Tidewater Midstream and Infrastructure Ltd. (“Tidewater” or the

“Company”) (TSX: TWM) announces a financing plan to fully fund the

repayment of its $125 million senior unsecured notes due December

19, 2022 (the “Senior Unsecured Notes”) and $20 million second lien

term loan (the “Second Lien Term Loan”). The Company intends to use

new capital sources as follows:

- $70 million draw

on the Company’s senior credit facility that, through an expanded

syndicate of lenders, the Company intends to increase in size to

$550 million (the “Expanded Senior Credit Facility”);

- $40.5 million

offering of units (“Units”) issued to the public on a bought deal

basis (the “Public Offering”) at a price of $1.20 per Unit (the

“Issue Price”), each Unit will be comprised of one common share of

the Company (each a “Common Share”) and one-half of one common

share purchase warrant (each full warrant, a “Warrant”). Each

Warrant will entitle the holder to acquire one Common Share from

the Company at a price of $1.44 per Common Share for a period of 24

months following the closing of the Public Offering; and

- $34.5 million

offering of Units to affiliates of Birch Hill (as defined below),

the Company’s largest shareholder, funds managed and advised by

Kicking Horse Capital Inc. (respectively, the “Kicking Horse Funds”

and "Kicking Horse"), and officers of the Company on a non-brokered

private placement basis (the “Private Placement”), to be issued at

the Issue Price and comprised of one Common Share and one-half of

one Warrant.

The new capital sources outlined above will

fully refinance the maturing Senior Unsecured Notes and Second Lien

Term Loan. The expenses of the refinancing will be funded via the

Expanded Senior Credit Facility. Following the completion of the

refinancing, Tidewater is expected to have remaining liquidity of

approximately $70 million under its Expanded Senior Credit

Facility. The combination of the equity raise, the increased

liquidity from the Expanded Senior Credit Facility, and the strong

performance of the Company, places Tidewater in a strong financial

position going forward.

“These transactions simplify Tidewater’s balance

sheet and enhance liquidity to provide a durable financial base for

our business. Our strong business performance is driving financial

results that have us at the lower end of our leverage targets and

in a strong position to progress our growth initiatives,” comments

Tidewater’s Chairman and CEO, Joel Macleod.

SECOND QUARTER 2022

RESULTSConsistent operating results combined with

favorable refining margins have led to strong second quarter of

2022 financial results for the Company. During the second quarter,

the Company’s Pipestone Gas Plant processed volumes in excess of

100 MMcf/d, above forecast volumes and the Company’s Prince George

Refinery realized strong refining margins. Additionally, Tidewater

Renewables Ltd. ("Tidewater Renewables"), a subsidiary in which

Tidewater owns a 69% interest, has exceeded initial forecasts due

to increased renewable diesel prices and carbon credit

values. Strong aggregate business

performance for Tidewater has driven initial second quarter 2022

consolidated net income estimates of $18-$20 million and

Consolidated Adjusted EBITDA of $67-$69 million, with Tidewater

Renewables generating $4-5 million of net income and $15-$16

million of Adjusted EBITDA supporting the Company’s full year

outlook released with Tidewater’s first quarter results. Full

second quarter 2022 financial results are expected to be released

on August 11, 2022.

EXPANDED SENIOR CREDIT

FACILITYThrough an expanded syndicate of lenders including

two of Canada’s largest financial institutions, the Company intends

to increase the size of its senior credit facility by approximately

30% to $550 million with the facility maturing in mid-year 2024.

With the announced refinancing transaction, the Company’s current

senior lenders have eliminated the previously announced deadline to

refinance the Senior Unsecured Notes and Second Lien Term Loan.

SECOND LIEN FACILITYTidewater

has received a binding commitment from affiliates of its largest

shareholder, Birch Hill Private Equity Partners Fund V (“Birch

Hill”), for a second lien debt facility of up to $15 million

available to the Company until November 30, 2022 (the “Second Lien

Facility”). The Second Lien Facility could be used to reduce the

borrowings under the Expanded Senior Credit Facility if the Company

does not reduce such facility through other means prior to November

30, 2022. The Company does not expect to draw upon the Second Lien

Facility. If drawn, the Second Lien Facility will bear interest at

the rate of 9.85% per annum and will mature on October 18, 2024. A

commitment fee of $1.75 million is payable to Birch Hill upon

availability of the Second Lien Facility. Borrowings under the

Second Lien Facility will be subject to an original issue discount

of 3.25% and a one-time fee of $750,000. The Company will have the

ability to repay the Second Lien Facility at any time prior the

maturity date without any additional premium or penalty.

The closing of the Second Lien Facility is

subject to the closing of the Offering (as defined below) and

certain other customary closing conditions including approval from

the Toronto Stock Exchange (“TSX”).

Birch Hill is a related party within the meaning

of Multilateral Instrument 61-101 Protection of Minority Security

Holders in Special Transactions (“MI 61-101”).

UNIT FINANCINGThe Company has

entered into agreements to raise $75 million of new equity via an

issuance of Units. $40.5 million of the Units will be issued via

the Public Offering and $34.5 million of the Units will be issued

via the Private Placement to Birch Hill, the Kicking Horse Funds

and certain Tidewater directors and officers (the Private

Placement, together with the Public Offering, the “Offering”). Net

proceeds from the Offering, together with amounts drawn under

Tidewater’s Expanded Senior Credit Facility will be used to repay

Tidewater’s Senior Unsecured Notes and Second Lien Term Loan.

Tidewater has entered into an agreement with a

syndicate of underwriters (the “Underwriters”) led by CIBC Capital

Markets, National Bank Financial, RBC Capital Markets and ATB

Capital Markets Inc. pursuant to the Public Offering by which the

Company will issue $40.5 million aggregate amount of Units at a

price of $1.20 per Unit to the public on a “bought deal” basis.

Each Unit will consist of one Common Share and one-half of one

Warrant. Each Warrant will entitle the holder to acquire one Common

Share from the Company at a price of $1.44 per Common Share for a

period of 24 months following the closing of the Offering.

Additionally, the Company will issue a total of

$34.5 million of Units pursuant to the Private Placement. Units

will be issued to Birch Hill in the amount of $17 million, Kicking

Horse Funds in the amount of $16 million and certain officers of

Tidewater in the amount of $1.5 million. Units issued in the

Private Placement will be sold at the Issue Price. Birch Hill and

Kicking Horse Funds will be paid a commitment fee of 5% each on

their subscriptions ($850,000 and $800,000 respectively), equal to

the underwriting fee in the Public Offering.

The Company has granted the Underwriters of the

Public Offering an option (the “Over-Allotment Option”),

exercisable at the Issue Price for a period of 30 days following

the closing of the Public Offering, to purchase up to an additional

15% of the Public Offering to cover over-allotments, if any. This

Over-Allotment Option may be exercised by the Underwriters for

additional Units, Common Shares, Warrants or any combination of

such securities (the “Securities”). Should the Over-Allotment

Option be exercised, the subscribers under the Private Placement

will have the option to purchase on a pro-rata basis additional

Securities that are purchased by the Underwriters pursuant to the

Over-Allotment Option.

The Units offered under the Public Offering will

be offered in each of the provinces of Canada by way of a short

form prospectus, and by way of private placement in the United

States to “qualified institutional buyers” pursuant to Rule 144A or

in such a manner as to not require registration under the U.S.

Securities Act of 1933, as amended.

The Offering is expected to close on or about

August 16, 2022, and closing of each of the Public Offering and

Private Placement will be subject to, among other things, customary

conditions, the concurrent closing of the other such Offering and

the entering into the Expanded Senior Credit Facility. The Offering

is subject to the approval of the TSX.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in the United States or in any other

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities have not been registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements thereunder.

RETIREMENT OF SENIOR UNSECURED NOTES AND

SECOND LIEN TERM LOANThe Company has committed to retire

the $125 million Senior Unsecured Notes due December 19, 2022.

Following the closing of the Offering, the Company will provide 10

days’ notice of redemption to holders to satisfy the obligations of

the notes. Tidewater also intends to fully repay the Second Lien

Term Loan upon the closing of the Offering.

BOARD OF DIRECTORS UPDATEIn

connection with the transaction and an investment by the Kicking

Horse Funds of $16 million in the Private Placement, Thomas P. Dea

will join the Board of Directors of the Company. Mr. Dea is the

President and CEO of Kicking Horse, a Toronto-based investment

manager. He was previously a Partner with West Face Capital Inc.

and a Managing Director of Onex Corporation. Pursuant to and in

connection with the Private Placement, the Company and Kicking

Horse will enter into a board nomination agreement whereby the

Company will agree to nominate Mr. Dea, or another Kicking Horse

nominee so long as the Kicking Horse Funds hold at least 2% of the

issued and outstanding basic common shares of the Company.

TRANSACTION DECISION AND

APPROVALSThe Board of Directors has determined that the

comprehensive financing package and associated transactions as

described herein are in the Company's best interests as it will

allow the Company to fully finance the retirement of the $125

million Senior Unsecured Notes due December 19, 2022 and $20

million Second Lien Term Loan due October 31, 2022 and provide

the Company with additional liquidity under its Expanded Senior

Credit Facility.

This determination was based on a number of

factors, including but not limited to, the unanimous recommendation

of a special committee of independent directors formed to consider

the Company's financing after consultation with the Company's

financial and legal advisors.

The involvement of management and Birch Hill in

the Offering and Second Lien Facility are “related party

transactions” within the meaning of MI 61-101 and the Company is

relying on the exemptions in sections 5.5(a) and 5.7(a) [Fair

Market Value Not More Than 25% of Market Capitalization] of MI

61-101 in connection with such transactions, as the aggregate fair

market value of such transactions does not exceed 25% of the

Company’s current market capitalization.

ABOUT TIDEWATERTidewater is

traded on the TSX under the symbol “TWM”. Tidewater's business

objective is to build a diversified midstream and infrastructure

company in the North American natural gas, natural gas liquids,

crude oil, refined product, and renewable energy value chain. Its

strategy is to profitably grow and create shareholder value through

the acquisition and development of conventional and renewable

energy infrastructure. To achieve its business objective, Tidewater

is focused on providing customers with a full service, vertically

integrated value chain through the acquisition and development of

energy infrastructure, including downstream facilities, natural gas

processing facilities, natural gas liquids infrastructure,

pipelines, railcars, export terminals, storage, and various

renewable initiatives. To complement its infrastructure asset base,

the Company also markets crude, refined product, natural gas, NGLs

and renewable products and services to customers across North

America.

Tidewater is a majority shareholder in Tidewater

Renewables, a multi-faceted, energy transition company focusing on

the production of low carbon fuels. Tidewater Renewables' common

shares are publicly traded on the TSX under the symbol “LCFS”.

FURTHER INFORMATION:

For more information, please contact:

| Joel

Macleod, Chairman & Chief Executive Officer |

Brian

Newmarch, Chief Financial Officer |

| Tidewater Midstream and Infrastructure Ltd. |

Tidewater Midstream and Infrastructure Ltd. |

| Phone: (587) 475-0210 |

Phone: (587) 315-8368 |

| Email: jmacleod@tidewatermidstream.com |

Email: bnewmarch@tidewatermidstream.com |

NON-GAAP MEASURES

Throughout this press release and in other

materials disclosed by the Company, Tidewater uses a number of

financial measures when assessing its results and measuring overall

performance. The intent of non-GAAP measures and ratios is to

provide additional useful information to investors and analysts.

Certain of these financial measures do not have a standardized

meaning prescribed by GAAP and are therefore unlikely to be

comparable to similar measures presented by other entities. As

such, these measures should not be considered in isolation or used

as a substitute for measures of performance prepared in accordance

with GAAP. For more information with respect to financial measures

which have not been defined by GAAP, including reconciliations to

the closest comparable GAAP measure, see the “Non-GAAP Measures”

section of Tidewater’s most recent MD&A which is available on

SEDAR.

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA is calculated as

income (or loss) before finance costs, taxes, depreciation,

share-based compensation, unrealized gains/losses on derivative

contracts, non-cash items, transaction costs, lease payments under

IFRS 16 Leases and other items considered non-recurring in nature

plus the Company’s proportionate share of EBITDA in their equity

investments. Consolidated Adjusted EBITDA is used by management to

set objectives, make operating and capital investment decisions,

monitor debt covenants and assess performance. In addition to its

use by management, Tidewater also believes consolidated Adjusted

EBITDA is a measure widely used by securities analysts, investors,

lending institutions, and others to evaluate the financial

performance of the Company and other companies in the midstream

industry. The Company issues guidance on this key measure. As a

result, consolidated Adjusted EBITDA is presented as a relevant

measure in the MD&A to assist analysts and readers in assessing

the performance of the Company as seen from management’s

perspective.

Capital Management Measures

Consolidated net debt is used by the Company to

monitor its capital structure and financing requirements. It is

also used as a measure of the Company’s overall financial strength.

Consolidated net debt is defined as bank debt, notes payable and

convertible debentures, less cash. In addition to reviewing

consolidated net debt, management reviews deconsolidated net debt

to highlight the Company’s financial flexibility, balance sheet

strength and leverage. Deconsolidated net debt is calculated as

consolidated net debt less the portion attributable to Tidewater

Renewables. Consolidated and deconsolidated net debt exclude

working capital, lease liabilities and derivative contracts as the

Company monitors its capital structure based on deconsolidated net

debt to deconsolidated Adjusted EBITDA, consistent with its credit

facility covenants.

FORWARD LOOKING STATEMENTS

Certain statements contained in this press release constitute

forward-looking statements and forward-looking information

(collectively referred to herein as, “forward-looking statements“)

within the meaning of applicable Canadian securities laws. Such

forward-looking statements relate to future events, conditions or

future financial performance of Tidewater based on future economic

conditions and courses of action. All statements other than

statements of historical fact may be forward-looking statements.

Such forward-looking statements are often, but not always,

identified by the use of any words such as “seek”, “anticipate”,

“budget”, “plan”, “continue”, “forecast”, “estimate”, “expect”,

“may”, “will”, “project”, “predict”, “potential”, “targeting”,

“intend”, “could”, “might”, “should”, “believe”, “will likely

result”, “are expected to”, “will continue”, “is anticipated”,

“believes”, “estimated”, “intends”, “plans”, “projection”,

“outlook” and similar expressions. These statements involve known

and unknown risks, assumptions, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. The Company

believes the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that these

expectations will prove to be correct and such forward-looking

statements included in this press release should not be unduly

relied upon.

In particular, this press release contains

forward-looking statements pertaining to but not limited to the

following:

- the use of the proceeds from the

Offering, together with amounts drawn under Tidewater’s Expanded

Senior Credit Facility and potentially the Second Lien

Facility

- the expectation that the Second

Lien Facility will not be drawn;

- these transactions simplify

Tidewater’s balance sheet and enhance liquidity to provide a

durable financial base for our business and future growth;

- that the Over-Allotment Option may

be exercised and may ultimately increase the size of the Private

Placement;

- the receipt of all required

regulatory and other approvals and the satisfaction of all

conditions to the completion of the transactions describe

herein;

- the expected closing of the

Offering and the other financing transactions described

herein;

- Tidewater will enter into a board

nomination agreement with Kicking Horse and Mr. Dea will be

appointed to its board of directors upon closing

- the comprehensive financing package

and associated transactions as described herein are in the

Company's best interests as it will allow the Company to fully

finance the retirement of the $125 million Senior Unsecured Notes

due December 19, 2022 and $20 million Second Lien Term Loan due

October 31, 2022.

Any financial outlook or future oriented

financial information (in each case "FOFI") contained in this news

release regarding prospective financial position, including, but

not limited to: the Company's expectations for its net income

estimates, its Consolidated Adjusted EBITDA, Tidewater Renewables'

net income and Adjusted EBITDA, are based on reasonable assumptions

about future events, including those described below, and based on

an assessment by management of the relevant information that is

currently available. The actual results will likely vary from the

amounts set forth herein and such variations may be material.

Although the forward-looking statements and FOFI

contained in this press release are based upon assumptions which

management of the Company believes to be reasonable, the Company

cannot assure investors that actual results will be consistent with

these forward-looking statements and FOI. With respect to

forward-looking statements and FOI contained in this press release,

the Company has assumptions regarding, but not limited to:

- the Company’s ability to satisfy

the conditions to completion of the transactions described

herein;

- Tidewater’s ability to execute on

its business plan;

- general economic and industry

trends including the duration and effect of the COVID-19

pandemic;

- liabilities inherent in operations

in the energy industry;

- impacts of commodity prices and

demand on the Company's working capital requirements; continuing

government support for existing policy initiatives;

- the Company's ability to obtain and

retain qualified staff and equipment in a timely and cost effective

manner;

- the ability to obtain additional

financing on satisfactory terms;

- foreign currency, exchange and

interest rates, and expectations relating to inflation;

- the Company's future debt levels

and the ability of the Company to repay its debt when due;

- that PGR crack spreads remain

strong and refined product demand continues to increase;

- future commodity prices, including

natural gas, crude oil, NGL and renewable energy prices;

- processing and marketing

margins;

- that there are no unforeseen events

preventing the performance of contracts;

- Cenovus volume demands from the PGR

are consistent with forecasts;

- assumptions regarding amount of

operating costs to be incurred;

- that there are no unforeseen

material costs relating to the facilities which are not recoverable

from customers;

- distributable cash flow and net

cash provided by operating activities are consistent with

expectations;

- the ability of Tidewater to

successfully market its products; and

- credit rating changes.

The Company's actual results could differ

materially from those anticipated in the forward-looking statements

and FOFI, as a result of numerous known and unknown risks and

uncertainties and other factors including but not limited to:

- changes in demand for refined and

renewable products;

- general economic, political, market

and business conditions, including fluctuations in interest rates,

foreign exchange rates, stock market volatility, supply/demand

trends and inflationary pressures;

- risks of health epidemics,

pandemics, public health emergencies, quarantines, and similar

outbreaks, including COVID-19, which may have sustained material

adverse effects on the Company's business financial position

results of operations and/or cash flows;

- competition for business

capital;

- changes in the creditworthiness of

counterparties;

- changes in the credit rating of the

Company, and the impacts of this on the Company’s access to private

and public credit markets in the future and increase the costs of

borrowing;

- adverse claims made in respect of

the Company's properties or assets;

- risks and liabilities associated

with the transportation of dangerous goods and derailments;

- reliance on key personnel;

- technology and security risks,

including cybersecurity;

- potential losses which would stem

from any disruptions in production, including work stoppages or

other labour difficulties, or disruptions in the transportation

network on which the Company is reliant;

- activities of producers and

customers and overall industry activity levels;

- failure to negotiate and conclude

any required commercial agreements;

- non-performance of agreements in

accordance with their terms;

- failure to execute formal

agreements with counterparties in circumstances where letters of

intent or similar agreements have been executed and announced by

Tidewater;

- failure to close transactions as

contemplated and in accordance with negotiated terms;

- that the resolution of any

particular legal proceedings could have an adverse effect on the

Company's operating results or financial performance;

- operational matters, including

potential hazards inherent in the Company's operations and the

effectiveness of health, safety, environmental and integrity

programs;

- actions by governmental

authorities, including changes in government regulation, tariffs

and taxation;

- changes in operating and capital

costs, including fluctuations in input costs;

- effects of weather conditions;

- legal risks and environmental risks

and hazards, including risks inherent in the transportation of NGLs

and refining of light crude oils which may create liabilities to

the Company in excess of the Company's insurance coverage, if

any;

- actions by joint venture partners

or other partners which hold interests in certain of the Company’s

assets;

- reliance on key relationships and

agreements;

- potential losses which would stem

from any disruptions in production, including work stoppages or

other labour difficulties, or disruptions in the transportation

network on which the Company is reliant;

- technical and processing problems,

including the availability of equipment and access to properties;

and

- changes in gas composition.

The foregoing lists are not exhaustive.

Additional information on these and other factors which could

affect the Company's operations or financial results are included

in the Company's most recent AIF and in other documents on file

with the Canadian Securities regulatory authorities.

Management of the Company has included the above

summary of assumptions and risks related to forward-looking

statements and FOFI provided in this press release in order to

provide holders of common shares in the capital of the Company with

a more complete perspective on the Company's current and future

operations and such information may not be appropriate for other

purposes. The Company's actual results or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and FOFI and, accordingly, no assurance

can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any off

them do so, what benefits the Company will derive therefrom.

Readers are therefore cautioned that the foregoing list of

important factors is not exhaustive, and they should not unduly

rely on the forward-looking statements included in this press

release. Tidewater does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, other than as required by applicable securities law.

All forward-looking statements contained in this press release are

expressly qualified by this cautionary statement. Further

information about factors affecting forward-looking statements and

FOFI and management's assumptions and analysis thereof is available

in filings made by the Company with Canadian provincial securities

commissions available on the System for Electronic Document

Analysis and Retrieval (“SEDAR”) at www.sedar.com.

PRELIMINARY FINANCIAL INFORMATION

The Company's expectations for its net income

estimates, its Consolidated Adjusted EBITDA, Tidewater Renewables'

net income and Adjusted EBITDA (see “Non-GAAP Measures”) are based

on, among other things, the Company's and Tidewater Renewables'

anticipated financial results for the three and six month period

ended June 30, 2022. The Company's and Tidewater Renewables'

anticipated financial results are unaudited and preliminary

estimates that: (i) represent the most current information

available to management as of the date of hereof; (ii) are subject

to completion of interim review procedures that could result in

significant changes to the estimated amounts; and (iii) do not

present all information necessary for an understanding of the

Company's or Tidewater Renewables' financial condition as of, and

the Company's or Tidewater Renewables' results of operations for,

such periods. The anticipated financial results are subject to the

same limitations and risks as discussed under "Forward Looking

Statements" above. Accordingly, the Company's and Tidewater

Renewables' anticipated financial results for such periods may

change upon the completion and approval of the financial statements

for such periods and the changes could be material.

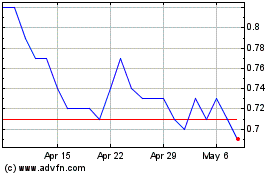

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

From Dec 2023 to Dec 2024