Prairie Provident Resources Inc. ("Prairie Provident", "PPR" or the

"Company") today announces our financial and operating results for

the three and nine months ended September 30, 2020. PPR’s

unaudited condensed interim consolidated financial statements for

the three and nine months ended September 30, 2020 (“Interim

Financial Statements”) and related Management’s Discussion and

Analysis (“MD&A”) for the three and nine months ended

September 30, 2020 are available on our website at www.ppr.ca

and filed on SEDAR.

PPR’s third quarter financial results continue

to reflect the significant decline in global energy demand and

resultant impact on crude oil pricing caused by the COVID-19

pandemic since early 2020. While the health and safety of our

employees, partners and communities remains a priority, the Company

has proactively taken steps to maintain our liquidity and financial

position during this unprecedented time.

Initiatives undertaken include suspending the

capital program; identifying immediate and targeted operating cost

reductions; reducing compensation across the organization; and

reaching an agreement with our lenders to defer the Company's

borrowing base re-determination and to suspend cash interest

payments on our 15% subordinated unsecured notes due October 31,

2021 ("Senior Notes").

As a result of these initiatives, the Company

expects to realize adjusted funds flow ("AFF")1 savings of

approximately $8.0 million to $10.0 million for 2020. In addition,

PPR has WTI hedges on over 80% of our 2020 and 30% of our 2021

forecast base oil production (net of royalties), respectively,

which protect our operating cash flows and provide further

resiliency amid continued volatility. At September 30,

2020, our hedges were fair valued at over $4.7 million.

Q3 2020 HIGHLIGHTS

- Due to the ongoing adverse effects of the COVID-19 pandemic and

OPEC+ supply issues, oil prices were significantly depressed

throughout the second quarter of 2020, and despite moderate

improvement in the third quarter of 2020 remain significantly lower

year-over-year from 2019 levels. PPR's Q3 2020 cash flows were

partially protected by our hedging program, which brought in $2.8

million of realized gains for the quarter.

- Production averaged 4,516 boe/d (68% liquids) in the third

quarter of 2020, a 27% or 1,698 boe/d decrease from the same period

in 2019, primarily driven by natural declines and production

shut-ins, partially offset by production from our 2019/2020

drilling program. In response to weak oil prices, PPR permanently

shut-in approximately 130 boe/d of uneconomic oil production and

suspended our capital program during the second quarter of 2020,

and also deferred workover activities to preserve reserves value

and liquidity, which resulted in temporary production loss over the

quarter. As oil prices have partially recovered, PPR resumed

workover activities in the third quarter of 2020 on select projects

that meet our current economic thresholds of less than one-year

payout.

- In addition to shutting in uneconomic production, PPR

implemented various other cost reduction initiatives including the

realignment of field structure, negotiating rate reductions with

vendors and suspending workover activities. These cost

savings initiatives together with lower production, resulted in a

decrease in operating expenses of $1.1 million compared to the

third quarter of 2019, partially offset by a higher level of

workover activities.

- Operating netback1 after the impact of realized gains on

derivatives was $6.3 million ($15.15/boe) for the third quarter of

2020, reflecting a decrease of $4.5 million or 42% from the same

period in 2019. Our hedging program provided $2.8 million of

realized gains in the third quarter of 2020 which partially

mitigated a 29% drop in realized oil prices from the corresponding

period in 2019.

- Net capital expenditures1 during the second quarter of 2020

were nominal, as a result of the suspension of the capital

program.

- Adjusted funds flow1, excluding $0.1 million of decommissioning

settlements, was $3.9 million ($0.02 per basic and diluted share)

for the third quarter of 2020, a 40% or $2.7 million decrease from

the same quarter in 2019. Primary contributors to the decrease were

lower production volumes and lower realized oil prices, which were

partially offset by a reduction in operating expenses, royalties,

general and administrative ("G&A") expenses and cash interest

expenses.

- Net loss totaled $8.3 million in the third quarter of 2020

compared to a net loss of $2.3 million in the same period of 2019,

driven primarily by a non-cash unrealized loss on derivative

instruments of $3.9 million in the third quarter of 2020 versus an

unrealized gain of $5.2 million in the third quarter of 2019. The

unrealized loss on derivative instruments was due to a decrease in

derivative asset value between June 30, 2020 and September 30,

2020. The decrease in derivative asset value during the third

quarter of 2020 was largely due to realizing $2.8 million of gains

from contracts settled in the period.

- Net debt1 at September 30, 2020 totaled $117.6 million, up

$6.2 million from December 31, 2019. The increase is

attributed to an unrealized foreign exchange loss of $2.0 million,

which was driven by a weaker Canadian dollar relative to the US

dollar on the Company's US-dollar denominated debt, amortization of

deferred financing costs and an increase of $5.3 million in

deferred interest on the Company's bank debt, partially offset by a

year-to-date AFF1 that exceeds capital expenditures, finance lease

payments and decommissioning settlements.

- A lender redetermination of the senior secured revolving note

facility (“Revolving Facility”) borrowing base, originally

scheduled for the spring of 2020, continues to be temporarily

deferred. Until the redetermination is concluded, the Company

agreed to direct excess funds, after payment of all operating,

G&A and other costs of conducting our business, to the

repayment of borrowings on the Revolving Facility and to not make

further advances under that facility. PPR also agreed to a 200

basis point payment-in-kind margin increase on outstanding

advances, payable on maturity of the Revolving Facility.

- The maturity date of the Revolving Facility is April 30, 2021.

As the maturity date is within 12 months from September 30, 2020,

the total outstanding amount under the Revolving Facility is

classified under current liabilities as at September 30, 2020.

The Company and our lenders continue to work towards a long‐term

solution on the credit facilities. The lenders under both the

Revolving Facility and the Senior Notes agreed to waive the

application of all financial covenants for September 30, 2020.

- At September 30, 2020, PPR had US$57.3 million of

borrowings drawn against the US$60.0 million Revolving Facility,

comprised of US$30.3 million (C$40.5 million equivalent using the

exchange rate at the time of borrowing, plus C$0.4 million

equivalent of deferred interest, using the September 30, 2020

exchange rate of $1.00 USD to $1.33 CAD) of CAD-denominated

borrowing and US$27.0 million of USD-denominated borrowing (C$35.7

million, plus C$0.4 million of deferred interest equivalent using

the September 30, 2020 exchange rate). In addition, US$34.4

million (C$38.0 million, plus C$7.8 million of deferred interest

equivalent using the September 30, 2020 exchange rate)

of Senior Notes were outstanding at September 30, 2020, for

total borrowings of US$91.7 million (C$122.9 million using the

September 30, 2020 exchange rate).

1 Non-IFRS measure – see below under

“Non-IFRS Measures”

CEO SUCCESSION

Prairie Provident also announces that Tim

Granger, Chief Executive Officer and a director of the Company, has

decided to retire after almost eight years of service to PPR and

its predecessor, Lone Pine Resources, and that Tony van Winkoop

will be appointed Chief Executive Officer.

"The board of directors, shareholders and

employees of Prairie Provident wish to thank Tim for his years of

loyal service, sound leadership and stewardship. We wish him

well in his future endeavors," said Patrick McDonald, Chair of the

Board of Directors. "On behalf of the Board, I would also like to

congratulate Tony on his appointment as CEO, a well-deserved

recognition of his contribution to the Company and moreover

demonstration of our confidence in his abilities to lead the

Company," said McDonald.

Mr. van Winkoop, who has served as Vice

President, Exploration for over 5 years and now President, was

Chief Executive Officer of Arsenal Energy until its combination

with Lone Pine Resources to form Prairie Provident in September

2016, and has been an integral member of the executive leadership

team ever since.

The changes will be effective at the annual

meeting of PPR shareholders to be held on December 18, 2020, at

which Mr. van Winkoop will also stand for election to the board of

directors together with Patrick McDonald (Chairman), Derek Petrie,

William Roach, Ajay Sabherwal and Rob Wonnacott. Mr. Granger

and Terence (Tad) Flynn are not standing for re-election.

A notice of meeting and information circular for

the 2020 shareholders' meeting has been filed on SEDAR under the

Company's issuer profile at www.sedar.com, and will be disseminated

to shareholders in the coming days.

FINANCIAL AND OPERATING

SUMMARY

|

|

Three Months Ended September

30, |

Nine Months Ended September

30, |

|

($000s except per unit amounts) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| Production

Volumes |

|

|

|

|

| Crude oil (bbls/d) |

2,931 |

|

4,029 |

|

3,188 |

|

4,051 |

|

| Natural gas (Mcf/d) |

8,704 |

|

12,092 |

|

9,411 |

|

11,792 |

|

| Natural

gas liquids (bbls/d) |

135 |

|

169 |

|

134 |

|

172 |

|

| Total

(boe/d) |

4,516 |

|

6,214 |

|

4,891 |

|

6,188 |

|

| %

Liquids |

68 |

% |

68 |

% |

68 |

% |

68 |

% |

| Average Realized

Prices |

|

|

|

|

| Crude oil ($/bbl) |

43.70 |

|

61.83 |

|

35.81 |

|

61.81 |

|

| Natural gas ($/Mcf) |

2.26 |

|

1.14 |

|

2.09 |

|

1.57 |

|

| Natural

gas liquids ($/bbl) |

24.96 |

|

25.53 |

|

22.47 |

|

30.26 |

|

| Total

($/boe) |

33.47 |

|

43.01 |

|

27.99 |

|

44.29 |

|

| Operating Netback

($/boe)1 |

|

|

|

|

| Realized price |

33.47 |

|

43.01 |

|

27.99 |

|

44.29 |

|

| Royalties |

(3.38 |

) |

(4.85 |

) |

(2.78 |

) |

(4.57 |

) |

|

Operating costs |

(21.79 |

) |

(18.92 |

) |

(20.80 |

) |

(20.86 |

) |

| Operating netback |

8.30 |

|

19.24 |

|

4.41 |

|

18.86 |

|

|

Realized gains (losses) on derivatives |

6.85 |

|

(0.29 |

) |

9.65 |

|

(1.02 |

) |

|

Operating netback, after realized gains (losses) on

derivatives |

15.15 |

|

18.95 |

|

14.06 |

|

17.84 |

|

- Operating netback is a Non-IFRS measure (see “Non-IFRS

Measures” below).

|

Capital Structure($000s) |

September 30, 2020 |

|

December 31, 2019 |

|

|

Working capital1 |

3.4 |

|

2.2 |

|

|

Bank debt2 |

(121.0 |

) |

(113.6 |

) |

| Total net debt3 |

(117.6 |

) |

(111.4 |

) |

|

Common shares outstanding (in millions) |

172.1 |

|

171.4 |

|

- Working capital (deficit) is a Non-IFRS measure (see "Non-IFRS

Measures" below) calculated as current assets less current portion

of derivative instruments, minus accounts payable and accrued

liabilities.

- Bank debt includes the Revolving Facility and the Senior

Notes.

- Net debt is a Non-IFRS measure (see "Non-IFRS Measures" below),

calculated by adding working capital (deficit) and bank debt.

|

|

Three Months Ended September

30, |

Nine Months Ended September

30, |

|

Drilling Activity |

2020 |

2019 |

2020 |

2019 |

| Gross wells |

0.0 |

0.0 |

1.0 |

1.0 |

| Net (working interest) wells |

n/a |

n/a |

1.0 |

1.0 |

|

Success rate, net wells (%)1 |

n/a |

n/a |

100% |

100% |

- For the nine months ended September 30, 2020, the Company

drilled one development well with a 100% success rate.

OUTLOOK

The COVID-19 pandemic has resulted in a sharp

decline in global economic activity, and consequently, a

significant drop in energy demand. There has been a recent

resurgence of COVID-19 cases in certain areas and the timing and

extent of an eventual economic recovery remains highly

uncertain.

The downturn in oil prices has adversely

affected PPR's operating results and financial position, although

the impact has been somewhat muted given that 80% of our 2020

forecast base oil production (net of royalties) is protected by

hedges. Our hedging program has shielded the Company against the

severe price deterioration that has occurred during these

unprecedented times, underpinning the importance of maintaining

liquidity and financial position. After completing the Michichi

well in March 2020, PPR has suspended our capital program to

preserve liquidity and protect development economics.

Operationally, PPR conducted a bottom-up review

of all of our operating expenses and identified and moved forward

with immediate reduction opportunities. Operating cost reductions

are being realized through rate negotiations, workforce

optimizations, shutting-in uneconomic production and the deferral

of activities, and are expected to total approximately $2.9 million

for the year or $4.0 million on an annualized basis.

In addition, effective April 2020, executive and

non-executive salaries and director annual remuneration were

reduced. Certain employee benefit programs have also been

suspended. These measures are expected to result in approximately

$2.0 million of gross G&A reductions for 2020 or $2.2 million

on an annualized basis.

PPR continues to actively monitor and pursue

available COVID-19 relief programs and has to date realized some

benefit under the Canada Emergency Wage Subsidy and the Site

Rehabilitation Program for federal funding of abandonment and

reclamation work.

As a result of the ongoing impacts caused by

COVID-19, the Company expects the remainder of 2020 and first half

of 2021 to be a challenging time for our industry and for the

global economy in general. While PPR cannot control or influence

the macro environment, we are committed to maintaining our balance

sheet and liquidity through active cost reduction efforts and will

continue to work closely with our lenders.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at the

Michichi and Princess areas in Southern Alberta targeting the

Banff, the Ellerslie and the Lithic Glauconite formations, along

with an established and proven waterflood project at our Evi area

in the Peace River Arch. Prairie Provident protects our balance

sheet through an active hedging program and manages risk by

allocating capital to opportunities offering maximum shareholder

returns.

For further information, please contact:

Prairie Provident Resources Inc.

Tim Granger – Chief Executive OfficerTel: (403) 292-8110 Email:

tgranger@ppr.ca

Tony van Winkoop – PresidentTel: (403) 292-8071Email:

tvanwinkoop@ppr.ca

Forward-Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein. All

statements other than statements of current or historical fact

constitute forward-looking statements. Forward-looking statements

are typically, but not always, identified by words such as

“anticipate”, “believe”, “expect”, “intend”, “plan”, “budget”,

“forecast”, “target”, “estimate”, “propose”, “potential”,

“project”, “continue”, “may”, “will”, “should” or similar words

suggesting future outcomes or events or statements regarding an

outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to: the

Company's liquidity and financial position going-forward; cost

reduction opportunities (including anticipated amounts) and the

Company's ability to achieve them; and future improvements in

economic activity and energy demand.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements but which

may prove to be incorrect. Although the Company believes that the

expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and assumptions.

Prairie Provident can give no assurance that the forward-looking

statements contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. Actual results or events will differ, and the

differences may be material and adverse to the Company. In addition

to other factors and assumptions which may be identified herein,

assumptions have been made regarding, among other things: future

commodity prices and currency exchange rates, including consistency

of future prices with current price forecasts; the economic impacts

of the COVID-19 pandemic, including the adverse effect on global

energy demand, and the oversupply of oil production; results from

development activities, and their consistency with past operations;

the quality of the reservoirs in which Prairie Provident operates

and continued performance from existing wells, including production

profile, decline rate and product mix; the accuracy of the

estimates of Prairie Provident's reserves volumes; operating and

other costs, including the ability to achieve and maintain cost

improvements; continued availability of external financing and cash

flow to fund Prairie Provident's current and future plans and

expenditures, with external financing on acceptable terms; the

impact of competition; the general stability of the economic and

political environment in which Prairie Provident operates; the

general continuance of current industry conditions; the timely

receipt of any required regulatory approvals; the ability of

Prairie Provident to obtain qualified staff, equipment and services

in a timely and cost efficient manner; drilling results; the

ability of the operator of the projects in which Prairie Provident

has an interest in to operate the field in a safe, efficient and

effective manner; field production rates and decline rates; the

ability to replace and expand oil and natural gas reserves through

acquisition, development and exploration; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Prairie Provident to secure adequate product

transportation; regulatory framework regarding royalties, taxes and

environmental matters in the jurisdictions in which Prairie

Provident operates; and the ability of Prairie Provident to

successfully market its oil and natural gas products.

Forward-looking statements are not guarantees of

future performance or promises of future outcomes, and should not

be relied upon. Such statements, including the assumptions made in

respect thereof, involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements including, without limitation: changes in realized

commodity prices; changes in the demand for or supply of Prairie

Provident's products; the early stage of development of some of the

evaluated areas and zones; the potential for variation in the

quality of the geologic formations targeted by Prairie Provident’s

operations; unanticipated operating results or production declines;

changes in tax or environmental laws, royalty rates or other

regulatory matters; changes in development plans of Prairie

Provident or by third party operators; increased debt levels or

debt service requirements; inaccurate estimation of Prairie

Provident's oil and gas reserves volumes; limited, unfavourable or

a lack of access to capital markets; increased costs; a lack of

adequate insurance coverage; the impact of competitors; and such

other risks as may be detailed from time-to-time in Prairie

Provident's public disclosure documents, (including, without

limitation, those risks identified in this news release and Prairie

Provident's current Annual Information Form).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Barrels of Oil Equivalent

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand cubic

feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure,

particularly if used in isolation. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

Non-IFRS Measures

The Company uses certain terms in this news

release and within the MD&A that do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS), and, accordingly these measurements may not be

comparable with the calculation of similar measurements used by

other companies. For a reconciliation of each non-IFRS measure to

its nearest IFRS measure, please refer to the “Non-IFRS Measures”

section in the MD&A. Non-IFRS measures are provided as

supplementary information by which readers may wish to consider the

Company's performance but should not be relied upon for comparative

or investment purposes. The non-IFRS measures used in this news

release are summarized as follows:

Working Capital – Working capital (deficit) is

calculated as current assets excluding the current portion of

derivative instruments, less accounts payable and accrued

liabilities. This measure is used to assist management and

investors in understanding liquidity at a specific point in

time. The current portion of derivatives instruments is

excluded as management intends to hold derivative contracts through

to maturity rather than realizing the value at a point in time

through liquidation. The current portion of bank debt is excluded

from working capital calculation as it relates to financing

activities and is included in net debt calculation. The current

portion of decommissioning expenditures is excluded as these costs

are discretionary and the current portion of flow-through share

premium and warrant liabilities are excluded as it is a

non-monetary liability. Lease liabilities have historically been

excluded as they were not recorded on the balance sheet until the

adoption of IFRS 16 – Leases on January 1, 2019.

Net Debt – Net debt is defined as bank debt plus

working capital surplus or deficit. Net debt is commonly used in

the oil and gas industry for assessing the liquidity of a

company.

Operating Netback – Operating netback is a

non-IFRS measure commonly used in the oil and gas industry. This

measurement assists management and investors to evaluate the

specific operating performance at the oil and gas lease level.

Operating netbacks included in this news release were determined by

taking (oil and gas revenues less royalties less operating costs).

Operating netback may be expressed in absolute dollar basis or per

unit basis. Per unit amounts are determined by dividing the

absolute value by gross working interest production. Operating

netback, including realized commodity (loss) and gain, adjusts the

operating netback for only realized gains and losses on derivative

instruments.

Adjusted Funds Flow – Adjusted funds flow is

calculated based on cash flow from operating activities before

changes in non-cash working capital, transaction costs,

restructuring costs, and other non-recurring items. Management

believes that such a measure provides an insightful assessment of

PPR’s operational performance on a continuing basis by eliminating

certain non-cash charges and charges that are non-recurring or

discretionary and utilizes the measure to assess its ability to

finance capital expenditures and debt repayments. Adjusted funds

flow as presented is not intended to represent cash flow from

operating activities, net earnings or other measures of financial

performance calculated in accordance with IFRS. Adjusted funds flow

per share is calculated based on the weighted average number of

common shares outstanding consistent with the calculation of

earnings per share.

Net Capital Expenditures – Net capital

expenditures is a non-IFRS measure commonly used in the oil and gas

industry. The measurement assists management and investors to

measure PPR’s investment in the Company’s existing asset base. Net

capital expenditures is calculated by taking total capital

expenditures, which is the sum of property and equipment and

exploration and evaluation expenditures from the consolidated

statement of cash flows, plus capitalized stock-based compensation,

plus acquisitions from business combinations, which is the outflow

cash consideration paid to acquire oil and gas properties, less

asset dispositions (net of acquisitions), which is the cash

proceeds from the disposition of producing properties and

undeveloped lands.

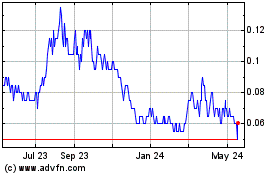

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

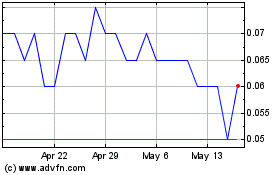

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025