Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”) is pleased to announce that it has entered into a

definitive business combination agreement with Ensign Minerals Inc.

(“Ensign”) and Revival Gold Amalgamation Corp. (“Revival Subco”)

dated April 9th, 2024 (the “Definitive Agreement”), whereby Revival

Gold will acquire all of the issued and outstanding shares of

Ensign, a private company, in exchange for an aggregate of

61,376,126 million shares of Revival Gold based on a share exchange

ratio of 1.1667 Revival shares for each Ensign share. Upon

completion of the proposed business combination (the

“Transaction”), Revival Gold will pursue engineering and economic

studies at the newly acquired Mercur Gold Project (“Mercur”)

located in Utah, USA while continuing to advance permitting

preparations and ongoing exploration at the Company’s

Beartrack-Arnett Gold Project (“Beartrack-Arnett”) located in

Idaho, USA.

In connection with the Transaction, Paradigm

Capital Inc. and BMO Capital Markets Inc. have agreed to act as

lead agents and joint bookrunners, on behalf of a syndicate of

agents, in connection with a concurrent offering of subscription

receipts of Revival Subco (the “Subscription Receipts”) for

aggregate gross proceeds of C$7,000,000 (the “Concurrent

Offering”).

Transaction Highlights

- Delivers Accretive

Growth. With aggregate Measured and Indicated Mineral

Resources of 2.4 million ounces of gold1,3 and Inferred Mineral

Resources of 3.8 million ounces of gold2,3, the Transaction

increases Revival Gold’s heap leach gold resources per share and

creates one of the largest, pure gold, development companies in the

United States4.

- Shortens Estimated Timeline

to Heap Leach Gold Production. Mercur’s preferential

location on predominately patented (private) claims, in a semi-arid

zone, with existing infrastructure, and a short drive from Salt

Lake City, Utah, is ideal for permitting and is expected to

accelerate Revival Gold’s goal of becoming a mid-tier U.S. heap

leach gold producer.

- Complementary and Sizeable

Asset Base. Opportunity for capital efficient phased

production growth from brownfield sites with a combined target open

pit heap leach production objective of 150,000 ounces of gold per

year from Mercur and Beartrack-Arnett, potentially growing to

greater than 250,000 ounces of gold per year with the exploitation

of Beartrack-Arnett underground mill material. 5,6 A phased

development approach lowers risk and creates greater value per

share as the business grows.

- Significant Exploration

Potential. Numerous open exploration targets have been

identified on the extensive land packages at both Mercur in the

northeastern Great Basin and Beartrack-Arnett in the Idaho Orogenic

Gold Belt.

- Synergies. The

regional proximity of the projects offers the potential to unlock

management, G&A, operational and public market efficiencies. No

significant additional management resources are required since the

assets are in adjacent states approximately six hours’ drive from

each other. There is potential to leverage cross-project experience

and expertise to collaborate on studies, permitting, and project

de-risking.

- Financial

Strength. Concurrent C$7 million equity financing and

existing cash balances will provide funding support to advance key

milestones at Mercur and Beartrack-Arnett.

- Veteran Leadership in

Gold. The resulting company will have significant in-state

experience in the exploration, development, and operation of gold

projects in the Western U.S. with strategic and capital markets

leadership from Toronto backed by a larger group of key

shareholders.

Notes: 1Contained

within 86.2 million tonnes at 0.87 g/t gold at

Beartrack-Arnett. 2Contained within 50.7 million tonnes at 1.34 g/t

gold at Beartrack-Arnett for 2.19 million ounces of gold and 89.6

million tonnes at 0.57 g/t gold at Mercur for 1.64 million ounces

of gold. 3See “Preliminary Feasibility Study NI 43-101 Technical

Report on the Beartrack-Arnett Heap Leach Project, Lemhi County,

Idaho, USA” prepared by Kappes, Cassidy & Associates, IMC, KCH

and WSP, dated August 2nd, 2023, and “NI 43-101 Technical Report

for the Mercur Project, Camp Floyd and Ophir Mining Districts,

Tooele & Utah Counties, Utah, USA” prepared by Lions Gate

Geological Consulting Inc., RESPEC Company LLC, and Kappes, Cassidy

& Associates, dated February 1st, 2024, for further details.

4Based on analysis of industry peers, pre and post transaction

Revival Gold shares outstanding, and pro-forma Mineral Resources

noted in the Technical Reports referenced above. 5Target production

based on Beartrack-Arnett 2023 PFS average production and future

potential from Mercur Mineral Resource. 6Considers potential

underground operation for Beartrack-Arnett based PFS Mineral

Resource factors including 2,500 tpd unground throughput, average

grade, and recovery.

"With the addition of Mercur, we expect to

shorten our estimated timeline to heap leach gold production while

increasing the potential production scale of Revival Gold’s heap

leach gold business to approximately 150,000 ounces per year. The

combined Mineral Resource will vault Revival Gold ahead to become

one of the largest, pure gold, development companies in the United

States”, said Revival Gold President & CEO, Hugh Agro.

Mr. Agro further commented: “We are pleased to

be entrusted by Ensign’s shareholders with the future development

of Mercur. The Transaction is a “win-win” outcome for all concerned

creating a clear path for Revival Gold to unlock significant value

for shareholders by potentially expediting the path to become a

mid-tier open pit heap leach gold producer. With Mercur, Revival

Gold will obtain a high-quality complementary project at an

attractive acquisition price of about US$10 per ounce in situ.

Incorporating an asset that brings forward Revival Gold’s potential

production date marks a considerable enhancement to the value, risk

profile, and upside for the Company”.

John Knowles, Chairman and Director of Ensign,

added: “Ensign is pleased to join with Revival Gold to deliver

value for our respective shareholders in gold. The combined company

will feature veteran industry leadership, synergistic and

complementary gold assets, and a credible business plan to become a

cash-flowing mid-tier U.S. gold producer”.

Conference Call

Management will host a conference call later

this morning to discuss Revival Gold’s acquisition of Ensign.

Call-in information below:

|

Scheduled Start: |

Wednesday,

April 10th, 2024, 10:00 am EST |

|

Call-In Number: |

416-764-8658 |

|

Toll-Free in North America: |

888-886-7786 |

A replay of the conference call will be

available for one week at 416-764-8691 or toll-free in North

America at 877-674-6060. Playback passcode 712425#.

Transaction Details

Pursuant to the terms of the Definitive

Agreement, Revival Gold will acquire all of the issued and

outstanding common shares of Ensign pursuant to a statutory

three-cornered amalgamation (the “Amalgamation”) under the Business

Corporations Act (British Columbia), whereby Ensign and Revival

Gold Amalgamation Corp., a wholly-owned subsidiary of Revival Gold

incorporated for the purpose of completing the Amalgamation, will

amalgamate to form a newly amalgamated company (“Amalco”). Under

the Amalgamation, shareholders of Ensign (“Ensign Shareholders”),

other than Ensign Shareholders who have validly exercised and have

not withdrawn rights of dissent, will receive 1.1667 Revival Shares

(as defined below) for each one common share of Ensign (each, an

“Ensign Share”) held. The consideration implies a purchase price of

C$0.4164 per Ensign Share, or gross consideration of approximately

C$21.9 million, based on a deemed 20-day volume weighted average

price per Revival Share of C$0.3569 prior to announcement. Upon

completion of the Amalgamation, Amalco will become a wholly owned

subsidiary of Revival Gold. As of the date hereof, there are (i)

113,159,547 Revival Shares issued and outstanding, and (ii)

52,606,605 Ensign Shares issued and outstanding. Upon completion of

the Transaction (and without accounting for the Concurrent

Offering), Revival Gold is expected to have approximately

174,535,673 Revival Shares issued and outstanding, on an undiluted

basis, with (i) approximately 65% of such Revival Shares expected

to be held by the current shareholders of Revival Gold, and (ii)

approximately 35% of such Revival Shares expected to be held by the

former shareholders of Ensign.

Upon completion of the Transaction, Revival Gold

will be the parent company and the sole shareholder of Amalco and

will indirectly carry on the current business of Ensign. In

connection with the Transaction, Ensign will seek the approval of

its shareholders with respect to the Amalgamation at a meeting of

Ensign Shareholders to be convened around the end of April 2024

(the “Ensign Meeting”). An information circular providing further

information on the Amalgamation will be provided to the Ensign

Shareholders in connection with the Ensign Meeting.

The Transaction has been unanimously approved by

the Boards of Directors of Revival Gold and Ensign, and the Board

of Directors of Ensign recommends that Ensign shareholders vote in

favour of the Transaction and related matters. Ensign’s Board and

management and other shareholders representing approximately 27% of

the Ensign Shares have entered into voting support agreements in

support of the transaction. Wayne Hubert, Revival Gold’s current

Non-Executive Chairman, is the President and CEO and a Director of

Ensign and abstained from voting on the Transaction for both

Revival Gold and Ensign due to conflicting interests. Closing of

the Transaction is subject to certain condition precedents,

including but not limited to: Obtaining Ensign Shareholder approval

at the Ensign Meeting, obtaining any applicable regulatory

approvals including the approval of the TSXV, closing of the

Concurrent Offering for aggregate gross proceeds of a minimum of

$5,000,000, and other customary conditions for transactions of this

nature.

The Board of Directors of Revival Gold has

received an opinion from MPA Morrison Park Advisors Inc. to the

effect that, based on and subject to the assumptions, limitations,

and qualifications stated in such opinion, the consideration to be

paid by Revival Gold pursuant to the Transaction is fair, from a

financial point of view to Revival Gold.

The Board of Directors of Revival Gold following

the closing of the Transaction is expected to remain at seven (7)

Directors, with Ensign Board of Director nominee Norm Pitcher

expected to replace Michael Mansfield as a Director of Revival

Gold, who is expected to resign from his position upon closing of

the Transaction. Additionally, upon closing of the Transaction,

Revival Gold expects to designate independent Director Tim Warman

as Non-Executive Chairman, with Hugh Agro serving as President

& CEO and Director, John Meyer as Vice President, Engineering

& Development, and Lisa Ross as Vice President & CFO.

Mercur Gold Project

Overview

The majority of the information summarized below

on Mercur has been extracted from the Technical Report titled, “NI

43-101 Technical Report for the Mercur Project, Camp Floyd and

Ophir Mining Districts, Tooele & Utah Counties, Utah, USA”,

prepared by Lions Gate Geological Consulting Inc., RESPEC Company

LLC, and Kappes, Cassidy & Associates, dated February 1st,

2024. The Technical Report will be filed within 45 days of this

news release under Revival Gold’s SEDAR+ profile

(www.sedarplus.ca). Readers are encouraged to read this technical

report in its entirety, including all qualifications, assumptions

and exclusions that relate to the Mineral Resource estimate. This

technical report is intended to be read as a whole, and sections

should not be read or relied upon out of context.

1. Location and

History

Mercur is located 57 kilometers southwest of

Salt Lake City in the Oquirrh Mountains in Utah, a highly

mineralized mountain range that is also host to the Barney’s Canyon

and Melco sediment-hosted gold deposits, and Bingham Canyon, one of

the world’s largest copper-gold mines. See Figure 1, Location Map,

below.

Figure 1: Mercur Gold Project Location

Map

Historically, 2.6 million ounces of gold were

mined from the Mercur District, including approximately 1.5 million

ounces of gold produced from Mercur by Getty Oil Company (“Getty”)

and later Barrick Gold (“Barrick”) during the period of 1983 to

1998.

Mercur includes interests in 463 patented mining

claims, 426 fee land tax parcels, 395 unpatented lode mining

claims, three unpatented mill site claims, and six Utah state

metalliferous minerals leases that cover 6,255 net hectares

(approximately 15,300 net acres) of mineral rights. The existing

Mineral Resources are primarily situated on private land.

Barrick operated Mercur until 1998 when it was

closed due to low gold prices. Since closure, Barrick has

substantially completed reclamation of the Mercur site.

In August 2020, Ensign executed an assignment

agreement with Rush Valley Exploration for 3,579 net hectares

primarily in the West Mercur area, which was followed by, also in

August 2020, a merger agreement with Priority Minerals securing an

additional 213 net hectares in the South Mercur area.

On May 13, 2021, Ensign entered into an option

agreement (subsequently amended on June 13, 2022, May 15, 2023, and

April 1, 2024) with Barrick (the “Barrick Agreement”) to acquire

Barrick’s interests in the Mercur area (the “Mercur Option”). The

Barrick Agreement, as amended, which has an expiry of January 2,

2026, enables Ensign to acquire Barrick’s interests for a total of

US$20 million in cash or, at the sole discretion of Barrick,

shares, payable as follows:

|

(i) |

US$5 million due on exercise of the Mercur Option; |

|

(ii) |

US$5

million due on first anniversary of commercial production at

Mercur; |

|

(iii) |

US$5

million due on second anniversary of commercial production at

Mercur; and, |

|

(iv) |

US$5

million due on third anniversary of commercial production at

Mercur. |

In addition, in connection with the Barrick

Agreement, Ensign issued Barrick four million Ensign warrants with

an exercise price of C$0.25 per Ensign share and an expiry of

January 2, 2029, and granted Barrick a 2% Net Smelter Return

(“NSR”) over the Main Mercur area and a 1% Area of Interest NSR

over certain other Barrick claims within the Mercur district.

In late August 2021, Ensign completed an option

and assignment agreement with Mountainwest Minerals for certain

claims in South Mercur. In October 2021, two option and assignment

agreements were executed with Sacramento Gold Mining (three-year

option to explore 90 net hectares) and Geyser Marion Gold Mining

(three-year option to explore 673 net hectares). Throughout 2021,

Ensign staked several claims at Main, North, South and West Mercur.

In 2022, Ensign executed an exploration license with an option to

purchase on one claim held by a private party and purchased a 4.2%

outstanding interest on some of its properties to consolidate a

100% interest. In 2023, Ensign leased an outstanding 25% interest

in certain claims to increase its interest to 75%. The resulting

Mercur property position is outlined in Figure 2, Mercur Gold

Project Claim Map, below.

Figure 2: Mercur Gold Project Claim

Map

2. Mineral Resource and

Geology

The Mercur property hosts an Inferred Mineral

Resource of 89.6 million tonnes, grading 0.57 g/t gold containing

1.64 million ounces of gold as summarized in Table 1, Mercur Gold

Project Mineral Resource, below.

Table 1: Mercur Gold Project Mineral

Resource Estimate

|

Deposit |

Tonnes (Mt) |

Gold (g/t) |

Contained Gold (koz) |

|

Main Mercur |

74.1 |

0.57 |

1,350 |

|

South Mercur |

15.6 |

0.59 |

290 |

|

Total Inferred |

89.6 |

0.57 |

1,640 |

Note: See “NI 43-101 Technical Report for the

Mercur Project, Camp Floyd and Ophir Mining Districts, Tooele &

Utah Counties, Utah, USA” prepared by Lions Gate Geological

Consulting Inc., RESPEC Company LLC, and Kappes, Cassidy &

Associates, dated February 1st, 2024, for further details.

The Mercur Mineral Resource has been estimated

in conformity with generally accepted guidelines outlined in CIM

Estimation of Mineral Resources and Mineral Reserves Best Practices

Guidelines (November 29, 2019) and is reported in accordance with

NI 43-101.

Estimations are made from 3D block models based

on geostatistical applications using commercial mine planning

software (MinePlan). The project limits are based on a local mine

grid system. Separate block models were set up for Main Mercur and

South Mercur with a nominal block size of 50 x 50 x 30 feet (15 x

15 x 9 meters). Sample data is derived from a combination of

surface diamond and reverse circulation drill holes. The pierce

points of the drill holes into the mineralized zone vary but can be

approximately 25- to 50-foot (8- to 15-meter) spacing in the areas

of historic mining.

There is a total of 2,970 drillholes in the

block models. Of these, 2,861 holes are historical holes that were

primarily drilled by Barrick and Getty, and 109 holes were drilled

by Ensign. Comparisons show that the Ensign drill hole and Barrick

drill hole sample results agree over all areas being

investigated.

The Mercur Mineral Resource estimate has been

generated from drill hole sample assay results and the

interpretation of a geologic model that relates to the spatial

distribution of gold and silver. Interpolation characteristics were

defined based on the geology, drill hole spacing, and

geostatistical analysis of the data. The Mineral Resources were

classified according to their proximity to sample data locations

and are reported, as required by NI 43-101, according to the CIM

Definition Standards for Mineral Resources and Mineral Reserves

(May 2014).

3. Exploration &

Development

Revival Gold considers the large regional

package at Mercur to hold attractive potential for additional

discoveries based on the project’s track record of past production

and the results of recent fieldwork undertaken by Ensign.

Nevertheless, Revival Gold’s primary objective with its work

programs on Mercur over the next 6-12 months will be to advance

metallurgy, optimize the project’s geological model and pursue the

completion of a potential PEA.

While advancing towards a PEA, Revival Gold

expects to continue the compilation of historical data,

property-wide prospecting, geological mapping, and planning for

potential future exploration drilling.

The potential exists to expand existing

resources and to identify new gold resources beyond the pit margins

of the historical Mercur mine. At South Mercur, there are also

opportunities to expand the known gold

mineralization.

In addition to the potential expansion of known

mineralization at Main Mercur and South Mercur, Mercur offers

several exploration opportunities for new targets. At Main Mercur,

the potential for mineralized feeder structures and deeper,

potential stratigraphic host units is under-explored. At South

Mercur, where mineralization seems to occur at the intersection of

the northerly striking Mercur Member beds and northwest-trending

structural zones, there is potential for the discovery of new

en-echelon pods of mineralization. The West Mercur pediment is a

greenfield area that holds potential for deposits concealed beneath

relatively thin alluvial cover. North Mercur is an early-stage

exploration area that has permissive geology for new silver and

gold discoveries.

4. Metallurgy

Mineralization at Mercur consists of very fine

to fine gold particles associated with oxide, sulfide, and

carbonaceous minerals. The oxidation profile in the deposits is

complex with influence from bottom-up fluid movement and structural

disruption. A carbon-in-leach (“CIL”) process plant was built and

commissioned at the site in 1983 to process the higher-grade ore

and operated until 1997. This CIL plant operated until 1997 and

produced approximately 1.5 million ounces of gold. A dump heap

leach for the low-grade materials operated from 1985 to 1998

producing approximately 380,000 ounces of gold. In 1988, a pressure

oxidation (“POX”) plant was installed to treat refractory sulfide

materials. This POX plant operated until February 1996 and

pre-processed approximately 300,000 ounces of gold ultimately

produced out of the CIL plant. Mercur produced approximately 1.5

million ounces of gold until it was closed by Barrick in 1998.

Ensign’s focus has been on potential heap

leachable and/or CIL material at Mercur. During 2022 and 2023,

initial metallurgical test work was completed for Ensign jointly by

Bureau Veritas Minerals in Richmond, British Columbia, Canada and

ALS Metallurgy in Kamloops, British Columbia, Canada. This work

included ten CIL bottle roll cyanide amenability tests (2022) and

ten direct cyanidation (“DCN”) leach tests (2022).

Historical and Ensign DCN testing results were

used by Ensign’s consultants to estimate heap leach gold

recoveries. DCN estimates were incorporated into the Mercur block

model then discounted by 15% to reflect potential heap leach gold

recoveries. The gold recoveries assumed for the Mercur Mineral

Resource estimate by domain are summarized in Table 2 below.

Table 2: Heap Leach Gold Recoveries

Assumed for the Mercur Mineral Resource

|

Mineral Resource Area |

Tonnes(Mt) |

Estimated Heap LeachGold

Recovery |

|

Main Mercur |

74.1 |

65% |

|

South Mercur |

15.6 |

55% |

|

Total/Weighted Average |

89.6 |

63% |

Note: See “NI 43-101 Technical Report for the Mercur Project,

Camp Floyd and Ophir Mining Districts, Tooele & Utah Counties,

Utah, USA” prepared by Lions Gate Geological Consulting Inc.,

RESPEC Company LLC, and Kappes, Cassidy & Associates, dated

February 1st, 2024, for further details.

5. Existing

Infrastructure

Mercur has existing infrastructure with a paved

access road to the Mercur security gate. The former Barrick mine

offices and security gate are operational. The site is connected to

grid power at 460 kW and has potential access to water through

wells used by the prior operation. The wells and associated water

rights are currently held by Tooele County and are not in use.

Concurrent Offering Details

Revival Gold will issue a subsequent news

release outlining the details of the proposed Concurrent Offering

once finalized. The net proceeds of the Concurrent Offering are

expected to be used by Revival Gold, following completion of the

Transaction, to complete a Preliminary Economic Assessment (“PEA”)

on Mercur, advance permitting preparations on Beartrack-Arnett,

continue exploration for high-grade material at Beartrack-Arnett,

and for working capital and general corporate purposes. In

addition, Revival Gold will grant the Agents an option,

exercisable, in whole or in part, for a period of up to two (2)

business days prior to the closing of the Concurrent Offering, to

sell up to an additional 15% of the Subscription Receipts offered

under the Concurrent Offering. The Concurrent Offering is subject

to settling definitive terms, the approval of the TSX Venture

Exchange (the “TSXV”) and other necessary regulatory approvals. The

Concurrent Offering is expected to close in early May, 2024.

Select Financial

Information

The following table presents selected financial

statement information with respect to Ensign. Such information is

derived from the unaudited financial statements of Ensign for the

financial years ended December 31, 2023, and 2022, and the

unaudited interim financial statements of Ensign for the nine

months ended September 30, 2023.

|

|

As at September 30, 2023 ($US) |

As at December 31, 2023 ($US) |

As at December 31, 2022 ($US) |

|

Current Assets |

147,788 |

82,012 |

722,056 |

|

Non-Current Assets |

4,163,063 |

4,149,430 |

4,339,396 |

|

Total Assets |

4,310,851 |

4,231,442 |

5,061,452 |

|

Current Liabilities |

35,246 |

361,749 |

13,799 |

|

Non-Current Liabilities |

- |

- |

- |

|

Total Liabilities |

35,246 |

361,749 |

13,799 |

|

Net Assets |

4,275,605 |

3,869,693 |

5,047,653 |

|

|

Nine months ended September 30, 2023 ($US) |

Year ended December 31, 2023 ($US) |

Year ended December 31, 2022 ($US) |

|

Exploration and Evaluation costs |

697,081 |

931,683 |

3,124,919 |

|

Administration and Travel |

453,543 |

606,182 |

1,017,729 |

|

Share Based Compensation |

287,940 |

305,026 |

262,253 |

|

Other Expenses |

744 |

1,075 |

- |

|

Depreciation |

44,665 |

58,298 |

61,016 |

|

Interest and Financing |

57 |

57 |

465 |

|

Net loss for the period |

1,484,030 |

1,902,321 |

4,466,382 |

Since inception, Ensign has issued 52.6 million

common shares for consideration totalling C$18.7 million

(approximately C$0.36 per Ensign common share) and incurred

cumulative exploration expenditures of approximately

US$7,500,000.

The securities being offered pursuant to the

Concurrent Offering, or the Transaction have not been, nor will

they be, registered under the U.S. Securities Act and may not be

offered or sold in the United States or to, or for the account or

benefit of, U.S. persons absent registration or an applicable

exemption from the registration requirements. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any

state in which such offer, solicitation or sale would be unlawful.

“United States” and “U.S. person” are as defined in Regulation S

under the U.S. Securities Act.

Advisors and Counsel

MPA Morrison Park Advisors Inc. is acting as

financial advisor to Revival Gold. Peterson McVicar LLP is acting

as Revival Gold’s legal counsel. Osler, Hoskin & Harcourt LLP

is acting as Ensign’s legal counsel.

Qualified Persons

John P.W. Meyer, Vice President, Engineering and

Development, P.Eng., and Steven T. Priesmeyer, C.P.G., Vice

President Exploration, Revival Gold Inc., are the Company’s

designated Qualified Persons for this news release within the

meaning of National Instrument 43-101 Standards of Disclosure for

Mineral Projects and have reviewed and approved its scientific and

technical content.

About Revival Gold Inc.

Revival Gold is a growth-focused gold

exploration and development company. The Company is advancing the

Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing

gold mine in Idaho. The Project benefits from extensive existing

infrastructure and is the subject of a recent Preliminary

Feasibility Study for the potential restart of open pit heap leach

gold production operations.

Since reassembling the Beartrack-Arnett land

position in 2017, Revival Gold has made one of the largest new

discoveries of gold in the United States in the past decade. The

mineralized trend at Beartrack extends for over five kilometers and

is open on strike and at depth. Mineralization at Arnett is open in

all directions.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.com or on SEDAR+ at

www.sedarplus.ca.

For further information, please contact:

Hugh Agro, President or CEO or Lisa

Ross, CFOTelephone: (416) 366-4100 or Email:

info@revival-gold.com.

Ensign Minerals Inc.

Ensign is a private company existing under the

Business Corporations Act (British Columbia) and focused on

exploring for precious metals within the Mercur District, Utah,

USA. Ensign controls approximately 6,255 hectares in the district

where the known mineralization occurs on primarily privately held

patented claims. Ensign’s property holdings include Mercur, West

Mercur, South Mercur and North Mercur.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release includes certain

"forward-looking information" within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”). Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this document

include, but are not limited to, the advancement of permitting

preparations and ongoing exploration at Beartrack-Arnett, the

shortening of Revival Gold’s estimated timing to heap leach gold

production, statements with respect to the potential production

scale of Revival Gold’s heap leach gold business, the opportunity

for capital efficient phased production growth from brownfield

sites, a phased development approach lowers risk and creates

greater value per share as the business grows, potential synergies

between Revival Gold and Ensign, risk factors relating to the

timely receipt of all applicable shareholder, regulatory and third

party approvals for the Concurrent Offering or the Transaction,

including that of the TSX Venture Exchange, that the Concurrent

Offering or the Transaction may not close within the timeframe

anticipated or at all or may not close on the terms and conditions

currently anticipated by the Company for a number of reasons

including, without limitation, as a result of the occurrence of a

material adverse change, disaster, change of law or other failure

to satisfy the conditions to closing of the Offering; the inability

of the Company to apply the use of proceeds from the Offering as

anticipated; the size of the Concurrent Offering, the resale

restrictions of the securities issued pursuant to the Concurrent

Offering, the ability of Revival Gold to unlock value for

shareholders and enhance the value, risk profile and upside for the

Company, Revival Gold having a credible business plan to become a

cash-flowing mid-tier U.S. gold producer, the expected timing of

the Ensign Meeting, Revival Gold’s primary objective with its work

programs on Mercur over the next 6-12 months being to advance

metallurgy, optimize the project’s geological model and pursue the

completion of a potential PEA, satisfaction of the Escrow Release

Conditions, the Company’s objectives, goals and future plans, and

statements of intent, the implications of exploration results,

mineral resource/reserve estimates and the economic analysis

thereof, exploration and mine development plans, timing of the

commencement of operations, estimates of market conditions, and

statements regarding the results of the pre-feasibility study,

including the anticipated capital and operating costs, sustaining

costs, net present value, internal rate of return, payback period,

process capacity, average annual metal production, average process

recoveries, concession renewal, permitting of the project,

anticipated mining and processing methods, proposed pre-feasibility

study production schedule and metal production profile, anticipated

construction period, anticipated mine life, expected recoveries and

grades, anticipated production rates, infrastructure, social and

environmental impact studies, availability of labour, tax rates and

commodity prices that would support development of the Project.

Factors that could cause actual results to differ materially from

such forward-looking statements include, but are not limited to

failure to identify mineral resources, failure to convert estimated

mineral resources to reserves, the inability to maintain the

modelling and assumptions upon which the interpretation of results

are based after further testing, the inability to complete a

feasibility study which recommends a production decision, the

preliminary nature of metallurgical test results, delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals, changes in regulatory

requirements, political and social risks, uncertainties relating to

the availability and costs of financing needed in the future,

uncertainties or challenges related to mineral title in the

Company’s projects, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity and in particular gold

prices, delays in the development of projects, capital, operating

and reclamation costs varying significantly from estimates, the

continued availability of capital, accidents and labour disputes,

and the other risks involved in the mineral exploration and

development industry, an inability to raise additional funding, the

manner the Company uses its cash or the proceeds of an offering of

the Company’s securities, an inability to predict and counteract

the effects of COVID-19 on the business of the Company, including

but not limited to the effects of COVID-19 on the price of

commodities, capital market conditions, restriction on labour and

international travel and supply chains, future climatic conditions,

the discovery of new, large, low-cost mineral deposits, the general

level of global economic activity, disasters or environmental or

climatic events which affect the infrastructure on which the

project is dependent, and those risks set out in the Company’s

public documents filed on SEDAR+. Although the Company believes

that the assumptions and factors used in preparing the

forward-looking statements in this news release are reasonable,

undue reliance should not be placed on such information, which only

applies as of the date of this news release, and no assurance can

be given that such events will occur in the disclosed time frames

or at all. Specific reference is made to the most recent Annual

Information Form filed on SEDAR+ for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this presentation. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

other than as required by law.

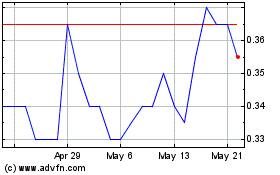

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Dec 2023 to Dec 2024