Senior Executives Resign From Greece's Bank Rescue Fund

July 06 2016 - 8:40AM

Dow Jones News

ATHENS—Greece's bank rescue fund said Wednesday that its chief

executive and deputy chief executive have stepped down as Greek

lenders struggle to get a grip on the €100 billion ($111.3 billion)

of bad loans brought on by the country's economic downturn.

The news comes during a broader shake up of management at Greek

banks demanded by international creditors—the International

Monetary Fund and eurozone nations—who are calling for the better

handling of bad loans to free up fresh credit to the economy.

The fund said that the three members of its executive

board—chief executive Aris Xenofos, deputy chief executive George

Koutsos and executive board member Anastasios Gagales—have all

submitted their resignations, effective as of July 18.

"The executive board submitted its resignation to pave the way

for the future role the fund will play in the banking system and

the Greek economy," it said in a statement.

Founded in 2010, the fund—called the Hellenic Financial

Stability Fund (HFSF)—was set up to help oversee three

recapitalizations to the sector completed with the help of state

aid as part of international rescue money provided to Greece to

prevent the country from going bankrupt.

Others tasks completed by the fund involved helping assess the

boards of the country's top commercial lenders as part of a

management overhaul to the sector currently in progress.

However, delays in convincing banks to tackle non performing

loans prompted a negative review of the HFSF's executive board by

an independent committee set up within the fund, called the

Selection Panel.

Last week, the Selection Panel demanded their resignations in a

report believed to have been sent to the Finance Ministry,

according to a senior bank official.

The final decision on their resignations will be made by Greek

Finance Minister Euclid Tsakalotos, although he is widely accepted

to agree with their decisions. The Finance Ministry declined to

comment.

About one in two loans held by Greek banks are nonperforming,

representing some €100 billion. Greece is stumbling through its

seventh year of an economic slump that has wiped more than a

quarter of its economic output and sent unemployment levels to

around 25%.

Despite a series of laws having been passed since late last year

allowing for reforms to the management of bad loans, Greek banks

have been reluctant to sell underperforming assets directly to

private equity groups, citing very low offers made on the

loans.

Greek bank executives argue that many of the large corporate

loans simply need to be restructured and should not be sold off at

a loss to third parties.

In one of the few deals seen in the sector, U.S. based KKR &

Co. signed an agreement with two of Greece's leading banks to

manage up to €1.2 billion of their problem loans, in a deal

announced in May.

KKR will help manage underperforming assets owned by Eurobank

and Alpha Bank, Greece's third and fourth largest lenders

respectively, via its platform, known as Pillarstone.

Write to Stelios Bouras at stelios.bouras@wsj.com

(END) Dow Jones Newswires

July 06, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

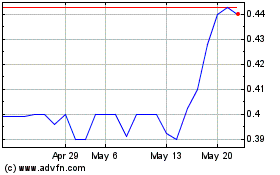

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Jan 2025 to Feb 2025

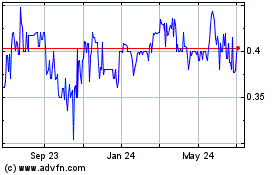

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Feb 2024 to Feb 2025