H&R Announces $125 Million Offering of Stapled Units to Finance Acquisition of Hess Tower, a State-of-the-Art, LEED Platinum ...

December 14 2011 - 3:30PM

Marketwired Canada

Editors Note: There is one photo associated with this press release.

H&R Real Estate Investment Trust (the "REIT") and H&R Finance Trust

(collectively, "H&R") (TSX:HR.UN) are pleased to announce that H&R has entered

into an agreement to sell, to a syndicate of underwriters co-led by CIBC and RBC

Capital Markets, on a bought deal basis, approximately $125 million of H&R

stapled units at a price of $23.30 per stapled unit (the "Offering"). Closing of

the Offering is expected to occur on or about December 22, 2011, subject to

receipt of Toronto Stock Exchange and any other necessary regulatory approvals.

The REIT plans to use its portion of the net proceeds of the Offering to repay,

in part, the bank indebtedness expected to be incurred for the Hess Tower

acquisition.

The REIT has also entered into an agreement to acquire, for U.S. $442.5 million,

Hess Tower, downtown Houston's newest and one of its most energy efficient

office buildings. Hess Tower has achieved the prestigious LEED Platinum

certification for Core and Shell, the U.S. Green Building Council's highest

rating.

Hess Tower is comprised of an impeccably designed 29-storey office tower

offering 844,763 rentable square feet of superior office space connected by a

climate-controlled skybridge to its adjacent 10-level, 1,430 space parking

garage. Hess Tower is part of Houston's Pedestrian Tunnel System that

interconnects 77 of Houston's major downtown office buildings to an abundance of

upscale restaurants, retail stores, first class hotels and world class sports

and entertainment destinations.

Completed in June 2011, Hess Tower is fully leased to Hess Corporation, a global

integrated energy company listed on the New York Stock Exchange. The REIT has

secured a commitment for a U.S. $250 million first mortgage financing at 4.5%

per annum.

Tom Hofstedter, President and CEO of the REIT stated: "This acquisition presents

a truly rare opportunity to acquire a best-in-class, LEED Platinum office tower

in an irreplaceable downtown Houston location, overlooking the recently

completed Discovery Green Park, with a long-term triple net lease secured by a

Fortune 100 investment grade tenant at a 6.6% capitalization rate. Hess Tower,

along with the recently acquired Gotham Center in New York City and the Bow in

downtown Calgary, will together become the hallmark of our portfolio of high

quality properties that will provide stable and growing cash flow to our

unitholders for decades to come".

The Offering is being made under H&R's existing short form base shelf prospectus

dated March 31, 2011.

The terms of the Offering will be described in a prospectus supplement to be

filed with Canadian securities regulators.

About H&R REIT

H&R REIT is an open-ended real estate investment trust, which owns a North

American portfolio of 38 office, 117 industrial and 133 retail properties

comprising over 42 million square feet, with a net book value of approximately

$5.4 billion. The foundation of H&R REIT's success since inception in 1996 has

been a disciplined strategy that leads to consistent and profitable growth. H&R

REIT leases its properties long term to creditworthy tenants and strives to

match those leases with primarily long-term, fixed-rate financing.

Notice to Reader

Certain statements in this news release contains forward-looking information

within the meaning of applicable securities laws (also known as forward-looking

statements), including in particular, H&R's expectation regarding the expected

closing of the Offering and timing thereof, the use of proceeds from the

Offering, the expected completion of the Hess Tower acquisition and timing

thereof, and the capitalization rate for the Hess Tower. Such forward-looking

statements reflect H&R's current beliefs and are based on information currently

available to management. These statements are not guarantees of future

performance and are based on H&R's estimates and assumptions that are subject to

risks and uncertainties, including those discussed in H&R's materials filed with

the Canadian securities regulatory authorities from time to time, which could

cause the actual results and performance of H&R to differ materially from the

forward-looking statements contained in this news release. Those risks and

uncertainties include, among other things, risks related to: prices and market

value of securities of H&R; availability of cash for distributions; development

and financing relating to the Bow development; restrictions pursuant to the

terms of indebtedness; liquidity; credit risk and tenant concentration; interest

rate and other debt related risk; tax risk; ability to access capital markets;

dilution; lease rollover risk; construction risks; currency risk; unitholder

liability; co-ownership interest in properties; competition for real property

investments; environmental matters; reliance on one corporation for management

of substantially all of the REIT's properties and changes in legislation and

indebtedness of H&R. Material factors or assumptions that were applied in

drawing a conclusion or making an estimate set out in the forward-looking

statements include that the general economy is stable; local real estate

conditions are stable; interest rates are relatively stable; equity and debt

markets continue to provide access to capital; and that the Hess Tower

acquisition will be completed. H&R cautions that this list of factors is not

exhaustive. Although the forward-looking statements contained in this news

release are based upon what H&R believes are reasonable assumptions, there can

be no assurance that actual results will be consistent with these

forward-looking statements. All forward-looking statements in this news release

are qualified by these cautionary statements. These forward-looking statements

are made as of today and H&R, except as required by applicable law, assumes no

obligation to update or revise them to reflect new information or the occurrence

of future events or circumstances.

To view the photo associated with this press release, please visit the following

link: http://www.marketwire.com/library/20111214-hess_tower1.jpg

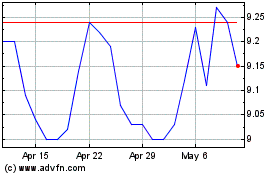

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

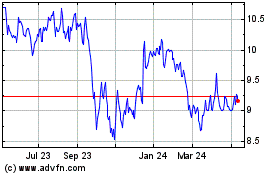

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024