- Increased Q3 2024 Subscription & Support Revenue by 19%

over Q3 2023

- Total revenue of $186 million in Q3 2024, representing 17%

year-over-year growth

- Achieved 28% YOY Growth of Customers with Annual Contract Value

Over $500K

Workiva Inc. (NYSE:WK), the world’s leading cloud platform for

assured integrated reporting, today announced financial results for

its third quarter ended September 30, 2024.

"Workiva is once again in a beat and raise position. Our results

highlight an acceleration of our growth and improved operating

leverage," said Julie Iskow, President & Chief Executive

Officer. "We delivered another record bookings quarter with broad

based demand across the entire solution portfolio and a high volume

of account expansion deals and platform wins across North America

and Europe."

"Subscription and support revenue growth of 19% drove our total

revenue beat to $2.6 million over the high end of our guidance

range," said Jill Klindt, Chief Financial Officer. "Due to our

solid performance, we are raising our total revenue guidance by $6

million to a range of $733 million to $735 million."

Third Quarter 2024 Financial

Results

- Revenue: Total revenue for the third quarter of 2024

reached $186 million, an increase of 17% from $158 million in the

third quarter of 2023. Subscription and support revenue contributed

$171 million, up 19% versus the third quarter of 2023. Professional

services revenue was $15 million, relatively flat compared to the

same quarter in the prior year.

- Gross Profit: GAAP gross profit for the third quarter of

2024 was $142 million compared with $120 million in the same

quarter of 2023. GAAP gross margin was 76.5% versus 75.8% in the

third quarter of 2023. Non-GAAP gross profit for the third quarter

of 2024 was $146 million, an increase of 20% compared with the

prior year's third quarter, and non-GAAP gross margin was 78.6%

compared to 76.9% in the third quarter of 2023.

- Results from Operations: GAAP loss from operations for

the third quarter of 2024 was $22 million compared with a loss of

$16 million in the prior year's third quarter. Non-GAAP income from

operations was $8 million compared with non-GAAP income from

operations of $5 million in the third quarter of 2023.

- GAAP Net Loss: GAAP net loss for the third quarter of

2024 was $17 million compared with a net loss of $56 million for

the prior year's third quarter. GAAP net loss per basic and diluted

share was $0.31 compared with a net loss per basic and diluted

share of $1.04 in the third quarter of 2023.

- Non-GAAP Net Income/Loss: Non-GAAP net income for the

third quarter of 2024 was $12 million compared with a net loss of

$35 million in the prior year's third quarter. Non-GAAP net income

per basic share and diluted share was $0.22 and $0.21,

respectively, compared with a net loss per basic share and diluted

share of $0.65 in the third quarter of 2023.

- Liquidity: As of September 30, 2024, Workiva had cash,

cash equivalents, and marketable securities totaling $776 million,

compared with $814 million as of December 31, 2023. Workiva had $71

million aggregate principal amount of 1.125% convertible senior

notes due in 2026, $702 million aggregate principal amount of

1.250% convertible senior notes due in 2028, and $14 million of

finance lease obligations outstanding as of September 30,

2024.

Key Metrics and Recent Business

Highlights

- Customers: Workiva had 6,237 customers as of September

30, 2024, a net increase of 292 customers from September 30,

2023.

- Revenue Retention Rate: As of September 30, 2024,

Workiva's revenue retention rate (excluding add-on revenue) was

98%, and the revenue retention rate including add-on revenue was

111%. Add-on revenue includes changes in both solutions and pricing

for existing customers.

- Large Contracts: As of September 30, 2024, Workiva had

1,926 customers with an annual contract value (“ACV”) of more than

$100,000, up 23% from 1,561 customers at September 30, 2023.

Workiva had 383 customers with an ACV of more than $300,000, up 29%

from 296 customers in the third quarter of 2023. Workiva had 166

customers with an ACV of more than $500,000, up 28% from 130

customers in the third quarter of 2023.

Financial Outlook

As of November 6, 2024, Workiva is providing guidance as

follows:

Fourth Quarter 2024 Guidance:

- Total revenue is expected to be in the range of $194 million to

$196 million.

- GAAP loss from operations is expected to be in the range of $16

million to $14 million.

- Non-GAAP income from operations is expected to be in the range

of $13 million to $15 million.

- GAAP net loss per basic share is expected to be in the range of

$0.21 to $0.18.

- Non-GAAP net income per basic share is expected to be in the

range of $0.31 to $0.34.

- Net income (loss) per basic share is based on 55.8 million

weighted-average shares outstanding.

Full Year 2024 Guidance:

- Total revenue is expected to be in the range of $733 million to

$735 million.

- GAAP loss from operations is expected to be in the range of $79

million to $77 million.

- Non-GAAP income from operations is expected to be in the range

of $30 million to $32 million.

- GAAP net loss per basic share is expected to be in the range of

$1.05 to $1.02.

- Non-GAAP net income per basic share is expected to be in the

range of $0.93 to $0.96.

- Net income (loss) per basic share is based on 55.4 million

weighted-average shares outstanding.

Quarterly Conference

Call

Workiva will host a webcast today at 5:00 p.m. ET to review the

Company’s financial results for the third quarter 2024, in addition

to discussing the Company’s outlook for the fourth quarter and full

year 2024. The webcast will be available on

https://investor.workiva.com/news-events/events. An archived

webcast will also be available an hour after the completion of the

call in the "Investor Relations" section of the Company’s website

at www.workiva.com.

About Workiva

Workiva Inc. (NYSE:WK) is on a mission to power transparent

reporting for a better world. We build and deliver the world’s

leading cloud platform for assured integrated reporting to meet

stakeholder demands for action, transparency, and disclosure of

financial and non-financial data. Workiva offers the only unified

SaaS platform that brings customers’ financial reporting,

Governance, Risk, and Compliance (GRC), and Environmental, Social,

and Governance (ESG) data together in a controlled, secure,

audit-ready platform. Our platform simplifies the most complex

reporting and disclosure challenges by streamlining processes,

connecting data and teams, and ensuring consistency. Learn more at

workiva.com.

Non-GAAP Financial

Measures

The non-GAAP adjustments referenced herein relate to the

exclusion of stock-based compensation and amortization of

acquisition-related intangible assets. A reconciliation of GAAP to

non-GAAP historical financial measures has been provided in Table I

at the end of this press release. A reconciliation of GAAP to

non-GAAP guidance has been provided in Table II at the end of this

press release.

Workiva believes that the use of non-GAAP gross profit and gross

margin, non-GAAP income (loss) from operations, non-GAAP net income

(loss) and non-GAAP net income (loss) per share is helpful to its

investors. These measures, which are referred to as non-GAAP

financial measures, are not prepared in accordance with generally

accepted accounting principles in the United States, or GAAP.

Non-GAAP gross profit is calculated by excluding stock-based

compensation expense attributable to cost of revenues from gross

profit. Non-GAAP gross margin is the ratio calculated by dividing

non-GAAP gross profit by revenues. Non-GAAP income (loss) from

operations is calculated by excluding stock-based compensation

expense and amortization expense for acquisition-related intangible

assets from loss from operations. Non-GAAP net income (loss) is

calculated by excluding stock-based compensation expense, net of

tax and amortization expense for acquisition-related intangible

assets from net loss. Non-GAAP net income (loss) per share is

calculated by dividing non-GAAP net income (loss) by the weighted-

average shares outstanding as presented in the calculation of GAAP

net loss per share. Because of varying available valuation

methodologies, subjective assumptions and the variety of equity

instruments that can impact a company’s non-cash expenses, Workiva

believes that providing non-GAAP financial measures that exclude

stock-based compensation expense allows for more meaningful

comparisons between its operating results from period to period.

For business combinations, we generally allocate a portion of the

purchase price to intangible assets. The amount of the allocation

is based on estimates and assumptions made by management and is

subject to amortization. The amount of purchase price allocated to

intangible assets and the term of its related amortization can vary

significantly and are unique to each acquisition and thus we do not

believe it is reflective of ongoing operations. Workiva’s

management uses these non-GAAP financial measures as tools for

financial and operational decision making and for evaluating

Workiva’s own operating results over different periods of time.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in

Workiva’s industry, as other companies in the industry may

calculate non-GAAP financial results differently. In addition,

there are limitations in using non-GAAP financial measures because

the non-GAAP financial measures are not prepared in accordance with

GAAP, may be different from non-GAAP financial measures used by

other companies and exclude expenses that may have a material

impact on Workiva’s reported financial results. Further,

stock-based compensation expense has been and will continue to be

for the foreseeable future a significant recurring expense in

Workiva’s business and an important part of the compensation

provided to its employees. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with GAAP. Investors should review the reconciliation

of non-GAAP financial measures to the comparable GAAP financial

measures included below, and not rely on any single financial

measure to evaluate Workiva’s business.

Forward-Looking

Statements

Certain statements in this press release are "forward-looking

statements" within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and are subject to the safe

harbor created thereby. These statements relate to future events or

the Company’s future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, levels of activity, performance or achievements of

the Company or its industry to be materially different from those

expressed or implied by any forward-looking statements. In

particular, statements about the Company’s expectations, beliefs,

plans, objectives, assumptions, future events or future performance

contained in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by

terminology such as "may," "will," "could," "would," "should,"

"expect," "plan," "anticipate," "intend," "believe," "estimate,"

"predict," "potential," "outlook," "guidance" or the negative of

those terms or other comparable terminology.

Please see the Company’s documents filed or to be filed with the

Securities and Exchange Commission, including the Company’s annual

reports filed on Form 10-K and quarterly reports on Form 10-Q, and

any amendments thereto for a discussion of certain important risk

factors that relate to forward-looking statements contained in this

report. The Company has based these forward-looking statements on

its current expectations, assumptions, estimates and projections.

While the Company believes these expectations, assumptions,

estimates and projections are reasonable, such forward-looking

statements are only predictions and involve known and unknown risks

and uncertainties, many of which are beyond the Company’s control.

These and other important factors may cause actual results,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Any

forward-looking statements are made only as of the date hereof, and

unless otherwise required by applicable securities laws, the

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

WORKIVA INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands,

except share and per share amounts)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

(unaudited)

Revenue

Subscription and support

$

171,035

$

143,421

$

486,749

$

409,857

Professional services

14,586

14,754

52,042

53,529

Total revenue

185,621

158,175

538,791

463,386

Cost of revenue

Subscription and support (1)

30,621

24,864

86,493

74,080

Professional services (1)

13,050

13,491

39,873

42,297

Total cost of revenue

43,671

38,355

126,366

116,377

Gross profit

141,950

119,820

412,425

347,009

Operating expenses

Research and development (1)

48,425

41,747

142,328

130,235

Sales and marketing (1)

89,756

72,576

257,086

215,168

General and administrative (1)

25,551

21,022

76,225

86,660

Total operating expenses

163,732

135,345

475,639

432,063

Loss from operations

(21,782

)

(15,525

)

(63,214

)

(85,054

)

Interest income

9,298

7,294

30,089

15,546

Interest expense

(3,199

)

(47,437

)

(9,668

)

(50,437

)

Other expense, net

(350

)

(71

)

(309

)

(1,450

)

Loss before provision for income taxes

(16,033

)

(55,739

)

(43,102

)

(121,395

)

Provision for income taxes

959

530

3,125

1,934

Net loss

$

(16,992

)

$

(56,269

)

$

(46,227

)

$

(123,329

)

Net loss per common share:

Basic and diluted

$

(0.31

)

$

(1.04

)

$

(0.84

)

$

(2.28

)

Weighted-average common shares outstanding

- basic and diluted

55,581,841

54,256,941

55,226,254

53,987,791

(1) Includes stock-based compensation

expense as follows:

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

(unaudited)

Cost of revenue

Subscription and support

$

2,164

$

1,247

$

5,708

$

3,732

Professional services

858

623

2,348

1,923

Operating expenses

Research and development

5,681

4,155

15,474

13,677

Sales and marketing

9,942

7,108

26,470

20,769

General and administrative

8,825

6,244

25,879

37,928

WORKIVA INC.

CONSOLIDATED BALANCE SHEETS (in thousands)

September 30, 2024

December 31, 2023

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

248,239

$

256,100

Marketable securities

528,115

557,622

Accounts receivable, net

137,921

125,193

Deferred costs

44,726

39,023

Other receivables

8,646

7,367

Prepaid expenses and other

21,055

23,631

Total current assets

988,702

1,008,936

Property and equipment, net

21,757

24,282

Operating lease right-of-use assets

9,485

12,642

Deferred costs, non-current

43,557

33,346

Goodwill

202,133

112,097

Intangible assets, net

30,278

22,892

Other assets

6,174

4,665

Total assets

$

1,302,086

$

1,218,860

Liabilities and Stockholders’

Deficit

Current liabilities

Accounts payable

$

13,346

$

5,204

Accrued expenses and other current

liabilities

111,029

97,921

Deferred revenue

414,229

380,843

Finance lease obligations

555

532

Total current liabilities

539,159

484,500

Convertible senior notes, non-current

764,281

762,455

Deferred revenue, non-current

27,527

36,177

Other long-term liabilities

236

178

Operating lease liabilities,

non-current

8,062

10,890

Finance lease obligations, non-current

13,631

14,050

Total liabilities

1,352,896

1,308,250

Stockholders’ deficit

Common stock

56

54

Additional paid-in-capital

645,083

562,942

Accumulated deficit

(698,868

)

(652,641

)

Accumulated other comprehensive income

2,919

255

Total stockholders’ deficit

(50,810

)

(89,390

)

Total liabilities and stockholders’

deficit

$

1,302,086

$

1,218,860

WORKIVA INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (in

thousands)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

(unaudited)

Cash flows from operating

activities

Net loss

$

(16,992

)

$

(56,269

)

$

(46,227

)

$

(123,329

)

Adjustments to reconcile net loss to net

cash provided by operating activities

Depreciation and amortization

3,006

2,686

8,092

8,353

Stock-based compensation expense

27,470

19,377

75,879

78,029

Provision for (recovery of) doubtful

accounts

57

8

(46

)

57

Accretion of premiums and discounts on

marketable securities, net

(2,638

)

(1,930

)

(9,543

)

(4,530

)

Amortization of debt discount and issuance

costs

609

472

1,826

1,122

Induced conversion expense

—

45,144

—

45,144

Realized loss on sale of

available-for-sale securities, net

—

—

—

708

Deferred income tax

(1

)

(14

)

(292

)

(17

)

Changes in assets and liabilities:

Accounts receivable

(15,187

)

(15,234

)

(11,507

)

7,243

Deferred costs

(4,946

)

3,116

(15,140

)

6,248

Operating lease right-of-use asset

1,210

1,244

3,808

3,807

Other receivables

(1,745

)

(1,556

)

2,796

(1,842

)

Prepaid expenses and other

344

3,452

2,764

(3,985

)

Other assets

464

1,043

(1,191

)

1,479

Accounts payable

4,788

(386

)

7,630

(1,267

)

Deferred revenue

26,606

11,120

22,159

22,225

Operating lease liability

(878

)

(750

)

(2,831

)

(3,129

)

Accrued expenses and other liabilities

(3,261

)

3,468

5,559

10,217

Net cash provided by operating

activities

18,906

14,991

43,736

46,533

Cash flows from investing

activities

Purchase of property and equipment

(243

)

(895

)

(554

)

(1,732

)

Purchase of marketable securities

(158,522

)

(144,989

)

(310,075

)

(322,008

)

Maturities of marketable securities

108,993

36,906

345,733

76,811

Sale of marketable securities

—

—

4,609

65,052

Acquisitions, net of cash acquired

187

—

(98,093

)

—

Purchase of intangible assets

(44

)

(48

)

(116

)

(167

)

Net cash used in investing activities

(49,629

)

(109,026

)

(58,496

)

(182,044

)

Cash flows from financing

activities

Proceeds from option exercises

3,273

1,120

3,865

3,324

Taxes paid related to net share

settlements of stock-based compensation awards

(1,173

)

(984

)

(11,424

)

(9,424

)

Proceeds from shares issued in connection

with employee stock purchase plan

6,709

6,967

13,822

12,513

Proceeds from the issuance of convertible

senior notes, net of issuance costs

—

691,113

—

691,113

Payments for repurchase of convertible

senior notes

—

(396,869

)

—

(396,869

)

Principal payments on finance lease

obligations

(134

)

(127

)

(395

)

(376

)

Net cash provided by financing

activities

8,675

301,220

5,868

300,281

Effect of foreign exchange rates on

cash

2,390

(1,239

)

925

(82

)

Net (decrease) increase in cash, cash

equivalents, and restricted cash

(19,658

)

205,946

(7,967

)

164,688

Cash, cash equivalents, and restricted

cash at beginning of period

268,412

198,939

256,721

240,197

Cash, cash equivalents, and restricted

cash at end of period

$

248,754

$

404,885

$

248,754

$

404,885

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Reconciliation of cash, cash

equivalents, and restricted cash to the consolidated balance

sheets

Cash and cash equivalents at end of

period

$

248,239

$

404,885

$

248,239

$

404,885

Restricted cash included within prepaid

expenses and other at end of period

515

—

515

—

Total cash, cash equivalents, and

restricted cash at end of period shown in the consolidated

statements of cash flows

$

248,754

$

404,885

$

248,754

$

404,885

TABLE I WORKIVA

INC. RECONCILIATION OF NON-GAAP INFORMATION (in

thousands, except share and per share)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Gross profit, subscription and support

$

140,414

$

118,557

$

400,256

$

335,777

Add back: Stock-based compensation

2,164

1,247

5,708

3,732

Add back: Amortization of

acquisition-related intangibles

$

1,007

$

—

$

1,007

$

—

Gross profit, subscription and support,

non-GAAP

$

143,585

$

119,804

$

406,971

$

339,509

Gross profit, professional services

$

1,536

$

1,263

$

12,169

$

11,232

Add back: Stock-based compensation

858

623

2,348

1,923

Gross profit, professional services,

non-GAAP

$

2,394

$

1,886

$

14,517

$

13,155

Gross profit

$

141,950

$

119,820

$

412,425

$

347,009

Add back: Stock-based compensation

3,022

1,870

8,056

5,655

Add back: Amortization of

acquisition-related intangibles

$

1,007

$

—

$

1,007

$

—

Gross profit, non-GAAP

$

145,979

$

121,690

$

421,488

$

352,664

Cost of revenue, subscription and

support

$

30,621

$

24,864

$

86,493

$

74,080

Less: Stock-based compensation

2,164

1,247

5,708

3,732

Less: Amortization of acquisition-related

intangibles

$

1,007

$

—

$

1,007

$

—

Cost of revenue, subscription and support,

non-GAAP

$

27,450

$

23,617

$

79,778

$

70,348

Cost of revenue, professional services

$

13,050

$

13,491

$

39,873

$

42,297

Less: Stock-based compensation

858

623

2,348

1,923

Cost of revenue, professional services,

non-GAAP

$

12,192

$

12,868

$

37,525

$

40,374

Research and development

$

48,425

$

41,747

$

142,328

$

130,235

Less: Stock-based compensation

5,681

4,155

15,474

13,677

Less: Amortization of acquisition-related

intangibles

414

891

2,267

2,668

Research and development, non-GAAP

$

42,330

$

36,701

$

124,587

$

113,890

Sales and marketing

$

89,756

$

72,576

$

257,086

$

215,168

Less: Stock-based compensation

9,942

7,108

26,470

20,769

Less: Amortization of acquisition-related

intangibles

467

598

1,292

1,805

Sales and marketing, non-GAAP

$

79,347

$

64,870

$

229,324

$

192,594

General and administrative

$

25,551

$

21,022

$

76,225

$

86,660

Less: Stock-based compensation

8,825

6,244

25,879

37,928

General and administrative, non-GAAP

$

16,726

$

14,778

$

50,346

$

48,732

Loss from operations

$

(21,782

)

$

(15,525

)

$

(63,214

)

$

(85,054

)

Add back: Stock-based compensation

27,470

19,377

75,879

78,029

Add back: Amortization of

acquisition-related intangibles

1,889

1,489

4,566

4,473

Income (loss) from operations,

non-GAAP

$

7,577

$

5,341

$

17,231

$

(2,552

)

Net loss

$

(16,992

)

$

(56,269

)

$

(46,227

)

$

(123,329

)

Add back: Stock-based compensation

27,470

19,377

75,879

78,029

Add back: Amortization of

acquisition-related intangibles

1,889

1,489

4,566

4,473

Net income (loss), non-GAAP

$

12,367

$

(35,403

)

$

34,218

$

(40,827

)

Net loss per basic and diluted share:

$

(0.31

)

$

(1.04

)

$

(0.84

)

$

(2.28

)

Add back: Stock-based compensation

0.50

0.36

1.38

1.44

Add back: Amortization of

acquisition-related intangibles

0.03

0.03

0.08

0.08

Net income (loss) per basic share,

non-GAAP

$

0.22

$

(0.65

)

$

0.62

$

(0.76

)

Net income (loss) per diluted share,

non-GAAP

$

0.21

$

(0.65

)

$

0.60

$

(0.76

)

Weighted-average common shares outstanding

- basic, non-GAAP

55,581,841

54,256,941

55,226,254

53,987,791

Weighted-average common shares outstanding

- diluted, non-GAAP

57,557,373

54,256,941

57,361,707

53,987,791

TABLE II WORKIVA

INC. RECONCILIATION OF NON-GAAP GUIDANCE (in

thousands, except share and per share data)

Three months ending December

31, 2024

Year ending December 31,

2024

Loss from operations, GAAP range

$

(16,186

)

-

$

(14,186

)

$

(79,400

)

-

$

(77,400

)

Add back: Stock-based compensation

27,121

27,121

103,000

103,000

Add back: Amortization of

acquisition-related intangibles

1,834

1,834

6,400

6,400

Income from operations, non-GAAP range

$

12,769

-

$

14,769

$

30,000

-

$

32,000

Net loss per share, GAAP range

$

(0.21

)

-

$

(0.18

)

$

(1.05

)

-

$

(1.02

)

Add back: Stock-based compensation

0.49

0.49

1.86

1.86

Add back: Amortization of

acquisition-related intangibles

0.03

0.03

0.12

0.12

Net income per share, non-GAAP range

$

0.31

-

$

0.34

$

0.93

-

$

0.96

Weighted-average common shares outstanding

- basic

55,800,000

55,800,000

55,400,000

55,400,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106940239/en/

Investor Contact: Mike Rost Workiva Inc.

investor@workiva.com

Media Contact: Mandi McReynolds Workiva Inc.

press@workiva.com

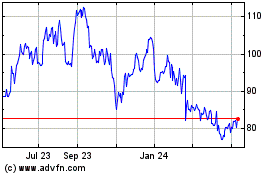

Workiva (NYSE:WK)

Historical Stock Chart

From Oct 2024 to Nov 2024

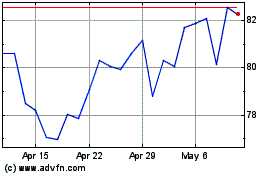

Workiva (NYSE:WK)

Historical Stock Chart

From Nov 2023 to Nov 2024