Yellow Media Limited (TSX:Y) (the "Company") released its operational and

financial results today for the third quarter ended September 30, 2013. The

Company continues to invest in its digital transformation, providing advertisers

with the right value, products, customer experience and audiences to manage and

grow their business.

Third Quarter 2013 Financial Results

Revenues for the third quarter ended September 30, 2013 were $237.4 million

compared to $267.7 million last year. The 11.3% decline results from a decline

in advertisers, alongside a decrease in spending amongst the Company's larger

advertisers as they migrate towards digital products.

Digital revenues for the third quarter of 2013 grew to $101.6 million compared

to $92 million for the prior year, representing growth of 10.5%. Growth in

digital revenues is due to the execution of the Yellow Pages 360 degrees

Solution sales approach across our sales channels, continued migration of print

revenues towards digital products and services, and the launch of new mobile and

premium digital products in 2012. Digital revenues represented approximately

42.8% of total revenues during the third quarter of 2013, compared to 34.3% for

the same period last year. As anticipated, print revenues for the third quarter

of 2013 continued to face steady declines, decreasing 22.8% year-over-year to

reach $135.8 million.

EBITDA declined to $102.1 million during the third quarter of 2013, as compared

to $137.9 million last year. The decrease in EBITDA is due principally to print

revenue pressure, alongside a decline in the EBITDA margin. The EBITDA margin

fell from 51.5% last year to 43.0% in the third quarter of 2013, a result of a

change in product mix and investments required to advance the Company's digital

transformation.

"As we further transform the business and grow digital revenues, protecting

profitability remains a key priority," said Ginette Maille, Chief Financial

Officer of Yellow Media. "The Company will invest in projects aimed at improving

the efficiency of the organization in order to realign the Company's cost

structure and optimize digital contribution margins."

Free cash flow for the third quarter of 2013 increased to $64.3 million compared

to $39.9 million last year, mainly due to lower utilized restructuring and

special charges, lower interest and income taxes paid, and favourable changes in

working capital, partly offset by lower EBITDA. The Company continues to

generate sufficient free cash flow to service all financial obligations and

invest in its digital transformation.

For the quarter ending September 30, 2013, the Company recorded net earnings of

$41.8 million and basic earnings per share of $1.51. This compares to $22.2

million of net earnings and $0.59 of basic earnings per share for the same

period last year. The increase in net earnings and basic earnings per share is

due primarily to a lower depreciation and amortization expense, lower

restructuring and special charges, lower financial charges and a loss on

settlement of debt recorded in the third quarter of 2012, partly offset by lower

EBITDA.

Delivering Value to Advertisers through the Yellow Pages 360 degrees Solution

The Yellow Pages(TM) 360 degrees Solution remains one of the most comprehensive

full-serve digital and traditional media and marketing solutions in Canada. This

value proposition is directly aligned with small to medium-sized advertisers'

key needs, offering them a single relationship to effectively manage their print

and digital marketing programs. Through products and services such as placement

on YPG's owned and operated properties, website development, search engine

optimization, search engine marketing, and Yellow Pages Analytics, the Yellow

Pages 360 degrees Solution helps advertisers generate value via enhanced digital

exposure within their local neighborhoods.

As at September 30, 2013, the penetration of the Yellow Pages 360 degrees

Solution offering among YPG's advertiser base, which is defined as advertisers

who purchase three product categories or more, grew to 24%. This compares to

13.9% at the end of the same period last year.

Mobile priority placement and digital services such as search engine

optimization and search engine solutions are currently the fastest growing

components of the Yellow Pages 360 degrees Solution. Advertiser penetration of

mobile priority placement products increased to 12.2% as at September 30, 2013

compared to 6.8% in 2012. Advertiser penetration of digital services also grew

from 5.9% last year to 8.3% as at September 30, 2013.

"The strategy to deliver Yellow Media's transformation is working and we are

pleased with the progress," said Robert MacLellan, Chairman of the Board of

Directors of Yellow Media. "Although print revenues remain challenged by

negative trends, investments in the digital transformation have led to better

experiences for our advertisers and users, growing advertiser adoption of

digital solutions, and digital revenue growth."

Promoting Revenue Growth by Attracting Valuable Advertisers and Enhancing the

Customer Experience

The Company had 283,000 advertisers as at September 30, 2013. This compares to

319,000 advertisers at the same period last year. Over the last twelve months,

the advertiser renewal rate fell slightly from 86% last year to 85% for the

period ending September 30, 2013. Advertiser acquisition declined from

approximately 18,300 last year to 11,900 for the twelve month period ending

September 30, 2013.

Deployed during the second quarter of 2013, the Company's acquisition strategy

is aimed at increasing advertiser leads and conversions through the creation of

specialized inbound and outbound call centers and a face-to-face network of over

100 sales advisors. In conjunction with this initiative, the Company launched

two new entry-level product packages (Business Builder Bundle and Booster Packs)

designed exclusively to help new, prospective advertisers gain a digital media

presence at entry-level pricing.

The PriorityPlus program provides high-spend advertisers with priority treatment

and service, regular meetings with sales advisors, and increased attention,

analysis and advice to ensure effective execution of their marketing strategy.

In conjunction with PriorityPlus, the Company also offers customizable premium

digital products, and access to dedicated professionals and creative services

specializing in search engine optimization, search engine marketing and website

development.

Attracting and retaining valuable advertisers remains key in promoting long-term

revenue growth. In response, the Company will continue investing in increasing

the efficiency of its sales channels, improving customer service and product

fulfillment, evolving its digital product offerings, and further growing digital

audiences.

Promoting Return on Investment for Advertisers

Attracting valuable local audiences towards YPG's digital network of properties

is key in generating ROI for advertisers. The Company's online properties

reached 8.4 million unduplicated unique visitors during the third quarter of

2013, representing 30% of Canada's online population. Cumulative mobile

downloads increased to 6.2 million by the end of the third quarter of 2013, as

compared to 4.7 million at the same period last year.

In an effort to improve the mobile user experience through enhanced tools and

content, the Company recently launched a real time gas pricing and comparison

feature on its Yellow Pages mobile application. This feature is available across

Canada, and provides a comparison of stations' real time gas prices, service

station information, directions and mapping, as well as detailed pricing for

various grades of gas.

The YellowAPI continues to promote advertiser ROI by making advertisers'

business information visible outside YPG's network of owned and operated

properties. During the third quarter of 2013, YPG extended an existing

collaboration with CBC/Radio-Canada to allow CBC.ca users to access YPG's local

business listings via the YellowAPI. Leading properties such as Yahoo! Canada,

Google, Poynt, AOL, and Bell Sympatico also use the YellowAPI to power local

business searches across their platforms.

To promote the important role of local businesses in driving sustainable

communities as well as to encourage local shopping, YPG has launched the Shop

The Neighbourhood initiative within the Greater Toronto Area. As part of Shop

The Neighbourhood, merchants will be able to promote their business and attract

local consumers by posting deals across YPG's digital network of properties. The

event will take place on Saturday, November 30, 2013, during a weekend when

Canadians shop in the U.S. for Black Friday or online for Cyber Monday deals.

The initiative will build further awareness around the Yellow Pages brand and

its relevancy in advocating for small business growth and connecting local

consumers with valuable shopping information.

CEO Appointment

On October 21, 2013, Julien Billot was appointed President and CEO of Yellow

Media effective January 1, 2014. The appointment results from a global search

executed by the search committee of the Board of Directors.

"Mr. Billot is the ideal candidate to lead Yellow Media's digital

transformation," continued MacLellan. "Julien is a seasoned executive with

proven success in spearheading digital product growth, development and

profitability across some of Europe's largest media companies."

Mr. Billot brings over 20 years of experience in executive level positions

within the global media industry, including Executive Vice-President and Head of

Media at Solocal Group (formerly PagesJaunes Groupe) and CEO of the digital and

new business group of Lagardere Active. Under his tenure at Solocal Group and

Lagardere Active, Mr. Billot led various initiatives which resulted in the

development and launch of mass market digital products and services, growth of

digital audiences, digital revenue growth and enhanced digital product

profitability.

Capital Structure

As at September 30, 2013, Yellow Media had reduced net debt to approximately

$601 million. This compares to $782 million of net debt as at December 31, 2012.

The net debt to latest twelve month EBITDA ratio as at September 30, 2013 was

1.3 times compared to 1.4 times as at December 31, 2012. The Company had

approximately $260 million of cash and cash equivalents as at November 4, 2013.

On October 29, 2013, Yellow Media exercised its option to redeem $27 million

aggregate principal amount of its 9.25% Senior Secured Notes (the "Notes"). The

Company also completed an $8 million principal open market purchase on the Notes

on September 25, 2013.

Pursuant to the indenture governing the Notes, the Company is required to use an

amount equivalent to 75% of its consolidated Excess Cash Flow for the

immediately preceding six-month period ending March 31 or September 30 to redeem

the Notes at par.

The Company anticipates making a $92.3 million mandatory redemption payment on

December 2, 2013. The mandatory redemption payments for 2013 will total $118.4

million, surpassing the minimum requirement of $100 million.

Upon completion of the December 2, 2013 mandatory redemption payment, $646.6

million principal amount of Notes will remain outstanding. This compares to $800

million principal amount of Notes outstanding as at December 31, 2012.

Investor Conference Call

Yellow Media Limited will hold an analyst and media call at 1:00 p.m. (Eastern

Time) on November 5, 2013 to discuss the third quarter 2013 results. The call

may be accessed by dialing (416) 340-8427 within the Toronto area, or 1 866

225-6564 outside of Toronto.

The call will be simultaneously webcast on the Company's website at

http://www.ypg.com/en/investors/financial-reports/2013/quarterly-reports/third-quarter-webcast

The conference call will be archived in the Investors section of the site at

www.ypg.com.

A playback of the call can also be accessed from November 5 to November 12, 2013

by dialing (905) 694-9451 within the Toronto area, or 1 800 408-3053 outside

Toronto.

The conference passcode is 1536381.

About Yellow Media Limited

Yellow Media Limited (TSX:Y) is a leading media and marketing solutions company

in Canada. The Company owns and operates some of Canada's leading properties and

publications including YellowPages.ca(TM), Canada411.ca and

RedFlagDeals.com(TM), the Yellow Pages, ShopWise and RedFlagDeals mobile

applications and Yellow Pages(TM) print directories. Its online destinations

reach 8.4 million unique visitors monthly and its mobile applications for

finding local businesses and deals have been downloaded 6.2 million times.

Yellow Media Limited is also a leader in national digital advertising through

Mediative, a division of Yellow Pages Group devoted to digital marketing and

performance media services for national agencies and advertisers. For more

information, visit www.ypg.com.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements about the objectives,

strategies, financial conditions, results of operations and businesses of the

Company. These statements are forward-looking as they are based on our current

expectations, as at November 5, 2013, about our business and the markets we

operate in, and on various estimates and assumptions. Our actual results could

materially differ from our expectations if known or unknown risks affect our

business, or if our estimates or assumptions turn out to be inaccurate. As a

result, there is no assurance that any forward-looking statements will

materialize. Risks that could cause our results to differ materially from our

current expectations are discussed in section 6 of our November 5, 2013

Management's Discussion and Analysis. We disclaim any intention or obligation to

update any forward-looking statements, except as required by law, even if new

information becomes available, as a result of future events or for any other

reason.

Financial Highlights

(in thousands of Canadian dollars - except share information)

----------------------------------------------------------------------------

For the three-month For the nine-month

periods ended September periods ended September

30, 30,

Yellow Media Limited 2013 2012 2013 2012

----------------------------------------------------------------------------

Revenues $237,350 $267,711 $733,810 $843,268

Income (loss) from

operations $82,547 $84,481 $270,597 ($2,647,854)

Net earnings (loss) $41,775 $22,236 $145,566 ($2,783,904)

Basic earnings (loss)

per share attributable

to common shareholders $1.51 $0.59 $5.22 ($100.19)

Cash flow from operating

activities $79,191 $49,640 $252,236 $176,824

----------------------------------------------------------------------------

EBITDA(1) $102,147 $137,890 $324,859 $427,703

EBITDA margin(1) 43.0% 51.5% 44.3% 50.7%

----------------------------------------------------------------------------

Weighted average number

of common shares

outstanding(2) 27,745,677 27,955,077 27,857,092 27,955,077

----------------------------------------------------------------------------

Non-IFRS Measures(1)

In order to provide a better understanding of the results, the Company uses the

term EBITDA, defined as income from operations before depreciation and

amortization, impairment of goodwill and restructuring and special charges.

Management believes this measure is reflective of ongoing operations. This term

is not a performance measure defined under IFRS. EBITDA does not have any

standardized meaning and are therefore not likely to be comparable to similar

measures used by other publicly traded companies. Management believes EBITDA to

be an important measure.

(2)Pursuant to the closing of the recapitalization transaction on December 20,

2012, the common shares of Yellow Media Inc. were exchanged for new common

shares of Yellow Media Limited. As a result, the weighted average number of

common shares outstanding for prior periods has been adjusted to reflect the

recapitalization transaction.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Relations

Amanda Di Gironimo

Senior Manager, Corporate Finance and Investor Relations

(514) 934-2680

Amanda.DiGironimo@ypg.com

Media

Fiona Story

Senior Manager, Public Relations

(514) 934-2672

Fiona.Story@ypg.com

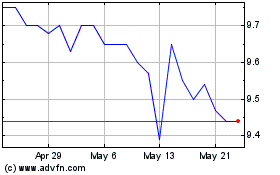

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jun 2024 to Jul 2024

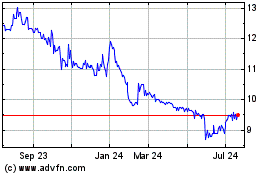

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jul 2023 to Jul 2024