Videotron Ltd. Notice of Partial Redemption: 9 1/8% Senior Notes Due April 15, 2018 CUSIP No. 92658T AM0

June 03 2013 - 10:57PM

Marketwired

Pursuant to Sections 3.01, 3.03 and 3.07 of the Indenture (the

"Indenture"), dated as of April 15, 2008, by and among Videotron

Ltd. ( "Videotron"), a corporation under the laws of the Province

of Quebec, each subsidiary guarantor party thereto, and Wells Fargo

Bank, National Association, as trustee and paying agent (the

"Trustee"), notice is hereby given that, subject to the terms of

the Indenture, Videotron is electing to redeem US$380,000,000

aggregate principal amount of outstanding 9 1/8% Senior Notes due

April 15, 2018 (the "Notes") at a redemption price of 104.563% of

the principal amount redeemed, plus accrued and unpaid interest on

the Notes redeemed to, but not including, the Redemption Date (as

defined below), on the terms set forth below. As at the date of

this notice, US$715,000,000 aggregate principal amount of the Notes

is outstanding. Capitalized terms used but not defined in this

Notice of Redemption have the meaning specified in the

Indenture.

Redemption Terms:

Redemption Date: July 2, 2013 (the "Redemption Date").

Redemption Price: US$1,045.63 in principal amount and premium per $1,000.00

principal amount redeemed, plus approximately $4.31 in

accrued and unpaid interest to but not including the

Redemption Date (the "Redemption Price").

Paying Agent: Holders of the Notes will be paid the Redemption Price

upon presentation and surrender of their Notes for

redemption at the Paying Agent's address indicated below.

Notes called for redemption must be so surrendered in

order to collect the Redemption Price. The Paying Agent's

address for delivery of the Notes is as follows:

Registered & Certified Regular Mail or Courier: In Person by Hand Only:

Mail:

----------------------------------------------------------------------------

Wells Fargo Bank, Wells Fargo Bank, Wells Fargo Bank,

National Association National Association National Association

Corporate Trust Corporate Trust Corporate Trust Services

Operations Operations

MAC N9303-121 MAC N9303-121 Northstar East Building

- 12th Floor

P.O. Box 1517 6th St & Marquette 608 Second Avenue South

Avenue

Minneapolis, MN 55480 Minneapolis, MN 55479 Minneapolis, MN 55402

To facilitate prompt payment, the Notes called for redemption

should be surrendered as soon as possible to the Paying Agent.

SECURITIES HELD IN BOOK-ENTRY FORM WILL BE REDEEMED IN ACCORDANCE

WITH THE APPLICABLE PROCEDURES OF THE DEPOSITORY TRUST

CORPORATION.

The Notes called for redemption are being redeemed pursuant to

Section 3.07 of the Indenture and will become due on the Redemption

Date. The Redemption Price will be paid promptly following the

later of the Redemption Date and the time of surrender of the Notes

called for redemption to the Paying Agent. On the Redemption Date,

the Redemption Price will become due and payable upon each Note to

be redeemed, and, unless Videotron defaults in paying the

Redemption Price, interest on the Notes or portions of them called

for redemption will cease to accrue on and after the Redemption

Date. Notes and portions of Notes selected will be in amounts of

US$1,000 or integral multiples of US$1,000, except that if all the

Notes of a Holder are to be redeemed, the entire outstanding amount

of Notes held by such Holder, even if not an integral multiple of

US$1,000, will be redeemed.

Neither Videotron nor the Trustee shall be held responsible for

the selection or use of the CUSIP numbers listed in this notice,

nor is any representation made by Videotron or the Trustee as to

the correctness or accuracy of the CUSIP numbers listed in this

notice or printed on the Notes. They are included solely for the

convenience of the Holders.

If you have any questions concerning this notice of redemption,

please contact Jean-Francois Pruneau, Vice President, at (514)

380-4144 or via mail c/o Videotron Ltd., 612 St-Jacques Street,

Montreal, Quebec, Canada, H3C 4M8.

IMPORTANT NOTICE AND TAXPAYER INFORMATION

Under current United States federal income tax law, backup

withholding, at a current rate of 28%, generally may apply to the

payment of gross redemption proceeds, unless (i) in the case of a

non-corporate holder that is a beneficial owner of Notes and that

is a United States person (as determined for U.S. federal income

tax purposes), the paying agent has received a properly completed

IRS Form W-9 setting forth the holder's taxpayer identification

number, or (ii) the holder otherwise establishes an exemption. A

holder that is a beneficial owner of Notes and that is not a United

States person (as determined for U.S. federal income tax purposes)

generally may establish an exemption from backup withholding by

providing to the paying agent an IRS Form W-8BEN, upon which it

certifies its foreign status.

Direct inquiries to the Trustee by telephone at 1-800-344-5128

or by Fax at 612-667-6282.

Videotron Ltd./Videotron Ltee

By: Wells Fargo Bank, National Association, As Trustee

This notice of redemption is dated and given this 3rd day of

June, 2013.

Contacts: Jean-Francois Pruneau Vice President (514) 380-4144

Direct inquiries to the Trustee by telephone 1-800-344-5128

612-667-6282 (FAX)

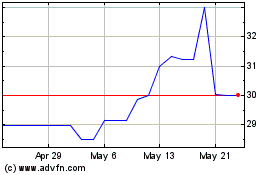

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024