adidas Group: First Half Year 2008 Results

August 05 2008 - 1:45AM

Business Wire

Second quarter adidas Group currency-neutral sales grow 14% During

the second quarter of 2008, Group revenues grew 14% on a

currency-neutral basis. All brand segments contributed to this

development with currency-neutral sales increasing 19% at adidas,

2% at Reebok and 6% at TaylorMade-adidas Golf. Currency movements

negatively impacted Group sales in euro terms. Group revenues grew

5% in euro terms to EUR 2.521 billion in the second quarter of 2008

from EUR 2.400 billion in 2007. Second quarter EPS increases 15%

The Group's gross margin increased 2.7 percentage points to a new

record level of 50.1% (2007: 47.4%) in the second quarter as a

result of an improving regional and product mix, further own-retail

expansion and favorable currency movements. Group gross profit

increased 11% to EUR 1.263 billion (2007: EUR 1.138 billion). As a

result of the strong gross margin increase in all brand segments

and operating profit growth in the HQ/Consolidation segment, the

Group's operating margin increased 0.4 percentage points to 8.2% in

the second quarter of 2008 versus 7.8% in the prior year. These

effects more than offset higher operating expenses as a percentage

of sales primarily as a result of the phasing of this year's

marketing expenses in the adidas segment. Operating profit grew 10%

to EUR 208 million versus EUR 188 million in 2007. In the second

quarter of 2008, the Group's net income attributable to

shareholders increased 12% to EUR 116 million (2007: EUR 104

million) due to the higher operating profit as well as a lower tax

rate. As a result of the lower weighted average number of shares

due to the share buyback program, earnings per share increased at

an even stronger rate. Basic EPS for the second quarter grew 15% to

EUR 0.59. adidas Group currency-neutral sales grow 12% in the first

half of 2008 During the first six months of 2008, Group revenues

increased 12% on a currency-neutral basis, driven by double-digit

sales growth in the adidas and TaylorMade-adidas Golf segments. The

adidas segment grew 16%, the Reebok segment decreased 2% and

TaylorMade-adidas Golf segment sales increased 11%. Currency

movements negatively impacted Group sales in euro terms. Group

revenues grew 4% in euro terms to EUR 5.142 billion in the first

half of 2008 from EUR 4.938 billion in 2007. "We are proud to

report a strong set of financial results for the first half of

2008. Our performance is nothing short of exceptional, particularly

in light of the tougher macroeconomic environment," commented

adidas CEO and Chairman Herbert Hainer. "adidas and

TaylorMade-adidas Golf continue to show strong momentum and we have

laid the foundation at Reebok for continued improvement in the

second half of the year." -0- *T 1st Half 1st Half Change Change y-

Year Year y-o-y o-y 2008 2007 in currency- euro neutral terms

------------------------------------- EUR in EUR in in % in %

millions millions

---------------------------------------------------------------------

adidas 3,787 3,454 10 16

---------------------------------------------------------------------

Reebok 923 1,038 (11) (2)

---------------------------------------------------------------------

TaylorMade-adidas Golf 417 419 (0) 11

---------------------------------------------------------------------

HQ/Consolidation 16 28 (44) (38)

---------------------------------------------------------------------

Total 5,142 4,938 4 12

---------------------------------------------------------------------

First half year net sales growth by segment *T Strong sales

increase in nearly all regions adidas Group sales grew at

double-digit rates in all regions except North America where

revenues declined. First half Group sales in Europe grew 16% on a

currency-neutral basis as a result of strong increases in nearly

all countries. In North America, Group revenues declined by 8% on a

currency-neutral basis due to lower adidas and Reebok sales in the

USA. Sales for the Group in Asia increased 25% on a

currency-neutral basis in the first half of 2008, driven by

particularly strong growth in China. In Latin America,

currency-neutral sales grew 29% in the first half of the year, with

double-digit increases coming from all of the region's major

markets. The development was supported by the first-time

consolidation of Reebok's joint ventures in the region. Currency

translation effects negatively impacted sales in euro terms in all

regions. Sales in Europe increased 11% in euro terms to EUR 2.352

billion in 2008 from EUR 2.116 billion in 2007. Revenues in North

America decreased 19% to EUR 1.160 billion in 2008 from EUR 1.429

billion in the prior year. In euro terms, revenues in Asia grew 17%

to EUR 1.214 billion in 2008 from EUR 1.036 billion in 2007. Sales

in Latin America grew 23% to EUR 381 million in 2008 from EUR 310

million in the prior year. -0- *T 1st Half 1st Half Change Change

y- Year Year y-o-y o-y 2008 2007 in currency- euro neutral terms

------------------------------------- EUR in EUR in in % in %

millions millions

---------------------------------------------------------------------

Europe 2,352 2,116 11 16

---------------------------------------------------------------------

North America 1,160 1,429 (19) (8)

---------------------------------------------------------------------

Asia 1,214 1,036 17 25

---------------------------------------------------------------------

Latin America 381 310 23 29

---------------------------------------------------------------------

Total(1) 5,142 4,938 4 12

---------------------------------------------------------------------

First half year net sales growth by region (1) Including

HQ/Consolidation. *T Record group gross margin The gross margin of

the adidas Group increased by 2.5 percentage points to 49.6% of

sales in the first half of 2008 (2007: 47.1%), driven by

improvements in all brand segments. This highest-ever first half

year rate was related to an improving regional and product mix,

increased own-retail activities as well as favorable currency

movements. Cost synergies resulting from the Reebok integration

into the adidas Group also continued to have a positive impact.

Input price increases had only a modest negative impact on the cost

of sales development in the first half of 2008. As a result of the

Group's strong top-line growth and gross margin improvement, gross

profit for the adidas Group rose 10% in the first half of 2008 to

reach EUR 2.552 billion versus EUR 2.326 billion in the prior year.

Operating margin increases by 1.1 percentage points The Group's

operating margin increased 1.1 percentage points to 9.5% in the

first half of 2008 (2007: 8.5%). This is the highest first half

operating margin since the acquisition of Reebok. Operating

expenses as a percentage of sales increased by 1.3 percentage

points to 40.9% in the first half of 2008 from 39.6% in 2007. This

development was primarily driven by higher marketing expenses as a

percentage of sales in the adidas segment in connection with this

year's major sporting events. Increased expenses to support growth

in emerging markets such as Russia in both the adidas and Reebok

segments also impacted this development. Operating profit for the

adidas Group increased 17% in the first half of 2008 to reach EUR

490 million versus EUR 417 million in 2007. Net financial expenses

decrease 3% Net financial expenses decreased 3% to EUR 71 million

in the first half of 2008 from EUR 73 million in the prior year as

a result of lower average borrowings in 2008 compared to the first

half of the prior year. Income before taxes increases by 22% As a

result of the Group's operating margin increase as well as lower

net financial expenses, income before taxes (IBT) as a percentage

of sales increased by 1.2 percentage points to 8.1% in 2008 from

7.0% in 2007. Income before taxes for the adidas Group grew 22% to

EUR 419 million in the first half of 2008 from EUR 344 million in

2007. Net income attributable to shareholders up 23% The Group's

net income attributable to shareholders increased 23% to EUR 286

million in the first half of 2008 from EUR 232 million in 2007. The

Group's tax rate decreased by 0.5 percentage points to 31.5% in the

first half of 2008 (2007: 32.0%) and thus also contributed to this

development. The Group's minority interests declined by 16% to EUR

1 million in the first half of 2008 from EUR 2 million during the

same period in the prior year. Earnings per share increase 25%

Basic earnings per share increased 25% to EUR 1.42 in the first

half of 2008 versus EUR 1.14 in the prior year. The weighted

average number of shares used in the calculation of basic earnings

per share was 200,415,758 (2007 average: 203,565,047). Diluted

earnings per share in 2008 increased 24% to EUR 1.35 from EUR 1.09

in the prior year. The weighted average number of shares used in

the calculation of diluted earnings per share was 216,211,434 (2007

average: 219,446,886). 3.3 million shares repurchased in the second

quarter On January 29, 2008, adidas AG announced the launch of a

share buyback program to repurchase up to 5% of the company's stock

capital until November 2008. During the second quarter, adidas AG

purchased over 3.3 million shares at an average price of EUR 41.99.

The buyback volume amounted to EUR 139 million in the second

quarter. Over the entire buyback period, since January 30 to date,

adidas AG bought back almost 7.7 million shares at an average price

of EUR 41.35. The total buyback volume amounted to EUR 318 million.

Working capital development supports further growth Group

inventories grew 5% to EUR 1.806 billion at the end of the first

half of 2008 versus EUR 1.716 billion in 2007. On a

currency-neutral basis, this represents an increase of 16%. This

development is due to business expansion in emerging markets and

inventories related to the newly established Reebok joint ventures

in Latin America. Group receivables decreased 3% to EUR 1.641

billion at the end of the first half of 2008 versus EUR 1.689

billion in the prior year. On a currency-neutral basis, receivables

increased 5%, which is well below net sales growth for the second

quarter. This reflects ongoing strict discipline in the Group's

trade terms management and concerted collection efforts in all

segments. Net borrowings reduced by EUR 134 million Net borrowings

at June 30, 2008 were EUR 2.260 billion, down 6% or EUR 134 million

versus EUR 2.395 billion in the prior year. Strong bottom-line

profitability and currency effects positively impacted this

development and more than offset cash outflows related to the share

buyback program. adidas backlogs grow 8% on a currency-neutral

basis Backlogs for the adidas brand at the end of the second

quarter of 2008 increased 8% versus the prior year on a

currency-neutral basis. This improvement was supported by adidas'

strength in most major categories. In euro terms, adidas backlogs

grew 1%. Footwear backlogs grew 9% in currency-neutral terms (+2%

in euros) with increases in all regions. Apparel backlogs grew 9%

on a currency-neutral basis (+2% in euros), driven by strong

double-digit increases in Asia and high-single-digit growth in

Europe. Hardware backlogs decreased due to the non-recurrence of

prior year orders related to the UEFA EURO 2008(TM). -0- *T

Footwear Apparel Total(2)

--------------------------------------------- in currency- in

currency- in currency- EUR neutral EUR neutral EUR neutral

---------------------------------------------------------------------

Europe 1 5 2 7 0 4

---------------------------------------------------------------------

North America (9) 6 (23) (10) (14) 0

---------------------------------------------------------------------

Asia 14 21 17 25 13 21

---------------------------------------------------------------------

Total 2 9 2 9 1 8

---------------------------------------------------------------------

Year-over-year development of adidas order backlogs by product

category and region as at June 30, 2008 (in %) (2) Includes

hardware backlogs. *T Reebok backlogs decline Currency-neutral

Reebok backlogs at the end of the second quarter of 2008 decreased

13% versus the prior year on a currency-neutral basis. In euro

terms, this represents a decline of 21%. Footwear backlogs

decreased 13% in currency-neutral terms (-21% in euros). Apparel

backlogs declined by 20% on a currency-neutral basis (-28% in

euros). Both of these developments reflect the short-term impact of

strategic initiatives to revitalize the Reebok brand in the USA,

the UK and Japan. Hardware backlogs were up at a double-digit rate

due to increases in the hockey category. Due to the exclusion of

the own-retail business and the high share of at-once business in

Reebok's sales mix, order backlogs in this segment are not

indicative of the expected 2008 sales development. -0- *T Footwear

Apparel Total(3) --------------------------------------------- in

currency- in currency- in currency- EUR neutral EUR neutral EUR

neutral

---------------------------------------------------------------------

Europe (13) (9) (27) (22) (15) (10)

---------------------------------------------------------------------

North America (39) (29) (32) (21) (32) (21)

---------------------------------------------------------------------

Asia 2 8 (1) 3 1 6

---------------------------------------------------------------------

Total (21) (13) (28) (20) (21) (13)

---------------------------------------------------------------------

Year-over-year development of Reebok order backlogs by product

category and region as at June 30, 2008 (in %) (3) Includes

hardware backlogs. *T Gross and operating margin full year guidance

increased adidas Group sales in 2008 are expected to grow at a

high-single-digit rate on a currency-neutral basis.

Currency-neutral sales for brand adidas in 2008 are now forecasted

to increase at a low-double-digit rate (previously:

high-single-digit rate). Sales guidance for the Reebok and

TaylorMade-adidas Golf segments remains unchanged. Currency-neutral

Reebok segment sales are projected to grow at a mid- to

high-single-digit rate in 2008. At TaylorMade-adidas Golf, full

year currency-neutral sales are forecasted to increase at a

mid-single-digit rate. As a result of the Group's strong gross

margin improvement during the first half of the year, the full year

gross margin is now expected to exceed 48.0% (previously: 47.5 to

48.0%), driven by improvements in all three brand segments. The

operating margin is now also projected to be higher than originally

forecasted. Group operating margin is expected to approach 10.0% in

2008 (previously: at least 9.5%). Full year net income attributable

to shareholders is projected to grow by at least 15% in 2008 versus

the 2007 level of EUR 551 million. This will represent the eighth

consecutive year of double-digit net income growth for the Group.

Herbert Hainer stated: "Our performance in the first half of the

year puts us firmly on track to achieve all of our financial

targets for 2008. We even expect to exceed some of our original

goals and at the upcoming Olympic Games we are ready to showcase

the power of our brands to audiences around the world." Second

quarter adidas Group currency-neutral sales grow 14% During the

second quarter of 2008, Group revenues grew 14% on a

currency-neutral basis. All brand segments contributed to this

development with currency-neutral sales increasing 19% at adidas,

2% at Reebok and 6% at TaylorMade-adidas Golf. Currency movements

negatively impacted Group sales in euro terms. Group revenues grew

5% in euro terms to � 2.521 billion in the second quarter of 2008

from � 2.400 billion in 2007. Second quarter EPS increases 15% The

Group�s gross margin increased 2.7 percentage points to a new

record level of 50.1% (2007:�47.4%) in the second quarter as a

result of an improving regional and�product mix, further own-retail

expansion and favorable currency movements. Group gross profit

increased 11% to ��1.263 billion (2007: ��1.138 billion). As a

result of the strong gross margin increase in all brand segments

and operating profit growth in the HQ/Consolidation segment, the

Group�s operating margin increased 0.4 percentage points to 8.2% in

the second quarter of 2008 versus 7.8% in the prior year. These

effects more than offset higher operating expenses as a percentage

of sales primarily as a result of the phasing of this year�s

marketing expenses in the adidas segment. Operating profit grew 10%

to ��208 million versus ��188�million in 2007. In the second

quarter of 2008, the�Group�s net income attributable to

shareholders increased 12% to ��116�million (2007: ��104�million)

due to the higher operating profit as well as a lower tax rate. As

a result of the lower weighted average number of shares due to the

share buyback program, earnings per share increased at an even

stronger rate. Basic EPS for the second quarter grew 15% to � 0.59.

adidas Group currency-neutral sales grow 12% in the first half of

2008 During the first six months of 2008, Group revenues increased

12% on a currency-neutral basis, driven by double-digit sales

growth in the adidas and TaylorMade-adidas Golf segments. The

adidas segment grew 16%, the Reebok segment decreased 2% and

TaylorMade-adidas Golf segment sales increased 11%. Currency

movements negatively impacted Group sales in euro terms. Group

revenues grew 4% in euro terms to � 5.142 billion in the first half

of 2008 from � 4.938 billion in 2007. �We are proud to report a

strong set of financial results for the first half of 2008. Our

performance is nothing short of exceptional, particularly in light

of the tougher macroeconomic environment,� commented adidas CEO and

Chairman Herbert Hainer. �adidas and TaylorMade-adidas Golf

continue to show strong momentum and we have laid the foundation at

Reebok for continued improvement in the second half of the year.� �

1st Half Year 2008 � 1st Half Year 2007 � Change y-o-y in euro

terms � Change y-o-y currency-neutral � � � in millions � � in

millions � in % � in % adidas � 3,787 � 3,454 � 10 � � 16 � Reebok

� 923 � 1,038 � (11 ) � (2 ) TaylorMade-adidas Golf � 417 � 419 �

(0 ) � 11 � HQ/Consolidation � 16 � 28 � (44 ) � (38 ) Total �

5,142 � 4,938 � 4 � � 12 � � � � First half year net sales growth

by segment Strong sales increase in nearly all regions adidas Group

sales grew at double-digit rates in all regions except North

America where revenues declined. First half Group sales in Europe

grew 16%�on a currency-neutral basis as a result of strong

increases in nearly all countries. In North America, Group revenues

declined by 8% on a currency-neutral basis due to lower adidas and

Reebok sales in the USA. Sales for the Group in Asia increased 25%

on a currency-neutral basis in the first half of 2008, driven by

particularly strong growth in China. In Latin America,

currency-neutral sales grew 29% in the first half of the year, with

double-digit increases coming from all of the region�s major

markets. The development was supported by the first-time

consolidation of Reebok�s joint ventures in the region. Currency

translation effects negatively impacted sales in euro terms in all

regions. Sales in Europe increased 11% in euro terms to � 2.352

billion in 2008 from � 2.116 billion in 2007. Revenues in North

America decreased 19% to � 1.160 billion in 2008 from � 1.429

billion in the prior year. In euro�terms, revenues in Asia grew 17%

to � 1.214 billion in 2008 from ��1.036�billion in 2007. Sales in

Latin America grew 23% to � 381 million in�2008 from � 310 million

in the prior year. � 1st Half Year 2008 � 1st Half Year 2007 �

Change y-o-y in euro terms � Change y-o-y currency-neutral � � � in

millions � � in millions � in % � in % Europe � 2,352 � 2,116 � 11

� � 16 � North America � 1,160 � 1,429 � (19 ) � (8 ) Asia � 1,214

� 1,036 � 17 � � 25 � Latin America � 381 � 310 � 23 � � 29 �

Total1 � 5,142 � 4,938 � 4 � � 12 � � � � First half year net sales

growth by region � 1 Including HQ/Consolidation. Record group gross

margin The gross margin of the adidas Group increased by 2.5

percentage points to 49.6% of sales in the first half of 2008

(2007: 47.1%), driven by improvements in all brand segments. This

highest-ever first half year rate was related to an improving

regional and product mix, increased own-retail activities as well

as favorable currency movements. Cost synergies resulting from the

Reebok integration into the adidas Group also continued to have a

positive impact. Input price increases had only a modest negative

impact on the cost of sales development in the first half of 2008.

As a result of the Group�s strong top-line growth and gross margin

improvement, gross profit for the adidas Group rose 10% in the

first half of 2008 to reach � 2.552 billion versus � 2.326 billion

in the prior year. Operating margin increases by 1.1 percentage

points The Group�s operating margin increased 1.1 percentage points

to 9.5% in the first half of 2008 (2007: 8.5%). This is the highest

first half operating margin since the acquisition of Reebok.

Operating expenses as a percentage of sales increased by 1.3

percentage points to 40.9% in the first half of 2008 from 39.6% in

2007. This development was primarily driven by higher marketing

expenses as a percentage of sales in the adidas segment in

connection with this year�s major sporting events. Increased

expenses to support growth in emerging markets such as Russia in

both the adidas and Reebok segments also impacted this development.

Operating profit for the adidas Group increased 17% in the first

half of 2008 to reach � 490 million versus ��417�million in 2007.

Net financial expenses decrease 3% Net financial expenses decreased

3% to � 71 million in the first half of 2008 from � 73 million in

the prior year as a result of lower average borrowings in 2008

compared to the first half of the prior year. Income before taxes

increases by 22% As a result of the Group�s operating margin

increase as well as lower net financial expenses, income before

taxes (IBT) as a percentage of sales increased by 1.2 percentage

points to 8.1% in 2008 from 7.0% in 2007. Income before taxes for

the adidas Group grew 22% to � 419 million in the first half of

2008 from � 344 million in 2007. Net income attributable to

shareholders up 23% The Group�s net income attributable to

shareholders increased 23% to ��286�million in the first half of

2008 from � 232 million in 2007. The Group�s tax rate decreased by

0.5 percentage points to 31.5% in the first half of 2008 (2007:

32.0%) and thus also contributed to this development. The Group�s

minority interests declined by 16% to � 1 million in the first half

of 2008 from � 2 million during the same period in the prior year.

Earnings per share increase 25% Basic earnings per share increased

25% to � 1.42 in the first half of 2008 versus � 1.14 in the prior

year. The weighted average number of shares used in the calculation

of basic earnings per share was 200,415,758 (2007 average:

203,565,047). Diluted earnings per share in 2008 increased 24% to �

1.35 from � 1.09 in the prior year. The weighted average number of

shares used in the calculation of diluted earnings per share was

216,211,434 (2007 average: 219,446,886). 3.3 million shares

repurchased in the second quarter On January 29, 2008, adidas AG

announced the launch of a share buyback program to repurchase up to

5% of the company�s stock capital until November 2008. During the

second quarter, adidas AG purchased over 3.3�million shares at an

average price of � 41.99. The buyback volume amounted to � 139

million in the second quarter. Over the entire buyback period,

since January 30 to date, adidas AG bought back almost 7.7 million

shares at an average price of � 41.35. The total buyback volume

amounted to ��318�million. Working capital development supports

further growth Group inventories grew 5% to � 1.806 billion at the

end of the first half of 2008 versus � 1.716 billion in 2007. On a

currency-neutral basis, this represents an increase of 16%. This

development is due to business expansion in emerging markets and

inventories related to the newly established Reebok joint ventures

in Latin America. Group receivables decreased 3% to � 1.641 billion

at the end of the first half of 2008 versus � 1.689 billion in the

prior year. On a currency-neutral basis, receivables increased 5%,

which is well below net sales growth for the second quarter. This

reflects ongoing strict discipline in the Group�s trade terms

management and concerted collection efforts in all segments. Net

borrowings reduced by � 134 million Net borrowings at June 30, 2008

were � 2.260 billion, down 6% or ��134�million versus � 2.395

billion in the prior year. Strong bottom-line profitability and

currency effects positively impacted this development and more than

offset cash outflows related to the share buyback program. adidas

backlogs grow 8% on a currency-neutral basis Backlogs for the

adidas brand at the end of the second quarter of 2008 increased 8%

versus the prior year on a currency-neutral basis. This improvement

was supported by adidas� strength in most major categories. In�euro

terms, adidas backlogs grew 1%. Footwear backlogs grew 9% in

currency-neutral terms (+2% in euros) with increases in all

regions. Apparel backlogs grew 9% on a currency-neutral basis (+2%

in euros), driven by strong double-digit increases in Asia and

high-single-digit growth in Europe. Hardware backlogs decreased due

to the non-recurrence of prior year orders related to the UEFA EURO

2008�. � Footwear � Apparel � Total2 � � in � � currency-neutral �

in � � currency-neutral � in � � currency-neutral Europe � 1 � � 5

� 2 � � 7 � � 0 � � 4 North America � (9 ) � 6 � (23 ) � (10 ) �

(14 ) � 0 Asia � 14 � � 21 � 17 � � 25 � � 13 � � 21 Total � 2 � �

9 � 2 � � 9 � � 1 � � 8 � � � � � � Year-over-year development of

adidas order backlogs by product category and region as at June 30,

2008 (in %) � 2 Includes hardware backlogs. Reebok backlogs decline

Currency-neutral Reebok backlogs at the end of the second quarter

of 2008 decreased 13% versus the prior year on a currency-neutral

basis. In euro terms, this represents a decline of 21%. Footwear

backlogs decreased 13% in currency-neutral terms (-21% in euros).

Apparel backlogs declined by 20% on a currency-neutral basis (-28%

in euros). Both of these developments reflect the short-term impact

of strategic initiatives to revitalize the Reebok brand in the USA,

the UK and Japan. Hardware backlogs were up at a double-digit rate

due to increases in the hockey category. Due to the exclusion of

the own-retail business and the high share of at-once business in

Reebok�s sales mix, order backlogs in this segment are not

indicative of the expected 2008 sales development. � Footwear �

Apparel � Total3 � � in � � currency-neutral � in � �

currency-neutral � in � � currency-neutral Europe � (13) � (9) �

(27) � (22) � (15) � (10) North America � (39) � (29) � (32) � (21)

� (32) � (21) Asia � 2 � 8 � (1) � 3 � 1 � 6 Total � (21) � (13) �

(28) � (20) � (21) � (13) � � � � � � Year-over-year development of

Reebok order backlogs by product category and region as at June 30,

2008 (in %) � � 3 Includes hardware backlogs. Gross and operating

margin full year guidance increased adidas Group sales in 2008 are

expected to grow at a high-single-digit rate on a currency-neutral

basis. Currency-neutral sales for brand adidas in 2008 are now

forecasted to increase at a low-double-digit rate (previously:

high-single-digit rate). Sales guidance for the Reebok and

TaylorMade-adidas Golf segments remains unchanged. Currency-neutral

Reebok segment sales are projected to grow at a mid- to

high-single-digit rate in 2008. At TaylorMade-adidas Golf, full

year currency-neutral sales are forecasted to increase at a

mid-single-digit rate. As a result of the Group�s strong gross

margin improvement during the first half of the year, the full year

gross margin is now expected to exceed 48.0% (previously: 47.5 to

48.0%), driven by improvements in all three brand segments. The

operating margin is now also projected to be higher than originally

forecasted. Group operating margin is expected to approach 10.0% in

2008 (previously: at least 9.5%). Full year net income attributable

to shareholders is projected to grow by at least 15% in 2008 versus

the 2007 level of � 551 million. This will represent the eighth

consecutive year of double-digit net income growth for the Group.

Herbert Hainer stated: �Our performance in the first half of the

year puts us firmly on track to achieve all of our financial

targets for 2008. We even expect to exceed some of our original

goals and at the upcoming Olympic Games we are ready to showcase

the power of our brands to audiences around the world.�

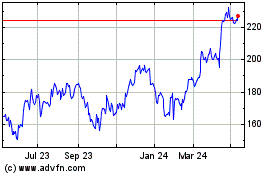

Adidas (TG:ADS)

Historical Stock Chart

From Dec 2024 to Jan 2025

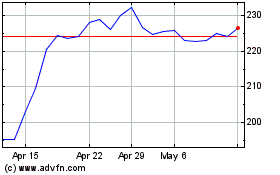

Adidas (TG:ADS)

Historical Stock Chart

From Jan 2024 to Jan 2025