "it is too early to quantify the

implications of Brexit."

Mr. Rowe said M&S saw consumer confidence soften in November

following terror attacks in Europe, concerns about the economy and

the U.K.'s referendum on the European Union, and that the company

had noticed a further softening in March. But he added that

M&S's change in strategy around promotions made it "very

difficult to assess" the impact of the decision to leave the

EU.

"On the day of the vote itself our footfall was down on that day

as customers went to vote and that's the only thing I can say about

it," said Mr. Rowe, who took the reins of M&S in April and has

since set in place the strategy of reducing promotions while

cutting everyday prices.

Liberum analyst Tom Gadsby described M&S's performance as

"very poor" and scaled back his earnings forecasts, predicting that

sales would take a further hit. "We believe that in the light of

the Brexit vote consumer demand will be more severely impacted," he

said.

M&S said it has currency hedges in place for the majority of

the current fiscal year and the first half of the next fiscal year,

meaning any impact on sourcing costs from the weak pound won't

start to show for a while.

International sales, which represent around 10% of the group

total, rose 6.1% or 0.7% at constant currency.

By contrast, on Thursday shares in Associated British Foods PLC

jumped 9.7% to 2800 pence after the company, which owns budget

clothing chain Primark, offered a brighter outlook for the year and

logged higher sales for the 40 weeks ended June 18, saying revenue

was up 1% or 3% at constant currency.

Primark reported 7% sales growth at constant currency in the

first 40 weeks of its financial year, driven by increased selling

space and high sales per square foot. That helped offset weak

like-for-like sales in the third quarter which the company blamed

on "unpredictable weather."

Overall, the group's third-quarter growth was 4% at constant

currency and 7% at actual exchange rates.

ABF—which supplies food ingredients including sugar and enzymes

and also owns food brands such as Ryvita crisp bread and Twinings

tea—indicated it would benefit from Britain's vote to leave the EU

in the short-term.

ABF in April warned of a "marginal decline" in adjusted earnings

per share for the full year but on Thursday said the weak pound

would translate into higher revenue from its international

operations and hence it no longer expects earnings to decline.

For the next fiscal year, ABF said it would see both positive

and negative impacts from the falling pound. Primark will see U.K.

clothing margins squeezed by higher costs—since much of its costs

are dollar-denominated—but margins in ABF's British sugar business

will benefit from lower costs. Separately ABF said group profits

earned outside the U. K.—roughly 50% of the total—will be helped by

the weak pound.

It said the underlying operating performance of the group during

the third quarter was ahead of its expectations, boosted by an

improvement in the sugar business.

â "Rory Gallivan and Anais Voski contributed to this article

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and Ian

Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 07, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

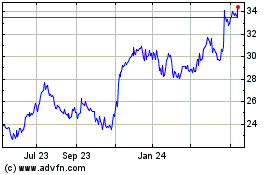

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From May 2024 to Jun 2024

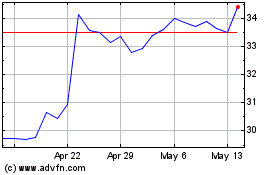

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jun 2023 to Jun 2024