Excelsior Announces Up to $20 Million Equity and Flow-Through Offering to Further Delineate Oil Sands Properties at Hangingstone

August 06 2008 - 5:22PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Corporation") is

pleased to announce that it has commenced an overnight marketed public offering

where the Corporation intends to raise up to $20 million through the combination

of flow-through common shares (the "FT Common Shares") at a price of $0.34 per

FT Common Share and common shares (the "Common Shares") at a price of $0.29 per

Common Share (collectively, the "Offering"). In addition to the gross proceed of

$20 million, the Corporation has granted the Agents an option, to purchase an

additional 15% of the number of Common Shares offered and 15% of the number of

FT Common Shares offered, on the same terms and conditions as the Offering,

exercisable in whole or in part at any time prior to the date that is 24 hours

prior to closing of the Offering. In the event that the entire option is

exercised, the proceeds would increase by $3.0 million for total gross proceeds

up to $23.0 million.

The proceeds from this Offering will be used to further delineate Excelsior's

existing land base in Hangingstone and West Surmont, exploration and development

activities, and for general working capital purposes.

The Offering will be completed by way of private placement and will be subject

to the statutory hold period of 4 months from the time of closing of the

Offering. Closing of the Offering is subject to customary terms and conditions,

including receipt of required TSX Venture Exchange approval, and is expected to

occur on or about September 3, 2008.

The Offering will be marketed through a syndicate of investment dealers lead by

Raymond James Ltd. ("Lead Agent") and includes Macquarie Capital Markets Canada

Ltd., and National Bank Financial ("collectively the "Agents").

The Common Shares and the FT Common Shares to be issued under this Offering have

not been and will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent registration

or an exemption from such registration. This news release shall not constitute

an offer to sell or a solicitation of an offer to buy any securities in the

United States nor shall there be any offer or sale of securities in any

jurisdiction where such offer, solicitation or sale would be unlawful.

About Excelsior Energy

Excelsior is active in oil sands exploration and appraisal in the Hangingstone

and West Surmont areas near Fort McMurray, Alberta and will hold a 75% working

interest in 58 contiguous sections on completion of its farm-in obligations. The

Corporation also indirectly holds a 75% working interest in Blocks 16/1a and

16/6c in the UK North Sea and a minor interest in gas production in Alberta.

Excelsior's strategy is to capture oil and gas appraisal and development

opportunities where the Corporation can leverage Management's diverse

international experience and field development expertise. This includes heavy

oil reservoir engineering and development of complex fields.

Forward Looking Statements: This press release contains forward-looking

statements. Management's assessment of future plans and operations, expected

production levels, operating costs, capital expenditures, the nature of capital

expenditures, methods of financing capital expenditures, future engineering

reports and the timing of increases in production may constitute forward-looking

statements under applicable securities laws and necessarily involve risks

including, without limitation, risks associated with oil and gas exploration,

development, exploitation, production, marketing and transportation, loss of

markets, volatility of commodity prices, currency fluctuations, imprecision of

reserve estimates, environmental risks, competition from other producers,

inability to retain drilling rigs and other services, incorrect assessment of

the value of acquisitions, failure to realize the anticipated benefits of

acquisitions, delays resulting from or inability to obtain required regulatory

approvals and ability to access sufficient capital from internal and external

sources. As a consequence, the Corporation's actual results may differ

materially from those expressed in, or implied by, the forward-looking

statements. Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that could effect

the Corporation's operations and financial results are included in reports on

file with Canadian securities regulatory authorities and may be accessed through

the SEDAR website (www.sedar.com). Furthermore, the forward looking statements

contained in this press release are made as at the date of this press release

and the Corporation does not undertake any obligation to update publicly or to

revise any of the included forward looking statements, whether as a result of

new information, future events or otherwise, except as may be required by

applicable securities laws.

The Units, Common Shares and Warrants have not been registered under the United

States Securities Act of 1933, as amended, and will not be offered or sold in

the United States absent registration or an applicable exemption from the

registration requirement.

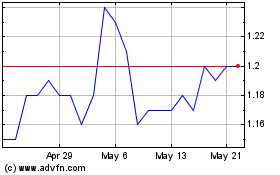

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

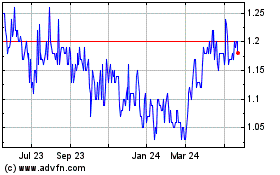

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024