Ivanhoe Mines Completes Bought-Deal Financing and Concurrent

Private Placement and Announces Exercise in Full of Over-Allotment

Option

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jun 10, 2014) -

Robert Friedland, Executive Chairman, and Lars-Eric Johansson,

Chief Executive Officer of Ivanhoe Mines (TSX:IVN), announced today

that the company has completed its public offering of 83,334,000

units, each consisting of one Class A common share and one Class A

common share purchase warrant, which were sold at a price of C$1.50

per unit for gross proceeds of C$125,001,000.

The offering, announced on May 20, was conducted through a

syndicate of underwriters led by BMO Capital Markets, CIBC and

Macquarie Capital Market Canada Ltd. In addition, the underwriters

exercised their over-allotment option in full, resulting in the

company issuing a further 12,500,100 units and increasing the total

gross proceeds received by the company to C$143,751,150.

The company also has completed a concurrent private placement to

Robert Friedland of an additional 16,666,667 units, on the same

terms and conditions as the public offering, to raise additional

gross proceeds of C$25,000,001. Mr. Friedland also has 30 days to

exercise his option to purchase an additional 2,500,000 units,

which became effective as a result of the exercise by the

underwriters of their over-allotment option in whole.

The net proceeds of the offering and private placement will be

used for the advancement of, and pre-development activities at, the

Kamoa and Kipushi Projects in the Democratic Republic of Congo, and

for general corporate purposes.

Mr. Friedland beneficially owned 147,966,755 common shares. As a

result of the concurrent private placement of 16,666,667 units (or

2.8% of the common shares, before giving effect to the offering and

concurrent private placement), Mr. Friedland now beneficially owns

164,633,422 common shares, or 23.6% of the company's outstanding

common shares. Should Mr. Friedland exercise his option in full to

purchase an additional 2,500,000 common shares (0.35%), and

assuming no exercise of any other outstanding warrants or options

to acquire common shares, Mr. Friedland then would beneficially own

167,133,422 common shares, or 23.8% (assuming no exercise by him of

the 2,500,000 warrants included in his option for 2,500,000 units)

of the company's then outstanding common shares. Mr. Friedland has

acquired the common shares for investment purposes.

This news release does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of the

securities in the United States or in any other jurisdiction in

which such offer, solicitation or sale would be unlawful. The

securities have not been registered under the U.S. Securities Act

of 1933, as amended, and have not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements thereunder.

About Ivanhoe Mines

Ivanhoe Mines, with offices in Canada, the United Kingdom and

South Africa, is advancing and developing its three principal

projects:

- The Kamoa copper discovery in a previously unknown extension of

the Central African Copperbelt in the DRC's Province of

Katanga.

- The Platreef Discovery of platinum, palladium, nickel, copper,

gold and rhodium on the Northern Limb of the Bushveld Complex in

South Africa.

- The historic, high-grade Kipushi zinc, copper and germanium

mine, also on the Copperbelt in the DRC, now being drilled and

upgraded following an 18-year care-and-maintenance program that

ended when Ivanhoe acquired its majority interest in the mine in

2011.

Ivanhoe Mines also is evaluating other opportunities as part of

its objective to become a broadly based, international mining

company.

Cautionary statement on forward-looking information

This news release contains "forward-looking statements" or

"forward-looking information" within the meaning of applicable

Canadian securities legislation. Such statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information. Such statements can be identified by the

use of words such as "may", "would", "could", "will", "intend",

"expect", "believe", "plan", "anticipate", "estimate", "scheduled",

"forecast", "predict" and other similar terminology, or state that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved. These statements reflect

the company's current expectations regarding future events,

performance and results and speak only as of the date of this news

release.

Specific statements contained in this news release that

constitute forward-looking statements or information include, but

are not limited to, the potential exercise by Robert Friedland of

the option granted to him to purchase an additional 2,500,000 units

and the use of proceeds of the offering.

A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including without limitation, the factors discussed in

the Annual Information Form of the company.

Although the forward-looking statements contained in this news

release are based upon what management of the company believes are

reasonable factors and assumptions, the company cannot assure

readers that actual results will be consistent with these

forward-looking statements. The company's actual results could

differ materially from those anticipated in these forward-looking

statements, as a result of, among others, those factors noted above

and those listed in the Annual Information Form under the heading

"Risk Factors". Accordingly, readers should not place undue

reliance on forward-looking information. These forward-looking

statements are made as of the date of this news release and are

expressly qualified in their entirety by this cautionary statement.

Subject to applicable Canadian securities laws, the company assumes

no obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this news release.

Investors:Bill Trenaman+1.604.688.6630MediaNorth America:Bob

Williamson+1.604.512.4856South Africa:Jeremy

Michaels+27.11.088.4300www.ivanhoemines.com

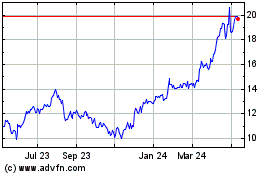

Ivanhoe Mines (TSX:IVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

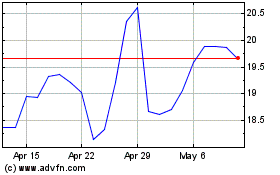

Ivanhoe Mines (TSX:IVN)

Historical Stock Chart

From Jan 2024 to Jan 2025