VANCOUVER, BRITISH COLUMBIA (TSX: CS) announces its financial

results for the four month stub period ending December 31, 2007

including production and sales for the Cozamin mine located in

Zacatecas State, Mexico. All dollar amounts are stated in U.S.

dollars unless otherwise indicated.

Overview and Highlights

For the four months ended December 31, 2007, Capstone's

earnings, before future income tax allowance were $16.8 million or

$0.21 per share ($0.20 per share diluted), and earnings, after

future income tax allowance, a non-cash item, were $10.4 million or

$0.13 per share ($0.12 per share diluted).

- Revenue for the four months ended December 31, 2007 was $33.0

million. The average realized price for sales of copper, zinc, lead

and silver in the four months was $3.09/lb, $1.07/lb, $1.24/lb and

$8.40/oz respectively.

- Copper production during the four months ended December 31,

2007 was 9.0 million lbs compared with 13.9 million lbs for the 12

months ended August 31 2007 (65% of the previous 12 month

period).

- At December 31, 2007, Capstone had working capital of $51.7

million including $25 million in cash, $8.1 million in marketable

securities, current receivables of $14.9 and no bank debt, in

addition the fair market value of Capstone's share ownership of

Silverstone Resources Corp. as of today is approximately $90

million, which is not included in working capital.

- Copper cash costs for the four months ended December 31, 2007

were $0.96/lb of copper (net of by-product credits and including

smelter, refining, transportation and all site costs).

- Total costs (the aggregate of cash costs, royalty, depletion

and amortization and accretion) for the four months ended December

31, 2007 were $1.16/lb.

- Capstone continued its share buyback plan and purchased an

additional 815,500 common shares on the open market at an average

price of CDN$2.76. The shares have been returned to treasury and

cancelled under its normal course issuer bid.

- During the four month stub period the Cozamin mine operated at

its current designed throughput rate of 2,200 tpd.

------------------------------------------------------------------------

4 months ended Year ended

December 31, 2007 August 31, 2007

------------------------------------------------------------------------

------------------------------------------------------------------------

Revenue $33.0M $55.3M

------------------------------------------------------------------------

Copper $26.5M $37.7M

------------------------------------------------------------------------

Zinc $ 1.5M $ 8.0M

------------------------------------------------------------------------

Lead $ 1.9M $ 2.7M

------------------------------------------------------------------------

Silver $ 3.1M $ 6.9M

------------------------------------------------------------------------

Operating profit $16.8M $27.2M

------------------------------------------------------------------------

Earnings (before future tax) $16.8M $25.2M

------------------------------------------------------------------------

EPS - basic (before future tax) $ 0.21 $ 0.31

------------------------------------------------------------------------

Earnings (after future taxes) $10.4M $22.7M

------------------------------------------------------------------------

EPS - basic $ 0.13 $ 0.28

------------------------------------------------------------------------

Cozamin Mine

4 Months Ended December 31, 2007 Production and Sales

Highlights

- Capstone produced the following metals during the year.

- 9.0 million pounds of copper

- 2.5 million pounds of zinc

- 1.6 million pounds of lead

- 414,000 ounces of silver

- Concentrate sales for the period were dry metric tonnes

("DMT"), containing;

- 8.6 million pounds of copper

- 1.4 million pounds of zinc

- 1.5 million pounds of lead

- 377,000 ounces of silver

Concentrate inventory at December 31, 2007 was 9,793 DMT

(containing 2.8 million pounds of copper, 2.9 million pounds of

zinc and 0.5 million pounds of lead).

December 31, 2007 Production Results and Forecast for 2008 and 2009

------------------------------------------------------------------

2008 (F) 2009 (F)

------------------------------------------------------------------

Total tons milled 850,000 1,000,000

------------------------------------------------------------------

------------------------------------------------------------------

Copper (payable lbs) 30,000,000 40,000,000

------------------------------------------------------------------

Silver (payable ounces) 1,300,000 1,500,000

------------------------------------------------------------------

Zinc (payable lbs) 9,000,000 10,000,000

------------------------------------------------------------------

Lead (payable lbs) 5,100,000 5,000,000

------------------------------------------------------------------

The following table is a summary of the actual operating statistics for

the four months ended December 31, 2007 and the year ended August 31, 2007.

---------------------------------------------------------------------------

4 months

ended Year ended

Dec 31, 2007 Aug 31, 2007

---------------------------------------------------------------------------

Total tons mined 251,716 484,641

---------------------------------------------------------------------------

Tons of ore milled 260,714 461,933

---------------------------------------------------------------------------

Copper grade (%) 1.79 1.59

---------------------------------------------------------------------------

Zinc grade (%) 1.24 1.47

---------------------------------------------------------------------------

Silver grade (g/t) 69 71

---------------------------------------------------------------------------

Lead grade (%) 0.52 0.6

---------------------------------------------------------------------------

Copper recovery (%) 87.1 86

---------------------------------------------------------------------------

Zinc recovery (%) 41.3 44.9

---------------------------------------------------------------------------

Silver recovery (%) 73.3 73

---------------------------------------------------------------------------

Lead recovery (%) 49.8 52.6

---------------------------------------------------------------------------

Copper production (million DMT lbs) 9.0 13.9

---------------------------------------------------------------------------

Zinc production (million DMT lbs) 2.5 6.8

---------------------------------------------------------------------------

Silver production ('000 ounces) 414 747

---------------------------------------------------------------------------

Lead production (million DMT lbs) 1.6 3.0

---------------------------------------------------------------------------

Note: Silver reports to all concentrates.

Stub Four Month Period Production Highlights

Copper

- Copper in concentrate produced during the four month period

was 9.0 million pounds of copper, year ended August 31, 2007 was

13.9 million.

- Copper concentrate sales for the period were 18,277 dry metric

tons ("DMT"), containing 8.6 million pounds of copper, year ended

August 31, 2007 was 11.8 million.

- The average price for sales of copper in the period was

$3.09/lb.

- Copper concentrate inventory at December 31, 2007 was 5,631

DMT, an increase in inventory from the 5,447 DMT of concentrate on

hand at August 31, 2007.

- Silver in the copper concentrate produced during the period

totaled 335,000 ounces.

Zinc

- Zinc in concentrate produced during the four month period was

2.5 million pounds of zinc, year ended August 31, 2007 was 6.8

million.

- Zinc sales for the period were 1,799 DMT, containing 1.4

million pounds of zinc, year ended August 31, 2007 was 5.0

million.

- The average price for sales of zinc in the period was

$1.07/lb.

- Zinc concentrate inventory at December 31, 2007 was 3,804 DMT,

an increase in inventory from the 2,413 DMT of concentrate on hand

at August 31, 2007.

- Silver in the zinc concentrate produced during the period

totaled 12,000 ounces.

Lead

- Lead in concentrate produced during the four month period was

1.6 million pounds of lead, year ended August 31, 2007 was 3.0

million.

- Lead concentrate sales for the period were 1,147 DMT,

containing 1.5 million pounds of lead, year ended August 31, 2007

was 2.8 million.

- The average price for sales of lead in the period was

$1.24/lb.

- Lead concentrate inventory at December 31, 2007 was 358 DMT,

an increase in inventory from the 290 DMT of concentrate on hand at

August 31, 2007.

- Silver in the lead concentrate produced during the period

totaled 67,000 ounces.

Mill Expansion Project

Tons mined and processed were higher in the four months ended

December 31, 2007 compared to previous 2007 periods as expansion to

the 2,200 tpd was completed in September. Capital expenditures are

budgeted at $10 million to further expand the facility to 3,000 tpd

which is expected to be completed by the fourth quarter this

year.

Labour

There were 4 minor lost time accidents during the period from

both operations and construction. The number of personnel at the

end of the period was 530, of which approximately 90 were

contractors related to the expansion project.

Four Month Actual Sales

Actual sales and costs for the year are tabulated below.

---------------------------------------------------------------

4 months

ended

Dec 31, 2007

---------------------------------------------------------------

Copper (million lbs) 8.6

---------------------------------------------------------------

Zinc (million lbs) 1.4

---------------------------------------------------------------

Lead (million lbs) 1.5

---------------------------------------------------------------

Silver ('000 ounces) 377

---------------------------------------------------------------

Copper production costs, net of by product

credits, per lb of copper $ 0.55

---------------------------------------------------------------

Off property costs for transport, smelting

and refining per lb of copper $ 0.41

---------------------------------------------------------------

Total cash costs of production per lb of copper $ 0.96

---------------------------------------------------------------

Copper production costs in the four months ended December 31,

2007 were $0.21 above plan reflecting the impact of the company

having sold less zinc and writing down a portion of the zinc with

lower grade in the concentrate and the lower by product metal

prices.

Financial Results

The information in this news release and the selected financial

information contained in the following pages should be read in

conjunction with the audited Consolidated Financial Statements and

Management Discussion and Analysis for the four months ended

December 31, 2007, which will be available at Capstone's website at

www.capstonemining.com and at www.sedar.com.

The Company's earnings before future tax accruals for the four

months ended December 31, 2007 were $16.8 million or $0.21 per

share compared to earnings of $25.2 million or $0.31 per share for

the year ended August 31, 2007. The Company's net earnings for

December 31, 2007 were $10.4 million or $0.13 per share compared to

$22.7 million or $0.28 per share for August 31, 2007 after future

income tax allowance, a non-cash item.

The Company reported revenues for the four month period of $33.0

million (year ended August 31, 2007 - $55.3 million). Revenues

consisted of copper concentrate sales of $26.5 million, zinc

concentrate sales of $1.5 million, lead concentrate sales of $1.9

million and silver in concentrate sales of $3.1 million.

Cost of sales for the four month period was $9.0 million (year

ended August 31, 2007 - $14.2 million), treatment and

transportation charges were $5.3 million (August 31, 2007 - $10.1

million), royalty charges were $0.6 million (August 31, 2007 - $1.4

million) and depletion was $0.9 million (August 31, 2007 - $1.7

million).

For the four month period ended December 31, 2007, the Company

recorded an unrealized gain related to mark-to-market on the

outstanding derivative contracts in the amount of $2,928,644

(August 31, 2007 - $Nil).

A future income tax provision of $6.3 million was recorded at

December 31, 2007 compared to $2.5 million at August 31, 2007. The

increase in the income tax provision is mainly due to the reversal

of the current future income tax asset set up at August 31, 2007 as

well as an increase in the excess of book value of capital assets

over tax values.

Glencore International AG and Trafigura Beheer B.V. purchases

the concentrates produced by the Cozamin mine pursuant to the terms

of a written contract.

Capstone Mining Corp.

Selected Financial Information

Consolidated Balance Sheets

-------------------------------------------------------------------------

Dec 31, Aug 31,

2007 2007

-------------------------------------------------------------------------

Cash $ 25,114,753 $ 35,988,166

Marketable securities 8,097,348 -

Investment in Silverstone Resources Corp. 39,022,891 28,498,044

Property, plant and equipment 45,655,190 44,616,033

Other assets 27,090,014 24,888,492

-------------------------------------------------------------------------

Total assets 144,980,196 133,990,735

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Deferred revenue 41,398,281 43,056,390

Other liabilities 17,833,194 15,561,814

-------------------------------------------------------------------------

Total liabilities 59,231,475 58,618,204

Shareholder's equity 85,748,721 75,372,531

-------------------------------------------------------------------------

Total liabilities and shareholders' equity 144,980,196 133,990,735

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Consolidated Statements of Operations

-------------------------------------------------------------------------

Four months Year

ended ended

Dec 31, Aug 31,

2007 2007

-------------------------------------------------------------------------

Total revenues $ 32,975,274 $ 55,335,647

Total cost of sales (16,157,585) (28,138,291)

-------------------------------------------------------------------------

Operating profit 16,817,689 27,197,356

G&A and other expenses (3,437,958) (3,773,660)

Other items 3,409,803 1,726,946

-------------------------------------------------------------------------

Earnings (loss) before income taxes 16,789,534 25,150,642

Future income tax (6,333,610) (2,479,593)

-------------------------------------------------------------------------

Earnings (loss) for the year 10,415,923 22,671,049

-------------------------------------------------------------------------

-------------------------------------------------------------------------

EPS - Basic 0.13 0.28

EPS - Diluted 0.12 0.27

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Capstone will host a conference call on Friday, February 29 at

8:00 a.m. Pacific Time (11:00 AM Eastern Time) to discuss these

results. The conference call may be accessed by dialing

1.866.514.1894 in North America or 1.480.248.5085 internationally,

please ask for the Capstone Mining Corp. conference call. The

conference call will be archived for later playback until March 7,

2008 and can be accessed by dialing 1.866.501.5559 and the passcode

is 21264082#.

ABOUT CAPSTONE

Capstone is a Canadian based mining company currently operating

the 100% owned Cozamin copper-silver-lead-zinc mine located in

Zacatecas State, Mexico. Capstone has approximately 81.4 million

shares outstanding and is well financed with no bank debt. More

information is available online at: www.capstonemining.com.

Contacts: Capstone Mining Corp. Chris Tomanik (604) 684-8894

Email: ctomanik@capstonemining.com Capstone Mining Corp. Mark

Patchett (604) 684-8894 (604) 688-2180 (FAX) Email:

mpatchett@capstonemining.com Website: www.capstonemining.com

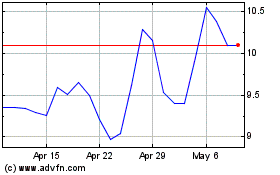

Capstone Copper (TSX:CS)

Historical Stock Chart

From Jun 2024 to Jul 2024

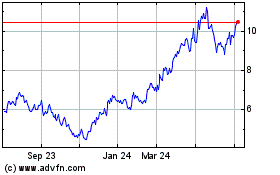

Capstone Copper (TSX:CS)

Historical Stock Chart

From Jul 2023 to Jul 2024