Maxim Power Corp. Announces First Quarter 2010 Results

May 14 2010 - 7:03PM

Marketwired Canada

Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX:MXG) announced today that

it released the financial and operating results for its first quarter ended

March 31, 2010. The unaudited financial statements, accompanying notes and

Management Discussion and Analysis will be available on SEDAR on May 17, 2010

and on MAXIM's website. All figures reported herein are Canadian dollars unless

otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended

March 31

2010 2009

----------------------------------------------------------------------------

($ in thousands except per share amounts)

Revenue $50,775 $55,276

EBITDA(1) 11,930 17,433

Net income 1,298 5,003

Per share diluted $0.02 $0.09

Cash provided by operations 6,477 20,298

Per share diluted $0.12 $0.37

Electricity Deliveries (MWh) 384,635 332,334

Net Generation Capacity (MW)(2) 809 773

Average Alberta Electricity Price ($ per MWh) $41 $63

Average Milner Realized Electricity Price ($

per MWh) $42 $67

1. EBITDA is earnings before interest, taxes, depreciation and amortization

and is not a measure under Canadian Generally Accepted Accounting

Principles ("GAAP") and may not be comparable to similar measures

presented by other companies. Refer to Non-GAAP measures section of the

MD&A for an explanation and reconciliation.

2. Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

MAXIM generated 384,635 MWh during the first quarter of 2010 compared to 332,334

MWh for the same quarter of 2009, which is an increase of 52,301 MWh or 15.7%.

Revenue for the quarter decreased $4.5 million or 8.1% to $50.8 million over

2009 revenue of $55.3 million primarily as a result of the lower average Alberta

power price realized at HR Milner in 2010 of $42 per MWh compared to $67 per MWh

in 2009. The decrease in average power price was partially offset by an increase

in production during the quarter.

Accordingly, earnings before interest, taxes, depreciation and amortization

(refer to Non-GAAP measures - "EBITDA" in the MD&A), decreased $5.5 million to

$11.9 million in 2010 from $17.4 million in 2009, net income was $1.3 million

compared to 2009 of $5.0 million, and cash flow from operations was $6.5 million

compared to 2009 of $20.3 million.

On March 2, 2010, MAXIM amalgamated with EarthFirst Canada Inc. ("EarthFirst")

(the "Amalgamation") for a total investment of $5.9 million plus closing costs.

The Amalgamation provides MAXIM with a strategic development opportunity, the

Buffalo Atlee Power Project ("Buffalo Atlee"), which has the potential for over

200 MW of wind generation capacity. The amalgamation provides MAXIM with $117.4

million in Canadian tax pools related to the power business.

On February 22, 2010, Comax France S.A.S ("COMAX") entered into power purchase

agreements ("PPA's") to provide 74 MW of electrical peaking services to

Electricite de France ("EdF") for a term of eight years. The provision of

peaking services represents an important diversification of services and entry

into a new market for COMAX, which has historically focused on cogeneration

applications whereby electricity is sold to EdF and thermal energy is sold to

local businesses such as greenhouses.

GROWTH INITIATIVES

Mine 14 Project

During 2009, MAXIM obtained the permit to develop the Mine 14 coal leases and

commence commercial operations. MAXIM considers this resource to be valuable

both as a fuel source for its existing Milner facility, its planned Milner

Expansion, and for the sale of metallurgical coal commencing as early as Q4

2011. MAXIM is currently evaluating options to construct the mine and

anticipates that it will commence construction once key commercial arrangements

have been concluded.

Deerland Peaking Station

As previously announced, MAXIM has received regulatory approvals from the

Alberta Utilities Commission and Alberta Environment to construct and operate

the Deerland Peaking Station, a 190 MW natural gas-fired peaking facility. The

station is to be located immediately adjacent to the existing Deerland high

voltage substation in Alberta's industrial heartland, an area expected to

experience significant growth in electrical demand. Construction of the facility

is expected to take approximately twelve months once key commercial arrangements

have been concluded.

Milner Expansion

MAXIM continues to propose to construct and operate a 500 MW coal-fired

generation facility adjacent to its existing Milner facility. The regulatory

review process has commenced and is expected to conclude with the receipt of a

permit in late 2010.

Buffalo Atlee

MAXIM acquired the Buffalo Atlee Power Project ("Buffalo Atlee"), situated near

Brooks, Alberta, through an amalgamation with EarthFirst Canada Inc. This

project has the potential for development of over 200 MW of wind generation

capacity. Wind data has been collected on the site for approximately four years

and Buffalo Atlee holds an exploratory Crown land permit with a term of five

years, expiring on January 1, 2011. MAXIM intends to renew the land permit upon

its expiry. The addition of wind generation to MAXIM's existing portfolio of

assets will diversify MAXIM's generation fuel types and provides the potential

to offset the impact of proposed carbon legislation. MAXIM is advancing the

development of this project.

OUTLOOK

Alberta Electricity Prices

The Corporation's outlook depends on Alberta electricity and fuel prices.

Electricity prices are a key revenue determinant for MAXIM's Milner and Gold

Creek facilities. Alberta electricity prices fluctuate based on the supply of

and demand for electricity within Alberta as well as key inputs costs such as

the cost of natural gas. The following chart compares the average annual Alberta

electricity price to Alberta natural gas price since deregulation of the

electric industry in Alberta. Increasing demand for electricity and natural gas

should have a positive effect on electricity prices.

To view the accompanying chart, please visit the following link:

http://media3.marketwire.com/docs/514mxg.jpg

Coal Supply

Milner Power Limited Partnership's ("MPLP") supply of thermal coal to the Milner

Facility is primarily sourced from Coal Valley Resources Inc.'s ("CVRI") mine

located in Hinton, Alberta. In July of 2008, MPLP exercised its option to extend

the term of the coal supply agreement ("CSA") for an additional five years

expiring on December 31, 2013. The price of coal during the extension term is

established in the CSA and reflects an annual inflation adjustment over the

prior year's price. It is CVRI's view that it has the right to initiate a price

review and has given notice to MPLP that it wishes to review the price for the

extension term. It is MAXIM's view that the price review can only be initiated

if anticipated operating costs at the Coal Valley mine would not allow its

profitable operation at the price levels set out in the CSA. MAXIM does not

believe this condition has been satisfied and does not believe a price review is

warranted under the CSA. CVRI has referred this matter to arbitration and a

decision is anticipated in May 2010. A price adjustment could result in a

material obligation arising during the second quarter of 2010 relating to coal

purchased from February 1, 2009 up to the date of the arbitration decision and

could result in a material adverse impact to MAXIM's 2010 and future earnings.

Mine 14 has coal resources sufficient to satisfy the coal requirements of Milner

for an estimated 27 years and in addition to alternate fuel supplies, can

mitigate this impact beyond 2010. MAXIM will issue guidance for 2010 following

the decision of the arbitrator.

CONFERENCE CALL FOR FIRST QUARTER 2010 RESULTS

MAXIM will host a conference call for analysts and investors on May 26, 2010 at

10:00 a.m. MT (12:00 p.m. ET). The call will be hosted by John Bobenic, MAXIM's

President and Chief Executive Officer, and by Mike Mayder, Vice President,

Finance and Chief Financial Officer. To participate in this conference call,

please dial (866) 226-1792 or (416) 340-2216 in the Toronto area. It is

recommended that participants call at least ten minutes prior to start time.

A recording of the conference call will be available from 1:00 p.m. MT (3:00

p.m. EDT) on May 27, 2010 until June 2, 2010 at 9:59 p.m. MDT (11:59 p.m. ET).

To access this replay, please dial (800) 408-3054 or (416) 695-5800 followed by

the passcode 6008104. In addition, the webcast will be available commencing May

31, 2010 in the Investor Relations section of MAXIM's web site at

www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 44 power plants in

western Canada, United States and France, having 809 MW of electric and 117 MW

of thermal net generating capacity. Approximately 80% of MAXIM's current

portfolio is comprised of clean burning natural gas, high efficiency

cogeneration, waste heat and landfill gas fuelled generation. MAXIM trades on

the TSX under the symbol "MXG". For more information about MAXIM, visit our

website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

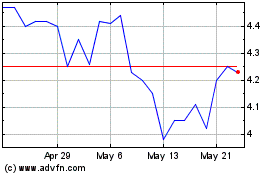

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

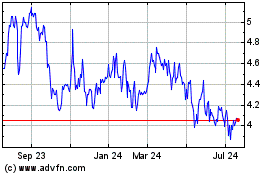

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024