Scandinavian Airline SAS Gets Rescue Deal From Castlelake-Led Investor Group

October 03 2023 - 12:59PM

Dow Jones News

By Dominic Chopping

STOCKHOLM--SAS is set to be taken over by an investor group led

by Castlelake, which plans to pump over $1 billion into the

struggling airline, averting the threat of bankruptcy.

In the deal, the group will invest a total of $1.18 billion for

majority control of the Scandinavian airline, wiping out existing

shareholders and bringing an end to SAS's 22 years as a listed

company.

The investor group will own around 86% of the airline, with U.S.

investment firm Castlelake taking a 32% stake, the Danish state

increasing its stake to 25.8% from 21.8%, Air France-KLM with 19.9%

and Lind Invest, 8.6%.

"This is a significant achievement of our transformation plan,"

SAS Chairman Carsten Dilling said in a statement. "Securing new

capital is one of the key pillars in the SAS Forward

[transformation] plan and will provide a strong financial

foundation to help drive our airline forward and facilitate our

emergence from the U.S. chapter 11 process."

Like most airlines, SAS was severely weakened by the Covid-19

pandemic, when the company saw its revenue plummet, its cash

reserves dwindle and its debt increase. Grappling with debt and

cut-throat competition from low-cost carriers, SAS launched a

restructuring plan early last year.

SAS aimed to adjust its cost base from top to bottom under the

restructuring, slashing annual costs by SEK7.5 billion while

cutting or converting SEK20 billion of debt and raising capital.

But shortly after launching the plan, around 1,000 SAS pilots went

on strike, worsening finances and prompting SAS to file for Chapter

11 bankruptcy.

SAS has sought to push through the comprehensive measures at a

faster pace under Chapter 11, continuing to operate while

negotiating with stakeholders.

As part of the process, earlier this year it began seeking new

investors to inject cash into the reorganized business. Tuesday's

deal includes $475 million in new unlisted equity, $700 million in

secured convertible debt and $500 million in refinancing by

Castlelake of SAS's current debtor-in-possession term loan.

As a result of the agreement, existing shareholders will be left

with nothing and SAS plans to delist its shares during the second

quarter of next year. Commercial hybrid bond holders are only

expected to receive a modest recovery in their debt.

The governments of Sweden and Denmark each held a 21.8% stake in

SAS before Tuesday's agreement. Denmark previously suggested it was

open to injecting fresh funds and writing off debts, contingent on

other investors contributing and as long as the government

maintained some influence in SAS. Copenhagen Airport is SAS's

largest hub and a key transit route, which Denmark is keen to

maintain.

Sweden had previously rejected a plea for more cash, instead

lending support to converting its debt into equity. It isn't part

of the new investor consortium and will no longer be a shareholder

in the airline.

SAS added that it intends to eventually join the SkyTeam

Alliance, of which Air France-KLM is a founding member, and exit

the Star Alliance, subject to any relevant approvals and emergence

from the Chapter 11 process.

The deal remains subject to relevant approvals and emergence

from the Chapter 11 process, while details and final documentation

for the agreed transaction structure are yet to be finalized.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 03, 2023 12:44 ET (16:44 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

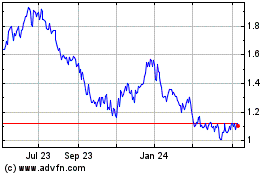

Air France ADS (PK) (USOTC:AFLYY)

Historical Stock Chart

From Nov 2024 to Dec 2024

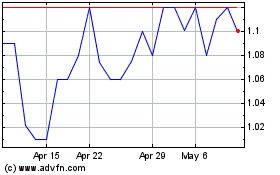

Air France ADS (PK) (USOTC:AFLYY)

Historical Stock Chart

From Dec 2023 to Dec 2024