UPDATE: EU Wheat Settles At 11-month High On Weather Woes

May 18 2012 - 1:18PM

Dow Jones News

European wheat futures soared Friday to close at their highest

point for 11 months, as extreme weather in the former Soviet Union

boosted sentiment, while Chicago also added support as the U.S.

market responded to domestic dryness concerns.

November Paris milling wheat futures settled up EUR8.25, or

4.0%, at EUR215.25 a metric ton, the new crop contract's highest

closing level since June 13, having earlier hit an intra-day high

of EUR218.00/ton.

Wheat prices have been buoyed by dry weather conditions in

Russia, Kazakhstan and U.S. winter wheat producing areas, Barclays

said. While global wheat inventories are still hefty, weather

concerns and their impact on supply has supported prices, the bank

said.

Jaime-Nolan Miralles, commodity risk manager at FCStone Europe,

said Russian dryness will continue to foster a growing sense of

nervousness across the wheat world this weekend, with only

scattered rains expected over the weekend there.

Indeed, MDA EarthSat Weather said dryness remains extensive

across south central Ukraine, central and northern North Caucasus,

western Kazakhstan and north central and western Volga Valley.

Drier conditions are expected to continue there over the next 10

days along with very warm temperatures, and with further windy

conditions seen over the next few days crop stress will build and

yield potential decline, the forecaster said.

Frontier Agriculture said such a turnaround in wheat values,

given the very negative sentiment just a week ago, reaffirms

concerns that still underpin the cereal complex and highlights the

requirement of all the major crop regions around the world to

deliver in upcoming harvests.

The U.K. grain merchant, which is jointly owned by Cargill Inc.

and Associated British Foods PLC (ABF.LN), said that aside from the

questions over wheat, corn's progress will also add to the nervous

sentiment, with the grain only just being planted across the main

U.S. growing states.

Wheat was also the big mover on the Chicago Board of Trade as

the massive speculative short is being pushed out, but RCM Asset

Management analyst Doug Bergman said there was nothing to justify

the recent rally, despite the weather problems in Europe and the

U.S.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

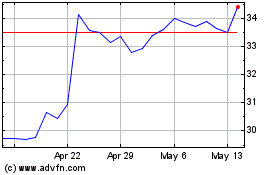

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jun 2024 to Jul 2024

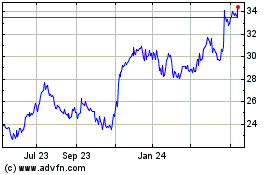

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jul 2023 to Jul 2024