UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2014

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________

to________________

Commission file number 000-51612

(Exact name of registrant as specified in its charter)

| Nevada |

68-0542002 |

| (State or other jurisdiction |

(I.R.S. Employer |

| of incorporation or organization) |

Identification No.) |

305 Camp Craft Road, Suite 525, Austin, TX

78746

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including area code

512.222.0975

Securities registered pursuant to Section 12(b) of the Act:

| None |

N/A |

| Title of each class |

Name of each exchange on which registered

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title

of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No

[X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No

[X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

| Large accelerated filer [ ] |

|

Accelerated filer [ ] |

| Non-accelerated filer [ ] |

(Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such

common equity, as of the last business day of the registrant’s most recently

completed second fiscal quarter. $2,216,014.515 based on a price of $0.045

per share, average bid and asked price, as of the last business day of

the registrant’s most recently completed second fiscal

quarter.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock, as of the latest practicable date.

54,182,267 shares of common stock as at December 16,

2014.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by

reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which

the document is incorporated: (1) Any annual report to security holders; (2) Any

proxy or information statement; and (3) Any prospectus filed pursuant to Rule

424(b) or (c) under the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g., annual report to security

holders for fiscal year ended December 24, 1980).

Not Applicable

ii

TABLE OF CONTENTS

iii

1

PART I

FORWARD LOOKING STATEMENTS.

This report contains forward-looking statements. These

statements relate to future events or our future financial performance. In some

cases, you can identify forward-looking statements by terminology such as “may”,

“should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”,

“potential” or “continue” or the negative of these terms or other comparable

terminology. These statements are only predictions and involve known and unknown

risks, uncertainties and other factors, including the risks in the section

entitled “Risk Factors”, that may cause our company’s or our industry’s actual

results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States, we do not

intend to update any of the forward-looking statements to conform these

statements to actual results.

Our audited consolidated financial statements are stated in

United States dollars and are prepared in accordance with United States

generally accepted accounting principles. The following discussion should be

read in conjunction with our audited consolidated financial statements and the

related notes that appear elsewhere in this report.

In this report, unless otherwise specified, all references to

“common shares” refer to the shares of our common stock and the terms “we”,

“us”, “our company” and “Arkanova” mean Arkanova Energy Corporation.

ITEM 1. BUSINESS.

We were incorporated in the State of Nevada on September 6,

2001 under the name Talon Ventures, Inc.

On January 15, 2003, we changed our name to Alton Ventures,

Inc. On October 20, 2006, we entered into an agreement and plan of merger with

Arkanova Acquisition Corp., our wholly-owned subsidiary, and Arkanova Energy,

Inc., a private Delaware corporation. The agreement and plan of merger

contemplated the merger of Arkanova Energy, Inc. with and into Arkanova

Acquisition Corp., with Arkanova Acquisition Corp. surviving as our wholly-owned

subsidiary. Effective November 1, 2006, we changed our name from Alton Ventures

Inc. to Arkanova Energy Corporation. The closing of the agreement and plan of

merger occurred on March 1, 2007. As of that date, we acquired all of the

property interests formerly held by Arkanova Energy, Inc.

We are a junior producing oil and gas company and are also

engaged in the acquisition, exploration and development of prospective oil and

gas properties. We hold mineral leases in Delores County, Lone Mesa State Park,

Colorado and leasehold interests located in Pondera and Glacier Counties,

Montana. Please see the information under the heading “Item 2. Properties” on

page 11 of this annual report for a detailed description of our property

interests, including disclosure of our oil and gas operations with respect to

our Montana property.

In addition to our existing property interests, we intend to

acquire additional oil and gas property interests in the future. Management

believes that future growth of our company will primarily occur through the

exploration and development of our existing properties and through the

acquisition of additional oil and gas properties following extensive due

diligence by our company. However, we may elect to proceed through collaborative

agreements and joint ventures in order to share expertise and reduce operating

costs with other experts in the oil and gas industry. We anticipate that the

analysis of new property interests will be undertaken by or under the

supervision of our management and board of directors.

2

Competition

We are a junior producing oil and gas company and are also

engaged in the acquisition of prospective oil and gas properties for exploration

and development. We compete with other junior producing companies in addition to

significantly larger companies. As we are also engaged in the exploration and

development of prospective properties, we also compete with companies for the

identification of such properties and the financing necessary to develop such

properties.

We conduct our business in an environment that is highly

competitive and unpredictable. In seeking out prospective properties, we have

encountered intense competition in all aspects of our business as we compete

directly with other development stage companies as well as established

international producing companies. Many of our competitors are national or

international companies with far greater resources, capital and access to

information than us. Accordingly, these competitors may be able to spend greater

amounts on the acquisition of prospective properties and on the exploration and

development of such properties. In addition, they may be able to afford greater

geological expertise in the exploration and exploitation of mineral and oil and

gas properties. This competition could result in our competitors having resource

properties of greater quality and attracting prospective investors to finance

the development of such properties on more favorable terms. As a result of this

competition, we may become involved in an acquisition with more risk or obtain

financing on less favorable terms.

Customers

There are no contracts obligating our company to provide a

fixed quantity of oil and gas to any party. We have a contract with CHS Inc.,

that provides for their taking all of our oil and/or condensate production from

the Unit (as defined below under Item 2. Properties beginning on page 11) unless

either party gives 30 days advance written notice to terminate the agreement. In

the event our contact with CHS Inc. is terminated for any reason, our company

has determined that there are numerous other purchasers available to enter into

a similar arrangement without a material adverse effect on our company.

Government Regulation

The exploration and development of oil and gas properties is

subject to various United States federal, state and local governmental

regulations. Our company may, from time to time, be required to obtain licenses

and permits from various governmental authorities in regards to the exploration

of our property interests.

We are a company that started to produce oil and gas during the

year ended September 30, 2008 and we are subject to a high level of governmental

regulation. Matters subject to regulation include discharge permits for drilling

operations, drilling and abandonment bonds, reports concerning operations, the

spacing of wells, and pooling of properties and taxation. From time to time,

regulatory agencies have imposed price controls and limitations on production by

restricting the rate of flow of oil and gas wells below actual production

capacity in order to conserve supplies of oil and gas. The production, handling,

storage, transportation and disposal of oil and gas, by-products thereof, and

other substances and materials produced or used in connection with oil and gas

operations are also subject to regulation under federal, state and local laws

and regulations relating primarily to the protection of human health and the

environment. Additionally, we incur expenditures related to compliance with such

laws, and may incur costs in connection with the remediation of any

environmental contamination. The requirements imposed by such laws and

regulations are frequently changed and subject to interpretation, and we are

unable to predict the ultimate cost of compliance with these requirements or

their effect on our operations.

In the spring of 2014, the US Environmental Protection Agency

issued an injection well permit to Provident Energy Of Montana, LLC, Arkanova’s

100% owned subsidiary, for the purpose of water injection into the MAX 1 well #

2817. The permit allowed our company to commence the re-activation of waterflood

operations on our company’s Montana lease acreage, The Two Medicine Cut Bank

Sand Unit. Waterflood operations have started in October 2014 and are continuing

as of the date of this report.

3

Environmental Liabilities

Our business is governed by numerous laws and regulations at

various levels of government. These laws and regulations govern the operation

and maintenance of our facilities, the discharge of materials into the

environment and other environmental protection issues. Such laws and regulations

may, among other potential consequences, require that we acquire permits before

commencing drilling and restrict the substances that can be released into the

environment with drilling and production activities. Under these laws and

regulations, we could be liable for personal injury, clean-up costs and other

environmental and property damages, as well as administrative, civil and

criminal penalties.

Employees

Our company is currently operated by Pierre Mulacek as our

president and chief executive officer and Reginald Denny as our chief financial

officer. As of the date of this report, we had 7 employees including Pierre

Mulacek and Reginald Denny. We intend to periodically hire independent

contractors to execute our exploration and development activities. Our company

may hire employees when circumstances warrant. At present, however, our company

does not anticipate hiring any additional employees in the near future.

ITEM 1A. RISK FACTORS

Much of the information included in this annual report includes

or is based upon estimates, projections or other forward looking statements.

Such forward looking statements include any projections and estimates made by us

and our management in connection with our business operations. While these

forward-looking statements, and any assumptions upon which they are based, are

made in good faith and reflect our current judgment regarding the direction of

our business, actual results will almost always vary, sometimes materially, from

any estimates, predictions, projections, assumptions or other future performance

suggested herein.

Such estimates, projections or other forward looking statements

involve various risks and uncertainties as outlined below. We caution the reader

that important factors in some cases have affected and, in the future, could

materially affect actual results and cause actual results to differ materially

from the results expressed in any such estimates, projections or other forward

looking statements.

Risks Relating to our Business and the Oil and Gas

Industry

We have a history of losses and this trend may continue and

may negatively impact our ability to achieve our business objectives.

We have experienced net losses since inception, and expect to

continue to incur substantial losses for the foreseeable future. Our accumulated

deficit was $31,070,998 as at September 30, 2014. We may not be able to generate

significant revenues in the future and our company has incurred increased

operating expenses following the recent commencement of production. As a result,

our management expects our business to continue to experience negative cash flow

for the foreseeable future and cannot predict when, if ever, our business might

become profitable. We will need to raise additional funds, and such funds may

not be available on commercially acceptable terms, if at all. If we are unable

to raise funds on acceptable terms, we may not be able to execute our business

plan, take advantage of future opportunities, or respond to competitive

pressures or unanticipated requirements. This may seriously harm our business,

financial condition and results of operations.

4

We have a relatively limited operating history, which may

hinder our ability to successfully meet our objectives.

We have a relatively limited operating history upon which to

base an evaluation of our current business and future prospects. We have

commenced production in the year ended September 30, 2008 and we do not have an

established history of operating producing properties or locating and developing

properties that have oil and gas reserves. As a result, the revenue and income

potential of our business is unproven. In addition, because of our relatively

limited operating history, we have limited insight into trends that may emerge

and affect our business. Errors may be made in predicting and reacting to

relevant business trends and we will be subject to the risks, uncertainties and

difficulties frequently encountered by early-stage companies in evolving

markets. We may not be able to successfully address any or all of these risks

and uncertainties. Failure to adequately do so could cause our business, results

of operations and financial condition to suffer.

Our operations and proposed exploration activities will

require significant capital expenditures for which we may not have sufficient

funding and if we do obtain additional financing, our existing shareholders may

suffer substantial dilution.

We intend to make capital expenditures far in excess of our

existing capital resources to develop, acquire and explore oil and gas

properties. We intend to rely on funds from operations and external sources of

financing to meet our capital requirements to continue acquiring, exploring and

developing oil and gas properties and to otherwise implement our business plan.

We plan to obtain additional funding through the debt and equity markets, but we

can offer no assurance that we will be able to obtain additional funding when it

is required or that it will be available to us on commercially acceptable terms,

if at all. In addition, any additional equity financing may involve substantial

dilution to our then existing shareholders.

The successful implementation of our business plan is

subject to risks inherent in the oil and gas business, which if not adequately

managed could result in additional losses.

Our oil and gas operations are subject to the economic risks

typically associated with exploration and development activities, including the

necessity of making significant expenditures to locate and acquire properties

and to drill exploratory wells. In addition, the availability of drilling rigs

and the cost and timing of drilling, completing and, if warranted, operating

wells is often uncertain. In conducting exploration and development activities,

the presence of unanticipated pressure or irregularities in formations,

miscalculations or accidents may cause our exploration, development and, if

warranted, production activities to be unsuccessful. This could result in a

total loss of our investment in a particular well. If exploration efforts are

unsuccessful in establishing proved reserves and exploration activities cease,

the amounts accumulated as unproved costs will be charged against earnings as

impairments.

In addition, market conditions or the unavailability of

satisfactory oil and gas transportation arrangements may hinder our access to

oil and gas markets and delay our production. The availability of a ready market

for our prospective oil and gas production depends on a number of factors,

including the demand for and supply of oil and gas and the proximity of reserves

to pipelines and other facilities. Our ability to market such production depends

in substantial part on the availability and capacity of gathering systems,

pipelines and processing facilities, in most cases owned and operated by third

parties. Our failure to obtain such services on acceptable terms could

materially harm our business. We may be required to shut in wells for lack of a

market or a significant reduction in the price of oil or gas or because of

inadequacy or unavailability of pipelines or gathering system capacity. If that

occurs, we would be unable to realize revenue from those wells until

arrangements are made to deliver such production to market.

5

Our future performance is dependent upon our ability to

identify, acquire and develop oil and gas properties, the failure of which could

result in under use of capital and losses.

Our future performance depends upon our ability to identify,

acquire and develop additional oil and gas reserves that are economically

recoverable. Our success will depend upon our ability to acquire working and

revenue interests in properties upon which oil and gas reserves are ultimately

discovered in commercial quantities, and our ability to develop prospects that

contain proven oil and gas reserves to the point of production. Without

successful acquisition and exploration activities, we will not be able to

develop additional oil and gas reserves or generate additional revenues. We

cannot provide you with any assurance that we will be able to identify and

acquire additional oil and gas reserves on acceptable terms, or that oil and gas

deposits will be discovered in sufficient quantities to enable us to recover our

exploration and development costs or sustain our business.

The successful acquisition and development of oil and gas

properties requires an assessment of recoverable reserves, future oil and gas

prices and operating costs, potential environmental and other liabilities, and

other factors. Such assessments are necessarily inexact and their accuracy

inherently uncertain. In addition, no assurance can be given that our

exploration and development activities will result in the discovery of

additional reserves. Our operations may be curtailed, delayed or canceled as a

result of lack of adequate capital and other factors, such as lack of

availability of rigs and other equipment, title problems, weather, compliance

with governmental regulations or price controls, mechanical difficulties, or

unusual or unexpected formations, pressures and or work interruptions. In

addition, the costs of exploitation and development may materially exceed our

initial estimates.

We have a very small management team and the loss of any

member of our team may prevent us from implementing our business plan in a

timely manner.

We have two executive officers and a limited number of

additional consultants upon whom our success largely depends. We maintain a key

person life insurance policy on our president and CEO, but not on anyone else,

nor any consultants, the loss of which could seriously harm our business,

financial condition and results of operations. In such an event, we may not be

able to recruit personnel to replace our executive officers or consultants in a

timely manner, or at all, on acceptable terms.

Future growth could strain our personnel and infrastructure

resources, and if we are unable to implement appropriate controls and procedures

to manage our growth, we may not be able to successfully implement our business

plan.

We expect to experience growth in our operations, which will

place a significant strain on our management, administrative, operational and

financial infrastructure. Our future success will depend in part upon the

ability of our management to manage growth effectively. This may require us to

hire and train additional personnel to manage our expanding operations. In

addition, we must continue to improve our operational, financial and management

controls and our reporting systems and procedures. If we fail to successfully

manage our growth, we may be unable to execute upon our business plan.

Market conditions or operation impediments may hinder our

access to natural gas and oil markets or delay our production.

The marketability of production from our properties depends in

part upon the availability, proximity and capacity of pipelines, natural gas

gathering systems and processing facilities. This dependence is heightened where

this infrastructure is less developed. Therefore, if drilling results are

positive in certain areas of our oil and gas properties, a new gathering system

would need to be built to handle the potential volume of oil and gas produced.

We might be required to shut in wells, at least temporarily, for lack of a

market or because of the inadequacy or unavailability of transportation

facilities. If that were to occur, we would be unable to realize revenue from

those wells until arrangements were made to deliver production to market.

Our ability to produce and market natural gas and oil is

affected and also may be harmed by:

- the lack of pipeline transmission facilities or carrying capacity;

6

- government regulation of natural gas and oil production;

- government transportation, tax and energy policies;

- changes in supply and demand; and

- general economic conditions.

We might incur additional debt in order to fund our

exploration and development activities, which would continue to reduce our

financial flexibility and could have a material adverse effect on our business,

financial condition or results of operations.

When we incur indebtedness, the ability to meet our debt

obligations and reduce our level of indebtedness depends on future performance.

General economic conditions, oil and gas prices and financial, business and

other factors affect our operations and future performance. Many of these

factors are beyond our control. We cannot assure you that we will be able to

generate sufficient cash flow to pay the interest on our current or future debt

or that future working capital, borrowings or equity financing will be available

to pay or refinance such debt. Factors that will affect our ability to raise

cash through an offering of our capital stock or a refinancing of our debt

include financial market conditions, the value of our assets and performance at

the time we need capital. We cannot assure you that we will have sufficient

funds to make such payments. If we do not have sufficient funds and are

otherwise unable to negotiate renewals of our borrowings or arrange new

financing, we might have to sell significant assets. Any such sale could have a

material adverse effect on our business and financial results.

Our properties in Colorado and Montana and/or future

properties might not produce, and we might not be able to determine reserve

potential, identify liabilities associated with the properties or obtain

protection from sellers against them, which could cause us to incur

losses.

Although we have reviewed and evaluated our properties in

Colorado and Montana in a manner consistent with industry practices, such review

and evaluation might not necessarily reveal all existing or potential

liabilities. This is also true for any future acquisitions made by us.

Inspections may not always be performed on every well, and environmental

problems, such as groundwater contamination, are not necessarily observable even

when an inspection is undertaken. Even when problems are identified, a seller

may be unwilling or unable to provide effective contractual protection against

all or part of those problems, and we may assume environmental and other risks

and liabilities in connection with the acquired properties.

If we or our operators fail to maintain adequate insurance,

our business could be materially and adversely affected.

Our operations are subject to risks inherent in the oil and gas

industry, such as blowouts, cratering, explosions, uncontrollable flows of oil,

gas or well fluids, fires, pollution, earthquakes and other environmental risks.

These risks could result in substantial losses due to injury and loss of life,

severe damage to and destruction of property and equipment, pollution and other

environmental damage, and suspension of operations. We could be liable for

environmental damages caused by previous property owners. As a result,

substantial liabilities to third parties or governmental entities may be

incurred, the payment of which could have a material adverse effect on our

financial condition and results of operations.

Any prospective drilling contractor or operator which we hire

will be required to maintain insurance of various types to cover our operations

with policy limits and retention liability customary in the industry. We also

have acquired our own insurance coverage for such prospects. The occurrence of a

significant adverse event on such prospects that is not fully covered by

insurance could result in the loss of all or part of our investment in a

particular prospect which could have a material adverse effect on our financial

condition and results of operations.

7

The oil and gas industry is highly competitive, and we may

not have sufficient resources to compete effectively.

The oil and gas industry is highly competitive. We compete with

oil and natural gas companies and other individual producers and operators, many

of which have longer operating histories and substantially greater financial and

other resources than we do, as well as companies in other industries supplying

energy, fuel and other needs to consumers. Our larger competitors, by reason of

their size and relative financial strength, can more easily access capital

markets than we can and may enjoy a competitive advantage in the recruitment of

qualified personnel. They may be able to absorb the burden of any changes in

laws and regulation in the jurisdictions in which we do business and handle

longer periods of reduced prices for oil and gas more easily than we can. Our

competitors may be able to pay more for oil and gas leases and properties and

may be able to define, evaluate, bid for and purchase a greater number of leases

and properties than we can. Further, these companies may enjoy technological

advantages and may be able to implement new technologies more rapidly than we

can. Our ability to acquire additional properties in the future will depend upon

our ability to conduct efficient operations, evaluate and select suitable

properties, implement advanced technologies and consummate transactions in a

highly competitive environment.

Complying with environmental and other government

regulations could be costly and could negatively impact our production.

Our business is governed by numerous laws and regulations at

various levels of government. These laws and regulations govern the operation

and maintenance of our facilities, the discharge of materials into the

environment and other environmental protection issues. Such laws and regulations

may, among other potential consequences, require that we acquire permits before

commencing drilling and restrict the substances that can be released into the

environment with drilling and production activities.

Under these laws and regulations, we could be liable for

personal injury, clean-up costs and other environmental and property damages, as

well as administrative, civil and criminal penalties. Prior to commencement of

drilling operations, we may secure limited insurance coverage for sudden and

accidental environmental damages as well as environmental damage that occurs

over time. However, we do not believe that insurance coverage for the full

potential liability of environmental damages is available at a reasonable cost.

Accordingly, we could be liable, or could be required to cease production on

properties, if environmental damage occurs.

The costs of complying with environmental laws and regulations

in the future may harm our business. Furthermore, future changes in

environmental laws and regulations could result in stricter standards and

enforcement, larger fines and liability, and increased capital expenditures and

operating costs, any of which could have a material adverse effect on our

financial condition or results of operations.

Shortages of rigs, equipment, supplies and personnel could

delay or otherwise adversely affect our cost of operations or our ability to

operate according to our business plans.

If drilling activity increases in Colorado, Montana or the

southern United States generally, a shortage of drilling and completion rigs,

field equipment and qualified personnel could develop. The demand for and wage

rates of qualified drilling rig crews generally rise in response to the

increasing number of active rigs in service and could increase sharply in the

event of a shortage. Shortages of drilling and completion rigs, field equipment

or qualified personnel could delay, restrict or curtail our exploration and

development operations, which could in turn harm our operating results.

We will be required to replace, maintain or expand our

reserves in order to prevent our reserves and production from declining, which

would adversely affect cash flows and income.

In general, production from natural gas and oil properties

declines over time as reserves are depleted, with the rate of decline depending

on reservoir characteristics. If we are not successful in our exploration and

development activities, our proved reserves will decline as reserves are

produced. Our future natural gas and oil production is highly dependent upon our

ability to economically find, develop or acquire reserves in commercial

quantities.

8

To the extent cash flow from operations is reduced, either by a

decrease in prevailing prices for natural gas and oil or an increase in

exploration and development costs, and external sources of capital become

limited or unavailable, our ability to make the necessary capital investment to

maintain or expand our asset base of natural gas and oil reserves would be

impaired. Even with sufficient available capital, our future exploration and

development activities may not result in additional proved reserves, and we

might not be able to drill productive wells at acceptable costs.

The geographic concentration of all of our other properties

in Colorado and Montana subjects us to an increased risk of loss of revenue or

curtailment of production from factors affecting those areas.

The geographic concentration of all of our leasehold interests

in Lone Mesa State Park, Colorado and Pondera and Glacier Counties, Montana

means that our properties could be affected by the same event should the region

experience:

- severe weather;

- delays or decreases in production, the availability of equipment,

facilities or services;

- delays or decreases in the availability of capacity to transport, gather

or process production; or

- changes in the regulatory environment.

The oil and gas exploration and production industry

historically is a cyclical industry and market fluctuations in the prices of oil

and gas could adversely affect our business.

Prices for oil and gas tend to fluctuate significantly in

response to factors beyond our control. These factors include:

- weather conditions in the United States and wherever our property

interests are located;

- economic conditions, including demand for petroleum-based products, in the

United States wherever our property interests are located;

- actions by OPEC, the Organization of Petroleum Exporting Countries;

- political instability in the Middle East and other major oil and gas

producing regions;

- governmental regulations, both domestic and foreign;

- domestic and foreign tax policy;

- the pace adopted by foreign governments for the exploration, development,

and production of their national reserves;

- the price of foreign imports of oil and gas;

- the cost of exploring for, producing and delivering oil and gas;

- the discovery rate of new oil and gas reserves;

- the rate of decline of existing and new oil and gas reserves;

- available pipeline and other oil and gas transportation capacity;

- the ability of oil and gas companies to raise capital;

- the overall supply and demand for oil and gas; and

- the availability of alternate fuel sources.

Changes in commodity prices may significantly affect our

capital resources, liquidity and expected operating results. Price changes will

directly affect revenues and can indirectly impact expected production by

changing the amount of funds available to reinvest in exploration and

development activities. Reductions in oil and gas prices not only reduce

revenues and profits, but could also reduce the quantities of reserves that are

commercially recoverable. Significant declines in prices could result in

non-cash charges to earnings due to impairment.

Changes in commodity prices may also significantly affect our

ability to estimate the value of producing properties for acquisition and

divestiture and often cause disruption in the market for oil and gas producing

properties, as buyers and sellers have difficulty agreeing on the value of the

properties. Price volatility also makes it difficult to budget for and project

the return on acquisitions and the exploration and development of projects. We

expect that commodity prices will continue to fluctuate significantly in the

future.

9

Our ability to produce oil and gas from our properties may

be adversely affected by a number of factors outside of our control which may

result in a material adverse effect on our business, financial condition or

results of operations.

The business of exploring for and producing oil and gas

involves a substantial risk of investment loss. Drilling oil and gas wells

involves the risk that the wells may be unproductive or that, although

productive, the wells may not produce oil or gas in economic quantities. Other

hazards, such as unusual or unexpected geological formations, pressures, fires,

blowouts, loss of circulation of drilling fluids or other conditions may

substantially delay or prevent completion of any well. Adverse weather

conditions can also hinder drilling operations. A productive well may become

uneconomic if water or other deleterious substances are encountered that impair

or prevent the production of oil or gas from the well. In addition, production

from any well may be unmarketable if it is impregnated with water or other

deleterious substances. There can be no assurance that oil and gas will be

produced from the properties in which we have interests. In addition, the

marketability of oil and gas that may be acquired or discovered may be

influenced by numerous factors beyond our control. These factors include the

proximity and capacity of oil and gas, gathering systems, pipelines and

processing equipment, market fluctuations in oil and gas prices, taxes,

royalties, land tenure, allowable production and environmental protection. We

cannot predict how these factors may affect our business.

We may be unable to retain our leases and working interests

in our leases, which would result in significant financial losses to our

company.

Our properties are held under oil and gas leases. If we fail to

meet the specific requirements of each lease, such lease may terminate or

expire. We cannot assure you that any of the obligations required to maintain

each lease will be met. The termination or expiration of our leases may harm our

business. Our property interests will terminate unless we fulfill certain

obligations under the terms of our leases and other agreements related to such

properties. If we are unable to satisfy these conditions on a timely basis, we

may lose our rights in these properties. The termination of our interests in

these properties may harm our business. In addition, we will need significant

funds to meet capital requirements for the exploration activities that we intend

to conduct on our properties.

Title deficiencies could render our leases worthless which

could have adverse effects on our financial condition or results of operations.

The existence of a material title deficiency can render a lease

worthless and can result in a large expense to our business. It is our practice

in acquiring oil and gas leases or undivided interests in oil and gas leases to

forego the expense of retaining lawyers to examine the title to the oil or gas

interest to be placed under lease or already placed under lease. Instead, we

rely upon the judgment of oil and gas landmen who perform the field work in

examining records in the appropriate governmental office before attempting to

place under lease a specific oil or gas interest. This is customary practice in

the oil and gas industry. However, we do not anticipate that we, or the person

or company acting as operator of the wells located on the properties that we

currently lease or may lease in the future, will obtain counsel to examine title

to the lease until the well is about to be drilled. As a result, we may be

unaware of deficiencies in the marketability of the title to the lease. Such

deficiencies may render the lease worthless.

Our disclosure controls and procedures and internal control

over financial reporting were not effective, which may cause our financial

reporting to be unreliable and lead to misinformation being disseminated to the

public.

Our management evaluated our disclosure controls and procedures

as of September 30, 2014 and concluded that as of that date, our disclosure

controls and procedures were not effective. In addition, our management

evaluated our internal control over financial reporting as of September 30, 2014

and concluded that that there were material weaknesses in our internal control

over financial reporting as of that date and that our internal control over

financial reporting was not effective as of that date. A material weakness is a

control deficiency, or combination of control deficiencies, such that there is a

reasonable possibility that a material misstatement of the financial statements

will not be prevented or detected on a timely basis.

10

We have not yet remediated this material weakness and we

believe that our disclosure controls and procedures and internal control over

financial reporting continue to be ineffective. Until these issues are

corrected, our ability to report financial results or other information required

to be disclosed on a timely and accurate basis may be adversely affected and our

financial reporting may continue to be unreliable, which could result in

additional misinformation being disseminated to the public. Investors relying

upon this misinformation may make an uninformed investment decision.

Risks Relating To Our Common Stock

A decline in the price of our common stock could affect our

ability to raise further working capital and adversely impact our ability to

continue operations.

A prolonged decline in the price of our common stock could

result in a reduction in the liquidity of our common stock and a reduction in

our ability to raise capital. Because a significant portion of our operations

have been and will be financed through the sale of equity securities, a decline

in the price of our common stock could be especially detrimental to our

liquidity and our operations. Such reductions may force us to reallocate funds

from other planned uses and may have a significant negative effect on our

business plan and operations, including our ability to develop new properties

and continue our current operations. If our stock price declines, we can offer

no assurance that we will be able to raise additional capital or generate funds

from operations sufficient to meet our obligations. If we are unable to raise

sufficient capital in the future, we may not be able to have the resources to

continue our normal operations.

The market price for our common stock may also be affected by

our ability to meet or exceed expectations of analysts or investors. Any failure

to meet these expectations, even if minor, may have a material adverse effect on

the market price of our common stock.

If we issue additional shares in the future, it will result

in the dilution of our existing shareholders.

Our articles of incorporation, as amended, authorizes the

issuance of up to 1,000,000,000 shares of common stock with a par value of

$0.001. Our board of directors may choose to issue some or all of such shares to

acquire one or more businesses or to provide additional financing in the future.

The issuance of any such shares will result in a reduction of the book value and

market price of the outstanding shares of our common stock. If we issue any such

additional shares, such issuance will cause a reduction in the proportionate

ownership and voting power of all current shareholders. Further, such issuance

may result in a change of control of our corporation.

Trading of our stock may be restricted by the Securities

Exchange Commission’s penny stock regulations, which may limit a stockholder’s

ability to buy and sell our stock.

The Securities and Exchange Commission has adopted regulations

which generally define “penny stock” to be any equity security that has a market

price (as defined) less than $5.00 per share or an exercise price of less than

$5.00 per share, subject to certain exceptions. Our securities are covered by

the penny stock rules, which impose additional sales practice requirements on

broker-dealers who sell to persons other than established customers and

“accredited investors”. The term “accredited investor” refers generally to

institutions with assets in excess of $5,000,000 or individuals with a net worth

in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouse. The penny stock rules require a broker-dealer, prior to a

transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form prepared by the Securities and

Exchange Commission, which provides information about penny stocks and the

nature and level of risks in the penny stock market. The broker-dealer also must

provide the customer with current bid and offer quotations for the penny stock,

the compensation of the broker-dealer and its salesperson in the transaction and

monthly account statements showing the market value of each penny stock held in

the customer’s account. The bid and offer quotations, and the broker-dealer and

salesperson compensation information, must be given to the customer orally or in

writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer’s confirmation. In addition, the penny stock

rules require that prior to a transaction in a penny stock not otherwise exempt

from these rules, the broker-dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the

purchaser’s written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in the secondary

market for the

11

stock that is subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest

in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority, or FINRA, has

adopted sales practice requirements which may also limit a stockholder’s ability

to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA

has adopted rules that require that in recommending an investment to a customer,

a broker-dealer must have reasonable grounds for believing that the investment

is suitable for that customer. Prior to recommending speculative low priced

securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status,

tax status, investment objectives and other information. Under interpretations

of these rules, FINRA believes that there is a high probability that speculative

low priced securities will not be suitable for at least some customers. FINRA

requirements make it more difficult for broker-dealers to recommend that their

customers buy our common stock, which may limit your ability to buy and sell our

stock and have an adverse effect on the market for our shares.

Our common stock is illiquid and the price of our common

stock may be negatively impacted by factors which are unrelated to our

operations.

Our common stock currently trades on a limited basis on OTCQB

operated by the OTC Markets Group. Trading of our stock through OTCQB is

frequently thin and highly volatile. There is no assurance that a sufficient

market will develop in our stock, in which case it could be difficult for

shareholders to sell their stock. The market price of our common stock could

fluctuate substantially due to a variety of factors, including market perception

of our ability to achieve our planned growth, quarterly operating results of our

competitors, trading volume in our common stock, changes in general conditions

in the economy and the financial markets or other developments affecting our

competitors or us. In addition, the stock market is subject to extreme price and

volume fluctuations. This volatility has had a significant effect on the market

price of securities issued by many companies for reasons unrelated to their

operating performance and could have the same effect on our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

Executive Offices

Our executive and head office is located at 305 Camp Craft

Road, Suite 525, Austin, TX 78746. We lease the office on a month-to-month basis

at a cost of $4,960.26 per month. Our current premises are adequate for our

current operations and we do not anticipate that we will require any additional

premises in the foreseeable future.

We currently hold property interests in three counties in the

United States, which include one county in the State of Colorado and two

counties in the State of Montana as summarized below.

Montana Properties

On August 21, 2008, our wholly-owned subsidiary, Arkanova

Acquisition Corporation, entered into a stock purchase agreement with Billie J.

Eustice and the Gary L. Little Trust to acquire all of the issued and

outstanding capital stock of Prism Corporation, an Oklahoma corporation, for a

purchase price of $6,000,000.

Following the closing, we acquired all of the membership

interests of Provident Energy of Montana, LLC (formerly known as Provident

Energy Associates of Montana, LLC), which holds all of the leasehold interests

comprising the Two Medicine Cut Bank Sand Unit in Pondera and Glacier Counties

(the “Unit”), Montana, and the equipment, parts, machinery, fixtures and

improvements located on, or used in connection with, the Unit. The Unit covers

approximately 9,900 acres and is located at the far southern end of the Cut Bank

Field and is part of the Blackfeet

12

Indian Reservation. Since the establishment of the Unit in

1959, there have been 82 wells drilled on the Unit and there are currently 36

wells producing oil from the Unit. Of the 82 wells, 7 have been plugged and

abandoned. Ownership of these leasehold interests granted us the right to

develop and produce all of the oil and gas reserves under the Unit.

The funds used to make the acquisition were provided by an

unaffiliated lender and, as part of the loan transaction, our subsidiary pledged

the shares of Prism it acquired to secure the loan. The terms of the $9,000,000

loan stated that the proceeds were to be used for the acquisition of the Unit,

the oil and gas leases comprising same, the fixtures and equipment therewith,

all the capital stock of Prism Corporation and for general working capital

purposes.

On April 9, 2010, our subsidiary, Provident Energy of Montana

LLC, entered into a Purchase and Sale Agreement with Knightwall Invest, Inc.

Pursuant to the agreement, Provident Energy agreed to sell to Knightwall Invest

30% of the leasehold working interests comprising the Unit and the equipment,

parts, machinery, fixtures and improvements located on, or used in connection

with, the Unit, for a purchase price of $7,000,000. The closing of the purchase

and sale, which was subject to the payment in full of all instalments of the

purchase price and other conditions of closing, was scheduled to occur on August

6, 2010 but was delayed because of delayed drilling commitments. The final

closing took place on November 23, 2010 with the final payment of $1,500,000

being received. Knightwall Invest was a lender to our company and it had an

outstanding loan to our company of $330,000 in principal amount bearing interest

at the rate of 10% per annum and due and payable by our company on July 8, 2010,

plus interest of $33,000. The total amount due ($367,077.53, which included

accrued interest to the date of payment) was paid in full from the portion of

the purchase price paid by Knightwall Invest on August 3, 2010.

The purchase price was payable in instalments, with the initial

payment of $1,500,000 paid on April 8, 2010, a second payment of $2,000,000 was

paid on July 8, 2010, a third payment of $2,000,000 ($367,077.53 of which

Knightwall Invest applied to the payment in full of its loan to our company)

being due on July 8, 2010 and paid on August 3, 2010, and the remaining final

$1,500,000 being paid on November 23, 2010.

On November 22, 2010, Provident entered into an option

agreement with Knightwall Invest pursuant to which Provident Energy granted an

option to Knightwall Invest to purchase an additional 5% working interest in the

Unit. On March 15, 2011, Knightwall Invest exercised the option and paid

$1,500,000 to Provident on April 5, 2011. The proceeds of $1,500,000 were

applied against the full cost pool resulting in a gain on sale of oil and gas

properties in the amount of $1,438,396. Knightwall Invest currently holds a 35%

working interest in the Unit.

On October 21, 2011, our subsidiary entered into a Conversion

and Loan Modification Agreement and a Note Purchase Agreement with Aton Select

Funds Limited which were effective as of October 1, 2011, and pursuant to which

Aton agreed to, among other things, convert $6,000,000.00 of the remaining

principal balance of a Promissory Note that our subsidiary issued to Aton on

October 1, 2009 into a 10% working interest in the Unit. Please see Item 7 –

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Liquidity and Capital Resources – Outstanding Promissory Notes”

beginning on page 20 for additional information.

Reserves

The following estimates of proved reserve and proved developed

reserve quantities and related standardized measure of discounted net cash flow

are estimates only, and do not purport to reflect realizable values or fair

market values of our company’s reserves. We emphasize that reserve estimates are

inherently imprecise and that estimates of new discoveries are more imprecise

than those of producing oil and gas properties. Accordingly, these estimates are

expected to change as future information becomes available.

Future cash flows are computed by applying prices of oil which

are based on the respective 12-month unweighted average of the first of the

month prices to period end quantities of proved oil reserves. The 12-month

unweighted average of the first of the month market prices used for the

standardized measures below was $77.69 and $78.77/barrel for liquids for

September 30, 2014 and 2013, respectively. Future operating expenses and

development costs are computed primarily by our company’s petroleum engineers by

estimating the expenditures to be incurred in developing and producing our

company’s proved natural gas and oil reserves at the end of the period, based on

period end costs and assuming continuation of existing economic conditions.

13

Future income taxes are based on period end statutory rates,

adjusted for tax basis and applicable tax credits. A discount factor of 10% was

used to reflect the timing of future net cash flows. The standardized measure of

discounted future net cash flows is not intended to represent the replacement

cost of fair value of our company’s natural gas and oil properties. An estimate

of fair value would also take into account, among other things, the recovery of

reserves not presently classified as proved, anticipated future changes in

prices and costs, and a discount factor more representative of the time value of

money and the risks inherent in reserve estimate of natural gas and oil

producing operations.

A November 25, 2013 report of Gustavson Associates prepared on

our Montana Properties was attached as an exhibit to our annual report on Form

10-K filed on December 24, 2013. An updated report of Gustavson Associates dated

November 18, 2014 was attached as an exhibit to our annual report on Form 10-K

filed on December xx, 2014.

Proved Oil and Gas Reserve Quantities

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

| |

|

Oil |

|

|

Oil |

|

| |

|

(Mbbl)* |

|

|

(Mbbl)* |

|

| |

|

|

|

|

|

|

| Balance beginning of the year |

|

38,170 |

|

|

87,678 |

|

| Revisions of previous estimates |

|

4,685 |

|

|

(39,726 |

) |

| Production |

|

(9,765 |

) |

|

(9,782 |

) |

| Transfer of oil

and gas interest |

|

– |

|

|

- |

|

| |

|

|

|

|

|

|

| Balance end of the

year |

|

33,090 |

|

|

38,170 |

|

*Thousand barrels

Standardized Measure of Discounted Future Net Cash

Flow

| |

|

September 30, 2014 |

|

| |

|

|

|

| Future cash inflows |

$ |

2,570,759 |

|

| Future production and development costs |

|

(1,437,698 |

) |

| Future income tax expenses |

|

(396,571 |

) |

| Future net cash flows |

|

736,490 |

|

| |

|

|

|

| 10% annual

discount for estimated timing of cash flows |

|

(153,925 |

) |

| |

|

|

|

| Standardized

measure of discounted future net cash flows |

$ |

582,565 |

|

Production

During the year ended September 30, 2014, the average net sales

price per barrel of oil received by contract was $77.82/barrel. The average net

production cost was $80.08 per barrel. The high cost of production was due to

upgrading flow lines, facilities, batteries, and well bores as the property was

not maintained for several years.

We are currently producing approximately 1,400 to 2,600 barrels

per month and intend to eventually increase this production to over 3,000

barrels per month.

Productive Wells and Acreage

As of September 30, 2014, there were 75 net oil wells on the

lease of which 36 are now oil producing. This has increased from 12 wells that

were producing in October 2008 at the time we acquired the property interests.

14

Undeveloped Acreage

All of the 9,900 acres on the Unit are considered to be

developed and developmental acreage. Provident Energy has worked with

Schlumberger to develop infield vertical and horizontal drilling locations. We

believe that the property has 80 acre spacing with the potential for 40 acre to

20 acre spacing allowing for a minimum of 80 infield drilling locations. We

believe that the property also has the potential for 30 Bakken type horizontal

wells based on 320 acre spacing.

Drilling Activity

On August 12, 2011, we announced that Provident Energy of

Montana, LLC finished the completion of the six stage perf and frac of the

Tribal-Max 1-2817; the first horizontal well drilled in the Cut Bank Sand

formation. In addition the company also recompleted three existing vertical

wells within the Two Medicine Cut Bank Sand Unit (TMCBSU).

The Tribal-Max 1-2817 as of the date of this report was still

flowing back at a high rate and pressure. Completion of the Tribal-Max 1-2817

included a six stage frac consisting of approximately 12,410 barrels of

stimulation fluid and 474,981 pounds of sand. Three other wells within the field

were also stimulated, achieving near to or exceeded design parameters.

Present Activities

As of the date of this report, we are continuing our efforts to

bring more producing wells on line through recompletion and reactivation of

existing wells to more than 36 in 2014. In the spring of 2014, the Environmental

Protection Agency issued an injection well permit to Provident Energy Of

Montana, LLC, Arkanova’s 100% owned subsidiary, for the purpose of water

injection into the MAX 1 well # 2817. The permit will now allow our company to

commence the re-activation of waterflood operations on our company’s Montana

lease acreage, The Two Medicine Cut Bank Sand Unit (TMCBSU), for the purpose of

attempting to increase oil production from our lease wells. We have proceeded

with the installation of new equipment at the injection plant, replacing

injection lines, and associated equipment for the waterflood project.

The budgeted amount is $3 million for the waterflood

re-activation. The financing and support are now in place to accomplish our

goals of increasing anticipated oil production and value to the shareholders.

Provident has a 55% working interest of approximately 80% net revenue interest

in approximately 9,900 acres in Pondera and Glacier Counties, Montana, the

TMCBSU. It is the hope of our company that this pilot project will be successful

and lead to the expansion of injection to the balance of the lease acreage.

In the third quarter of 2015, we plan to drill a second Bakken

test well in Pondera County near the southern end of our existing TMCBSU lease.

This vertical well is for testing the Bakken intervals so to correlate with the

geology learned from the MAX 1 well # 2817.

Delivery Commitments

There are no contracts obligating our company to provide a

fixed quantity of oil and gas to any party. We have a contract with CHS Inc.,

that provides for their taking all of our oil and/or condensate production from

the unit unless either party gives 30 days advance written notice to terminate

the agreement.

15

Internal Controls Over Reserves Estimates

Estimates of proved reserves at September 30, 2014, 2013 and

2012 were prepared by Gustavson Associates, LLC, our independent consulting

petroleum engineers. The technical persons responsible for preparing the reserve

estimates are independent petroleum engineers, geologists, economists, and

appraisers and prepared the estimate of reserves in accordance with the US

Securities and Exchange Commission’s definitions and guidelines. Gustavson

Associates, LLC, holds neither direct nor indirect financial interest in the

subject properties, in Provident Energy of Montana, LLC, or in any other

affiliated companies. Our independent engineering firm reports jointly to the

board of directors and to our President and Chief Executive Officer, Pierre

Mulacek. For information regarding the experience and qualifications of the

members of our board of directors and our President, please see Item 10 -

“Directors, Executive Officers and Corporate Governance” beginning on page 47.

Colorado Property

Effective February 15, 2008, Arkanova Acquisition Corporation,

our wholly-owned subsidiary leased a total of 1,320 gross mineral acres in

Delores County, Colorado from The Curtis Jones Family Trust, Vera Lee Redd

Family Trust and Redd Royalties Ltd. for an aggregate price of $93,500. The

initial term of the leases is for seven years, and continues thereafter so long

as oil or gas is being produced from the lease areas in paying quantities. We

anticipate we will have a 100% working interest in the property and an

approximate combined net royalty of 83.25%, with the remaining royalty interest

to the lessors. In connection with the acquisition of the lease from The Curtis

Jones Family Trust, we agreed to pay a third-party a 3.5% overriding royalty on

220 net mineral acres. The exploration targets on this prospect include a series

of fractured black shales of the Pennsylvanian age Paradox Formation with

drilling depths of 8,000 feet to 9,500 feet. The target intervals were already

encountered in a well located on the leasehold, which was drilled for deeper oil

targets and then was plugged in a time when gas was uneconomic due to price. In

the 100 foot thick main target interval, the gas show while drilling was

reported to be 14,000 units of C1 (28,000+ units by chromatograph) and pressure

was calculated at approximately 4,600 psi. We plan to request permission from

the State of Colorado to re-enter and complete this bypassed gas pay when

natural gas prices become economical to do so. Gas prices at current levels do

not warrant the re-newing of these leases and we may decide to let them expire

in 2015.

Undeveloped Acreage

We do not have any undeveloped acreage and are not planning to

purchase any.

Drilling Activity

There has not been any drilling activity on the leases in the

last three years and we do not plan to drill any wells in 2014.

Prior Arkansas Properties

Pursuant to the terms of an oil and gas lease acquisition and

development agreement dated July 24, 2006, we acquired leases of mineral rights

in approximately 50,000 acres of prospective oil and gas lands located in

Phillips and Monroe Counties, Arkansas.

The Arkansas well, the DB Griffin #1-33, was drilled to a total

depth of 7,732 feet on November 29, 2007. It was evaluated and the decision was

made to plug and abandon the well in May 2011.

Under the terms of the acquisition and development agreement,

we were obligated to pay approximately an additional $5,600,000 to acquire the

remainder of the acreage which we had committed to acquire, unless we elected to

pay a majority of the costs with shares of our common stock at $1.25 per share.

In addition, we were required to drill five additional wells within 24 months,

from the date upon which we would have made the last of the lease bonus payments

as required in the agreement. These wells were never drilled. We do not

anticipate paying the final lease payment. It is the opinion of management that

any and all obligations have expired with respect to these leases due to

non-performance.

16

Management chose not to re-negotiate the expired Arkansas

leases because of the costs of exploration and development in undeveloped

acreage, natural gas prices being uneconomical, the depth of the possible play

and any funding could be better utilized in our producing area of Montana.

ITEM 3. LEGAL PROCEEDINGS.

We know of no material, active or pending legal proceedings

against our company, nor are we involved as a plaintiff in any material

proceeding or pending litigation. There are no proceedings in which any of our

directors, officers or affiliates, or any registered or beneficial shareholder,

is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

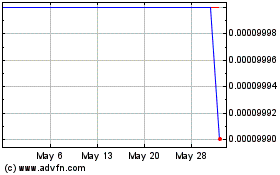

Our common stock trades on OTCQB operated by the OTC Markets

Group under the symbol “AKVA”.

The following quotations obtained from the OTCQB reflect the

high and low bids for our common stock based on inter-dealer prices, without

retail mark-up, mark-down or commission an may not represent actual

transactions. The high and low bid prices of our common stock for the periods

indicated below are as follows:

| Quarter Ended |

High |

Low |

| September 30, 2014 |

$0.045 |

$0.025 |

| June 30, 2014 |

$0.045 |

$0.18 |

| March 31, 2014 |

$0.04 |

$0.04 |

| December 31, 2013 |

$0.055 |

$0.025 |

| September 30, 2014 |

$0.03 |

$0.02 |

| June 30, 2013 |

$0.03 |

$0.0155 |

| March 31, 2013 |

$0.0425 |

$0.0155 |

| December 31, 2012 |

$0.03 |

$0.009

|

On December 16, 2014, the closing price of our common stock as

reported by OTCQB was $0.016.

Our transfer agent and registrar for our common stock is

Pacific Stock Transfer Company, located at 4045 South Spencer Street, Suite 403,

Las Vegas, NV 89119, Tel: (702) 361-3033, Fax: (702) 433-1979, E-mail:

info@pacificstocktransfer.com.

Holders

On December 16, 2014, there were approximately 108 registered

shareholders of our common stock and 54,182,267 common shares issued and

outstanding.

Dividends

We have not declared or paid any cash dividends since

inception. Although there are no restrictions that limit our ability to pay

dividends on our common shares, we intend to retain future earnings, if any, for

use in the operation and expansion of our business and do not intend to pay any

cash dividends in the foreseeable future.

17

Securities authorized for issuance under equity compensation

plans

On April 25, 2007, our compensation committee and board of

directors adopted a stock option plan named the 2007 Stock Option Plan, the

purpose of which is to attract and retain the best available personnel and to

provide incentives to employees, officers, directors and consultants, all in an

effort to promote the success of our company. The 2007 Stock Option Plan

initially authorized our company to issue 2,500,000 shares of common stock. On

November 14, 2008, we amended the 2007 Stock Option Plan, renamed the plan the

2008 Amended Stock Option Plan and increased the number of shares available for

issuance from 2,500,000 to 5,000,000.

The following table provides a summary of the number of stock

options granted under the 2008 Amended Stock Option Plan, the weighted average

exercise price and the number of stock options remaining available for issuance

under the 2008 Amended Stock Option Plan, all as at September 30, 2014:

|

Number of securities

to be

issued upon

exercise of

outstanding options |

Weighted-Average

exercise price of

outstanding options |

Number of securities

remaining

available

for future issuance

under equity

compensation plan |

Equity compensation plans not

approved by security

holders |

4,800,000

|

$0.10

|

200,000

|

Equity compensation plans approved

by security holders

|

Nil

|

Nil

|

Nil

|

Re-pricing of Stock Options

On November 15, 2013, we re-priced 3,200,000 stock options

granted to directors, officers, employees and consultants to $0.10 and extended

the expiry dates of the stock options as noted below:

Name |

Position |

Date of Grant |

No. of

Options |

Original

Exercise Price |

Original

Expiry Date |

New Expiry Date |

Reginald

Denny |

Director &

Officer |

November 19,

2008 |

100,000

|

$0.12

|

November 19,

2013 |

September 30,

2018 |

Reginald

Denny |

Director &

Officer |

October 14,

2009 |

350,000

|

$0.20

|

October 14,

2014 |

December 31,

2018 |

Burdette

Taylor |

Employee

|

October 14,

2009 |

100,000

|

$0.20

|

October 14,

2014 |

December 31,

2018 |

Pierre

Mulacek |

Director &

Officer |

October 14,

2009 |

600,000

|

$0.20

|

October 14,

2014 |

December 31,

2018 |

Erich Hofer

|

Director &

Officer |

October 14,

2009 |

300,000

|

$0.20

|

October 14,

2014 |

December 31,

2018 |

Tommy

Overstreet |

Employee

|

August 1, 2010

|

100,000

|

$0.24

|

August 1, 2015

|

December 31,

2018 |

Pierre

Mulacek |

Director &

Officer |

October 8,

2010 |

650,000

|

$0.25

|

October 8, 2015

|

December 31,

2018 |

Reginald

Denny |

Director &

Officer |

October 8,

2010 |

550,000

|

$0.25

|

October 8, 2015

|

December 31,

2018 |

Erich Hofer

|

Director &

Officer |

October 8,

2010 |

300,000

|

$0.25

|

October 8, 2015

|

December 31,

2018 |

Burdette

Taylor |

Employee

|

October 8,

2010 |

150,000

|

$0.25

|

October 8, 2015

|

December 31,

2018 |

| |

|

|

3,200,000 |

|

|

|

The option agreements previously signed will remain in full

force and effect and will be amended solely to amend the exercise price and the

expiry date.

18

Recent sales of unregistered securities