Maxim Power Corp. Announces Third Quarter 2011 Financial and Operating Results

November 14 2011 - 4:44PM

Marketwired Canada

Maxim Power Corp. (TSX:MXG) ("MAXIM" or "the Corporation") announced today the

release of financial and operating results for its third quarter ended September

30, 2011. The unaudited financial statements, accompanying notes and Management

Discussion and Analysis will be available on SEDAR on November 15, 2011 and on

MAXIM's website. All figures reported herein are Canadian dollars unless

otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended Nine Months Ended

September 30, September 30,

($ in thousands except

per share amounts) 2011 2010 2011 2010

Net revenue (1) $ 37,593 $ 31,123 $ 110,474 $ 114,555

Adjusted EBITDA (1) 13,445 6,466 27,038 29,703

Net income 17,787 108 16,871 24,882

Per share-basic and

diluted $ 0.33 $ 0.00 $ 0.31 $ 0.46

Funds from operations

(1) 13,135 5,609 27,313 24,569

Per share-basic and

diluted $ 0.24 $ 0.10 $ 0.51 $ 0.45

Electricity Deliveries

(MWh) 335,268 351,910 907,808 998,486

Net Generation Capacity

(MW) (2) 815 815 815 815

Average Alberta Prices

($ per MWh) $ 94.71 $ 35.69 $ 76.72 $ 52.37

Average Milner Realized

Electricity Price

($ per MWh) $ 95.41 $ 51.72 $ 76.91 $ 60.03

1. Select financial information was derived from the unaudited condensed

consolidated interim financial statements and is prepared in accordance

with IFRS, except net revenue, adjusted EBITDA and funds from operations

("FFO"). Net revenue is provided to highlight revenue net of any gains

or losses realized on commodity swaps. Adjusted EBITDA is provided to

assist management and investors in determining the Corporation's

approximate operating cash flows before interest, income taxes,

depreciation and amortization and certain other income and expenses and

FFO is provided to assist management and investors in determining the

Corporation's cash flows generated by operations before the cash impact

of working capital fluctuations. Net revenue, adjusted EBITDA and FFO do

not have any standardized meaning prescribed by IFRS and may not be

comparable to similar measures presented by other companies. Refer to

'Non-IFRS measures' for reconciliations between non-IFRS financial

measures and comparable measures calculated in accordance with IFRS.

2. Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

Third quarter 2011 revenue, net of a realized loss on commodity price swaps

("net revenue"), adjusted EBITDA, funds from operations, and net income

increased $6.5 million, $7.0 million, $7.5 million, and $17.7 million,

respectively, in comparison to the same period of 2010. The improvement in these

performance measures reflects higher Alberta power prices during the quarter and

the impact of reselling coal that was surplus to Milner requirements. Net income

has increased by a greater amount than the other noted key performance

indicators due to unrealized gains on coal remarketing and coal purchase

agreements.

On a year to date basis, net revenue and adjusted EBITDA have decreased $4.1

million and $2.7 million, respectively, when compared to the same period of

2010. The negative movements in these performance measures reflect the impact of

low second quarter power prices and generation volumes, which was partially

offset by higher Alberta power prices in the first and third quarters and by

higher earnings from MAXIM's US Northeast facilities in the first quarter of the

year.

Funds from operations for the nine months ended September 30, 2011 increased

$2.7 million in comparison to the same period of the prior year, when funds from

operations was reduced by an unfavourable non-recurring $4.2 million arbitration

settlement reached in May 2010. The remaining change in funds from operations is

a decrease of $1.5 million, which is due to the unfavourable items noted above,

partially offset by a decrease in taxes paid during the period.

Net income of $16.9 million for the nine months ended September 30, 2011

represents an $8.0 million decrease in comparison to the same period of 2010.

The decrease is primarily due to a one-time $22.6 million gain recognized in the

first nine months of 2010 as a result of MAXIM's amalgamation with EarthFirst

Canada Inc. offset by the $4.2 million arbitration settlement noted above. The

remaining change in net income is an increase of $10.4 million, which is due to

a gain on derivative coal contracts in the third quarter of 2011, offset by the

unfavourable factors noted above in respect to net revenue and adjusted EBITDA

variances, and by a non-cash mark-to-market unrealized loss on floating for

fixed commodity swaps.

GROWTH INITIATIVES

Mine 14 ("M14")

MAXIM has extracted and tested unoxidized coal and prepared detailed

metallurgical specifications of the low volatile resource to finalize the wash

plant design. Construction activities are now targeted to commence in early 2012

and MAXIM anticipates that M14 will be fully commissioned and producing coal in

2013. Various options to finance M14 are still under evaluation.

Milner Expansion ("M2")

On August 10, 2011, the Alberta Utilities Commission ("AUC") issued a final

decision on MAXIM's application to construct and operate a 500 MW Milner

expansion project ("M2") adjacent to the existing 150 MW Milner facility ("M1").

M2 has been under development by MAXIM since May 2005. A lengthy public

consultation and regulatory approval process culminated in the project's

approval by the AUC. M2 will utilize supercritical, pulverized coal technology,

making it one of the cleanest and most fuel-efficient coal-fired power plants in

Canada that can meet Alberta's growing electric energy needs and allow for the

orderly retirement of a less efficient, less reliable and aging conventional

coal-fired fleet.

The M2 design incorporates emission control equipment capable of achieving 60 to

80 percent reductions in sulphur dioxide, nitrogen oxides and mercury compared

to the conventional coal- fired power plants still operating in Alberta. The

highly efficient M2 design will also reduce carbon dioxide emissions by 20%

compared to these existing plants. M2 is a reliable and low- cost generation

supply solution for Albertans that is entirely consistent with federal and

provincial goals for emissions reductions.

Deerland Peaking Station ("D1")

MAXIM has received all required regulatory approvals to construct and operate

the Deerland Peaking Station ("D1"), a 190 MW natural gas-fired peaking facility

that will be located in Bruderheim, Alberta, immediately adjacent to the

existing Deerland high voltage substation in Alberta's industrial heartland.

This area is expected to experience significant growth in electrical demand.

Subject to the conclusion of satisfactory commercial arrangements necessary to

support the investment, MAXIM will initiate construction of this shovel-ready

project.

Buffalo Atlee

The Buffalo Atlee Power Project, situated near Brooks, Alberta, has the

potential for over 200 MW of wind generation capacity. Wind data has been

collected on the 22,000 acre project site for the last 5 years. MAXIM holds an

exploratory Crown land permit with a term of five years, expiring on January 1,

2016. The addition of wind generation to MAXIM's existing portfolio of assets

would diversify MAXIM's generation fuel types.

France

COMAX France S.A.S. will be investing development capital of $2.2 million

dollars to repower certain cogeneration facilities and add to its peaking fleet

commencing in Q4 2011. The renovation will result in the renewal of a 12 year

Power Purchase Agreement ("PPA") with Electricity de France ("EdF") at the

cogeneration site. Comax will be adding 7MW to its growing portfolio of peaking

service assets, that operate under eight year PPA's. Financing for 80% of the

cost of these investments has been committed by various banks in France. COMAX

continues to pursue growth opportunities through acquisitions and renovations of

existing assets.

GUIDANCE

In preparing its guidance, management uses Alberta forward electricity prices as

a proxy for actual future Alberta spot electricity prices. The market for

forward contracts is relatively illiquid and forward prices may not be a good

predictor of settled prices as they may not factor in events such as unplanned

outages, which can cause a significant increase in settled power prices.

Notwithstanding, MAXIM prepares its guidance using forward electricity prices

from independent sources.

MAXIM is updating guidance issued on March 25, 2011 as follows:

Guidance provided on

Select guidance KPI's March 25, 2011 Updated 2011 Guidance

----------------------------------------------------------------------------

Adjusted EBITDA(1) 37,972 37,185

Funds from operations(1) 34,853 37,941

Funds from operations per

share - basic and

diluted(1)(2) ($per share) 0.65 0.70

Net income (loss) 6,436 17,237

Net income (loss) per share

- basic and diluted(2) 0.12 0.32

----------------------------------------------------------------------------

1. Adjusted EBITDA and funds from operations are not measures under IFRS and may

not be comparable to similar measures presented by other companies. Refer to

'Non-IFRS measures' for additional detail.

2. Per share amounts are calculated using average weighted shares outstanding

consistent with the table below.

MAXIM is revising 2011 Guidance primarily due to an increase in forecast net

income from $6.4 million to $17.2 million. The $10.8 million increase is largely

attributable to unrealized financial derivative gains on MAXIM's long-term coal

purchase contract and coal remarketing agreements.

Forecast funds from operations has increased from $34.9 million to $37.9

million. The increase relates primarily to the transition from Canadian GAAP to

IFRS during 2011. The cash flow statement prepared as part of the March 25, 2011

Guidance classified finance costs as an operating activity, whereas Updated

Guidance has moved such costs into investing activities in accordance with IFRS

presentation requirements. The financial derivative gains noted above are

non-cash items and do not impact funds from operations.

Forecast adjusted EBITDA has fluctuated only $0.8 million from 2011 Guidance

provided on March 25, 2011.

These projections are based on MAXIM's existing portfolio of assets, do not

include the impact of possible acquisitions or the commercialization of

development initiatives, and are based on the following assumptions:

Guidance provided on Updated 2011

Guidance Assumptions March 25, 2011 Guidance

----------------------------------------------------------------------------

Electricity deliveries (MWh):

- HR Milner 1,016,791 776,461

- Other facilities 598,237 471,102

Net generation capacity at year

end (MW) 822 818

Capital expenditures (excluding

acquisitions):

- France repowering and peaking

facilities 16,922 7,511

- Development projects 1,693 4,164

- Other assets 1,871 2,207

- HR Milner 1,000 2,371

Average 2011 Alberta spot

electricity price ($/MWh) (1) 73.21 77.88

Average annual foreign exchange

rates:

- C$/USD 1.00 0.98

- C$/Euro 1.35 1.38

Weighted average shares

outstanding - basic and diluted

(000's) 54,033 54,065

----------------------------------------------------------------------------

1. The updated forecast average 2011 Alberta power price is based upon

January to September settled prices and forward wholesale prices.

The decrease in Milner generation from 1,016,791 MWh per March 25, 2011 Guidance

to 776,461 MWh per Updated Guidance is a result of reduced generation during

periods of lower power prices during the second quarter. The decrease in

forecast generation at other MAXIM facilities is attributable to reduced

production from US Northeast power plants, primarily due to less favourable

weather conditions than originally forecast.

Forecast capital expenditures have been decreased to reflect the rescheduling of

certain plant renovations in France, offset by increased Mine 14 development

activity and higher capital spending during Milner's annual turnaround.

CONFERENCE CALL FOR Q3 2011 RESULTS

MAXIM will host a conference call for analysts and investors on November 16,

2011 at 1:30 pm MT (3:30 pm ET). The call will be hosted by John Bobenic,

MAXIM's President and Chief Executive Officer, and by Mike Mayder, Vice

President, Finance and Chief Financial Officer. To participate in this

conference call, please dial (877) 240-9772 or (416) 340-8527 in the Toronto

area. It is recommended that participants call at least ten minutes prior to

start time.

A recording of the conference call will be available from 3:30 pm MT (5:30 pm

ET) on November 15, 2011 until November 30, 2011 at 9:59 pm MDT (11:59 pm ET).

To access this replay, please dial (800) 408-3053 or (416) 694-9451 followed by

the passcode 5535068. In addition, the call will be available commencing

November 16, 2011 in the Investor Relations section of MAXIM's website at

www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 44 power plants in

western Canada, the United States and France, having 809 MW of electric and 117

MW of thermal net generating capacity. MAXIM trades on the TSX under the symbol

"MXG". For more information about MAXIM, visit our website at

www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

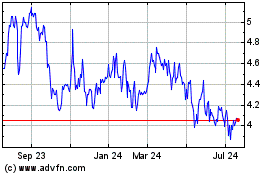

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

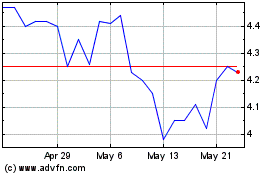

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024