Excelsior Announces 2008 Results

April 23 2009 - 5:32PM

Marketwired Canada

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company")

announces that is has filed its financial statements and management's discussion

and analysis for the year ended December 31, 2008. The Company has also filed

its reports regarding its reserve data and other oil and natural gas information

as mandated by National Instrument 51-101. The above referenced documents are

available for viewing on SEDAR at www.sedar.com.

"We are excited by the opportunity that our proprietary in situ combustion

technology ("COGD") could provide a lower cost and more efficient recovery

process for heavy oil and bitumen. The Company is on track to submit its

experimental project application by the end of June 2009 to demonstrate the

technology. Two seasons of core well delineation have confirmed the high quality

bitumen resource at Hangingstone which importantly, is in close proximity to

infrastructure that will drive the project cycle-time and capital efficiency"

said David Winter, Excelsior's President and Chief Executive Officer. "The

Company continues to meet its objectives and execute its programs on schedule

and on budget. Excelsior is fully funded to submit its Hangingstone COGD project

application, reprocess seismic in the North Sea and cover ongoing general and

administration costs to the end of 2010. We recognise that current economic

conditions limit access to capital and will await the return of market stability

in order to finance the COGD pilot at Hangingstone and appraisal of our North

Sea properties."

2008 Highlights

- The Company completed the 2007/2008 winter drilling program in March, 2008

drilling a total of 35 core wells at Hangingstone and Surmont which represented

the majority of $14.3 million of capital expenditures in 2008. The program was

completed on schedule and on budget with results exceeding expectations.

Fourteen of these wells contained excellent net pay thickness in excess of 20

meters, including six wells exceeding 30 meters.

- An independent engineering report on the Hangingstone asset was completed by

McDaniel and Associates in July 2008, ("the Report"). The Report assigned 119

mmbbls of contingent resources, 1.59 billion barrels of discovered resource

(petroleum initially in place) and a further 86 mmbbls of prospective resource.

The Company updated the reports for Hangingstone and West Surmont to December

31, 2008. The updated reports assigned 132 mmbbls of contingent resources, 2.2

billion barrels of discovered resource (petroleum initially in place) and a

further 85 mmbbls of prospective resource. The reports were updated to include

data from two new core holes drilled in late December 2008 at Hangingstone, and

nine wells drilled at West Surmont in Q1 2008, and current economic conditions

and oil price forecast.

- The Company developed a proprietary in situ combustion bitumen-recovery

process ("Combustion Overhead Gravity Drainage"). The COGD technology provides

an opportunity to significantly improve bitumen recovery economics through both

enhanced recovery gains and substantial reductions in the amount of required

water, fuel gas and diluents than that used in SAGD applications. The Company

has consequently suspended plans to develop Hangingstone with steam assisted

gravity drainage ("SAGD") technology in favour of a strategy to deploy a COGD

process.

- The Company completed two equity financings in 2008 for gross proceeds of

$12.5 million. Excelsior had working capital of $11.5 million at December 31,

2008 to fund the 2008/2009 winter core drilling program at Hangingstone, an

experimental COGD in situ pilot application, and general corporate expenses to

the end of 2010.

- The Company restructured its holdings in Excelsior Energy North Sea Limited

("EENS") exchanging all shares of EENS for shares in ENS Energy Ltd. ("ENS"), a

newly incorporated Alberta private company. Subsequent to the restructuring, ENS

issued 25% of its common shares in a private placement for gross proceeds of

$1.0 million. The financing had the effect of reducing the Company's equity

interest in ENS from 100% to 75% as Excelsior did not participate in the

financing resulting in a gain on reorganization of $614,544. The transaction

segregated the Company's oil sands and North Sea assets to provide better access

to capital markets for these opportunities independently.

- The Company had commitments to incur and renounce $16,425,800 of eligible

expenditures by December 31, 2008, and $9,237,766 of eligible expenditures by

December 31, 2009. As at December 31, 2008, the Company incurred approximately

$18,080,000 of eligible expenditures. The remaining $7,583,566 of eligible

expenditures to be incurred by December 31, 2009 are expected to be satisfied

with the 2008/2009 winter drilling program at Hangingstone.

2009 Activity and Outlook

- Excelsior successfully completed a 29 core well delineation program in mid

March at Hangingstone on schedule and on budget. Two additional areas discovered

last year have been further delineated. These greatly expand the area of thick

bitumen sands and confirm the excellent resource potential at Hangingstone. A

new resource report incorporating all 29 new core wells by McDaniel and

Associates is expected to be completed by late Q2 2009.

- All data necessary to support the experimental project application has been

obtained and Excelsior expects to submit a COGD experimental project application

to the Alberta Government targeted by the end of Q2 2009. Regulatory approval is

expected to take approximately one year with pilot start-up anticipated for Q1

2011.

- Seismic reprocessing on licence P1500 in the UK North Sea has been completed

and interpreted. A potential drilling location has been identified to test one

of the prospects which is a step-out from an existing oil discovery drilled in

1996. The Company is required to commit to drill on the block by November 30,

2009, or relinquish the licence at no further cost.

- ENS was awarded licence P1691 for two new blocks in the UK North Sea at 16/1b

and 16/2c in the UKCS 25th Licensing Round by DECC in March 2009. These blocks

are contiguous to ENS's existing North Sea blocks and cement our acreage

position around our primary prospect. The licence requires seismic reprocessing

and interpretation on the blocks over the next two years.

Selected Information

---------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

($'s except weighted average shares) Dec 31, 2008 Dec 31, 2007

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gas revenue 108,001 76,335

Royalties (16,496) (16,585)

Operating expenses (35,102) (19,115)

----------------------------------------------------------------------------

Net gas revenue 56,403 40,635

----------------------------------------------------------------------------

Interest and other income 317,672 374,764

General and administrative expense 1,537,808 1,232,441

Net loss and comprehensive loss (3,401,081) (4,941,321)

Loss per share (basic and diluted) (0.03)

(0.07)

----------------------------------------------------------------------------

Capital expenditures

Petroleum and natural gas properties - cash 14,285,031 32,472,009

----------------------------------------------------------------------------

Cash flows

Cash flows used in operations (1,086,857) (1,023,540)

Cash flows used in investing (13,597,374) (29,692,266)

Cash flows from financing 12,583,640 42,598,497

----------------------------------------------------------------------------

Change in cash and cash equivalents (2,100,591) 11,882,691

Cash and cash equivalents, beginning of year 15,848,648 3,965,957

----------------------------------------------------------------------------

Cash and cash equivalents, end of year 13,748,057 15,848,648

----------------------------------------------------------------------------

Basic and diluted weighted average number of

shares outstanding 119,986,718 65,768,355

----------------------------------------------------------------------------

About Excelsior Energy

Excelsior is an early stage, oil sands company with 58 operated sections in the

Hangingstone and West Surmont areas of the Athabasca Oil Sands Region near Fort

McMurray, Alberta. The Company has developed a proprietary in situ combustion

technology (Combustion Overhead Gravity Drainage "COGD") which has game-changing

potential in the development and recovery of heavy oil and bitumen. An

application for an experimental pilot project to field demonstrate the COGD

technology will be submitted in Q2 2009 with a targeted start up in Q1 2011. In

addition the Company indirectly holds a 100% working interest in UK North Sea

Licences P.1500 and P.1691 covering four part-blocks through its 75% owned

subsidiary ENS Energy Ltd. Excelsior's strategy is to capture oil and gas

appraisal and development opportunities where we can leverage Management's

diverse international operating, heavy oil and field development expertise with

developing technologies to produce oil and gas.

Forward Looking Statements

This press release contains forward-looking statements. Management's assessment

of future plans and operations, expected production levels, operating costs,

capital expenditures, the nature of capital expenditures, methods of financing

capital expenditures, future engineering reports and the timing of increases in

production may constitute forward-looking statements under applicable securities

laws and necessarily involve risks including, without limitation, risks

associated with oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

currency fluctuations, imprecision of reserve estimates, environmental risks,

competition from other producers, inability to retain drilling rigs and other

services, incorrect assessment of the value of acquisitions, failure to realize

the anticipated benefits of acquisitions, delays resulting from or inability to

obtain required regulatory approvals and ability to access sufficient capital

from internal and external sources. As a consequence, the Company's actual

results may differ materially from those expressed in, or implied by, the

forward-looking statements. Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and other factors

that could effect the Company's operations and financial results are included in

reports on file with Canadian securities regulatory authorities and may be

accessed through the SEDAR website (www.sedar.com). Furthermore, the forward

looking statements contained in this press release are made as at the date of

this press release and the Company does not undertake any obligation to update

publicly or to revise any of the included forward looking statements, whether as

a result of new information, future events or otherwise, except as may be

required by applicable securities laws.

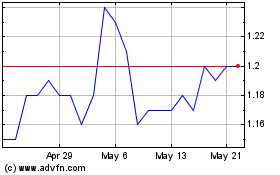

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

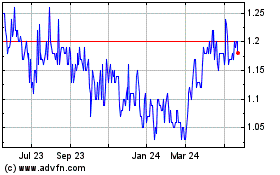

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024