(All monetary figures are expressed in Canadian Dollars unless

otherwise stated)

Dundee Precious Metals Inc. ("DPM" or the "Company") (TSX:

DPM)(TSX: DPM.WT)(TSX: DPM.WT.A) today announced its unaudited

results for the second quarter ended June 30, 2009. DPM reported

second quarter net earnings of $3.3 million (basic and diluted net

earnings per share of $0.03). This compares with a second quarter

2008 net loss of $14.1 million (basic and diluted net loss per

share of $0.23).

"Second quarter results were characterized by strong operating

performance at Chelopech that is expected to continue into the

future and a restart of operations at Deno Gold with a considerably

improved cost structure," noted Jonathan Goodman, DPM President

& CEO. "In addition, the Company is now positioned to ramp-up

construction on the Chelopech mine and mill expansion project in

the third quarter of this year, which will position it as a low

cost producer."

The following table summarizes the Company's financial and

operating results for the periods indicated:

----------------------------------------------------------------------------

$ millions, except per share amounts Three Months Six Months

------------- --------------

Ended June 30, 2009 2008 2009 2008

----------------------------------------------------------------------------

Net Revenue $ 32.7 $ 32.7 $ 59.7 $ 72.5

Cost of Sales 23.2 28.8 46.6 50.7

----------------------------------------------------------------------------

Gross Profit from Mining Operations 9.5 3.9 13.1 21.8

----------------------------------------------------------------------------

Investment and Other Income (Expense) 1.1 (1.4) 0.2 1.0

Net Earnings (Loss) 3.3 (14.1) (2.8) (5.7)

Basic Net Earnings (Loss) Per Share $ 0.03 $ (0.23) $ (0.03) $ (0.09)

Diluted Net Earnings (Loss) Per Share $ 0.03 $ (0.23) $ (0.03) $ (0.09)

Net Cash Provided By (Used in)

Operating Activities (2.2) 21.7 (14.9) 14.3

Capital Expenditures (7.7) (27.6) (16.2) (47.4)

Proceeds on Sale of Short-term

Investments 34.7 - 29.1 -

Proceeds on Sale of Exploration

Property 7.0 - 7.0 -

Other Investing Activities (1.1) 16.9 (2.4) 20.0

Financing Activities (1.6) (1.3) (2.5) (1.9)

----------------------------------------------------------------------------

Net Increase (Decrease) in Cash $ 29.1 $ 9.7 $ 0.1 $ (15.0)

----------------------------------------------------------------------------

Concentrate Produced (mt)

Chelopech 18,902 11,987 35,207 26,170

Deno Gold 3,173 2,704 3,173 4,589

Cash Cost per tonne Ore Processed

(US$/t)(1)

Chelopech $ 62.34 $ 68.03 $ 55.25 $ 63.52

Deno Gold $ 66.66 $110.65 $ 66.66 $109.05

----------------------------------------------------------------------------

SECOND QUARTER 2009 - FINANCIAL HIGHLIGHTS

- Second quarter of 2009 financial results, relative to second

quarter of 2008, benefited from improved operating performance at

Chelopech and Deno Gold, an 86% reduction in exploration expense

and a 23% reduction in administrative expense.

- Net earnings in the second quarter of 2009 were $3.3 million

compared to a net loss of $14.1 million in the corresponding prior

year period. The increase in earnings was primarily due to higher

gross profit from mining operations and a decrease in exploration

and administrative expenses. The increase in gross profit from

mining operations was primarily due to higher deliveries of

concentrates produced at Chelopech, lower production costs at

Chelopech and reduced operating loss at Deno Gold. These positive

variances were partially offset by a 45% decrease in copper price

in the second quarter of 2009 relative to the corresponding prior

year period.

- The Chelopech operations reported net revenue of $34.1 million

on corresponding concentrate deliveries of 17,685 tonnes. Chelopech

cash cost per tonne of ore processed(1) in the period was 8% lower

than the corresponding prior year period due to the favourable

impact of a 13% depreciation of the average Euro to U.S. dollar

exchange rate, higher volumes of material processed, lower

employment expenses and reduced spending on services as a result of

cost savings initiatives. These favourable variances were partially

offset by higher royalties reflecting the new royalty rates

effective July 31, 2008, higher spending on backfill resulting from

higher volumes of backfill placed in stopes and higher prices for

and usage of certain materials.

- Following its restart in April 2009 and despite lower than

planned copper grades due to excess mine dilution experienced in

several high grade copper veins, Deno Gold achieved full production

of 30,000 tonnes of ore mined in the month of June. Immediate

action has been taken to address the copper grade shortfalls and

further modifications are being introduced to realize additional

manpower savings. Deno Gold's operating loss in the period was $3.0

million lower than the prior year corresponding period due to

improved and more efficient operations. Deno Gold cash cost per

tonne of ore processed(1) in the period was 40% lower than the

corresponding prior year period due to a 20% devaluation of the

Armenian dram relative to the U.S. dollar, improved operating

performance and reductions in headcount and external contractors.

Improved grades and metal recovery rates resulted in a 17% increase

in concentrate production compared to the second quarter of

2008.

- Working capital requirements in the second quarter of 2009

increased by $8.4 million due primarily to an increase in

inventories as a result of a build-up of concentrate inventories at

Deno Gold following the restart of operations, an increase in

accounts receivable resulting from increased revenue in the period

and a decrease in accounts payable.

- As at June 30, 2009, DPM had cash, cash equivalents and

short-term investments of $74.9 million compared to $104.0 million

at December 31, 2008.

SIGNIFICANT ITEMS

- In the second quarter of 2009, activities related to the

Chelopech mine and mill expansion project progressed in the areas

of the paste fill plant, upgrade to the tailings facility and

modifications to the process circuit to allow tailings reclaim.

- On June 9, 2009, DPM completed its previously announced sale

of the Back River exploration project in Nunavut to Sabina Silver

Corporation ("Sabina"). Pursuant to the transaction, the Company

received in exchange for the Back River project a cash payment of

$7 million, 17 million Sabina common shares and 10 million Special

Warrants, each exercisable for one common share and 1/2 common

share purchase warrant upon Sabina achieving certain exploration

and production milestones or upon the occurrence of certain other

events. On June 30, 2009, the Sabina investment was valued at $24.1

million, of which a) $16.0 million related to Sabina common shares

and b) $8.1 million related to Sabina Special Warrants.

- The Company is currently evaluating value enhancing strategic

opportunities available to it in respect of its Serbian assets.

A complete set of DPM's Consolidated Financial Statements, Notes

to the Consolidated Financial Statements and Management's

Discussion and Analysis for the second quarter ended June 30, 2009

will be posted on the Company's website at www.dundeeprecious.com

and will be filed on Sedar at www.sedar.com.

CONFERENCE CALL

DPM will be holding an analyst call to present its Second

Quarter 2009 Financial Results on Friday, July 31, 2009 at 8.30

a.m. (EST).

The call will be webcast live (audio only) at:

http://events.onlinebroadcasting.com/dundee/073109/index.php

The audio webcast for this conference call will be archived and

available on the Company's website at www.dundeeprecious.com.

OVERVIEW

DPM is a Canadian-based, international mining company engaged in

the acquisition, exploration, development and mining of precious

metal properties. Its common shares and share purchase warrants

(symbols: DPM; DPM.WT; DPM.WT.A) are traded on the Toronto Stock

Exchange ("TSX"). DPM's business objectives are to identify,

acquire, finance, develop and operate low-cost, long-life mining

properties.

The Company's operating interests include its 100% ownership of

Chelopech Mining EAD ("Chelopech"), a gold, copper, silver

concentrates producer, owner of the Chelopech mine located

approximately 70 kilometres east of Sofia, Bulgaria, and a 95%

interest in Vatrin Investment Limited ("Vatrin"), a private entity

which holds 100% of Deno Gold Mining Company CJSC ("Deno Gold"),

its principal asset being the Kapan mine, a gold, copper, zinc,

silver concentrates producer located about 320 kilometres south

east of the capital city of Yerevan in Southern Armenia. DPM's

interests also include a 100% interest in the Krumovgrad

development stage gold property located in south eastern Bulgaria,

near the town of Krumovgrad, and numerous exploration properties in

one of the larger gold-copper-silver mining regions in Serbia.

SUMMARIZED FINANCIAL RESULTS

Net Revenue

Net revenue from the sale of concentrates of $32.7 million in

the second quarter of 2009 was comparable to the net revenue in the

second quarter of 2008. The benefits of higher deliveries of

concentrates produced at Chelopech due to increased volume of ore

mined and processed, higher metal grades and metal recovery rates

in the second quarter of 2009 relative to the prior year period and

the favourable impact of a weaker Canadian to U.S. dollar exchange

rate were offset by a 45% decrease in copper price and lower

deliveries of concentrates produced at Deno Gold. A weaker Canadian

to U.S. exchange rate in the second quarter of 2009, compared to

the corresponding prior year period, increased revenue by $4.7

million. Deliveries of concentrates produced at Chelopech of 17,685

tonnes in the second quarter of 2009 were 49% higher than second

quarter of 2008 deliveries of 11,891 tonnes. Deliveries of

concentrates produced at Deno Gold of 905 tonnes in the second

quarter of 2009 were lower than deliveries of 3,592 tonnes in the

second quarter of 2008 due to a build-up of concentrate inventories

following the restart of operations in April 2009. Net favourable

mark-to-market adjustments and final settlements of $1.3 million,

related to the open positions of provisionally priced concentrate

sales, were recorded in the second quarter of 2009 compared to net

unfavourable mark-to-market adjustments and final settlements of

$1.5 million in the second quarter of 2008. In the second quarter

of 2009, DPM recorded unrealized and realized losses on its copper

derivatives of $0.3 million and $2.5 million, respectively. The

copper derivative contracts were entered into to mitigate

substantially all the copper price exposure and associated earnings

volatility as a result of the time lag between the receipt of

provisional sales revenue associated with the contractual sales of

concentrates and the specified final pricing period.

Net revenue from the sale of concentrates of $59.7 million in

the first six months of 2009 was $12.7 million or 18% lower than

the corresponding prior year period due primarily to a 50% decrease

in copper price and lower deliveries of concentrates produced at

Deno Gold partially offset by higher deliveries of concentrates

produced at Chelopech and the favourable impact of a weaker

Canadian to U.S. dollar exchange rate, which increased revenue by

$9.7 million in the period. Deliveries of concentrates produced at

Chelopech of 34,258 tonnes in the first six months of 2009 were 13%

higher than the corresponding prior year period deliveries of

30,420 tonnes due to increased production in 2009. Deliveries of

concentrates produced at Deno Gold of 905 tonnes in the first six

months of 2009 were lower than deliveries of 4,464 tonnes in the

corresponding prior year period due to a build-up of concentrate

inventories in the second quarter of 2009. Deno Gold was on care

and maintenance in the first quarter of 2009. Net favourable

mark-to-market adjustments and final settlements of $5.9 million,

related to the open positions of provisionally priced concentrate

sales, were recorded in the first six months of 2009 compared to

net favourable mark-to-market adjustments and final settlements of

$1.3 million recorded in the corresponding prior year period. In

the first six months of 2009, DPM recorded unrealized and realized

losses on its copper derivatives of $0.3 million and $3.8 million,

respectively.

The average London Bullion gold price(2) in the second quarter

of 2009 of US$922 per ounce was 3% higher than the second quarter

of 2008 average price of US$896 per ounce. The average London Metal

Exchange ("LME") cash copper price(2) in the second quarter of 2009

of US$2.12 per pound was 45% lower than the second quarter of 2008

average price of US$3.83 per pound. The average LME cash zinc

price(2) in the second quarter of 2009 of US$0.67 per pound was 30%

lower than the second quarter of 2008 average price of US$0.96 per

pound.

The average London Bullion gold price(2) in the first six months

of 2009 of US$915 per ounce was comparable to the corresponding

prior year period average price of US$912 per ounce. The average

LME cash copper price(2) in the first six months of 2009 of US$1.83

per pound was 50% lower than the corresponding prior year period

average price of US$3.68 per pound. The average LME cash zinc

price(2) in the first six months of 2009 of US$0.60 per pound was

42% lower than the corresponding prior year period average price of

US$1.03 per pound.

Cost of sales

Cost of sales of $23.2 million in the second quarter of 2009 was

$5.6 million or 20% lower than the corresponding prior year period

due primarily to lower production costs at Chelopech and Deno Gold

and lower deliveries of concentrates produced at Deno Gold

partially offset by the unfavourable impact of a weaker Canadian to

U.S. dollar exchange rate and higher deliveries of concentrates

produced at Chelopech. A weaker Canadian to U.S. dollar exchange

rate in the second quarter of 2009, relative to the corresponding

prior year period, increased cost of sales by $3.3 million in the

period.

Cost of sales of $46.6 million in the first six months of 2009

was $4.1 million or 8% lower than the corresponding prior year

period due primarily to lower deliveries of concentrates produced

at Deno Gold and lower production costs at Chelopech partially

offset by the unfavourable impact of a weaker Canadian to U.S.

dollar exchange rate and higher deliveries of concentrates produced

at Chelopech. A weaker Canadian to U.S. dollar exchange rate in the

first half of 2009, relative to the corresponding prior year

period, increased cost of sales by $6.7 million in the period.

Cash cost per tonne of ore processed(1) at Chelopech in the

second quarter and first half of 2009 of US$62.34 and US$55.25

were, respectively, 8% and 13% lower than the corresponding prior

year periods due to the favourable impact of a weaker Euro to U.S.

dollar exchange rate, higher volumes of material processed, lower

employment expenses and reduced spending on services resulting from

cost savings initiatives implemented in late 2008 and first quarter

of 2009. These favourable variances were partially offset by higher

royalties reflecting the new royalty rates effective July 31, 2008,

higher spending on backfill resulting from higher volumes of

backfill placed in stopes and higher prices for and usage of

certain materials.

Gross profit

Chelopech recorded a gross profit from mining operations of

$11.9 million in the second quarter of 2009 compared to a gross

profit of $9.2 million in the second quarter of 2008. The increase

in gross profit from mining operations of $2.7 million was due to a

49% increase in deliveries of concentrates, higher gold contained

in concentrate produced due to higher grades and recoveries and

lower production costs partially offset by a 45% decrease in copper

price. Net favourable mark-to-market adjustments and final

settlements of $2.4 million, related to the open positions of

provisionally priced concentrate sales, were recorded in the second

quarter of 2009 compared to net unfavourable mark-to-market

adjustments and final settlements of $0.3 million in the second

quarter of 2008. Net losses of $2.8 million related to the copper

derivatives were recorded in the second quarter of 2009.

Chelopech recorded a gross profit from mining operations of

$19.2 million in the first half of 2009 compared to a gross profit

of $29.6 million in the corresponding prior year period. The

decrease in gross profit from mining operations of $10.4 million

was due to a 50% decrease in copper price partially offset by a 13%

increase in deliveries of concentrates due to higher metal grades

and recovery rates, lower production costs and net favourable

mark-to-market adjustments and final settlements, net of losses on

copper derivatives. Net favourable mark-to-market adjustments and

final settlements of $6.3 million, related to the open positions of

provisionally priced concentrate sales, were recorded in the first

six months of 2009 compared to net favourable mark-to-market

adjustments and final settlements of $1.2 million in the first half

of 2008. Offsetting the net favourable mark-to-market adjustments

and final settlements recorded in the first half of 2009 were net

losses related to the copper derivatives of $4.1 million.

Deno Gold recorded a gross loss from mining operations of $2.4

million in the second quarter of 2009 compared to a gross loss from

mining operations of $5.3 million in the corresponding prior year

period due to improved and more efficient operations. Net

unfavourable mark-to-market adjustments and final settlements of

$1.1 million related to the open positions of provisionally priced

concentrate sales were recorded in the second quarter of 2009

compared to net unfavourable mark-to-market adjustments and final

settlements of $1.2 million in the second quarter of 2008.

Deno Gold recorded a gross loss from mining operations of $6.0

million in the first six months of 2009 compared to a gross loss

from mining operations of $7.8 million in the first six months of

2008. Deno Gold was on care and maintenance in the first quarter of

2009. Net unfavourable mark-to-market adjustments and final

settlements of $0.4 million related to the open positions of

provisionally priced concentrate sales were recorded in the first

six months of 2009 compared to net favourable adjustments and final

settlements of $0.1 million in the corresponding prior year

period.

Investment and other income (expense)

Investment and other income was $1.1 million in the second

quarter of 2009 compared to an investment and other expense of $1.4

million. DPM recorded a gain on sale of the Back River project of

$0.7 million in the second quarter of 2009. Included in the second

quarter of 2008 were net realized losses on sale of investments of

$1.3 million and write-down of investments of $1.0 million.

Investment and other income was $0.2 million in the first half

of 2009 compared to investment and other income of $1.0 million in

the corresponding prior year period.

Administrative expense

Administrative expenses were $3.9 million and $8.0 million in

the second quarter and first half of 2009, respectively, compared

to $5.1 million and $10.1 million in the corresponding prior year

periods. The decrease in both periods was primarily due to lower

employment costs and associated expenses and lower spending on

outside services as a result of the cost savings initiatives

introduced in the first quarter of 2009.

Exploration expense

Exploration expense was $1.2 million and $2.8 million in the

second quarter and first half of 2009 compared to $8.9 million and

$14.0 million in the corresponding prior year periods,

respectively, due to a decrease in the level of exploration

activities in Serbia following the suspension of activities in the

fourth quarter of 2008.

Foreign Exchange

Monetary assets and liabilities denominated in foreign

currencies are translated into Canadian dollars at the period end

exchange rates, whereas non-monetary assets and liabilities and

related expenses denominated in foreign currencies are translated

at the exchange rate in effect at the transaction date. Income and

expense items are translated at the exchange rate in effect on the

date of the transaction. Exchange gains and losses resulting from

the translation of these amounts are included in the consolidated

statement of earnings. In the second quarter and first half of

2009, DPM recorded foreign exchange losses of $0.3 million and $3.0

million, respectively, compared with foreign exchange losses of

$1.2 million and $0.7 million in the corresponding prior year

periods.

Income tax recovery

DPM's effective tax recovery rate of 10% for the first six

months of 2009 was lower than the statutory rate of 33.0% due

primarily to the unrecognized tax benefits relating to operating

losses and non-deductible stock compensation and write-down of

investments partially offset by the benefit of profits earned in

jurisdictions having a lower tax rate. Following the sale of the

Back River project, a reversal of the flow-through shares liability

of $6.0 million was recognized as recovery in the period. In

addition, there was an increase in the valuation allowance on

investments and property of $6.1 million in the period.

Operating cash flow (shortfall)

The following table summarizes the Company's cash flow

(shortfall) from operating activities for the periods

indicated:

----------------------------------------------------------------------------

$ thousands Three Months Six Months

--------------- ----------------

Ended June 30, 2009 2008 2009 2008

----------------------------------------------------------------------------

Net earnings (loss) $ 3,316 $(14,118) $ (2,784) $ (5,690)

Non-cash charges (credits) to

earnings:

Amortization of property,

plant and equipment 4,749 3,613 9,317 7,142

Net losses (gains) on sale

of investments - 1,289 47 (496)

Write-downs of investments

to market value - 951 1,130 951

Losses on copper derivatives 523 - 1,847 -

Other (2,438) (289) (1,706) (65)

----------------------------------------------------------------------------

Total non-cash charges to

earnings 2,834 5,564 10,635 7,532

Increase (decrease) in non-cash

working capital (8,376) 30,225 (22,781) 12,481

----------------------------------------------------------------------------

Net cash provided by (used in)

operating activities $(2,226) $ 21,671 $ (14,930) $ 14,323

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash used in operating activities in the second quarter of 2009

was $2.2 million compared with cash provided in operating

activities of $21.7 million in the second quarter of 2008. The

increase in cash used in operating activities in the second quarter

of 2009 relative to the corresponding prior year period was

primarily due to an increase in working capital requirements

partially offset by higher gross profit from mining operations. The

non-cash working capital requirements of $8.4 million in the second

quarter of 2009 was primarily due to an increase in inventories as

a result of a build-up of concentrate inventories at Deno Gold

following the restart of the operations in April 2009, an increase

in accounts receivable due to increased revenue in the period and a

decrease in accounts payable.

Cash used in operating activities in the first half of 2009 was

$14.9 million compared with cash provided by operating activities

of $14.3 million in the first half of 2008. The increase in cash

used in operating activities in the first half of 2009 relative to

the corresponding prior year period was primarily due to an

increase in working capital requirements and lower gross profit

from mining operations. The non-cash working capital requirements

of $22.8 million in the first half of 2009 was primarily due to a

decrease in accounts payable, an increase in accounts receivable

and an increase in inventories.

The following table summarizes the Company's investing

activities for the periods indicated:

----------------------------------------------------------------------------

$ thousands Three Months Six Months

--------------- ----------------

Ended June 30, 2009 2008 2009 2008

----------------------------------------------------------------------------

Proceeds on sale of

exploration property $ 7,000 $ - $ 7,000 $ -

Proceeds on sale of

investments at fair value - 16,214 2,304 19,191

Proceeds on sale of

short-term investments 34,695 - 29,137 -

Loan advances (1,120) - (4,887) -

Capital expenditures (7,698) (27,637) (16,168) (47,360)

Proceeds on sale of property,

plant and equipment 43 709 137 709

----------------------------------------------------------------------------

Net cash provided by (used

in) investing activities $ 32,920 $ (10,714) $ 17,523 $ (27,460)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Capital expenditures at Chelopech in the second quarter and

first half of 2009 of $5.9 million and $12.0 million were,

respectively, 53% and 51% lower than the corresponding prior year

periods due to a reduction in non-critical expenditures, including

those related to the expansion project. Capital expenditures at

Deno Gold in the second quarter and first half of 2009 of $1.3

million and $3.8 million were, respectively, 83% and 72% lower than

the corresponding prior year periods due primarily to the

suspension of exploration activities in the fourth quarter of

2008.

In the second quarter and first half of 2009, DPM advanced $1.1

million (US$1.0 million) and $4.9 million (US$4.0 million) to

Namibia Custom Smelters (Pty) Limited ("NCS"), a subsidiary of

Weatherly International plc, as per the agreement DPM signed with

NCS in December 2008 to advance up to US$7.0 million of loans to

NCS. The total commitment of US$7.0 million had been advanced as at

June 30, 2009.

Financing Activities

The following table summarizes the Company's financing

activities for the periods indicated:

----------------------------------------------------------------------------

$ thousands Three Months Six Months

--------------- ----------------

Ended June 30, 2009 2008 2009 2008

----------------------------------------------------------------------------

Redemption of deferred share

units $ - $ - $ - $ (58)

Repayment of debt (1,409) (1,271) (2,120) (1,834)

Repayment of lease (209) - (416) -

----------------------------------------------------------------------------

Net cash used in financing

activities $ (1,618) $ (1,271) $ (2,536) $ (1,892)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

AVERAGE METAL PRICES

The following table, summarizing the average metal prices for

the London Bullion Market Association ("LBM") gold, LME copper

Grade A, LME special high grade ("SHG") zinc and LBM silver prices,

is used to illustrate the Company's average metal price exposures

based on its key reference prices for the periods indicated.

----------------------------------------------------------------------------

US$ Average Three Months Six Months

--------------- ----------------

Ended June 30, 2009 2008 2009 2008

----------------------------------------------------------------------------

London Bullion gold ($/oz) $ 922 $ 896 $ 915 $ 912

LME settlement copper ($/lb) 2.12 3.83 1.83 3.68

LME SHG zinc ($/lb) 0.67 0.96 0.60 1.03

LBM spot silver ($/oz) $ 13.73 $ 17.17 $ 13.17 $ 17.43

----------------------------------------------------------------------------

NON-GAAP FINANCIAL MEASURES

We have referred to cash cost per tonne of ore processed because

we understand that certain investors use this information to assess

the Company's performance and also determine the Company's ability

to generate cash flow for investing activities. This measurement

captures all of the important components of the Company's

production and related costs. In addition, management utilizes this

metric as an important management tool to monitor cost performance

of the Company's operations. This measurement has no standardized

meaning under Canadian GAAP and is therefore unlikely to be

comparable to similar measures presented by other companies. This

measurement is intended to provide additional information and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with Canadian

GAAP.

The following table provides, for the periods indicated, a

reconciliation between the Company's cash cost measure and Canadian

GAAP cost of sales:

----------------------------------------------------------------------------

$ thousands, unless otherwise indicated

For the quarter ended June 30, 2009 Chelopech Deno Gold Total

----------------------------------------------------------------------------

Ore processed (mt) 257,721 67,787

Cost of sales (Cdn$) $ 21,390 $ 1,740 $ 23,130

Cost of sales (US$) $ 17,834 $ 1,536 $ 19,370

Add (deduct):

Amortization (2,991) (661)

Reclamation costs and other (497) (128)

Change in concentrate inventory 1,720 3,772

----------------------------------------------------------------------------

Total cash cost of production (US$) $ 16,066 $ 4,519

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash cost per tonne of ore processed (US$) $ 62.34 $ 66.66

----------------------------------------------------------------------------

----------------------------------------------------------------------------

$ thousands, unless otherwise indicated

For the quarter ended June 30, 2008 Chelopech Deno Gold Total

----------------------------------------------------------------------------

Ore processed (mt) 201,887 74,955

Cost of sales (Cdn$) $ 15,346 $ 13,454 $ 28,800

Cost of sales (US$) $ 14,905 $ 13,069 $ 27,974

Add/(Deduct):

Amortization and other (2,423) (733)

Change in concentrate inventory 1,251 (4,042)

----------------------------------------------------------------------------

Total cash cost of production (US$) $ 13,733 $ 8,294

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash cost per tonne of ore processed (US$) $ 68.03 $ 110.65

----------------------------------------------------------------------------

(1) A reconciliation of the Company's cash cost per tonne ore processed to

cost of sales under Canadian GAAP for the second quarters of 2009 and

2008 is shown in the table entitled "Non-GAAP Financial Measures."

(2) Refer to the quarterly information section for the average metal prices

used to illustrate the Company's average metal price exposure based on

its key reference prices.

To view the Financial Statements, please click the following

link: http://media3.marketwire.com/docs/dpm0730financials.pdf.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" that

involve a number of risks and uncertainties. Forward-looking

statements include, but are not limited to, statements with respect

to the future price of gold, copper, zinc and silver the estimation

of mineral reserves and resources, the realization of mineral

estimates, the timing and amount of estimated future production,

costs of production, capital expenditures, costs and timing of the

development of new deposits, success of exploration activities,

permitting time lines, currency fluctuations, requirements for

additional capital, government regulation of mining operations,

environmental risks, unanticipated reclamation expenses, title

disputes or claims, limitations on insurance coverage and timing

and possible outcome of pending litigation. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "expects", or "does not expect", "is expected",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "does not anticipate", or "believes", or

variations of such words and phrases or state that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved. Forward-looking statements are based

on the opinions and estimates of management as of the date such

statements are made, and they involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any other future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, among others: the actual results

of current exploration activities; actual results of current

reclamation activities; conclusions of economic evaluations;

changes in project parameters as plans continue to be refined;

future prices of gold, copper, zinc and silver; possible variations

in ore grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes and

other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of

development or construction activities, fluctuations in metal

prices, as well as those risk factors discussed or referred to in

Management's Discussion and Analysis under the heading "Risks and

Uncertainties" and other documents filed from time to time with the

securities regulatory authorities in all provinces and territories

of Canada and available at www.sedar.com.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking statements if

circumstances or management's estimates or opinions should change.

Accordingly, readers are cautioned not to place undue reliance on

forward-looking statements.

Contacts: Dundee Precious Metals Inc. Jonathan Goodman President

and Chief Executive Officer (416) 365-2408

jgoodman@dundeeprecious.com Dundee Precious Metals Inc. Stephanie

Anderson Executive Vice President and Chief Financial Officer (416)

365-2852 sanderson@dundeeprecious.com Dundee Precious Metals Inc.

Lori Beak Vice President, Investor Relations and Corporate

Secretary (416) 365-5165 lbeak@dundeeprecious.com

www.dundeeprecious.com

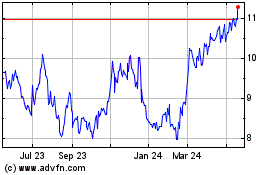

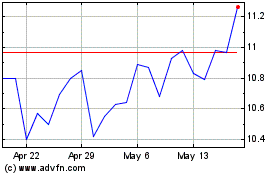

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Sep 2023 to Sep 2024