ALSTOM SA: Alstom announces the sale of its North American conventional signalling business. An important milestone in the implementation of the group’s deleveraging plan.

April 19 2024 - 11:35AM

ALSTOM SA: Alstom announces the sale of its North American

conventional signalling business. An important milestone in the

implementation of the group’s deleveraging plan.

Alstom announces the sale of its North

American conventional signalling business. An important milestone

in the implementation of the group’s deleveraging

plan.

19 April 2024 – Alstom, global

leader in smart and sustainable mobility, announced today that it

has entered into a binding agreement with Knorr-Bremse AG to sell

Alstom’s North American conventional signalling business for a

purchase price of around €630 million1.

This transaction is part of the comprehensive

company action plan that Alstom announced on 15 November 2023,

aiming at reinforcing its leadership position in the Rail industry.

Alstom will provide the details of its plan to maintain a solid and

sustainable investment grade rating and of its €2 billion

deleveraging target at full-year results on 8 May 2024.

"We are pleased to sign this agreement, which

marks an important step in the implementation of our action plan.

It evidences the work of our North American signalling employees,

who have built and advanced this very successful business over the

past few years”, said Henri Poupart-Lafarge, Chairman and Chief

Executive Officer.

This transaction concerns the conventional part

of the North American signalling business, and the perimeter to be

sold had revenues of approximately €300 million in FY 2023/24.

Alstom will continue to serve the North American

signalling market on different segments, notably with

Communications Based Train Control (CBTC) and European Train

Control System (ETCS) solutions.

Closing of the transaction is only subject to

customary conditions, including regulatory approval, and is

expected to take place as soon as Summer 2024.

Alstom is accompanied by Crédit Agricole CIB as

financial advisor, White & Case LLP as legal advisor, Cleary

Gottlieb Steen & Hamilton LLP as antitrust advisor, and

Accuracy for financial due diligences.

Alstom™ is a protected trademark of the Alstom

Group.

1 Proceeds for Alstom at closing (net of expected tax and

transaction costs) are expected to reach ca.€620 million.

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focuses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more information,

please visit www.alstom.com. |

|

|

|

| |

Contacts |

PressThomas ANTOINE (HQ) – Tel.: +33 (0) 6 11 47

28 60thomas.antoine@alstomgroup.com Dani SIMONS (AMERICAS) – Tel.:

+1 646 856 3412dani.simons@alstomgroup.com Investor

Relations Martin VAUJOUR – Tel.: +33 (0) 6 88 40 17

57martin.vaujour@alstomgroup.com Estelle MATURELL

ANDINO – Tél.: +33 (0) 6 71 37 47

56estelle.maturell@alstomgroup.com |

|

Important information

This communication does not constitute or form

any part of an offer to exchange or purchase, or solicitation of an

offer to buy or exchange, any securities. Any such offer or

solicitation will be made only pursuant to an official offer

documentation approved by the appropriate regulators. Securities

may not be sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended.

This announcement includes certain

forward-looking statements concerning Alstom.

These forward-looking statements may be

identified by words such as “expect,” “look forward to,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,”

“will,” “project” or words of similar meaning. Forward looking

statements in this document include, but are not limited to,

statements regarding the expected timing of the completion of the

sale of Alstom’s North American conventional signalling business,

the ability to execute in full or in part the previously announced

assets disposal programme, the maintenance of the Group’s

Investment Grade rating or the ability to reduce the Group’s net

debt position. Although Alstom believes its expectations are based

on reasonable assumptions, these forward-looking statements are

subject to a number of risks, uncertainties and factors, including

but not limited to: (i) the general economic and competitive

situation in Alstom’s remaining businesses, (ii) the performance of

financial markets (in particular market volatility, liquidity, and

credit events), (iii) adverse publicity, regulatory actions or

litigation with respect to Alstom, (iv) changes in laws and

regulations, including tax regulations, and (v) general competitive

conditions. Should one or more of these risks or uncertainties

materialize, or should underlying expectations or assumptions prove

to be incorrect, the actual results, performance, financial

condition and prospects of Alstom may vary materially from those

expressed or implied in the relevant forward-looking statements.

Alstom does not intend, and does not assume any obligation, to

update or revise these forward-looking statements in light of

subsequent developments, new information or circumstances that

differ from those currently anticipated. There can be no assurance

that the proposed transaction will be consummated or that the

anticipated benefits will be realised. The proposed transaction is

subject to various regulatory approvals and the fulfilment of

certain conditions, and there can be no assurance that any such

approvals will be obtained and/or such conditions will be met.

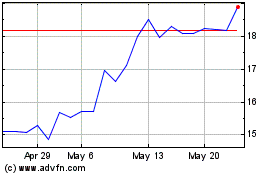

Alstom (TG:AOMD)

Historical Stock Chart

From Apr 2024 to May 2024

Alstom (TG:AOMD)

Historical Stock Chart

From May 2023 to May 2024