Maxim Power Corp. Announces 2011 Financial and Operating Results and Appointment of Director

March 22 2012 - 8:16PM

Marketwired Canada

Maxim Power Corp. (TSX:MXG) ("MAXIM" or the "Corporation") announced today the

release of financial and operating results for its fourth quarter and year ended

December 31, 2011. The audited financial statements, accompanying notes,

Management Discussion and Analysis, and Annual Information Form will be

available on SEDAR and on MAXIM's website on March 23, 2012. All figures

reported herein are Canadian dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended Twelve Months Ended

December 31 December 31

($ in thousands except per

share amounts) 2011 2010 2011 2010

Net revenue (1) $ 44,816 $ 36,694 $ 155,290 $ 151,249

Adjusted EBITDA (1) 11,304 5,769 38,827 36,135

Net income (loss) (1,555) (633) 15,316 24,249

Per share - basic and

diluted $ (0.03) $ (0.01) $ 0.28 $ 0.45

Funds from operations (1) 11,489 5,538 38,802 30,107

Per share - basic and

diluted $ 0.21 $ 0.10 $ 0.72 $ 0.55

Electricity Deliveries (MWh) 295,420 323,551 1,203,227 1,322,037

Net Generation Capacity (MW)

(2) 815 809 815 809

Average Alberta Power Prices

($ per MWh) $ 76.07 $ 45.94 $ 76.21 $ 50.88

Average Milner Realized

Electricity Price ($ per

MWh) $ 89.12 $ 49.35 $ 80.12 $ 57.52

(1) Select financial information was derived from the audited consolidated

financial statements and is prepared in accordance with International Financial

Reporting Standards ("IFRS"), except net revenue, adjusted EBITDA and funds from

operations ("FFO"). Net revenue is provided to highlight revenue net of any

gains or losses realized on commodity swaps. Adjusted EBITDA is provided to

assist management and investors in determining the Corporation's approximate

operating cash flows before interest, income taxes, and depreciation and

amortization and certain other income and expenses and FFO is provided to assist

management and investors in determining the Corporation's cash flows generated

by operations before the cash impact of working capital fluctuations. Net

revenue, adjusted EBITDA and FFO do not have any standardized meaning prescribed

by IFRS and may not be comparable to similar measures presented by other

companies. Refer to 'Non-IFRS measures' for reconciliations between non-IFRS

financial measures and comparable measures calculated in accordance with IFRS.

(2) Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

Net revenue, adjusted EBITDA, and funds from operations increased in 2011 when

compared to 2010. These increases are primarily due to improving Alberta power

prices and their positive impact on Milner results.

Net income decreased over 2010 due to the impact of one-time events that

occurred in 2010. Net income in 2011 benefited from a gain on derivative

contracts and an increase in Alberta power prices, net of realized losses on

power price swaps entered throughout the year. This increase was offset by a

one-time $22.6 million tax gain recognized in 2010 as a result of MAXIM's

amalgamation with EarthFirst Canada Inc. net of a $4.2 million arbitration

settlement occurring in that year.

During the fourth quarter of 2011, MAXIM earned net revenue of $44.8 million

compared to $36.7 million for 2010 and adjusted EBITDA was $11.3 million

compared to $5.8 million in 2010 primarily due to higher Alberta power prices.

Fourth quarter 2011 production decreased 28,131 MWh or 9% to 295,420 MWh

compared to 323,551 MWh during the same quarter of 2010. The decrease is

primarily due to a 56% or 37,793 MWh decrease at the northeast United States

facilities as a result of milder weather. This was offset by smaller increases

in production at Milner and in France.

GROWTH INITIATIVES

Deerland Peaking Station ("D1")

MAXIM is actively pursuing commercial arrangements that will allow for the

construction of the 190 MW Deerland peaking station ("D1") to commence in 2012.

MAXIM received regulatory approvals in 2008 to construct and operate D1. The D1

site is located near Buderheim in Alberta's industrial heartland, which is in

close proximity to the entry point of the proposed Gateway pipeline and adjacent

to the existing Deerland high voltage substation. This area is expected to

experience significant growth in electrical demand. MAXIM further expects

peaking requirements across Alberta to continue to grow to meet overall demand

growth and to provide firm backup for additional intermittent wind resources.

Summit Coal Mine 14 ("M14")

MAXIM has advanced the development of its Mine 14 ("M14") metallurgical coal

resource during 2011 and is currently assessing the potential to expand the coal

resources within its three coal leases.

On December 2, 2009, the ERCB granted Milner Power Inc. a permit to develop the

underground coal mine referred to by the Corporation as M14. On April 20, 2011,

the ERCB granted Milner Power Inc. the license to commence underground mining of

the M14 coal reserve. M14 will be located north of Grande Cache, Alberta and is

estimated to contain 13 million recoverable tonnes of high quality metallurgical

coal reserves. The resource is considered valuable both as a potential fuel

source to Milner and for the potential sale of coal to metallurgical coal

markets.

On August 8, 2011, MAXIM incorporated Summit Coal Inc., which entered into a

partnership with Milner Power Limited Partnership ("MPLP") to form Summit Coal

Limited Partnership ("Summit"). Pursuant to a contribution agreement between

MPLP and Summit dated October 3, 2011, MPLP agreed to contribute all of its

interests in M14, including its interest in the coal leases, to Summit in

exchange for limited partnership units. All further development of M14 is now

carried on through Summit and Summit Coal Inc.

During the third quarter of 2011, an adit was completed to recover un-oxidized

coal for the purpose of conducting metallurgical quality testing. Results of

this testing confirmed that M14 coal is a low-mid volatile metallurgical grade

coal.

On December 15, 2011, Summit entered into a ten year terminal services agreement

with Ridley Terminals Inc., commencing January 1, 2015. This agreement provides

Summit with firm terminal capacity and terminal processing services to enable

the majority of Summit's proposed coal production to access the valuable

seaborne coking coal market. Signing this agreement reduces the development risk

of M14 as Summit advances to the construction phase of its M14 project.

Summit has secured firm 2013 delivery dates for critical mining equipment,

including two continuous miners and three shuttle cars.

Milner Expansion ("M2")

On August 10, 2011, MAXIM received approval from the Alberta Utilities

Commission for its new 500 MW M2 project. MAXIM is planning to construct and

operate this new 500 MW generating station on the site of and adjacent to the

existing 150 MW Milner generating station. The M2 design incorporates emission

control equipment capable of achieving 60 to 80 percent reductions in sulphur

dioxide, nitrogen oxides and mercury compared to the conventional coal fired

power plants still operating in Alberta. The highly efficient M2 design will

also reduce carbon dioxide emissions by 20% compared to these existing plants.

Buffalo Atlee ("B1")

MAXIM acquired the Buffalo Atlee Power Project ("B1"), situated near Brooks,

Alberta, through an amalgamation with EarthFirst Canada Inc. This project has

the potential for development of over 200 MW of wind generation capacity. Wind

data has been collected on the site for approximately four years and supports

project development based on higher power prices than those realized during

recent months. MAXIM holds an exploratory Crown land permit with a term of five

years, expiring on January 1, 2016. The addition of wind generation to MAXIM's

existing portfolio of assets will diversify MAXIM's generation fuel types and

provides the potential to offset the impact of proposed carbon legislation.

MAXIM plans to advance the development of this project once greater clarity on

carbon policy is available in 2012.

CONFERENCE CALL FOR 2011 RESULTS

MAXIM will host a conference call for analysts and investors on Tuesday, March

27, 2012 at 11:00 am MT. The call will be hosted by John Bobenic, MAXIM's

President and Chief Executive Officer, and by Mike Mayder, Vice President,

Finance and Chief Financial Officer. To participate in this conference call,

please dial (877) 440-9795 or (416) 340-8530 in the Toronto area. It is

recommended that participants call at least ten minutes prior to start time.

A recording of the conference call will be available from March 27, 2012 to

April 10, 2012. To access the replay, dial (800) 408-3053 or (905) 694-9451

followed by the passcode 7623210. In addition, the webcast will be available

commencing March 28, 2012 in the Investor Relations section of MAXIM's website

at www.maximpowercorp.com.

APPOINTMENT OF MR. JOEL LUSMAN AS DIRECTOR

Mr. Joel Lusman has been appointed to the Board of Directors of MAXIM. Mr.

Lusman is the founder and portfolio manager of Lusman Capital Management. Prior

thereto, Mr. Lusman spent over five years as portfolio manager for Korsant

Partners. Mr. Lusman also gained significant industry experience as an analyst

working for Kingdon Capital and Davidson Kempner.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 40 power plants in

western Canada, United States and France, having 788 MW of electric and 111 MW

of thermal net generating capacity. MAXIM trades on the TSX under the symbol

"MXG". For more information about MAXIM, visit our website at

www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward-looking statements as required pursuant

to applicable securities laws.

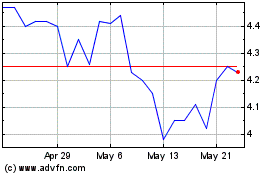

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

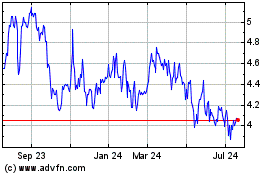

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024