WIA Declares Year-End Supplemental Dividend and January Monthly Dividend

December 10 2008 - 3:28PM

Business Wire

The Western Asset/Claymore Inflation-Linked Securities & Income

Fund (NYSE: WIA), a closed-end management investment company, has

declared a year-end supplemental dividend of $0.155 per share for

common shareholders. In addition, the Fund announced its January

dividend of $0.0460 per share, a reduction of $0.0115 per share.

The source of this supplemental dividend is net investment income

earned by the Fund. This distribution is being made at this time in

order to allow the Fund to meet its distribution requirements for

income for the year. Similar to other closed-end funds, the Fund

seeks to qualify as a regulated investment company (�RIC�) under

the Internal Revenue Code of 1986. To qualify as a RIC, the Fund

must distribute each year at least 90% of its net investment

income. Further, in order to avoid a 4% federal excise tax, the

Fund must distribute at least 98% of its net investment income in a

given calendar year. This supplemental dividend primarily

represents ordinary income earned by the Fund�s holdings of U.S.

Treasury Inflation Protected Securities (�U.S. TIPS�) resulting

from a higher-than-expected level of inflation experienced in the

first half of 2008 as measured by the Consumer Price Index for All

Urban Consumers (�CPI-U�). The increase in income for Fund

shareholders stemming from these elevated inflation levels reflects

the inflation protection feature of U.S. TIPS. As stated in the

Fund�s most recent quarterly review, for the period ended September

30, 2008, this year�s inflation increase was driven by the run up

in commodities which have since shed most of their gains in the

latter-half of 2008. By the middle of next year, CPI-U is expected

to be negative on a year-over-year basis for a several months and,

we believe, long-term prospects for inflation remain contained. We

believe that some of this reduced inflation outlook has already

been evidenced in the market. For example, CPI-U decreased 1.0

percent in October, before seasonal adjustment � the largest

one-month decrease on record. Should inflation continue to

decrease, U.S. TIPS would suffer in the short-run from lower

inflation accretion which, in turn, may result in a decrease in

income for the Fund. The supplemental dividend will be paid on

December 31, 2008, to shareholders of record as of December 15,

2008, with an ex-dividend date of December 11, 2008. As a result of

the recent pronounced decline in inflation and contained inflation

outlook, the Fund has reduced the January monthly dividend per

share from $0.0575 to $0.0460 per share. The January dividend will

be paid on January 30, 2009, to shareholders of record as of

January 15, 2009, with an ex-dividend date of January 13, 2009.

Required notifications pursuant to Section 19a-1 of the Investment

Company Act of 1940 will be posted to the Fund�s website after the

close of business three business days prior to the payable date. If

a distribution rate is largely comprised of sources other than

income, it may not be reflective of the Fund�s performance. Western

Asset is one of the world's premier fixed-income managers. With

offices in Pasadena, New York, London, Tokyo, Singapore, Hong Kong,

Melbourne and Sao Paulo, Western Asset offers institutional and

retail clients a full range of fixed-income products. By devoting

all of its resources to fixed-income, Western Asset is able to

provide a full commitment to its clients in every area of the firm.

This focused approach has generated superior returns in products

with a variety of risk disciplines. Western Asset's long

performance track record and global presence has them positioned to

continue their commitment to excellence in fixed-income investment

management and client service. As of September 30, 2008, Western

Asset has $585 billion in assets under management. Claymore

Securities, Inc. serves as the Fund�s Servicing Agent. Claymore

Securities, Inc. is a privately-held financial services company

offering unique investment solutions for financial advisors and

their valued clients. Claymore entities have provided supervision,

management, servicing and/or distribution on approximately $13.8

billion in assets, as of September 30, 2008. Claymore currently

offers closed-end funds, unit investment trusts and exchange-traded

funds. Additional information on Claymore�s closed-end funds is

available at www.claymore.com/CEFs. Registered investment products

are sold by prospectus only and investors should read the

prospectus carefully before investing. This information does not

represent an offer to sell securities of the Fund and it is not

soliciting an offer to buy securities of the Fund. There can be no

assurance that the Fund will achieve its investment objectives. The

net asset value of the Fund will fluctuate with the value of the

underlying securities. It is important to note that closed-end

funds trade on their market value, not net asset value, and

closed-end funds often trade at a discount to their net asset

value. Past performance is not indicative of future performance. An

investment in the Fund is subject to certain risks and other

considerations. Such risks and considerations include, but are not

limited to: Investment Risk, Market Discount Risk, Interest Rate

Risk, U.S. TIPS Risk, Credit Risk, Lower-Grade and Unrated

Securities Risk, Leverage Risk, Issuer Risk, Country Risk,

Prepayment Risk, Reinvestment Risk, Derivatives Risk,

Inflation/Deflation Risk, Management Risk, Turnover Risk,

Anti-Takeover Provisions, Smaller Company Risk, and Market

Disruption and Geopolitical Risk. Investors should consider the

investment objectives and policies, risk considerations, charges

and expenses of the Fund carefully before they invest. For this and

more information, please contact a securities representative or

Claymore Securities, Inc., 2455 Corporate West Drive, Lisle,

Illinois 60532, 800-345-7999. Member FINRA/SIPC (12/08) NOT

FDIC-INSURED | NOT BANK-GUARANTEED | MAY LOSE VALUE

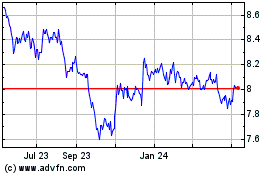

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

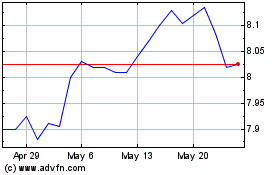

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jul 2023 to Jul 2024