Excelsior Reports First Quarter 2008 Results-Delineation Drilling Program Confirms Resource Potential

May 30 2008 - 11:15AM

Marketwired Canada

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company") is

pleased to report results for the three month period ended March 31, 2008. The

Company continued to focus efforts on oil sands exploration and appraisal in the

Hangingstone and West Surmont areas in the Athabasca oil sands region of

Alberta. Excelsior completed its first delineation drilling program in March

2008, drilling 35 core wells at its Hangingstone and Surmont properties on time

and on budget, with results exceeding expectations.

"We are very pleased with our drilling results this winter and are accelerating

development planning at Hangingstone" said David Winter, President and Chief

Executive Officer. "These results have confirmed the resource potential at

Hangingstone and we are moving towards a Phase I, 10,000 barrels of bitumen per

day SAGD production project."

First Quarter Highlights

- At Hangingstone the Company drilled, cored and logged 26 core wells, 22 of

which exceeded the 10 meter net pay cut off. Net pay cut off is defined as

greater than 27% porosity, greater than 50% oil saturation and shale content

less than 40%. Fourteen of these wells contained net pay thickness in excess of

20 meters and six core wells contained net pay thickness in excess of 30 meters.

- At West Surmont nine core wells were drilled, cored and logged and a channel

trend was identified which contained three core wells with net pay thickness

exceeding 20 meters.

- Both drilling programs were completed on time and on budget.

- Excelsior completed the second tranche of a December private placement issuing

2,305,500 common shares at $0.52 for gross proceeds of $1,198,860.

- Excelsior fully earned its 75% working interest in the 39 section Hangingstone

property with the completion of the core drilling program in March 2008.

Second Quarter Outlook

- Core analysis from the core drilling programs has been completed as at May 28,

2008.

- An independent engineering report on the Hangingstone asset is expected to be

completed by McDaniel and Associates in Q2, 2008. Independent engineering

reports for Surmont are planned to be updated in Q3, 2008.

- Excelsior has engaged an experienced oil sands contractor to assist in

regulatory application and environmental assessments for the Phase I production

project with fieldwork to commence in July 2008.

- Excelsior contracted Paradigm Strategic Consulting, an industry leader in

digital subsurface asset management, to assist in accelerating the development

planning of a Phase 1, 10,000 barrels of bitumen per day SAGD project at

Hangingstone.

- The Company restructured its holdings in Excelsior Energy North Sea Limited

("ENS") exchanging all shares of ENS for shares in a newly incorporated Alberta

private company ("NorthseaCo"). In connection with the restructuring NorthseaCo

intends to issue 25% of its common shares in a private placement for gross

proceeds of $1.0 million. The transaction segregates the oil sands and North Sea

assets providing access to capital markets for these opportunities

independently.

The following information should be read in conjunction with the management

discussion and analysis and unaudited interim consolidated financial statements

for the three months ended March 31, 2008, available online at www.sedar.com.

Selected Information

--------------------------------------------------------------------------

--------------------------------------------------------------------------

($'s except weighted average shares) Three Months Three Months

Ended Ended

March 31, 2008 March 31, 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Gas sales 37,038 31,954

Royalties (6,051) (9,059)

Operating costs (8,046) (1,828)

--------------------------------------------------------------------------

Net gas revenue 22,491 21,067

--------------------------------------------------------------------------

Interest and other income 140,529 26,069

General and administrative expense 279,028 236,441

Net loss and comprehensive loss (577,495) (304,103)

Loss per share (basic and diluted) (0.01) (0.01)

--------------------------------------------------------------------------

Capital expenditures

Petroleum and natural gas properties 10,839,905 2,388,621

--------------------------------------------------------------------------

Cash flows

Cash flows used in operations (407,158) (218,393)

Cash flows used in investing (6,697,462) (2,827,628)

Cash flows from financing 1,111,725 2,957,133

--------------------------------------------------------------------------

Change in cash position (5,992,895) (88,888)

Cash and cash equivalents, beginning of

period 15,848,648 3,965,957

--------------------------------------------------------------------------

Cash and cash equivalents, end of period 9,855,753 3,877,069

--------------------------------------------------------------------------

Weighted average number of shares

outstanding 108,517,539 28,266,101

--------------------------------------------------------------------------

About Excelsior Energy

Excelsior is active in oil sands exploration and appraisal in the Hangingstone

and West Surmont areas near Fort McMurray, Alberta and will hold a 75% working

interest in 58 contiguous sections on completion of its farm-in obligations. The

Company also indirectly holds a 100% working interest in Blocks 16/1a and 16/6c

in the UK North Sea and a minor interest in gas production in Alberta.

Excelsior's strategy is to capture oil and gas appraisal and development

opportunities where we can leverage Management's diverse international

experience and field development expertise. This includes heavy oil reservoir

engineering and development of complex fields.

Forward Looking Statements: This press release contains forward-looking

statements. Management's assessment of future plans and operations, expected

production levels, operating costs, capital expenditures, the nature of capital

expenditures, methods of financing capital expenditures, future engineering

reports and the timing of increases in production may constitute forward-looking

statements under applicable securities laws and necessarily involve risks

including, without limitation, risks associated with oil and gas exploration,

development, exploitation, production, marketing and transportation, loss of

markets, volatility of commodity prices, currency fluctuations, imprecision of

reserve estimates, environmental risks, competition from other producers,

inability to retain drilling rigs and other services, incorrect assessment of

the value of acquisitions, failure to realize the anticipated benefits of

acquisitions, delays resulting from or inability to obtain required regulatory

approvals and ability to access sufficient capital from internal and external

sources. As a consequence, the Company's actual results may differ materially

from those expressed in, or implied by, the forward-looking statements. Readers

are cautioned that the foregoing list of factors is not exhaustive. Additional

information on these and other factors that could effect the Company's

operations and financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com). Furthermore, the forward looking statements contained in this

press release are made as at the date of this press release and the Company does

not undertake any obligation to update publicly or to revise any of the included

forward looking statements, whether as a result of new information, future

events or otherwise, except as may be required by applicable securities laws.

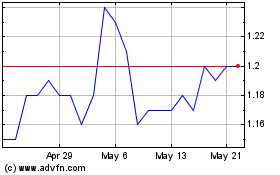

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

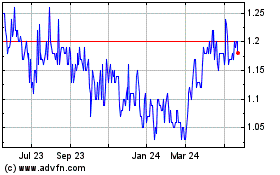

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024