Guardian Announces Proposed Business Combination

September 23 2009 - 4:10PM

Marketwired Canada

Guardian Exploration Inc. (TSX VENTURE:GX) ("Guardian") is pleased to announce

that it has entered into a letter of intent (the "Letter of Intent") with

respect to a proposed business combination (the "Business Combination") of

Guardian and Luxor Oil & Gas Inc. ("Luxor"), an Alberta based private oil and

gas company. The resulting issuer following the Proposed Business Combination is

herein referred to as "Newco".

About the Business Combination

Guardian and Luxor have agreed to combine their businesses to form a new oil and

natural gas exploration and development company which will continue under a name

that is to be determined. The Letter Agreement contemplates that Guardian and

Luxor will, with the assistance of their respective professional advisers,

determine a transaction structure for the Business Combination. Representatives

of Guardian and Luxor expect to finalize the transaction structure for the

Business Combination and enter into a formal agreement on or prior to September

30, 2009, at which time Guardian and Luxor expect to issue a further press

release setting out additional details concerning the Business Combination.

For purposes of the Business Combination, it is anticipated that with respect to

Guardian, the outstanding common shares of Guardian ("Guardian Shares")

(including Guardian Shares issued on exercise or conversion of Guardian's issued

and outstanding convertible securities subsequent to the date hereof and prior

to the effective date of the Business Combination) will be exchanged for such

number of common shares ("Newco Shares") of the resulting company after

completion of the Business Combination ("Newco") as will reflect a net value of

Guardian equal to $500,000 (the "Guardian Exchange Ratio"), subject to

adjustment based upon the due diligence review of Guardian to be completed by

Luxor.

For purposes of the Business Combination, it is anticipated that with respect to

Luxor, the outstanding common shares of Luxor ("Luxor Shares") (including Luxor

Shares issued on exercise or conversion of Luxor's issued and outstanding

convertible securities subsequent to the date hereof and prior to the effective

date of the Business Combination) will be exchanged for such number of Newco

Shares as will reflect a net value of Luxor equal to $700,000 (inclusive of the

Luxor Share Financing, as defined below) (the "Luxor Exchange Ratio"), subject

to adjustment based upon the value of Luxor at closing. The value of Luxor will

be based on the independent valuation of Luxor oil and gas reserves (based on

proven plus one-half probable reserves at 15% discount to constant dollar

values) and net positive working capital of Luxor at Closing.

Further, pursuant to the Business Combination, holders of Luxor Shares will

receive an option whereby if certain payables of Guardian, which are considered

to be inactive, become active within 12 months following closing of the Business

Combination ("Renewed Payable Claims"), the shareholders of Luxor will have an

option to receive additional Newco Shares equal to the amount of the Renewed

Payable Claims multiplied by the Luxor Exchange Ratio at an exercise price of

$0.01 per Newco Share.

Other than as described below, all unexercised options and warrants to purchase

Guardian Shares or Luxor Shares will either be exercised prior to the effective

date of the Business Combination or will continue as Newco options or warrants

for the purchase of Newco Shares.

It is contemplated that the board of directors of the Newco will consist of five

members, including Wally Pollock and Issa Abu-Zahra, current directors of Luxor,

and Scott Reeves, a current director of Guardian, along with two additional (2)

nominees of Luxor. Mr. Pollock will also be appointed President and Chief

Executive Officer of Newco and Mr. Abu-Zahra will be appointed the

Vice-President, Operations. Additional officers of Newco, including a Chief

Financial Officer, are expected to be identified prior to the completion of the

Business Combination. Newco will also adopt an incentive stock option plan in

accordance with the policies of TSX Venture Exchange (the "Exchange") providing

for a pool of stock options to be not less than 10% of the issued and

outstanding shares of Newco, and such options will be granted to the management

and board of directors of Newco as determined by the board of directors of Newco

following closing of the Business Combination.

The Business Combination is an arms' length transaction as none of the directors

or officers of Luxor have any interest whatsoever in Guardian.

Prior to Closing, Luxor will complete a private placement financing involving

the issuance of units, each unit consisting of one Luxor Share and one purchase

warrant, at a price not less than $0.85 per unit, with each purchase warrant

being exercisable into one Luxor Share at a purchase price of $0.85 per Luxor

Share for a period of 24 months following closing (the "Luxor Share Financing").

Also prior to Closing, Luxor will also complete a private placement financing

involving the issuance of Luxor convertible debentures, convertible into Newco

Shares at a price not less than $0.0125 per share, for gross proceeds of

$800,000 (the "Luxor Debenture Financing").

Concurrently with the Closing of the Business Combination, Graydon Kowal,

President and Chief Executive Officer of Guardian ("Kowal") will (a) return to

Guardian for cancellation 7.3 million Guardian Shares beneficially held by him;

(b) execute an escrow agreement in a form suitable to Luxor and Guardian placing

2 million Guardian Shares owned by Kowal into escrow; (c) execute a settlement

agreement settling all employment matters including, but not limited to, any

severance and bonus entitlements for the sum of $1; and (d) agree to the

cancellation of all option of Guardian held by him. In exchange, Guardian will

agree to transfer to Kowal at Closing its 100% shareholding in its wholly-owned

subsidiary, K2 America Corp. and grant to Kowal an option to repurchase the oil

and gas interests owned by Guardian in the Gunnel area of British Columbia for

an option price equal to $1, which option will terminate if an economic oil or

gas well has been drilled and tested by Luxor or its farm-in or joint venture

partner on or before December 31, 2012 (collectively, the "Kowal Obligations").

Completion of the Business Combination is subject to a number of conditions in

favor of Guardian and Luxor, respectively, including the execution and delivery

of a formal agreement, board approval of such formal agreement, completion of

satisfactory due diligence inquiries, receipt of all necessary regulatory

approvals (including the consent of the Exchange), receipt of third party

approvals, approval of the shareholders of Guardian and Luxor, Guardian having a

working capital deficit at Closing of not greater than $400,000 (net of

Guardian's $1.8 million flow through obligation and abandonment liabilities),

Guardian having net production from its wells located in the Girouxville area of

Alberta not less than an average of 115 bbls/day for the 60 days prior to August

31, 2009, the settlement by Guardian of all of its management contract

liabilities prior to Closing, Guardian having unexpended flow through share

contractual commitments of not greater than $1,800,000 at Closing, Luxor having

working capital at Closing of not less than $200,000 (including the Luxor Share

Financing, but not including the Luxor Debenture Financing), the completion of

the Luxor Debenture Financing for proceeds of not less than $800,000, the Kowal

Obligations being satisfied, and a threshold for the exercise of dissent rights

(10%) not being exceeded (if the Business Combination is structured in such a

manner as to give rise to statutory dissent rights). There is no assurance that

these conditions will be satisfied and the Business Combination will be

completed.

Information about Guardian Exploration Inc.

Guardian Exploration Inc. is an Alberta-based oil and natural gas company.

Guardian is engaged in the exploration for, and the acquisition, development and

production of, natural gas and crude oil with emphasis on the shallow to

mid-depth hydrocarbon prone zones of the western Canadian sedimentary basin in

Alberta and northeastern British Columbia.

Investors are cautioned that this news release contains forward looking

information. Such information is subject to known and unknown risks,

uncertainties and other factors that could influence actual results or events

and cause actual results or events to differ materially from those stated,

anticipated or implied in the forward-looking information. Readers are cautioned

not to place undue reliance on forward-looking information, as no assurances can

be given as to future results, levels of activity or achievements.

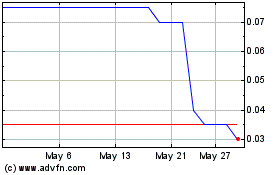

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jun 2024 to Jul 2024

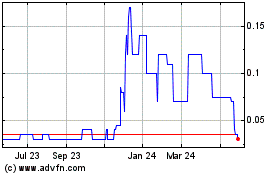

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jul 2023 to Jul 2024