Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company") is

pleased to report results for the three and six month periods ended June 30,

2008. The Company continues to focus efforts on oil sands exploration and

appraisal in the Hangingstone and West Surmont areas in the Athabasca oil sands

region of Alberta. The success of the core delineation program at Hangingstone

during the past winter has confirmed the resource potential of this asset. An

independent resource evaluation by McDaniel and Associates dated July 1, 2008

("the Report"), as announced on July 29, 2008, supports an economically feasible

commercial project, allowing Excelsior to move towards an application for a

development pilot project at Hangingstone by mid-2009.

"The Report confirms the commercial potential of the Hangingstone asset and

supports Excelsior's plan for a 10,000 bopd SAGD demonstration project

application in Q2 2009," said David Winter, Excelsior's President and Chief

Executive Officer. "The report results triggered a financing of up to $20

million to fund the 2008/2009 winter drilling program."

Second Quarter Highlights

- Core analysis from the core drilling programs was completed on May 28, 2008.

- Excelsior engaged an experienced oil sands contractor to assist in regulatory

application and environmental assessments for the Phase I production project;

fieldwork commenced in July 2008.

- Excelsior contracted Paradigm Strategic Consulting, an industry leader in

digital subsurface asset management, to accelerate the development planning of a

Phase 1, 10,000 barrels of bitumen per day SAGD project at Hangingstone.

- The Company restructured its holdings in Excelsior Energy North Sea Limited

("EENS") exchanging all shares of EENS for shares in ENS Energy Ltd. ("ENS"), a

newly incorporated Alberta private company. Subsequent to the restructuring, ENS

issued 25% of its common shares in a private placement for gross proceeds of

$1.0 million. The financing had the effect of reducing the Company's interest in

ENS from 100% to 75% as Excelsior did not participate in the financing. The

transaction segregated the Company's oil sands and North Sea assets, providing

access to capital markets for these opportunities independently.

Third Quarter Outlook

- Excelsior entered into an agreement on August 6, 2008 to raise up to $20

million through a private placement financing on a best efforts basis. The

Company plans to issue a combination of common shares at $0.29 per share and

common shares issued on a flow-through basis at $0.34 per share. The financing

is expected to close in early September 2008.

- An independent engineering report on the Hangingstone asset was completed by

McDaniel and Associates in July 2008.

- Excelsior will submit an oil sands exploration application to Alberta's Energy

Resources Conservation Board permitting the Company to engage in seismic and

drilling activities at Hangingstone and West Surmont for the 2008/2009 winter

program.

The following information should be read in conjunction with the management

discussion and analysis and unaudited interim consolidated financial statements

for the three and six months ended June 30, 2008, available online at

www.sedar.com.

Selected Information

----------------------------------------------------------------------------

($'s except

weighted average Six Months Six Months Three Months Three Months

shares) Ended Ended Ended Ended

June 30, 2008 June 30,2007 June 30, 2008 June 30, 2007

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gas sales 82,112 59,820 45,074 27,866

Royalties (12,461) (13,936) (6,410) (4,877)

Operating costs (18,066) (8,265) (10,020) (6,437)

----------------------------------------------------------------------------

Net gas revenue 51,585 37,619 28,644 16,552

----------------------------------------------------------------------------

Interest and

other income 191,947 54,338 51,418 28,269

General and

administrative

expense 703,922 495,227 424,894 258,786

Net loss and

comprehensive

loss (1,412,154) (623,710) (834,659) (319,607)

Loss per share

(basic and

diluted) (0.01) (0.01) (0.01) (0.01)

----------------------------------------------------------------------------

Capital

expenditures

Petroleum and

natural gas

properties - cash 11,256,704 8,954,619 416,799 6,565,998

----------------------------------------------------------------------------

Cash flows

Cash flows from

(used in)

operations (289,684) (572,576) 117,474 (354,183)

Cash flows used

in investing (12,341,523) (8,878,259) (5,644,061) (6,050,631)

Cash flows from

financing 2,111,725 35,847,176 1,000,000 32,890,043

----------------------------------------------------------------------------

Change in cash

position (10,519,482) 26,396,341 (4,526,587) 26,485,229

Cash and cash

equivalents,

beginning

of period 15,848,648 3,965,957 9,855,753 3,877,069

----------------------------------------------------------------------------

Cash and cash

equivalents, end

of period 5,329,166 30,362,298 5,329,166 30,362,298

----------------------------------------------------------------------------

Weighted average

number of shares

outstanding 107,917,809 34,699,258 108,824,891 41,110,964

----------------------------------------------------------------------------

Clarification

The Company would like to clarify that Mssr. Jeffrey, a member of the Audit

Committee, is not considered by the Company to be independent for the purposes

of National Instrument 52-110 contrary to the disclosure contained in the

Management Information Circular of the Company dated May 20, 2008.

About Excelsior Energy

Excelsior is active in oil sands exploration and appraisal in the Hangingstone

and West Surmont areas near Fort McMurray, Alberta and will hold a 75% working

interest in 58 contiguous sections on completion of its farm-in obligations. The

Company also indirectly holds a 75% working interest in Blocks 16/1a and 16/6c

in the UK North Sea and a minor interest in gas production in Alberta.

Excelsior's strategy is to capture oil and gas appraisal and development

opportunities where we can leverage Management's diverse international

experience and field development expertise. This includes heavy oil reservoir

engineering and development of complex fields.

Forward Looking Statements

This press release contains forward-looking statements. Management's assessment

of future plans and operations, expected production levels, operating costs,

capital expenditures, the nature of capital expenditures, methods of financing

capital expenditures, future engineering reports and the timing of increases in

production may constitute forward-looking statements under applicable securities

laws and necessarily involve risks including, without limitation, risks

associated with oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

currency fluctuations, imprecision of reserve estimates, environmental risks,

competition from other producers, inability to retain drilling rigs and other

services, incorrect assessment of the value of acquisitions, failure to realize

the anticipated benefits of acquisitions, delays resulting from or inability to

obtain required regulatory approvals and ability to access sufficient capital

from internal and external sources. As a consequence, the Company's actual

results may differ materially from those expressed in, or implied by, the

forward-looking statements. Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and other factors

that could effect the Company's operations and financial results are included in

reports on file with Canadian securities regulatory authorities and may be

accessed through the SEDAR website (www.sedar.com). Furthermore, the forward

looking statements contained in this press release are made as at the date of

this press release and the Company does not undertake any obligation to update

publicly or to revise any of the included forward looking statements, whether as

a result of new information, future events or otherwise, except as may be

required by applicable securities laws.

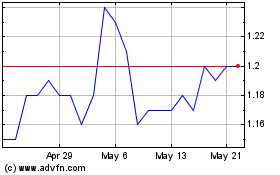

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

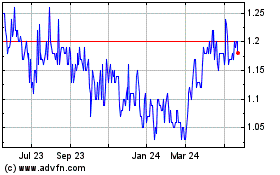

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024