Western Asset/Claymore Inflation-Linked Securities & Income Fund & Western Asset/Claymore Inflation-Linked Opportunities & In...

April 15 2011 - 8:16AM

Business Wire

Western Asset/Claymore Inflation-Linked Securities & Income

Fund (NYSE: WIA) and Western Asset/Claymore Inflation-Linked

Opportunities & Income Fund (NYSE: WIW) (together, the “Funds”)

today issued the following statement:

In his role as CIO Emeritus, S. Kenneth Leech plays an active,

hands-on role in determining Western Asset Management Company’s

(“Western Asset”) investment philosophy and strategy, working

closely with CIO Stephen A. Walsh and serving on various investment

strategy committees.

As part of a planned and strategic evolution, Mr. Leech has

gradually focused more of his time on the global investment

marketplace and on managing global portfolios, while continuing to

play a lead role in shaping Western Asset’s overall investment

strategies and macro themes.

In light of his changing role and expected further concentration

on global accounts, as of May 1, Mr. Leech will no longer serve as

a portfolio manager for non-global portfolios, including the Funds.

While Mr. Leech continues to help shape Western Asset’s overall

investment strategy, his day-to-day role is becoming more

concentrated on global portfolios. To reflect this global focus, he

will continue to serve as a portfolio manager of the global funds,

but not of the non-global funds.

As CIO, Mr. Walsh will remain listed as part of the portfolio

management team of the Funds, and the remaining named Portfolio

Managers of the Funds will continue in their respective roles.

Western Asset, founded in 1971, is one of the world’s premier

fixed-income managers, with offices in Pasadena, London and

Singapore. Exclusively focused on fixed income, Western Asset’s

client base includes several of the largest companies in the world

as well as numerous public entities, healthcare organizations,

foundations and public pension plans. Western Asset’s objective is

to provide fixed-income clients with value-oriented portfolios that

are managed for the long term. Western Asset believes significant

inefficiencies exist in the fixed income markets and by combining

traditional analysis with innovative technology, the firm attempts

to add value by exploiting these inefficiencies across eligible

sectors. For the Fund, Western Asset intends to employ proprietary

risk management techniques that were developed specifically to

enhance other leveraged funds.

Guggenheim Funds Investment Advisors, LLC acts as the Investment

Adviser for WIW and Guggenheim Funds Distributors, Inc. acts as the

Servicing Agent for WIA. Guggenheim Funds Distributors, Inc. and

its affiliates (together, “Guggenheim Funds”) offer strategic

investment solutions for financial advisors and their valued

clients. As an innovator in exchange-traded funds (ETFs), unit

investment trusts (UITs) and closed-end funds (CEFs), Guggenheim

Funds often leads its peers with creative investment strategy

solutions. Guggenheim Funds provides supervision, management or

servicing of assets with a commitment to consistently delivering

exceptional service. Guggenheim Funds is a wholly-owned subsidiary

of Guggenheim Partners, LLC, a global, diversified financial

services firm with more than $100 billion in assets under

management and supervision. Guggenheim Partners, LLC, through its

affiliates, provides investment management, investment advisory,

insurance, investment banking, and capital markets services. The

firm is headquartered in Chicago and New York with a global network

of offices throughout the United States, Europe, and Asia.

This information does not represent an offer to sell securities

of the Funds and it is not soliciting an offer to buy securities of

the Funds. There can be no assurance that the Funds will achieve

their investment objectives. The net asset values of the Funds will

fluctuate with the value of the underlying securities. It is

important to note that closed-end funds trade on their market

value, not net asset value, and closed-end funds often trade at a

discount to their net asset value. Past performance is not

indicative of future performance. An investment in the Funds is

subject to certain risks and other considerations. Such risks and

considerations include, but are not limited to: Market Discount

Risk Interest Rate Risk, Risks Relating to U.S. TIPS, Risks

Relating to Inflation-Linked Securities, Credit Risk, Lower Grade

Securities Risk, Leverage Risk, Issuer Risk, Smaller Companies

Risk, Country Risk, Emerging Markets Risk, Mortgage-Related

Securities Risk, Prepayment Risk, Reinvestment Risk, Derivatives

Risk, Inflation/Deflation Risk, Turnover Risk, Management Risk and

Market Disruption Risk.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of any

investment before they invest. For this and more information,

please contact a securities representative or Guggenheim Funds

Distributors, Inc., 2455 Corporate West Drive, Lisle, Illinois

60532, 800-345-7999.

Member FINRA/SIPC (4/11)

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY

LOSE VALUE

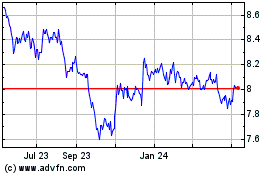

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

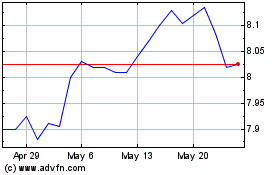

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jul 2023 to Jul 2024