Excelsior Announces Financing for North Sea Subsidiary

June 18 2008 - 5:49PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company") is

pleased to announce that its 75% owned subsidiary, ENS Energy Ltd. ("ENS")

(formerly 1385302 Alberta Ltd.) intends to enter into a private placement

financing of up to $5 million. After the restructuring of Excelsior's UK

subsidiary, announced on April 9, 2008, ENS wholly owns the UK subsidiary that

holds a 100% working interest in licence P.1500, blocks 16/1a and 16/6c, in the

United Kingdom Continental Shelf ("UKCS"). Excelsior currently owns 75% of ENS

following closing of an ENS private placement announced on June 9, 2008.

The ENS Board of Directors has approved a non-brokered private placement

financing of up to $5 million. The private placement contemplates the issuance

of up to 10 million units ("Units") at a subscription price of $0.50 per Unit.

Each Unit will consist of one common share of ENS ("Common Share") and one half

of a Common Share purchase warrant (each whole warrant a "Warrant"). Each

Warrant entitles the holder thereof to acquire one Common Share at a price of

$0.90 per Common Share. The Warrants will expire two years from the date of the

closing of the private placement. ENS intends to use the proceeds to fund

ongoing technical work on license P.1500 and business development activities in

the United Kingdom. ENS currently has 16 million Common Shares issued and

outstanding (19.6 million fully diluted).

David Winter, President and CEO of Excelsior and ENS commented, "This financing

will assist ENS to expand its asset base with a focus on properties with near

term production in the North Sea with a view to a public company strategy for

ENS".

ENS will manage and finance the work program in the 100% working interest

license P.1500, blocks 16/1a and 16/6c, UKCS. Block 16/1a and 16/6c were awarded

in April 2007, and are located within Quadrant 16 of the central North Sea, a

few kilometres northwest of the West Brae field. ENS is currently reprocessing

just over 300 square kilometers of 3-D seismic data to better image the

reservoir sands and to define a drilling location on a prospect which contains

an abandoned well drilled in 1992 which penetrated a 15 meter oil column.

About Excelsior Energy

Excelsior is active in oil sands exploration and appraisal in the Hangingstone

and West Surmont areas near Fort McMurray, Alberta and will hold a 75% working

interest in 58 contiguous sections on completion of its farm-in obligations. The

Company also indirectly holds a 75% working interest in Blocks 16/1a and 16/6c

in the UK North Sea and a minor interest in gas production in Alberta.

Excelsior's strategy is to capture oil and gas appraisal and development

opportunities where the Company can leverage Management's diverse international

experience and field development expertise. This includes heavy oil reservoir

engineering and development of complex fields.

Forward Looking Statements: This press release contains forward-looking

statements. Management's assessment of future plans and operations, expected

production levels, operating costs, capital expenditures, the nature of capital

expenditures, methods of financing capital expenditures, future engineering

reports and the timing of increases in production may constitute forward-looking

statements under applicable securities laws and necessarily involve risks

including, without limitation, risks associated with oil and gas exploration,

development, exploitation, production, marketing and transportation, loss of

markets, volatility of commodity prices, currency fluctuations, imprecision of

reserve estimates, environmental risks, competition from other producers,

inability to retain drilling rigs and other services, incorrect assessment of

the value of acquisitions, failure to realize the anticipated benefits of

acquisitions, delays resulting from or inability to obtain required regulatory

approvals and ability to access sufficient capital from internal and external

sources. As a consequence, the Company's actual results may differ materially

from those expressed in, or implied by, the forward-looking statements. Readers

are cautioned that the foregoing list of factors is not exhaustive. Additional

information on these and other factors that could effect the Company's

operations and financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com). Furthermore, the forward looking statements contained in this

press release are made as at the date of this press release and the Company does

not undertake any obligation to update publicly or to revise any of the included

forward looking statements, whether as a result of new information, future

events or otherwise, except as may be required by applicable securities laws.

The Units, Common Shares and Warrants have not been registered under the United

States Securities Act of 1933, as amended, and will not be offered or sold in

the United States absent registration or an applicable exemption from the

registration requirement.

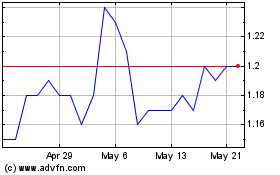

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

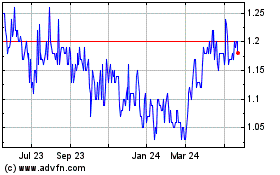

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024