Maxim Power Corp. ("MAXIM") Announces Financial and Operating Results for 2007

March 28 2008 - 6:34PM

Marketwired Canada

Maxim Power Corp. (TSX:MXG) ("MAXIM" or the "Corporation") is pleased to

announce the release of financial and operating results for its fourth quarter

and year ended December 31, 2007. The audited financial statements, accompanying

notes and Management Discussion and Analysis will be available on SEDAR on March

31, 2008 and on MAXIM's website. All figures reported herein are Canadian

dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended Twelve Months Ended

December 31 December 31

2007 2006 2007 2006

($ in thousands except per share

amounts)

Revenue $ 37,992 $ 40,470 $ 124,762 $ 111,237

EBITDA (1) 12,064 17,893 40,232 39,088

Net income 4,015 10,553 15,401 19,906

Per share diluted $ 0.09 $ 0.24 $ 0.35 $ 0.45

Cash provided by operations 7,940 8,566 35,490 23,851

Per share diluted $ 0.18 $ 0.19 $ 0.80 $ 0.54

Electricity Deliveries (MWh) 305,460 311,312 1,158,389 1,120,429

Net Generation Capacity (MW) (2) 492 447 492 447

Average Alberta Power Prices ($ per

MWh) $ 62 $ 117 $ 67 $ 80

(1) EBITDA is earnings before interest, taxes, depreciation and amortization

and is not a measure under Canadian Generally Accepted Accounting

Principles ("GAAP") and may not be comparable to similar measures

presented by other companies. Refer to Non-GAAP measures section of the

MD&A for an explanation and reconciliation.

(2) Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

During 2007, MAXIM outperformed the 2006 record operating results in terms of

revenue, megawatt hours ("MWh") generated, EBITDA, and cash provided by

operations. MAXIM earned revenue from electricity sales of $124.8 million versus

$111.2 million for 2006, an increase of $13.6 million or 12.2%. Generation in

2007 was 1,158,389 MWh versus 1,120,429 MWh in 2006, an increase of 37,960 MWh

or 3.4%. 2007 EBITDA was $40.2 million versus $39.1 million in 2006, an increase

of $1.1 million or 2.9% Cash provided by operations was $35.5 million for 2007

versus $23.9 in 2006, an increase of $11.6 million or 49%. Net income was $15.4

million for 2007 versus $19.9 million in 2006, a decrease of $4.5 or 23%.

MAXIM increased its revenue despite lower 2007 average Alberta power prices. The

average Alberta power price was $67 per MWh in 2007 compared to $80 per MWh in

2006. In North America, a portion from the HR Milner facility's generation was

sold at fixed prices above the 2007 average price. MAXIM also benefited from a

full year of operations from the Basin Creek and Capitol District Energy Centre

facilities and received market adjustments reflecting a full year of forward

capacity payments from its two power plants operating within the ISO New England

market. In France, MAXIM acquired 45 MW of generation capacity during 2007 which

increased revenue from France as of November 1, 2007 by $5.9 million. Net income

declined due to higher levels of interest and depreciation expense from MAXIM's

acquisitions in 2007 and 2006.

During the fourth quarter of 2007, MAXIM recorded revenue of $38.0 million

compared to $40.5 million for 2006 and EBITDA was $12.1 million compared to

$17.9 million in 2006 primarily due to lower Alberta power prices. Total

production for the fourth quarter was 305,460 MWh compared to 311,312 MWh in

2006 with HR Milner facility producing 247,975 MWh during the fourth quarter of

2007 compared to 253,867 MWh for the same period in 2006.

ACQUISITION AND DEVELOPMENT INITIATIVES

Forked River Generating Station

On September 17, 2007 the Corporation announced that it entered into an

agreement with Jersey Central Power and Light Company ("JCP&L") to acquire the

86 MW Forked River Power Station, located in Ocean County, New Jersey, for

US$20.0 million. The transaction is expected to close early in the second

quarter of 2008 subject to satisfying remaining conditions precedent to closing

and will be financed with cash on hand. In conjunction with this purchase, a ten

year tolling agreement will be entered into with FirstEnergy Solutions, a

subsidiary of FirstEnergy Corp. and an affiliate of JCP&L, for the entire

capacity of the plant. This project is strategically located in New Jersey and

includes 30 acres of land and existing infrastructure to support future

development of additional generating capacity on site.

French Acquisitions

MAXIM is pleased to announce that Comax France S.A.S., the Corporation's

wholly-owned French subsidiary, has entered into an agreement to purchase the

Somal facility in France for $3.4 million (2.2 million Euro), financed

substantially through the assumption of an existing capital lease in the amount

of $3.1 million (2.0 million Euro) and cash on hand of $300 thousand (180

thousand Euro). Closing is expected during April 2008. This acquisition will add

7 MW of electricity generating capacity and 7 MW of thermal generating capacity,

bringing MAXIM's generating portfolio of assets in France to 21 power plants

having a total of 129 MW electric and 121 MW thermal net installed generating

capacity.

Deerland Peaking Station

During 2007, MAXIM initiated the process to construct and operate a 190 MW

natural gas-fired power generation facility on a site immediately south of the

existing Deerland high voltage substation in Bruderheim, Alberta. The

Corporation secured an option for the plant site and initiated a public

consultation process on July 26, 2007. Regulatory applications for approvals to

construct and operate the facility were submitted on October 16, 2007 and MAXIM

expects to receive the permits early in the second quarter of 2008. MAXIM

anticipates that the facility could be operational in 2009. The facility will

use state of the art combustion turbine technology.

Milner Coal Leases

MAXIM continues to develop its three coal leases located in close proximity to

its HR Milner generating facility. According to a technical report prepared by

Marston & Marston in accordance with NI 43-101, the coal deposit is

metallurgical grade, low-to-medium matter bituminous coal that can also be used

in thermal applications that has energy content between 24.9 GJ/tonne and 27.8

GJ/tonne. Marston & Marston indicated resources of 26 million tonnes and

recoverable coal reserves of 13.4 million tonnes. MAXIM considers these

resources to be valuable both as fuel for the existing and planned expansion of

the HR Milner facility, and for sale in international coal markets. MAXIM

submitted mine permit and license applications during 2007 to the Alberta Energy

and Utilities Board and Alberta Environment for underground mine development and

is waiting for permits to proceed with development of these leases.

HR Milner Turnaround

The HR Milner facility was taken offline on March 27, 2008 to begin its annual

turnaround which is forecasted to be eight weeks in length in 2008. This

turnaround is considered major in nature with total costs budgeted to be $17.3

million. The turnaround includes refurbishing the major components such as the

generator and steam turbine, and other projects that will lengthen the economic

life of certain plant components and maintain the plant's high level of

efficiency. HR Milner was able to achieve a level of efficiency during 2007 to

meet greenhouse gas emission reduction targets under the Government of Alberta's

Specified Gas Emitters Regulation.

HR Milner Expansion

During 2007, MAXIM initiated a process to expand the generating capacity at the

HR Milner facility. Public disclosure documents were released in December 2007

and preliminary engineering and associated environmental studies are underway to

support preparation of regulatory applications. The 500 MW expansion will be

constructed with technology that complies with all relevant climate change

regulations and provides MAXIM with an opportunity for carbon capture.

CONFERENCE CALL AND WEBCAST FOR 2007 RESULTS

MAXIM will host a conference call for analysts and investors on Tuesday, April

1, 2008 at 9:00 a.m. MDT (11:00 a.m. EDT). The call will be hosted by John

Bobenic, MAXIM's President and Chief Executive Officer, and by Mike Mayder,

Vice-President, Finance and Chief Financial Officer.

To participate in this conference call, please dial (800) 732-9303 or (416)

644-3418 in the Toronto area. It is recommended that participants call at least

ten minutes prior to start time.

A recording of the conference call will be available from 12:00 p.m. MDT (2:00

p.m. EDT) on Tuesday, April 1, 2008 until Wednesday, April 11, 2008 at 9:59 p.m.

MDT (11:59 p.m. EDT). To access this replay, please dial (877) 289-8525 or (416)

640-1917 followed by the passcode 21267189#. In addition, the webcast will be

available commencing April 8, 2008 in the Investor Relations section of MAXIM's

web site at www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an Independent Power Producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM owns and operates 32 power plants in Western

Canada, United States and France, having 492 MW of electric and 125 MW of

thermal generating capacity. Upon closing acquisitions of the Forked River and

Somal power plants, MAXIM will own and operate 34 power plants having a total of

585 MW of electric and 132 MW of thermal net generating capacity.

MAXIM will continue to execute on its strategy as an Independent Power Producer

and is targeting significant growth through acquisitions and development of

power projects which utilize hydrocarbon based fuels and renewables in the

markets of Western Canada, United States and France. MAXIM trades on the TSX

under the symbol "MXG". For more information about MAXIM, visit our website at

www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

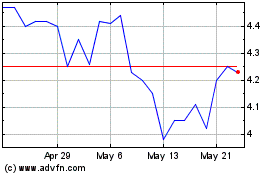

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

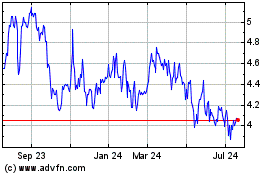

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024