Maxim Power Corp. ("MAXIM") Announces First Quarter 2008 Financial and Operating Results

May 12 2008 - 6:05PM

Marketwired Canada

Maxim Power Corp. (TSX:MXG) ("MAXIM" or the "Corporation") is pleased to

announce the release of financial and operating results for its first quarter of

2008. The unaudited consolidated financial statements, accompanying notes and

Management's Discussion and Analysis ("MD&A") will be available on SEDAR on May

13, 2008 and on MAXIM's website. All figures reported herein are in Canadian

dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

----------------------------------------------------------------------------

Three Months

Ended March 31

($ in thousands except per share amounts) 2008 2007

----------------------------------------------------------------------------

Revenue $ 47,469 $ 34,052

EBITDA (1) 15,362 10,001

Net income 5,956 3,322

Per share diluted $ 0.13 $ 0.08

Cash provided by operations 32,031 22,013

Per share diluted $ 0.72 $ 0.50

Electricity Deliveries (MWh) 295,546 247,696

Net Generation Capacity (MW) (2) 492 482

Average Alberta Prices ($ per MWh) $ 77 $ 64

(1) EBITDA is earnings before interest, taxes, depreciation and amortization

and is not a measure under Canadian Generally Accepted Accounting

Principles ("GAAP") and may not be comparable to similar measures

presented by other companies. Refer to Non-GAAP measure section of the

MD&A for an explanation and reconciliation.

(2) Net generation capacity is manufacturer's nameplate capacity net of

minority ownership interests of third parties.

OPERATING RESULTS

The first quarter results of 2008 was MAXIM's best first quarter ever in terms

of revenue, EBITDA, cash provided by operations and net income. The record first

quarter 2008 results compared to the first quarter of 2007 were: revenue of

$47.5 million versus $34.1 million for an increase of $13.4 million or 39.4%;

EBITDA of $15.4 million versus $10.0 million for an increase of $5.4 million or

53.6%; cash provided by operations of $32.0 million versus $22.0 for an increase

of $10.0 million or 45.5%; net income of $6.0 million versus $3.3 million for an

increase of $2.7 million or 79.3%; and electrical generation was 295,546 MWh

versus 247,696 MWh, an increase of 47,850 MWh or 19.3%.

The improved quarter over quarter performance was driven by higher average

Alberta power prices of $77 per MWh during the first quarter of 2008 versus $64

per MWh during the same period in 2007, the acquisition of eight cogeneration

plants in France during 2007 which added 45 MW of generation capacity, and

increased production at Milner. Milner commenced its 2008 turnaround on March

28, 2008 which is twenty one days later than the commencement date of March 7

for the 2007 turnaround. As a result, production from Milner during the quarter

was 224,375 MWh, which is an increase of 43,467 MWh or 24.0% compared to

production of 180,908 MWh during the first quarter of 2007.

Milner Turnaround

The Milner facility continues to undergo its scheduled major turnaround, which

began on March 28, 2008. It is expected that the cumulative expenditures

associated with the turnaround will approximate the budgeted amount of $17.3

million and the turnaround is expected to be completed within the budgeted time

frame. The turnaround is approximately eight weeks in duration and will have a

significant impact on the operating results for the second quarter. Over the

long term, the turnaround will improve reliability of the facility and extend

the life of certain key components.

ACQUISITIONS

Forked River

On April 17, 2008 the Corporation announced it had closed the purchase of the 86

MW Forked River Power Station in Ocean County, New Jersey for cash consideration

of US$20.0 million. This asset acquisition was financed with cash on hand and

included a ten year tolling agreement with an affiliate of the vendor for the

entire capacity of the plant. In addition to the 12 acres of land to which the

power plant is situated, the acquisition also included an additional 31 acre

parcel of vacant land which, given the existing infrastructure, could support

future development of additional generating capacity.

Pittsfield

MAXIM announced on April 15, 2008 that it had agreed to acquire the Pittsfield

Generating Company and its 170 MW electric power plant in Pittsfield,

Massachusetts, for US$52.9 million. This facility is contracted under a

Reliability Must Run Agreement with ISO New England ("ISO-NE") until June 1,

2010. Under this agreement, the plant is available to provide power to the

regional power grid when requested by ISO-NE. Following expiration of the

Reliability Must Run Agreement, the facility will be eligible for Forward

Capacity Market Payments from the ISO-NE, as well as the sale of energy into the

day-ahead and real-time energy markets of ISO-NE. Once this acquisition closes,

MAXIM's generating portfolio in the North Eastern region of United States will

include 4 power plants having a total of 383 MW of electric generating capacity,

all of which will be entitled to capacity payments.

Somal

On April 1, 2008, Comax France S.A.S., MAXIM's wholly-owned subsidiary, closed

the purchase of the Somal facility in France for $3.4 million (2.2 million

Euro). This acquisition was financed substantially through the assumption of an

existing capital lease. This acquisition adds 7 MW of electricity and thermal

generating capacity, bringing MAXIM's generating portfolio of assets in France

to 21 power plants having a total of 129 MW electric and 121 MW thermal

installed generating capacity.

DEVELOPMENT INITIATIVES

MAXIM continues to explore and invest in various acquisition and development

projects in Western Canada, the United States and France. MAXIM is currently

waiting for approval of regulatory applications to construct and operate the

Deerland peaking station and to develop three Milner coal leases. MAXIM also

continues to proceed with preliminary engineering and environmental studies to

support preparation of regulatory applications relating to the Milner expansion

project.

CONFERENCE CALL AND WEBCAST FOR Q1 2008 RESULTS

MAXIM will host a conference call for analysts and investors on May 15, 2008 at

9:00 am MT (11:00 am ET). The call will be hosted by John Bobenic, MAXIM's

President and Chief Executive Officer and Mike Mayder, Vice President, Finance

and Chief Financial Officer.

To participate in this conference call, please dial (800) 733-7571 or (416)

646-3095 in the Toronto area. It is recommended that participants call at least

ten minutes prior to start time.

A recording of the conference call will be available from 11:00 am MT (1:00 pm

ET) on May 15, 2008 until May 22, 2008 at 9:59 pm MT (11:59 pm ET). To access

this replay, please dial (877) 289-8525 or (416) 640-1917 followed by the

passcode 21272104#. In addition, the webcast will be available commencing May

16, 2008 in the Investor Relations section of MAXIM's web site at

www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an Independent Power Producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power plants. MAXIM now owns and operates 34 power plants in Western

Canada, United States and France, having 585 MW of electric and 132 MW of

thermal generating capacity. Upon closing the acquisition of the Pittsfield

Power Plant, MAXIM will own 35 power plants having 755 MW of electric and 132 MW

of thermal generating capacity. MAXIM will continue to execute on its strategy

as an Independent Power Producer and is targeting significant growth through

acquisitions and development of power projects which utilize hydrocarbon based

fuels and renewables in the markets of Western Canada, United States and France.

MAXIM trades on the TSX under the symbol "MXG". For more information about

MAXIM, visit our website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

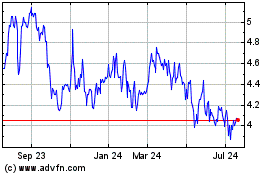

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

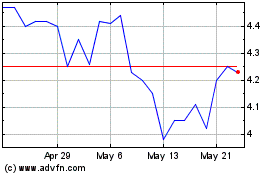

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024