0001442999

false

0001442999

2021-04-01

2021-06-30

0001442999

2021-10-11

2021-10-11

0001442999

2021-06-30

0001442999

2021-03-31

0001442999

us-gaap:CommonStockMember

2021-01-06

0001442999

us-gaap:AdditionalPaidInCapitalMember

2021-01-06

0001442999

us-gaap:ComprehensiveIncomeMember

2021-01-06

0001442999

us-gaap:RetainedEarningsMember

2021-01-06

0001442999

2021-01-06

0001442999

us-gaap:CommonStockMember

2021-01-07

2021-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

2021-01-07

2021-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

2021-01-07

2021-03-31

0001442999

us-gaap:RetainedEarningsMember

2021-01-07

2021-03-31

0001442999

2021-01-07

2021-03-31

0001442999

us-gaap:CommonStockMember

2021-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

2021-03-31

0001442999

us-gaap:RetainedEarningsMember

2021-03-31

0001442999

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001442999

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001442999

us-gaap:ComprehensiveIncomeMember

2021-04-01

2021-06-30

0001442999

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001442999

us-gaap:CommonStockMember

2021-06-30

0001442999

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001442999

us-gaap:ComprehensiveIncomeMember

2021-06-30

0001442999

us-gaap:RetainedEarningsMember

2021-06-30

0001442999

ABTI:IssuanceOneMember

2010-04-02

2010-05-03

0001442999

ABTI:IssuanceTwoMember

2021-01-01

2021-01-29

0001442999

2021-05-28

0001442999

ABTI:AuditFeesMember

2021-06-30

0001442999

ABTI:AuditFeesMember

2021-03-31

0001442999

ABTI:AccountingMember

2021-06-30

0001442999

ABTI:AccountingMember

2021-03-31

0001442999

ABTI:ResearchAndDevelopmentMember

2021-06-30

0001442999

ABTI:ResearchAndDevelopmentMember

2021-03-31

0001442999

ABTI:LegalAndTransferAgentMember

2021-06-30

0001442999

ABTI:LegalAndTransferAgentMember

2021-03-31

0001442999

2009-04-16

2021-06-30

0001442999

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

ABTI:TransitionalPeriodMember

2019-09-30

0001442999

ABTI:TransitionalPeriodMember

2020-10-01

2021-03-31

0001442999

ABTI:TransitionalPeriodMember

2019-10-01

2020-03-31

0001442999

ABTI:TransitionalPeriodMember

2019-10-01

2020-09-30

0001442999

ABTI:TransitionalPeriodMember

2018-10-01

2019-09-30

0001442999

us-gaap:CommonStockMember

ABTI:TransitionalPeriodMember

2019-09-30

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:TransitionalPeriodMember

2019-09-30

0001442999

ABTI:SharesHeldInTrustMember

ABTI:TransitionalPeriodMember

2019-09-30

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:TransitionalPeriodMember

2019-09-30

0001442999

us-gaap:CommonStockMember

ABTI:TransitionalPeriodMember

2019-10-01

2020-09-30

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:TransitionalPeriodMember

2019-10-01

2020-09-30

0001442999

ABTI:SharesHeldInTrustMember

ABTI:TransitionalPeriodMember

2019-10-01

2020-09-30

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:TransitionalPeriodMember

2019-10-01

2020-09-30

0001442999

us-gaap:CommonStockMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

ABTI:SharesHeldInTrustMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

us-gaap:CommonStockMember

ABTI:TransitionalPeriodMember

2020-10-01

2021-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:TransitionalPeriodMember

2020-10-01

2021-03-31

0001442999

ABTI:SharesHeldInTrustMember

ABTI:TransitionalPeriodMember

2020-10-01

2021-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:TransitionalPeriodMember

2020-10-01

2021-03-31

0001442999

us-gaap:CommonStockMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

ABTI:SharesHeldInTrustMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

ABTI:TransitionalPeriodMember

2018-09-30

0001442999

ABTI:TransitionalPeriodMember

2020-03-31

0001442999

2020-10-01

2021-03-31

0001442999

ABTI:AuditFeesMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

ABTI:AuditFeesMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

ABTI:AccountingMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

ABTI:AccountingMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

ABTI:LegalAndTransferAgentMember

ABTI:TransitionalPeriodMember

2021-03-31

0001442999

ABTI:LegalAndTransferAgentMember

ABTI:TransitionalPeriodMember

2020-09-30

0001442999

ABTI:TransitionalPeriodMember

ABTI:OfficerIssuanceMember

2018-10-01

2019-09-30

0001442999

ABTI:IssuanceTwoMember

ABTI:TransitionalPeriodMember

2021-01-01

2021-01-29

0001442999

2020-09-30

0001442999

ABTI:TransitionalPeriodMember

2009-01-16

2021-03-31

0001442999

ABTI:TransitionalPeriodMember

2021-05-01

2021-05-24

0001442999

ABTI:ABTIPharmaMember

2021-03-31

0001442999

ABTI:ABTIPharmaMember

2020-03-31

0001442999

ABTI:OrdinarySharesMember

2021-03-31

0001442999

ABTI:OrdinarySharesMember

2020-03-31

0001442999

ABTI:ABTIPharmaMember

2020-04-01

2021-03-31

0001442999

ABTI:ABTIPharmaMember

2019-04-01

2020-03-31

0001442999

us-gaap:CommonStockMember

ABTI:ABTIPharmaMember

2019-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:ABTIPharmaMember

2019-03-31

0001442999

us-gaap:RetainedEarningsMember

ABTI:ABTIPharmaMember

2019-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:ABTIPharmaMember

2019-03-31

0001442999

ABTI:ABTIPharmaMember

2019-03-31

0001442999

us-gaap:CommonStockMember

ABTI:ABTIPharmaMember

2019-04-01

2020-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:ABTIPharmaMember

2019-04-01

2020-03-31

0001442999

us-gaap:RetainedEarningsMember

ABTI:ABTIPharmaMember

2019-04-01

2020-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:ABTIPharmaMember

2019-04-01

2020-03-31

0001442999

us-gaap:CommonStockMember

ABTI:ABTIPharmaMember

2020-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:ABTIPharmaMember

2020-03-31

0001442999

us-gaap:RetainedEarningsMember

ABTI:ABTIPharmaMember

2020-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:ABTIPharmaMember

2020-03-31

0001442999

us-gaap:CommonStockMember

ABTI:ABTIPharmaMember

2020-04-01

2021-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:ABTIPharmaMember

2020-04-01

2021-03-31

0001442999

us-gaap:RetainedEarningsMember

ABTI:ABTIPharmaMember

2020-04-01

2021-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:ABTIPharmaMember

2020-04-01

2021-03-31

0001442999

us-gaap:CommonStockMember

ABTI:ABTIPharmaMember

2021-03-31

0001442999

us-gaap:AdditionalPaidInCapitalMember

ABTI:ABTIPharmaMember

2021-03-31

0001442999

us-gaap:RetainedEarningsMember

ABTI:ABTIPharmaMember

2021-03-31

0001442999

us-gaap:ComprehensiveIncomeMember

ABTI:ABTIPharmaMember

2021-03-31

0001442999

2020-04-01

2021-03-31

0001442999

2020-03-31

0001442999

ABTI:AlterolaBiotechMember

2021-03-31

0001442999

ABTI:ABTIPharmaLimitedMember

2021-03-31

0001442999

ABTI:ProformaAdjustmentsMember

2021-03-31

0001442999

ABTI:ProformaAsAdjustedMember

2021-03-31

0001442999

ABTI:ProFormaFinancialsMember

2021-03-31

0001442999

ABTI:AlterolaBiotechMember

2020-04-01

2021-03-31

0001442999

ABTI:ABTIPharmaLimitedMember

2020-04-01

2021-03-31

0001442999

ABTI:ProformaAdjustmentsMember

2020-04-01

2021-03-31

0001442999

ABTI:ProformaAsAdjustedMember

2020-04-01

2021-03-31

0001442999

2021-05-01

2021-05-24

0001442999

ABTI:ProFormaFinancialsMember

2020-04-01

2021-03-31

0001442999

2021-05-01

2021-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:GBP

iso4217:GBP

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Alterola Biotech, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

2834

|

|

82-1317032

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

47 Hamilton Square Birkenhead Merseyside

CH41 5AR United Kingdom

(800) 706-0806

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive office)

Spring Valley Solutions, LLC

4955 S. Durango Rd. Ste. 165

Las Vegas, NV 89113

(702) 982-5686

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Scott Doney

The Doney Law Firm

4955 S. Durango Rd. Ste. 165

Las Vegas, NV 89113

(702) 982-5686

Approximate date of commencement

of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. [X]

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated Filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

Emerging Growth Company

|

☐

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Number of

Shares of

Common

Stock to be

Registered(1)

|

|

|

Proposed

Maximum

Offering

Price Per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price(1)

|

|

|

Amount of

Registration

Fee(2)

|

|

|

Common stock, par value $0.001 per share

|

|

|

55,000,000

|

|

|

$

|

2.00

|

|

|

$

|

110,000,000

|

|

|

$

|

10,197

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

|

(2)

|

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

|

The Registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and

Exchange Commission, acting pursuant to Section 8(a), may determine.

The information

in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer

to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT

TO COMPLETION, DATED OCTOBER 18, 2021

|

Alterola Biotech, Inc.

55,000,000 Shares of Common Stock

Our common stock is quoted on

the OTC Markets under the symbol “ABTI.” The last reported sale price of our common stock on October 18, 2021 was $0.343 per

share.

This prospectus relates to the

offer and sale of up to 55,000,000 shares of common stock, par value $0.001, of Alterola Biotech Inc., a Nevada corporation, by EMC2 Capital,

LLC, or EMC2 or the Selling Stockholder.

The shares of common stock being

offered by the Selling Stockholder have been or may be issued pursuant to the purchase agreement dated August 11, 2021, that we entered

into with EMC2. See “The EMC2 Transaction” on page 7 for a description of that agreement and “Selling Stockholder”

on page 38 for additional information regarding EMC2. The prices at which EMC2 may sell the shares will be determined by the prevailing

market price for the shares or in negotiated transactions.

We are not selling any securities

under this prospectus and will not receive any of the proceeds from the sale of shares by the Selling Stockholder.

The Selling Stockholder may sell

the shares of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution”

on page 34 for more information about how the Selling Stockholder may sell the shares of common stock being registered pursuant to this

prospectus. The Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933,

as amended.

We will pay the expenses incurred

in registering the shares, including legal and accounting fees. See “Plan of Distribution”.

Investing in our common

stock involves a high degree of risk. See “Risk Factors” on page 4 in this prospectus to read about the factors you

should consider before buying shares of our common stock.

We may amend or supplement this

prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments

or supplements carefully before you make your investment decision.

Neither the Securities and Exchange

Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

October 18, 2021

TABLE OF CONTENTS

You should rely only on the

information contained in this prospectus and in any free writing prospectus that we may provide to you in connection with this offering.

We have not authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or

any such free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We can

provide no assurance as to the reliability of any other information that others may give you. We are not making an offer to sell or seeking

offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information

in this prospectus is accurate only as of the date on the front cover of this prospectus, and the information in any free writing prospectus

that we may provide you in connection with this offering is accurate only as of the date of such free writing prospectus. Our business,

financial condition, results of operations and prospects may have changed since those dates. Neither we, nor any of our officers, directors,

or agents, makes any representation to you about the legality of an investment in our common stock. You should not interpret the contents

of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors

for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before

investing in our common stock.

PROSPECTUS SUMMARY

This summary highlights information

about this offering and the information included in this prospectus. This summary does not contain all of the information that you should

consider before investing in our securities. You should carefully read this entire prospectus, especially the sections titled “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated

financial statements included herein, including the notes thereto, before making an investment decision. References in this prospectus

to “we,” “us,” “our,” “the company” and the “Company” refer to Alterola Biotech,

Inc. and, where appropriate, its subsidiaries, unless expressly indicated or the context otherwise requires.

Business Overview

Our goal is to provide better

medicines for patients across the globe. We believe in harnessing the therapeutic potential of cannabinoids and cannabinoid- like compounds,

which can bring valuable treatments to seriously ill patients. Rather than just focussing on one method of identifying, researching and

developing such medicines, we are interested in developing new medicines from all sources including botanical, traditional chemical synthesis

and biosynthetic methodologies.

On May 28, 2021, we acquired ABTI

Pharma Limited, a company registered in England and Wales (“ABTI Pharma”), with the purchase of all of its capital stock in

exchange for 600,000,000 shares of our common stock pro rata to the ABTI Pharma shareholders.

As a result of the acquisition,

we are a pharmacuetical company working with cannabinoid and cannabinoid like molecules. We have three areas of focus:

1) Development of regulated pharmaceuticals

(human and animal health) and regulated food products. This has been achieved via the strategic acquisition of Phytotherapeutix Ltd.

2) Production of low cost of goods

Active Pharmaceutical Ingredient (API) and food-grade ingredients (supported by the strategic acquisition of Ferven Ltd), and

3) Formulation, and drug delivery,

providing improved bioavailability, solubility and stability (supported by the exclusive licensing of IP and technology from Nano4M Ltd).

Phytotherapeutix Ltd, a subsidiary

of ABTI Pharma, has generated a number of molecules with patents pending, some of which have demonstrable pharmacological activity, similar

to that of CBD. This means that some of these molecules are anticipated to have a similar market potential to CBD across a range of therapeutic

areas.

Ferven Ltd, another subsidiary

of ABTI Pharma, is looking to produce cannabinoids by fermentation. The exclusively licensed organism has the potential to be genetically

modified to produce multiple cannabinoids at a very low cost of goods. It is anticipated that the selected genetically modified organisms

will grow very quickly, which in turn, reduces the cost of production.

Nano4M Ltd is a company which

has exclusively licensed its nano-formulation patents and know-how to ABTI Pharma Ltd.

Additionally, we may consider

entering into Joint Venture Partnerships, Acquisition of Companies with complimentary portfolios or Licencing Agreements to enhance the

product portfolio. These are strategies the Company may implement and any such opportunities will be assessed on a case by case basis

and on their merit at the time.

ABTI Pharma management has extensive

proven experience, know-how and connections in the cannabinoid medicines sector, and is looking to utilize this knowledge and experience

for the development of such medicines from existing cannabinoids and cannabinoid-like molecules.

Our address is 47 Hamilton Square

Birkenhead Merseyside CH41 5AR United Kingdom. Our telephone number is +44 151 601 9477. Our website is www.alterolabio.com.

We do not incorporate the information

on or accessible through our websites into this Registration Statement, and you should not consider any information on, or that can be

accessed through, our websites a part of this Registration Statement.

The EMC2 Transaction

On August 11, 2021, we entered

into a purchase agreement with EMC2, which we refer to in this prospectus as the Purchase Agreement, pursuant to which EMC2 has agreed

to purchase from us up to an aggregate of $125,000,000 of our common stock (subject to certain limitations) from time to time over the

term of the Purchase Agreement. Also, on August 11, 2021, we entered into a registration rights agreement with EMC2, which we refer to

in this prospectus as the Registration Rights Agreement, pursuant to which we are required to file with the SEC a registration statement

that includes this prospectus to register for resale under the Securities Act of 1933, as amended, or the Securities Act, the shares of

common stock that have been or may be issued to EMC2 under the Purchase Agreement. Pursuant to the terms of the Purchase Agreement, at

the time we signed the Purchase Agreement and the Registration Rights Agreement, we issued 7,500,000 shares of our common stock and 15,000,000

warrants to EMC2 as consideration for its commitment to purchase shares of our common stock under the Purchase Agreement, which we refer

to in this prospectus as the Commitment Shares and Commitment Warrants.

We do not have the right to commence

any sales of our common stock to EMC2 under the Purchase Agreement until certain conditions set forth in the Purchase Agreement, all of

which are outside of EMC2’s control, have been satisfied, including that the SEC has declared effective the registration statement

that includes this prospectus. Thereafter, we may, from time to time and at our sole discretion, direct EMC2 to purchase shares of our

common stock in amounts up to 100,000 shares on any single business day, subject to a maximum of $1,000,000 per purchase, plus other “VWAP

Purchases” under certain circumstances. There are no trading volume requirements or restrictions under the Purchase Agreement, and

we will control the timing and amount of any sales of our common stock to EMC2. The purchase price of the shares that may be sold to EMC2

under the Purchase Agreement will be based on the market price of our common stock preceding the time of sale as computed under the Purchase

Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock

split, or other similar transaction occurring during the business days used to compute such price. We may at any time in our sole discretion

terminate the Purchase Agreement without fee, penalty or cost upon one business day notice. There are no restrictions on future financings,

rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement,

other than a prohibition on entering into a “Variable Rate Transaction,” as defined in the Purchase Agreement. EMC2 may not

assign or transfer its rights and obligations under the Purchase Agreement.

As of August 11, 2021, there were

754,280,000 shares of our common stock outstanding, of which 115,130,000 shares were held by non-affiliates. Although the Purchase Agreement

provides that we may sell up to $125,000,000 of our common stock to EMC2, only 55,000,000 shares of our common stock are being offered

under this prospectus, which represents: (i) 7,500,000 shares that we issued to EMC2 as a commitment fee for making the commitment under

the Purchase Agreement; (ii) 15,000,000 shares underlying the Commitment Warrants; and (iii) an additional 32,500,000 shares which may

be issued to EMC2 in the future under the Purchase Agreement, if and when we sell shares to EMC2 under the Purchase Agreement. Depending

on the market price of our common stock at the time we elect to issue and sell shares to EMC2 under the Purchase Agreement, we may need

to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal

to the $125,000,000 total commitment available to us under the Purchase Agreement. If all of the 55,000,000 shares offered by EMC2 under

this prospectus were issued and outstanding as of the date hereof, such shares would represent 6.7% of the total number of shares of our

common stock outstanding and 32.33% of the total number of outstanding shares held by non-affiliates, in each case as of the date hereof.

If we elect to issue and sell more than the 55,000,000 shares offered under this prospectus to EMC2, which we have the right, but not

the obligation, to do, we must first register for resale under the Securities Act any such additional shares, which could cause additional

substantial dilution to our stockholders. The number of shares ultimately offered for resale by EMC2 is dependent upon the number of shares

we sell to EMC2 under the Purchase Agreement.

The Purchase Agreement also prohibits

us from directing EMC2 to purchase any shares of common stock if those shares, when aggregated with all other shares of our common stock

then beneficially owned by EMC2 and its affiliates, would result in EMC2 and its affiliates having beneficial ownership, at any single

point in time, of more than 4.99% of the then total outstanding shares of our common stock, as calculated pursuant to Section 13(d) of

the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3 thereunder, which limitation we refer to as the Beneficial

Ownership Cap.

Issuances of our common stock

in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests

of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that

our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of

our total outstanding shares after any such issuance to EMC2.

The Offering

|

Common stock outstanding prior to this offering

|

|

754,280,000 shares of common stock

|

|

|

|

|

|

Common stock offered by the Selling Stockholder

|

|

55,000,000 shares of common stock consisting of: 7,500,000 Commitment Shares issued to EMC2; 15,000,000 shares underlying the Commitement Warrants issued to EMC2; and 32,500,000 shares we may sell to EMC2 under the Purchase Agreement from time to time after the date of this prospectus.

|

|

|

|

|

|

Common stock to be outstanding immediately after this offering(1)

|

|

809,280,000 shares of common stock. If issued presently, the 55,000,000 shares of common stock registered for resale by EMC2 would represent approximately 6.7% of our issued and outstanding shares of common stock. Additionally, the 55,000,000 shares of common stock registered for resale herein would represent approximately 33% of our public float.

|

|

|

|

|

|

Offering price per share

|

|

EMC2 (the selling stockholder identified in this prospectus) may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices.

|

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of the shares of our common stock by EMC2 (the selling stockholder identified in this prospectus). However, we will receive proceeds from our initial sale of shares to EMC2, pursuant to the Purchase Agreement. The proceeds from the initial sale of shares will be used for the purpose of working capital and that the Board of Directors, in good faith deem to be in the best interest of the Company. See “Use of Proceeds”

|

|

|

|

|

|

Duration of this offering

|

|

The offering shall terminate on the earlier of (i) the date when the sale of all 55,000,000 shares is completed, or (ii) August 11, 2024.

|

|

|

|

|

|

Risk factors

|

|

Investing in our common stock involves a high

degree of risk, and the purchasers of our common stock may lose all or part of their investment. Before deciding to invest in our

securities, please carefully read the section entitled “Risk Factors” beginning on page 4 and the other information in

this prospectus.

|

|

|

|

|

|

OTC Markets trading symbol

|

|

Our common stock is quoted on the OTC Markets under the symbol “ABTI.”

|

RISK FACTORS

An investment in our securities

involves a high degree of risk. In addition to the other information contained in this prospectus, prospective investors should carefully

consider the following risks before investing in our securities. If any of the following risks actually occur, as well as other risks

not currently known to us or that we currently consider immaterial, our business, operating results and financial condition could be materially

adversely affected. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment

in our common stock. The risks discussed below also include forward-looking statements, and our actual results may differ substantially

from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements” in this

prospectus. In assessing the risks below, you should also refer to the other information contained in this prospectus, including the financial

statements and the related notes, before deciding to purchase any of our securities.

Risk Related to Covid 19

Our business and future

operations may be adversely affected by epidemics and pandemics, such as the recent COVID-19 outbreak.

We may face risks related

to health epidemics and pandemics or other outbreaks of communicable diseases, which could result in a widespread health crisis that could

adversely affect general commercial activity and the economies and financial markets of the world as a whole. For example, the outbreak

of COVID-19, which began in China, has been declared by the World Health Organization to be a “pandemic,” has spread across

the globe, including the United States of America. A health epidemic or pandemic or other outbreak of communicable diseases, such as the

current COVID-19 pandemic, poses the risk that we, or potential business partners may be disrupted or prevented from conducting business

activities for certain periods of time, the durations of which are uncertain, and may otherwise experience significant impairments of

business activities, including due to, among other things, operational shutdowns or suspensions that may be requested or mandated by national

or local governmental authorities or self-imposed by us, our users or other business partners. For example, due to COVID-19, we have been

unable to travel across the relevant jurisdictions pertaining to our business and foresee this as an ongoing issue. While it is not possible

at this time to estimate the full impact that COVID-19 could have on our business, potential users or other potential business partners,

the continued spread of COVID-19, the measures taken by the local and federal government, actions taken to protect employees, and the

impact of the pandemic on various business activities could adversely affect our results of operations and financial condition.

Risks Relating to Our Financial Condition

There are doubts about our ability to continue

as a going concern.

We have

generated no revenue, and have an accumulated deficit of $1,649,936 through June 30, 2021. These factors raise substantial doubt about

our ability to continue as a going concern.

There

can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds

will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital

resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force us to substantially

curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance

that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect

on our existing stockholders.

We seek

to overcome the circumstances that impact our ability to remain a going concern through a combination of the growth of revenues, with

interim cash flow deficiencies being addressed through additional equity and debt financing. We anticipate raising additional funds through

public or private financing, strategic relationships or other arrangements in the near future to support its business operations; however,

we may not have commitments from third parties for a sufficient amount of additional capital. We cannot be certain that any such financing

will be available on acceptable terms, or at all, and our failure to raise capital when needed could limit our ability to continue operations.

Our ability to obtain additional funding will determine its ability to continue as a going concern. Failure to secure additional financing

in a timely manner and on favorable terms would have a material adverse effect on our financial performance, results of operations and

stock price and require us to curtail or cease operations, sell off our assets, seek protection from our creditors through bankruptcy

proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of our common stock, and debt financing,

if available, may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require

that we relinquish valuable rights.

Because we have a limited

operating history, you may not be able to accurately evaluate our operations.

We have

had limited operations to date. Therefore, we have a limited operating history upon which to evaluate the merits of investing in our company.

Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises.

The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in

connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems

relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current

estimates. We expect to continue to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our

business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption

as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable

operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are dependent on

outside financing for continuation of our operations.

Because

we have generated no revenues and currently operate at a loss, we are completely dependent on the continued availability of financing

in order to continue our business operations. There can be no assurance that financing sufficient to enable us to continue our operations

will be available to us in the future.

We will

need additional funds to complete further development of our business plan to achieve a sustainable level where ongoing operations can

be funded out of revenues. We anticipate that we must raise $25,000,000 for our operations for the next 12 months, and $81,000,000 for

our initial clinical development program for each of the molecules and therapeutic indications. We will require further funding to fully

implement our business plan to its fullest potential and achieve our growth plans. There is no assurance that any additional financing

will be available or if available, on terms that will be acceptable to us.

Our failure

to obtain future financing or to produce levels of revenue to meet our financial needs could result in our inability to continue as a

going concern and, as a result, our investors could lose their entire investment.

Our operating results

may fluctuate, which could have a negative impact on our ability to grow our client base, establish sustainable revenues and succeed overall.

Our results

of operations may fluctuate as a result of a number of factors, some of which are beyond our control including but not limited to:

|

|

§

|

general economic conditions in the geographies and industries where we sell our services and conduct operations; legislative policies where we sell our services and conduct operations;

|

|

|

§

|

the budgetary constraints of our customers; seasonality;

|

|

|

§

|

success of our strategic growth initiatives;

|

|

|

§

|

costs associated with the launching or integration of new or acquired businesses; timing of new product introductions by us, our suppliers and our competitors; product and service mix, availability, utilization and pricing;

|

|

|

§

|

the mix, by state and country, of our revenues, personnel and assets; movements in interest rates or tax rates;

|

|

|

§

|

changes in, and application of, accounting rules; changes in the regulations applicable to us; and litigation matters.

|

As a

result of these factors, we may not succeed in our business and we could go out of business.

As a growing company,

we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We have

not yet produced any revenues or profit and may not in the near future, if at all. We cannot be certain that we will be able to realize

sufficient revenue to achieve profitability. Further, many of our competitors have a significantly larger industry presence and revenue

stream but have yet to achieve profitability. Our ability to continue as a going concern is dependent upon raising capital from financing

transactions, increasing revenue and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none

of which can be assured.

Risks Related with Management and Control Persons

We are dependent on the continued services of

our Chairman and Chief Operating Officer and if we fail to keep them or fail to attract and retain qualified senior executive and key

technical personnel, our business will not be able to expand.

We are dependent on the continued

availability of Dominic Schiller and Hunter Land, and the availability of new employees to implement our business plans. The market for

skilled employees is highly competitive, especially for employees in our industry. Although we expect that our planned compensation programs

will be intended to attract and retain the employees required for us to be successful, there can be no assurance that we will be able

to retain the services of all our key employees or a sufficient number to execute our plans, nor can there be any assurance we will be

able to continue to attract new employees as required.

Our lack of adequate D&O insurance may also

make it difficult for us to retain and attract talented and skilled directors and officers.

In the future we may be subject

to additional litigation, including potential class action and stockholder derivative actions. Risks associated with legal liability are

difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date, we have

not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance, the amounts we would

pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could have a

material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of adequate D&O insurance

may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely affect our business.

Our personnel may voluntarily terminate their

relationship with us at any time, and competition for qualified personnel is intense. The process of locating additional personnel with

the combination of skills and attributes required to carry out our strategy could be lengthy, costly and disruptive.

If we lose the services of key

personnel or fail to replace the services of key personnel who depart, we could experience a severe negative effect on our financial results

and stock price. The loss of the services of any key personnel, marketing or other personnel or our failure to attract, integrate, motivate

and retain additional key employees could have a material adverse effect on our business, operating and financial results and stock price

Our officers and directors have substantial

control over us and our policies and will be able to influence corporate matters.

Our officers and directors presently

beneficially own 60% of our common stock. They are able to exercise significant influence over all matters requiring approval by our stockholders,

including the election of directors, the approval of significant corporate transactions, and any change of control of our company. They

could prevent transactions, which would be in the best interests of the other shareholders. Our officers and directors’ interests

may not necessarily be in the best interests of the shareholders in general.

The elimination of monetary liability against

our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors,

officers and employees may result in substantial expenditures by our Company and may discourage lawsuits against our directors, officers

and employees.

Our Articles of Incorporation

contain provisions that eliminate the liability of our directors for monetary damages to our Company and shareholders. Our bylaws also

require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with

our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial expenditures

to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions

and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and employees for breaches of

their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers

and employees even though such actions, if successful, might otherwise benefit our Company and shareholders.

Our officers and directors have limited experience

managing a public company.

Our officers and directors have

limited managing a public company. Consequently, we may not be able to raise any funds or run our public company successfully. Our executive’s

officer’s and director’s lack of experience of managing a public company could cause you to lose some or all of your investment.

Risks Relating to our Common Stock and Offering

We will likely conduct further offerings of

our equity securities in the future, in which case your proportionate interest may become diluted.

We will likely be required to

conduct equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake.

If our common stock shares are issued in return for additional funds, the price per share could be lower than that paid by our current

shareholders. We anticipate continuing to rely on equity sales of our common stock shares in order to fund our business operations. If

we issue additional common stock shares or securities convertible into shares of our common stock, your percentage interest in us could

become diluted.

Our common stock price may be volatile and could

fluctuate widely in price, which could result in substantial losses for investors.

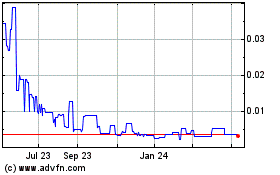

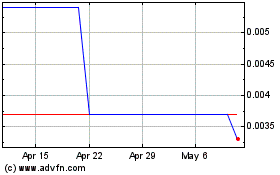

Our common stock is quoted on

the OTCPink under the symbol, “ABTI.” The market price of our common stock is likely to be highly volatile and could fluctuate

widely in price in response to various factors, many of which are beyond our control, including:

|

|

§

|

government regulation of our products and services;

|

|

|

§

|

the establishment of partnerships with sports development companies;

|

|

|

§

|

intellectual property disputes;

|

|

|

§

|

additions or departures of key personnel;

|

|

|

§

|

sales of our common stock

|

|

|

§

|

our ability to integrate operations, technology, products and services;

|

|

|

§

|

our ability to execute our business plan;

|

|

|

§

|

operating results below expectations;

|

|

|

§

|

loss of any strategic relationship;

|

|

|

§

|

economic and other external factors; and

|

|

|

§

|

period-to-period fluctuations in our financial results.

|

Because we have no revenues to

date, you should consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets

have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular

companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Our existing stockholders may experience significant

dilution from the sale of our common stock pursuant to the EMC2 Purchase Agreement.

The sale of our common stock to

EMC2 in accordance with the Purchase Agreement may have a dilutive impact on our shareholders. As a result, the market price of our common

stock could decline. In addition, the lower our stock price is at the time we exercise our put options, the more shares of our common

stock we will have to issue to EMC2 in order to exercise a put under the Purchase Agreement. If our stock price decreases, then our existing

shareholders would experience greater dilution for any given dollar amount raised through the offering.

The perceived risk of dilution

may cause our stockholders to sell their shares, which may cause a decline in the price of our common stock. Moreover, the perceived risk

of dilution and the resulting downward pressure on our stock price could encourage investors to engage in short sales of our common stock.

By increasing the number of shares offered for sale, material amounts of short selling could further contribute to progressive price declines

in our common stock.

The issuance of shares pursuant to the EMC2

Purchase Agreement may have significant dilutive effect.

Depending on the number of shares

we issue pursuant to the EMC2 Purchase Agreement, it could have a significant dilutive effect upon our existing shareholders. Although

the number of shares that we may issue pursuant to the Purchase Agreement will vary based on our stock price (the higher our stock price,

the less shares we have to issue), there may be a potential dilutive effect to our shareholders, based on different potential future stock

prices, if the full amount of the Purchase Agreement is realized. Dilution is based upon common stock put to EMC2 and the stock price

discounted to 91% of the lowest sales price on the purchase date.

EMC2 will pay less than the then-prevailing

market price of our common stock which could cause the price of our common stock to decline.

Our common stock to be issued

under the EMC2 Purchase Agreement will be purchased at 91% of the lowest sales price on the purchase date. EMC2 has a financial incentive

to sell our shares immediately upon receiving them to realize the profit between the discounted price and the market price. If EMC2 sells

our shares, the price of our common stock may decrease. If our stock price decreases, EMC2 may have further incentive to sell such shares.

Accordingly, the discounted sales price in the Purchase Agreement may cause the price of our common stock to decline.

We may not have access to the full amount under

the Purchase Agreement.

At an assumed purchase price under the Purchase Agreement of $ 0.312

(equal to 91% of the lowest sales price on October 18, 2021, we will be able to receive up to $ 17,160,000 in gross proceeds, assuming

the sale of the entire 55,000,000 purchase notice shares being registered hereunder pursuant to the Purchase Agreement. At an assumed

purchase price of $0.312 under the Purchase Agreement, we would be required to register 345,641,026 additional shares of our common stock

to obtain the balance of $ 107,840,000 of the total $125,000,000 under the Purchase Agreement. Due to the floating offering price, we

are not able to determine the exact number of shares that we will issue under the Purchase Agreement.

Our ability to draw down funds

and sell shares under the Purchase Agreement with EMC2 requires that the registration statement of which this prospectus forms a part

to be declared effective and continue to be effective. The registration statement of which this prospectus forms a part registers the

resale of 55,000,000 shares issuable under the Purchase Agreement with EMC2, and our ability to sell any remaining shares issuable under

the investment with EMC2 is subject to our ability to prepare and file one or more additional registration statements registering the

resale of these shares. These registration statements may be subject to review and comment by the staff of the Securities and Exchange

Commission and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of

these registration statements cannot be assured. The effectiveness of these registration statements is a condition precedent to our ability

to sell all of the shares of our common stock to EMC2 under the Purchase Agreement. Even if we are successful in causing one or more registration

statements registering the resale of some or all of the shares issuable under the purchase agreement with EMC2 to be declared effective

by the Securities and Exchange Commission in a timely manner, we may not be able to sell the shares unless certain other conditions are

met. For example, we might have to increase the number of our authorized shares in order to issue the shares to EMC2. Increasing the number

of our authorized shares will require board and stockholder approval. Accordingly, because our ability to draw down any amounts under

the Purchase Agreement with EMC2 is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion

or all of the proceeds of $125,000,000 under the investment with EMC2.

We have never declared or paid any cash dividends

or distributions on our capital stock. And we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We have never declared or paid

any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations

and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount

of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results

of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors

considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect

to the amount of any such dividend.

We may become involved in securities class action

litigation that could divert management’s attention and harm our business.

The stock market in general, and

the shares of early-stage companies in particular, have experienced extreme price and volume fluctuations. These fluctuations have often

been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations occur in the future,

the market price of our shares could fall regardless of our operating performance. In the past, following periods of volatility in the

market price of a particular company’s securities, securities class action litigation has often been brought against that company.

If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type of litigation, which

would be expensive and divert management’s attention and resources from managing our business.

As a public company, we may also

from time to time make forward-looking statements about future operating results and provide some financial guidance to the public markets.

Projections may not be made timely or set at expected performance levels and could materially affect the price of our shares. Any failure

to meet published forward-looking statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits

or other litigation, sanctions or restrictions issued by the SEC.

Our common stock is currently deemed a “penny

stock,” which makes it more difficult for our investors to sell their shares.

Our common stock is currently

deemed a “penny stock,” which makes it more difficult for our investors to sell their shares. The SEC has adopted rule 3a51-1

which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market

price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction

involving a penny stock, unless exempt, Rule 15g-9 requires:

• that

a broker or dealer approve a person’s account for transactions in penny stocks, and

• the

broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny

stock to be purchased.

In order to approve a person’s

account for transactions in penny stocks, the broker or dealer must:

• obtain

financial information and investment experience objectives of the person, and

• make

a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge

and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also

deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which,

in highlight form:

• sets

forth the basis on which the broker or dealer made the suitability determination and

• that

the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less

willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors

to dispose of our common stock and cause a decline in the market value of our stock.

Risks Relating to Our Company and Industry

Our future

success will largely depend on the success of our drug candidates, which development will require significant

capital resources and years of clinical development effort.

We currently have no drug products

on the market, and none of our drug development projects / pipeline drug candidates has reached

preclinical study or clinical trial status. Our business depends almost entirely on the successful clinical

development, regulatory approval and commercialization of our pipeline drug candidates. Investors need to be aware

that substantial additional investments including preclinical and clinical development and regulatory approval efforts will

be required before we are permitted to market and commercialize our pipeline drug

candidates, if ever. It may be several years before we can commence clinical trials, if ever.

Any clinical trial will be subject to extensive and rigorous review and regulation

by numerous government authorities in the United States, the European Union, and other jurisdictions where

we intend, if approved, to market our pipeline drug candidates. Before obtaining regulatory approvals for any of our

pipeline drug candidates, we must demonstrate through preclinical testing and clinical trials that the pipeline drug candidate

is safe and effective for its specific application. This process can take many years and may include post- marketing

studies and surveillance, which would require the expenditure of substantial resources. Of the large number of drugs in development

for approval in the United States, European Union (and the rest of the world), only a small percentage

will successfully complete the FDA regulatory approval process or be granted authorization to be marketed in

the European Commission or the other competent authorities in the European Union (“EU”) Member States, or the rest

of the world. Accordingly, even if we obtain the sufficient financing to fund our planned research, development and

clinical programs, we cannot assure you that any of our pipeline drug candidates will be successfully developed or commercialized.

We

may be unable to formulate or scale-up any or all of our pipeline drug candidates. There is no guarantee that any of the pipeline

drug candidates will be or are able to be manufactured or produced in a manner to meet the FDA’s criteria for

product stability, content uniformity and all other criteria necessary for product approval in the United States and other

markets. Any of our pipeline drug candidates may fail to achieve their specified endpoints in clinical trials.

Furthermore,

pipeline drug candidates may not be approved even if they achieve their specified endpoints in clinical trials.

The FDA may disagree with our trial design and our interpretation of data from clinical trials, or may change the requirements

for approval even after it has reviewed and commented on the design for our clinical trials. The FDA may also approve a drug

for fewer or more limited indications than we request, or may grant approval contingent on the performance of

costly post-approval clinical trials (i.e., Phase IV trials). In addition, the FDA may not approve the labeling

claims that we believe are necessary or desirable for the successful commercialization of our pipeline drug candidates.

If we are unable to expand our

pipeline and obtain regulatory approval for our pipeline drug candidates within the timelines

we anticipate, we will not be able to execute our business strategy effectively and our ability to substantially grow

our revenues will be limited, which would have a material adverse impact on our long-term business, results of operations,

financial condition, and prospects.

Our drug

development projects, if approved, may be unable to achieve the expected market acceptance and, consequently,

limit our ability to generate revenue

Even when drug development is

successful and regulatory approval has been obtained, our ability to generate significant revenue

depends on the acceptance of our (then) approved medicines by physicians, prescribers and patients. We cannot assure you that

any of our pipeline drug candidates will achieve the expected market acceptance and revenue, if and when we obtain the regulatory approvals.

The market acceptance of any drug depends on a number of factors, including the indication statement and warnings approved by regulatory

authorities for the drug label, continued demonstration of efficacy and safety in commercial

use, physicians’ / prescribers willingness to prescribe the drug, reimbursement from third-party payers such as government

health care systems and insurance companies, the price of the drug, the nature of any post-approval risk

management plans mandated by regulatory authorities, competition, and marketing and distribution support. Any factors preventing

or limiting the market acceptance of our drugs could have a material adverse effect on our business, results of operations and financial

condition.

Results

of preclinical studies and earlier clinical trials are not necessarily predictive indicators of future results.

Any

positive results from future preclinical testing of our pipeline drug candidates and potential future clinical trials may

not necessarily be predictive of the results from Phase 1, Phase 2 or Phase 3 clinical trials. In addition, our interpretation of results

derived from clinical data or our conclusions based on our preclinical data may prove inaccurate.

Frequently, pharmaceutical and biotechnology companies have suffered significant setbacks

in clinical trials after achieving positive results in preclinical testing and early phase clinical trials, and we cannot

be certain that we will not face similar setbacks. These setbacks may be caused by the fact

that preclinical and clinical data can be susceptible to varying interpretations and analyses.

Furthermore, certain pipeline drug candidates may perform satisfactorily in preclinical

studies and clinical trials, but nonetheless fail to obtain FDA approval, a marketing authorization granted by the European

Commission, or appropriate approvals by the appropriate medicines regulatory authorities in other countries.

If we fail to produce positive results in our clinical trials for our pipeline drug candidates, the development timeline

and regulatory approval and commercialization prospects for them and as a result our business and financial prospects, would

be materially adversely affected.

The regulatory

approval processes with the FDA, the EMA and other comparable foreign regulatory authorities is lengthy and

inherently unpredictable.

We

are not permitted to market our drug candidates as medicines in the United

States or the European Union or other countries until we receive approval of a

New Drug Application (“NDA”) from the FDA or a Marketing Authorization Application (“MAA”)

from the European Commission, respectively, or in any foreign countries until we receive the approval from the regulatory

authorities of such countries. Prior to submitting an NDA to the FDA or an MAA to the EMA for approval

of our drug candidates we will need to have completed our preclinical studies and clinical trials. Successfully completing any

clinical program and obtaining approval of an NDA or MAA is a complex, lengthy, expensive and uncertain process, and the FDA or EMA (or

other country medicines regulatory body) may delay, limit or deny approval of pipeline drug candidates for many reasons, including, among

others, because:

|

|

§

|

an inability to demonstrate that our pipeline drug

candidates are safe and effective

in treating patients to the satisfaction of the FDA or EMA (or any other country’s medicine regulatory body);

|

|

|

§

|

results of clinical trials that may not meet the

level of statistical

or clinical significance required by the FDA or EMA (or any other country’s medicine regulatory body);

|

|

|

§

|

disagreements with the FDA or EMA (or any other

country’s medicine regulatory body)

with respect to the number, design, size, conduct or implementation of clinical trials;

|

|

|

§

|

requirements by the FDA and EMA (or any other country’s

medicine regulatory body)

to conduct additional clinical trials;

|

|

|

§

|

disapproval by the FDA or EMA or other applicable

foreign regulatory authorities of certain formulations, labeling

or specifications of pipeline drug candidates;

|

|

|

§

|

findings by the FDA or EMA (or any other country’s

medicine regulatory

body) that the data from preclinical studies and clinical trials are insufficient;

|

|

|

§

|

the FDA or EMA (or any other country’s medicine regulatory body) may

disagree with the interpretation of data from preclinical studies and clinical trials; and

|

|

|

§

|

the FDA, European Commission or other applicable foreign regulatory agencies

may change their approval policies or adopt new regulations.

|

Any

of these factors, many of which are beyond our control, could increase development time

and / or costs or jeopardize our ability to obtain regulatory approval for

our drug candidates.

We may apply

for orphan drug status granted by the FDA and / or EMA for some

of our drug candidates for the treatment of rare diseases.

Regulatory

authorities in some jurisdictions, including the United States and the European Union, may designate drugs for

relatively small patient populations as orphan drugs. The FDA may grant orphan drug designation to drugs intended to treat

a rare disease or condition that affects fewer than 200,000 individuals annually in the United States. In the European

Union, the EMA’s Committee for Orphan Medicinal Products grants orphan drug designation to promote the development

of drugs that are intended for the diagnosis, prevention or treatment of life-threatening or chronically debilitating conditions

affecting not more than 5 in 10,000 persons in the European Union. Additionally, such designation is granted for drugs intended for the

diagnosis, prevention or treatment of a life-threatening, seriously debilitating or

serious and chronic condition and when, without incentives, it is unlikely that sales of the drug in the European Union would be sufficient

to justify the necessary investment in developing the drug.

In the USA, orphan drug designation

entitles a party to financial incentives, such as opportunities for grant funding towards clinical

trial costs, tax credits for certain research and user fee waivers under certain circumstances. In addition, if a drug receives

the first FDA approval for the drug and indication for which it has orphan drug designation, the drug is entitled to seven years of market

exclusivity, which means the FDA may not approve any other application for the same drug for the same indication for a period of seven

years, except in limited circumstances, such as a showing of clinical superiority over the

drug with orphan drug exclusivity. Orphan drug exclusivity does not prevent the FDA from approving a different drug for the

same disease or condition, or the same drug for a different disease or condition.

In

the European Union, orphan drug designation also entitles a party to financial incentives such as reduction of fees or fee

waivers and ten years of market exclusivity following drug approval. This period may be reduced to six years if the orphan

drug designation criteria are no longer met, including where it is shown that the drug is sufficiently profitable so that

market exclusivity is no longer justified.

Whilst the company may wish to

apply for ODDs for some or all of its pipeline drug candidates, there is no guarantee that FDA or EMA (or any other international regulatory

body) will grant an ODD for any of the company’s pipeline drug candidates.

Our

drug candidates may become subject to controlled substance laws and regulations in the U.S.

While cannabis and some cannabinoids

are controlled substances under the CSA in the United States, we plan to initially focus our drug development projects using cannabinoids

and other molecules that are produced from a variety of sources: (1) produced via chemical

synthesis and / or (2) produced biosynthetically and / or (3) produced via botanical means.

A number of cannabinoid-containing

medicines, such as Marinol® or

Syndros® (containing

dronabinol), or Epidiolex (containing botanically-derived cannabidiol) or Cesamet® (containing

nabilone) have been approved by the FDA for variousindications.

In the USA, while plant-derived

cannabinoids – during development - are categorized as Schedule I substances under the CSA, the scheduling changes once

a medicine has been approved by the FDA.

Marinol®,

a capsule formulation which contains synthetic tetrahydrocannabinol, or THC when

formulated is a Schedule III medicine.

Syndros® (which

also contains synthetic THC, dronabinol) is a liquid formulation as is classified as Schedule II.

Epidiolex® was

initially a Schedule V medicine when it was introduced in 2018, but was descheduled by the DEA in 2020.

It

is our intention to produce pipeline drug candidates via synthetic, and / or biosynthetic and

/ or botanical means, which may produce complex extracts or purified drug

substance as API.

Depending upon the content of

our selected API(s), and their subsequent controlled drug status in the USA, and if the company conducts preclinical

studies or clinical trials in the United States, we will become subject

to the CSA laws and regulation in addition to FDA regulations. If the Company decides to proceed

with APIs which are controlled drugs, it will evaluate where it is best to conduct its research and preclinical and

clinical trials. This may or may not be the USA.

Nevertheless, our finished drug

products may contain controlled substances as defined in the CSA. Pipeline drug candidates which contain controlled substances are subject

to a high degree of regulation under the CSA, which establishes, among other things, certain

registration, manufacturing quotas, security, recordkeeping, reporting, import, export

and other requirements administered by the DEA. The DEA classifies controlled substances into five schedules: Schedule I,

II, III, IV or V substances. Schedule I substances, by definition, have a high potential for abuse, have no currently

“accepted medical use” in the United States, lack accepted safety for use under medical supervision, and may not

be prescribed, marketed or sold in the United States. Pharmaceutical products approved for use in the United States may

be listed as Schedule II, III, IV or V, with Schedule II substances considered to present the highest potential for abuse

or dependence and Schedule V substances the lowest relative risk of abuse among such substances. Schedule I and

II drugs are subject to the strictest controls under the CSA, including manufacturing and procurement quotas, security

requirements and criteria for importation. In addition, dispensing of Schedule II drugs is further restricted. For example,

they may not be refilled without a new prescription.

While

cannabis and certain of its derivatives and certain cannabinoids are Schedule I controlled substances, drugs approved

for medical use in the United States that contain cannabis, cannabis extracts or certain cannabinoids must be placed

in Schedules II - V, since approval by the FDA satisfies the “accepted medical use” requirement. If, and when any

of our pipeline drug candidates receive FDA approval, for those that are considered

controlled substances under the CSA, the DEA will make a scheduling determination

and place it in a schedule other than Schedule I for it to be prescribed for patients in the United States. If approved by the FDA, depending